Automated Suturing Devices Market Size 2025-2029

The automated suturing devices market size is forecast to increase by USD 244.8 mn at a CAGR of 6.4% between 2024 and 2029.

What will be the Size of the Automated Suturing Devices Market During the Forecast Period?

How is this Automated Suturing Devices Industry segmented and which is the largest segment?

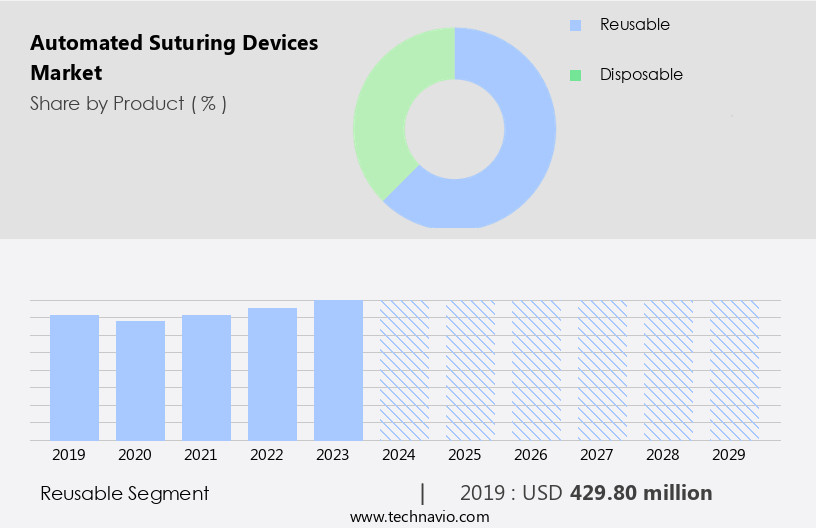

The automated suturing devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Reusable

- Disposable

- Geography

- North America

- US

- Europe

- Germany

- UK

- Asia

- China

- Japan

- Rest of World (ROW)

- North America

By Product Insights

The reusable segment is estimated to witness significant growth during the forecast period. Automated suturing devices refer to reusable medical instruments used to seal surgical incisions. These devices offer advantages such as improved patient throughput in ambulatory surgical centers and clinics, reduced surgical time, and cost efficiency. Technological advancements in robotics and infection resistance have led to the development of automated suturing devices suitable for various surgical procedures, including laparoscopic surgery, gastrointestinal procedures, cardiovascular disease treatment, arthroscopy, and hysteroscopy. The geriatric population, trauma patients, and those with chronic diseases like diabetes benefit significantly from these devices due to their minimally invasive nature and faster recovery times. Sterilization methods ensure infection control, and the availability of these devices in hospitals and clinics enhances patient treatment options.

The dental segment and endoscopic surgery also utilize automated suturing devices. As healthcare costs continue to rise, the importance of cost-effective, skilled specialists, and minimally invasive treatments becomes increasingly significant. Automated suturing devices contribute to hospital cost savings by reducing hospital admissions due to wound infections and road traffic crashes. Key players In the market focus on product development and technological advancements to cater to the growing demand for these devices.

Get a glance at the Automated Suturing Devices Industry report of share of various segments Request Free Sample

The Reusable segment was valued at USD 429.80 mn in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is experiencing significant growth due to the increasing number of surgical procedures, mergers and acquisitions, and the introduction of technologically advanced products. The US, being home to several leading companies, is a major contributor to the region's market share. New product launches, including capital equipment and accessories, and innovative business strategies are attracting investments globally. The adoption of minimally invasive treatments, such as laparoscopic, cosmetic, and plastic surgeries, is also driving market growth. Additionally, the rising prevalence of chronic diseases, hospital costs, and infection control concerns are increasing the demand for automated suturing devices in hospitals and ambulatory surgical centers.

Technological advancements in sterilization methods, patient outcomes, and cost efficiency are further boosting market growth. The dental and orthopedic segments, as well as clinics, are also expected to witness significant growth In the market. Key factors, including infection resistance, patient throughput, and recovery times, are influencing the adoption of these devices in various surgical procedures, including cardiovascular disorders, gastrointestinal procedures, arthroscopy, and trauma cases. The market is also witnessing growth In the areas of hysteroscopy, endoscopic surgery, and laparoscopic surgery for treating road traffic crashes, fall injuries, burn injuries, and obesity-related conditions. The market is expected to continue its growth trajectory due to the increasing consumer awareness and reimbursement policies favoring minimally invasive treatments.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automated Suturing Devices Industry?

- Increased number of surgical procedures is the key driver of the market.The rise in chronic conditions and subsequent surgical procedures has driven the demand for advanced technologies in healthcare, including automated suturing devices. These devices, utilized in various surgical procedures such as gynecologic, endoscopic, appendectomy, plastic and reconstructive, orthopedic, and laparoscopic surgeries, facilitate efficient wound healing. The European market witnesses a significant increase in surgical volume due to the prevalence of chronic diseases like cardiovascular disorders and obesity. Automated suturing devices contribute to cost efficiency, infection resistance, and improved patient outcomes, making them essential in ambulatory surgical centers, clinics, and hospitals. Technological advancements in sterilization methods, infection control, and minimally invasive treatment have further fueled their adoption. Key surgical areas, including cardiovascular disease, diabetes, trauma, and dental segment, benefit from these devices. Patient throughput and recovery times are optimized, reducing hospital admissions and healthcare costs.

What are the market trends shaping the Automated Suturing Devices Industry?

- Technological advances is the upcoming market trend. The healthcare industry is experiencing significant growth due to technological advancements, with automated suturing devices playing a pivotal role. These devices, such as Mellon Medical's Switch and Ethicon's PROXISURE, are revolutionizing various surgical fields, including vascular, transplant, cardiothoracic, orthopedic, gynecology, urology, neuro, and gastrointestinal procedures. By automating the suturing process, these devices enable faster surgical times, increased patient throughput, and improved infection resistance. This not only reduces the risks of complications but also decreases overall healthcare costs. Furthermore, technological developments in robotics and sterilization methods contribute to better patient outcomes and cost efficiency. The dental segment and clinics are also benefiting from these advancements. Automated suturing devices are particularly beneficial for treating chronic diseases, such as cardiovascular disorders, diabetes, and injuries from trauma, fall injuries, automobile accidents, burn injuries, and obesity. As consumer awareness of minimally invasive treatment options grows, the demand for these devices is expected to continue.

What challenges does the Automated Suturing Devices Industry face during its growth?

- High cost of automated suturing devices is a key challenge affecting the industry growth. Automated suturing devices are integral to surgical procedures for closing incisions with enhanced precision and accuracy. These devices offer benefits such as reduced surgical time and improved patient throughput in ambulatory surgical centers and clinics. However, their high cost compared to traditional sutures is a significant market challenge. Reusable automated suturing devices, like PROXISURE by Ethicon, have higher upfront costs, while disposable devices, such as Endo Stitch by Medtronic Plc, are sold as three devices in one pack. Government reimbursement policies in developing and underdeveloped countries, including India, China, and several African nations, do not cover the expense of automated suturing devices. Technological advancements in robotics, infection resistance, and sterilization methods contribute to the market growth. The orthopedic market, cardiovascular disorders, geriatric population, diabetes, chronic diseases, and trauma are significant end-users. Automated suturing devices find application in various surgical segments, including laparoscopic surgery, hysteroscopy, endoscopic surgery, arthroscopy, gastrointestinal procedures, and dental segment. Minimally invasive treatments, such as these, reduce hospital admissions, infection, and healthcare costs. Product availability and cost efficiency are crucial factors influencing consumer awareness and adoption. Injuries from road traffic crashes, fall injuries, cardiovascular disease, obesity, and burn injuries are common conditions treated with automated suturing devices. The market dynamics are shaped by factors like surgical volume, patient outcomes, infection control, and reimbursement policies. Technological developments in wound injury treatment, device costs, and skilled specialists continue to shape the market landscape.

Exclusive Customer Landscape

The automated suturing devices market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automated suturing devices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automated suturing devices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Apollo Endosurgery Inc. - Automated suturing devices, including OverStitch and OverStitch Sx, represent innovative solutions In the medical field. These advanced devices streamline the surgical process by automating the suturing technique, ensuring precise and consistent stitching. By reducing the need for manual dexterity and potential human error, these devices enhance surgical efficiency and improve patient outcomes. Additionally, automated suturing devices offer the potential for reduced operating room time and decreased costs, making them a valuable investment for healthcare providers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apollo Endosurgery Inc.

- B.Braun SE

- Becton Dickinson and Co.

- Boston Scientific Corp.

- Centenial Surgical Suture Ltd.

- Coloplast AS

- DemeTECH Corp.

- Johnson and Johnson Inc.

- LSI Solutions Inc.

- Medtronic Plc

- Mellon Medical BV

- Peters Surgical

- Smith and Nephew plc

- Suture Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The automated suturing device market is witnessing significant growth due to the increasing demand for minimally invasive surgical procedures and the need for cost efficiency in healthcare. These devices offer numerous benefits, including reduced surgical time, improved patient throughput, and enhanced infection resistance. Technological advancements have been a major driving force In the market. Robotics and computer-assisted systems are increasingly being used to automate suturing processes, leading to greater precision and consistency. This is particularly important in complex procedures, such as those used in cardiovascular disorders and orthopedic applications. The geriatric population is another key factor fueling market growth.

With an aging population comes an increased prevalence of chronic diseases, such as diabetes and obesity, which require frequent surgical interventions. Automated suturing devices offer a solution to the challenges posed by these conditions, including longer surgical times and the need for infection control. Infection control is a critical consideration in all surgical settings, from hospitals to ambulatory surgical centers and clinics. The use of automated suturing devices can help reduce the risk of infection, both for patients and healthcare workers. Sterilization methods have also advanced, making it easier to ensure the devices are free from contaminants. The dental segment is also seeing an increase In the adoption of automated suturing devices.

These devices offer improved patient outcomes, particularly in complex procedures such as gastrointestinal procedures, laparoscopic surgery, and arthroscopy. The use of automated suturing devices can also lead to shorter recovery times, which is a major advantage for patients. Cost efficiency is another key factor driving market growth. Automated suturing devices can help reduce hospital costs by streamlining surgical processes and reducing the need for skilled specialists. They also offer cost savings In the long term, as they can be reused multiple times. Consumer awareness is also playing a role in market growth. Patients are increasingly seeking out minimally invasive treatment options, and automated suturing devices offer a solution to this demand.

Trauma cases, including road traffic crashes and fall injuries, also require quick and efficient surgical interventions, making automated suturing devices an attractive option for healthcare providers. Product availability and reimbursement policies are important considerations for market growth. As more devices become available, and reimbursement policies become more favorable, the market is expected to continue growing. In conclusion, the automated suturing device market is experiencing significant growth due to the increasing demand for minimally invasive surgical procedures, the need for cost efficiency in healthcare, and the benefits offered by these devices, including reduced surgical time, improved patient throughput, and enhanced infection resistance.

Technological developments and consumer awareness are also driving market growth, making it an exciting area to watch In the healthcare industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.4% |

|

Market growth 2025-2029 |

USD 244.8 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

5.9 |

|

Key countries |

US, Germany, UK, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automated Suturing Devices Market Research and Growth Report?

- CAGR of the Automated Suturing Devices industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automated suturing devices market growth of industry companies

We can help! Our analysts can customize this automated suturing devices market research report to meet your requirements.