Discrete Diode Market Size 2024-2028

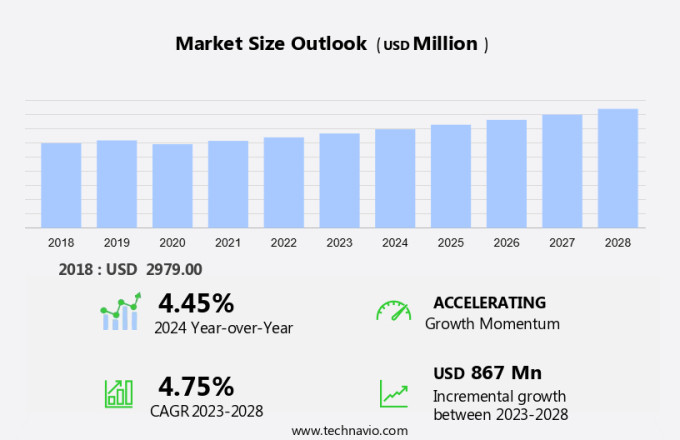

The discrete diode market size is forecast to increase by USD 867 billion at a CAGR of 4.75% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. The increasing demand for Internet of Things (IoT) devices and the acceptance of wearable technology are major drivers for market growth. Additionally, the miniaturization trend in electronic devices is leading to an increase in design complexity, necessitating the use of discrete diodes for power management and protection. These trends are expected to continue, fueling market expansion. Despite these opportunities, challenges remain, including price pressures and intense competition from alternative semiconductor technologies. To remain competitive, market participants must focus on innovation and cost-reduction strategies. Overall, the market is poised for strong growth In the coming years.

What will be the Size of the Discrete Diode Market During the Forecast Period?

- The discrete diodes market encompasses the sales of electronic elements that utilize semiconductor diodes, specifically those with distinct components rather than integrated into circuits. These diodes, which include rectifiers, switches, limiters, and various types such as power diodes and Schottky diodes, function by controlling the direction of current flow through pn junctions. Discrete diodes are essential in various applications, including consumer electronics, vehicle electrification for electric vehicles and traction inverters, and passive components in electronic assembly.

- Their resistance to current and transmission properties makes them indispensable in numerous industries, contributing significantly to the growth of the discrete semiconductor sector. Electronic manufacturers continue to innovate and invest in research and development, with the data bridge connecting the market's dynamics and trends, including the increasing demand for discrete diodes in portable products and the integration of these components into national economies.

How is this Discrete Diode Industry segmented and which is the largest segment?

The discrete diode industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Power diodes

- Small signal diodes

- RF diodes

- End-user

- Communications

- Computers

- Automotive

- Consumer electronics

- Others

- Geography

- APAC

- China

- South Korea

- Singapore

- North America

- US

- Europe

- South America

- Middle East and Africa

- APAC

By Product Insights

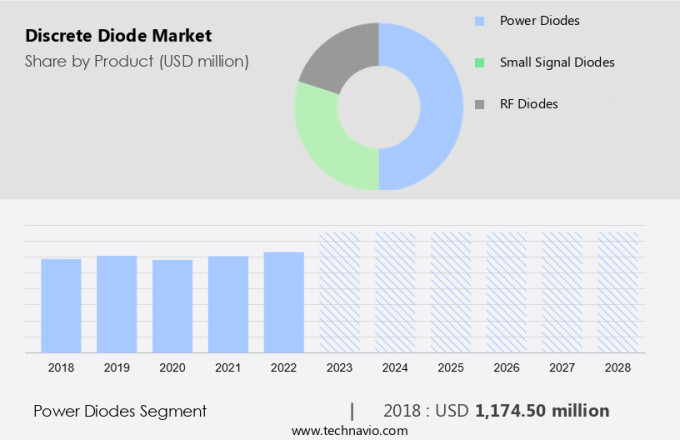

- The power diodes segment is estimated to witness significant growth during the forecast period.

Discrete diodes, specifically power diodes, are essential components in various electrical systems due to their rectifying, switching, and limiting functions. Power diodes, which include Schottky diodes, fast-recovery diodes, and general-purpose diodes, dominate the market. Schottky diodes offer high-speed performance, making them suitable for high-frequency applications. Fast recovery diodes, with reverse recovery times below 5us, are ideal for high-speed switching applications. General-purpose diodes, handling low power and low frequencies, are widely used in consumer electronics. Power diodes' high adoption in power electronics applications, such as voltage clamping, rectification, voltage multiplication, and freewheeling, drives the growth of the power diode segment In the market.

Get a glance at the Discrete Diode Industry report of share of various segments Request Free Sample

The power diodes segment was valued at USD 1.17 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

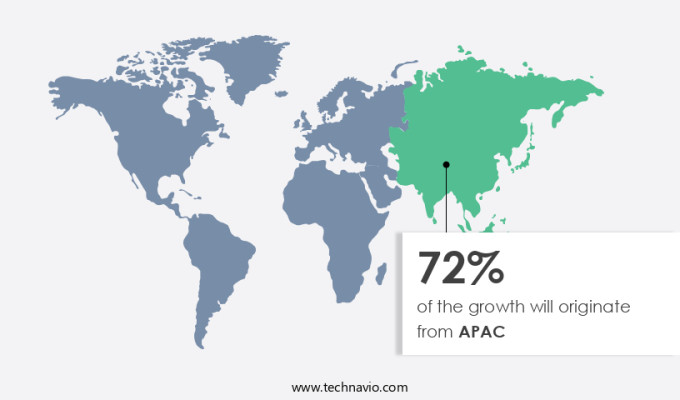

- APAC is estimated to contribute 72% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in Asia Pacific (APAC) is experiencing significant growth, with China being a major contributor to the region's revenue. The increasing demand for semiconductors In the automotive, aerospace, electronics and electrical, and other end-user industries, particularly in developing countries like China and India, is driving market expansion. Industrial development in countries such as China, India, South Korea, Indonesia, and Taiwan will necessitate high levels of automation, further boosting the demand for discrete diodes. The APAC market is expected to register one of the fastest growth rates during the forecast period due to these factors.

Market Dynamics

Our discrete diode market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Discrete Diode Industry?

Increasing demand for IoT devices is the key driver of the market.

- Discrete diodes, as essential electronic elements, play a significant role in various industries, including consumer electronics, power systems, and communication sectors. These semiconductor devices, characterized by their PN junctions, enable directional transmission of current and function as rectifiers, switches, and limiters. The market encompasses semiconductor manufacturers supplying these components to electronic product assemblers. The power diode segment, including power Schottky diodes and integrated circuits, experiences substantial growth due to increasing demand from the automotive industries for vehicle electrification and electric vehicle traction inverters. Consumer electronics, such as portable products, also rely on passive components like diodes and varistors for protection and functionality.

- The market dynamics are influenced by factors like national economies, factory floor automation, and emerging trends in advanced driver assistance systems (ADAS) and IoT applications. Porter analysis and SVOR analysis provide insights into the competitive landscape and microeconomic factors impacting decision-makers In the discrete semiconductor industry. Semiconductor manufacturers, cater to diverse sectors, ensuring the production of high-quality discrete diodes. The communication sector and computer sector further expand the market's reach, with applications in data centers, telecommunication networks, and computer systems.

What are the market trends shaping the Discrete Diode Industry?

Increasing acceptance of wearable devices is the upcoming market trend.

- The market encompasses semiconductor elements that regulate the flow of current based on the direction and voltage. These electronic elements are essential in various applications, including transmission, rectification, switching, and limiting. Semiconductor diodes, such as PN junctions, are the foundation of this market, with applications extending to power diodes, Schottky diodes, and integrated circuits. Consumer electronics, automotive industries, communication sector, and computer sector are significant contributors to the market's growth. Power diodes and Schottky diodes are crucial components in power electronics, while varistors, diodes, thyristors, and other passive components are integral to electronic assembly in portable products. The increasing adoption of advanced driver assistance systems (ADAS) and vehicle electrification In the automotive sector will fuel the demand for Discrete Diodes.

- IoT technology's proliferation across various industries, including electric vehicles, traction inverters, and wearable devices, will further accelerate market growth. Microeconomic factors, such as increasing production capacities and technological advancements, will influence decision-makers In the Discrete Semiconductor industry. The market is poised for growth, with emerging trends and technological advancements shaping its future.

What challenges does the Discrete Diode Industry face during its growth?

An increase in design complexity due to miniaturization is a key challenge affecting the industry growth.

- Discrete diodes, as essential electronic elements, play a pivotal role in various industries, including consumer electronics, power systems, and automotive sectors. These semiconductor devices, characterized by their PN junctions, exhibit unique properties such as directional current transmission, rectification, and switching functions. The market is segmented into power diodes, Schottky diodes, and other types, with power diodes dominating due to their extensive use in power electronics applications. The increasing demand for electronic products, such as vehicle electrification In the automotive industry and traction inverters in electric vehicles, fuels the growth of the market. In the consumer electronics sector, the proliferation of portable products and the integration of passive components in advanced driver assistance systems (ADAS) further boost market expansion.

- Manufacturers face challenges in producing miniaturized discrete diodes to cater to the demand for compact electronic devices. These challenges necessitate significant capital investments in research and development and manufacturing processes. Moreover, the frequent introduction of new electronic devices necessitates continuous innovation and adaptation to meet evolving industry standards. The market is subject to various microeconomic factors, including raw material prices, labor costs, and exchange rates. Decision-makers In the discrete semiconductor industry must closely monitor these factors to optimize their operations and maintain competitiveness. PORTER and SVOR analyses provide valuable insights into the market dynamics, competitive landscape, and potential threats and opportunities.

Exclusive Customer Landscape

The discrete diode market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the discrete diode market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, discrete diode market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

ABB Ltd. - ABB Ltd.: The company offers products such as abb diode, and discrete apparatus.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agilent Technologies Inc.

- Central Semiconductor Corp.

- Diodes Inc.

- Hitachi Ltd.

- Infineon Technologies AG

- Littelfuse Inc.

- MACOM Technology Solutions Inc.

- Microchip Technology Inc.

- Mitsubishi Electric Corp.

- NXP Semiconductors NV

- ON Semiconductor Corp.

- Panasonic Holdings Corp.

- Renesas Electronics Corp.

- ROHM Co. Ltd.

- Semtech Corp.

- Shindengen Electric Manufacturing Co. Ltd.

- STMicroelectronics International N.V.

- Texas Instruments Inc.

- Vishay Intertechnology Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Discrete diodes are essential electronic components that play a significant role in various industries, including consumer electronics, power systems, automotive, and communication sectors. These semiconductor devices are primarily used for rectifying, switching, limiting, and transmitting current in different directions. The fundamental operation of a discrete diode relies on its pn junction, which allows the flow of current in one direction while blocking it In the opposite direction. The market encompasses a wide range of applications, from simple rectifiers in electronic circuits to complex power diodes used in traction inverters for electric vehicles. The power diode segment, in particular, is witnessing substantial growth due to the increasing adoption of renewable energy sources and the electrification of vehicles.

Moreover, semiconductor diodes are the building blocks of various electronic products, including integrated circuits, Schottky diodes, and thyristors. These components are crucial in various applications, such as vehicle electrification, power supplies, and electronic assembly. In the automotive industry, discrete diodes are used in advanced driver assistance systems (ADAS), traction inverters, and other electronic control units (ECUs). The market is influenced by several microeconomic factors, including raw material prices, production costs, and technological advancements. Porter's Five Forces analysis and Svor analysis are essential tools for decision-makers to understand the competitive landscape and market dynamics. National economies and factory floors alike rely on discrete semiconductors to manufacture electronic components and assemble various products.

Furthermore, these components are used in portable products, communication systems, computer sectors, and other industries. Passive components, such as varistors and diodes, are essential in protecting electronic circuits from voltage spikes and ensuring proper voltage levels. The communication sector is another significant market for discrete diodes, with applications ranging from satellite communication to wireless networks. Discrete diodes are used in power amplifiers, mixers, and other components in communication systems to ensure efficient power handling and signal transmission. The computer sector also utilizes discrete diodes in various applications, such as power supplies, rectifiers, and logic circuits. These components are crucial in ensuring the proper functioning of computers and other electronic devices.

|

Discrete Diode Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

190 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.75% |

|

Market Growth 2024-2028 |

USD 867 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.45 |

|

Key countries |

China, US, South Korea, Taiwan, and Singapore |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Discrete Diode Market Research and Growth Report?

- CAGR of the Discrete Diode industry during the forecast period

- Detailed information on factors that will drive the Discrete Diode growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the discrete diode market growth of industry companies

We can help! Our analysts can customize this discrete diode market research report to meet your requirements.