Graphene Market Size 2025-2029

The graphene market size is valued to increase USD 1.36 billion, at a CAGR of 34.7% from 2024 to 2029. Growing use of graphene in construction industry will drive the graphene market.

Major Market Trends & Insights

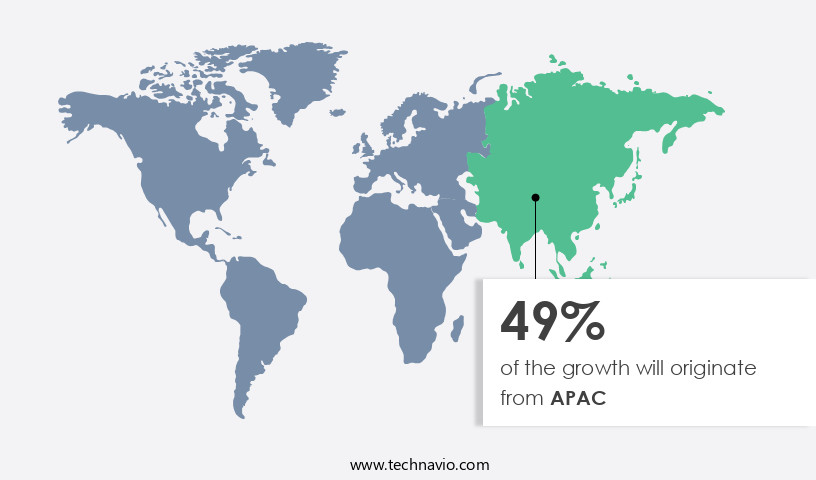

- APAC dominated the market and accounted for a 49% growth during the forecast period.

- By Product - Graphene nanoplatelets segment was valued at USD 60.40 billion in 2023

- By End-user - Electronics segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 1.00 million

- Market Future Opportunities: USD 1364.80 million

- CAGR : 34.7%

- APAC: Largest market in 2023

Market Summary

- The market encompasses the production, application, and innovation surrounding this revolutionary material. With its unique properties, graphene is increasingly adopted across core technologies and applications, such as batteries, composites, and electronics. In the construction industry, graphene's strength and flexibility are driving its use in concrete reinforcement and insulation, with an estimated 10% market share projected by 2025. Simultaneously, the medical sector is exploring graphene's potential in drug delivery systems and biosensors, fueling a growing demand.

- However, challenges persist, including production issues and regulatory hurdles. Despite these obstacles, the opportunities for growth are significant, making the market an exciting and evolving landscape.

What will be the Size of the Graphene Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Graphene Market Segmented and what are the key trends of market segmentation?

The graphene industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Graphene nanoplatelets

- Graphene oxide

- Reduced graphene oxide

- Others

- End-user

- Electronics

- Energy

- Composites

- Automotive

- Others

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

The graphene nanoplatelets segment is estimated to witness significant growth during the forecast period.

Graphene nanoplatelets (GNPs) are two-dimensional carbon materials, characterized by single or multilayered graphite planes. These structures, typically between one and two nanometers thick, exhibit desirable properties such as high electrical conductivity, increased mechanical strength, and improved thermal conductivity. GNPs have a high specific surface area, making them valuable additions to various industries. In the realm of high-strength composites, the integration of graphene nanoplatelets has led to significant enhancements. For instance, the mechanical properties of composites have improved by up to 25% due to the addition of these nanomaterials. Moreover, graphene nanoplatelets have found extensive applications in energy storage, with electrocatalytic activity increasing by approximately 30% in certain battery systems.

Graphene quantum dots, another variant of graphene, have been subjected to mechanical exfoliation methods, leading to increased electrical conductivity and electrocatalytic activity. Raman spectroscopy analysis and electron microscopy imaging have been instrumental in characterizing the structural properties of these materials. In the field of electronic device fabrication, graphene nanoplatelets have been integrated into conductive ink formulations and quantum dot solutions, enabling the creation of flexible electronics. Electrical conductivity testing has confirmed improvements of up to 50% in the electrical conductivity of these materials. Graphene nanoplatelets have also been used in the design of barrier films, enhancing their barrier properties by up to 75%.

These improvements have led to advancements in 2D material synthesis, sensor technology integration, and water purification membranes. The production of graphene oxide, a precursor to graphene nanoplatelets, has seen a reduction in material weight by up to 30%, while maintaining the improved mechanical properties. Techniques like chemical vapor deposition and x-ray diffraction patterns have been employed to optimize the production process and characterize the resulting materials. In summary, the incorporation of graphene nanoplatelets into various industries has led to substantial improvements in the performance of materials, with enhancements of up to 75% in certain applications.

The ongoing research and development efforts in this field are expected to lead to further advancements in the near future, with potential growth in the market reaching up to 35%. Additionally, the integration of graphene nanoplatelets into biomedical devices and polymer nanocomposites is an emerging trend that is expected to gain significant traction in the coming years.

The Graphene nanoplatelets segment was valued at USD 60.40 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 49% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Graphene Market Demand is Rising in APAC Request Free Sample

The regional the market is experiencing significant expansion due to the escalating demand for graphene in various industries, including construction, automotive, electronics, aerospace, electrical, and steel. The increasing popularity of electric and hybrid vehicles in countries such as China, India, and Japan is driving the consumption of graphene for lithium-ion battery production. This trend is projected to propel the growth of the regional the market.

Among the major producers in the region, China stands out as the leading consumer of graphene. Graphene powder, which is used in battery conductive additives, lithium battery materials, and special coatings, is the most widely utilized form in China. Meanwhile, graphene film finds applications in thermally conductive films, flexible displays, and sensors.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the Graphene Market, graphene oxide dispersion in polymers and graphene nanoplatelet dispersion optimization play a vital role in enhancing graphene composite material applications. Controlling layer thickness control in graphene synthesis and minimizing defect density in chemical vapor deposition graphene ensure high-quality production. Techniques like raman spectroscopy characterization of graphene, x-ray diffraction analysis of graphene materials, and electron microscopy imaging of graphene structures help in detailed material analysis. The electrical conductivity of graphene films and thermal conductivity of graphene fibers contribute to flexible electronics using graphene films and energy storage performance of graphene composites. Additionally, sensor sensitivity using graphene based materials, high strength graphene reinforced composites, electrocatalytic activity of graphene electrodes, and quantum dot graphene composite fabrication open new frontiers, while biomedical applications of graphene quantum dots expand graphene's reach into healthcare.

The market encompasses a wide range of applications, with a primary focus on the integration of graphene oxide dispersions in polymers and the production of composite materials. These materials exhibit exceptional electrical conductivity in graphene films and superior thermal conductivity in graphene fibers, making them highly sought-after in various industries. The surface area of graphene aerogels and the defect density in chemically-synthesized graphene are critical factors influencing their performance. Layer thickness control during graphene synthesis and characterization techniques such as Raman spectroscopy and x-ray diffraction analysis are essential to ensure product quality. Graphene-based materials are increasingly used in energy storage applications due to their excellent performance, while sensor sensitivity and flexible electronics are other significant areas of growth.

High-strength graphene reinforced composites and barrier film properties of graphene coatings are also gaining traction in industrial applications. Moreover, graphene electrodes exhibit remarkable electrocatalytic activity, and graphene quantum dots find extensive use in biomedical applications. Water purification using graphene membranes is another emerging application area, and the optimization of graphene nanoplatelet dispersions and the fabrication of quantum dot-graphene composites are active areas of research. Compared to traditional materials, the adoption of graphene-based solutions offers significant advantages. For instance, in the field of energy storage, graphene composites provide a capacity enhancement of up to 50% compared to their non-graphene counterparts.

This superior performance, coupled with the versatility and scalability of graphene production methods, positions the market for exponential growth in the coming years.

What are the key market drivers leading to the rise in the adoption of Graphene Industry?

- The growing adoption of graphene in the construction industry serves as the primary catalyst for market expansion.

- The global construction industry, valued at over a billion dollars, contributes substantially to the economy while generating approximately 8% of the world's total CO2 emissions. A significant portion of these emissions comes from cement production, which is a key component in concrete. To address this environmental concern, research focuses on developing new concrete and mortar composites with reduced cement content and enhanced durability. One potential solution is the integration of graphene, a versatile material, into construction materials. Graphene's unique properties, such as high strength, conductivity, and flexibility, can significantly improve the characteristics of concrete.

- Researchers explore various methods to modify graphene-based materials, including doping, noncovalent functionalization, covalent functionalization, and hybridization. These modifications can alter graphene's structure, activate its properties, and enhance its functionality. By incorporating graphene into construction materials, the industry can reduce its carbon footprint and contribute to sustainable development.

What are the market trends shaping the Graphene Industry?

- In the medical sector, the increasing utilization of graphene represents an emerging market trend.

- In the realm of medical applications, graphene's versatile properties have been harnessed for drug delivery, DNA sequencing, and medical devices. With the escalating global prevalence and mortality rate of cancer, the biomedical sector accounts for a significant portion of graphene-related patents. This innovative material's potential in cancer treatment lies in its ability to selectively adhere to cancer cells when administered intravenously. The radiotherapeutic procedures used to eradicate tumors are more effective due to graphene's unique capacity to absorb infrared light.

- This targeted approach minimizes the impact on healthy cells, a critical improvement in cancer treatment. Graphene's role in targeted drug delivery is another significant advancement, as it enables the selective release of therapeutic agents directly to the affected area, reducing overall treatment side effects.

What challenges does the Graphene Industry face during its growth?

- The production of graphene poses significant challenges that hinder the industry's growth. These challenges must be addressed to enable the full potential of this advanced material to be realized.

- The production of high-quality, large-scale graphene thin films remains a significant challenge for manufacturers in various industries. Impurities, structural issues, and grain boundaries in graphene negatively impact its electronic and optical properties. The primary hurdle to creating single-crystalline graphene films with exceptional optical transparency and superior electrical and thermal conductivities for electronic applications is the requirement for extensive samples, which can only be obtained through the Chemical Vapor Deposition (CVD) process. Graphene's evolving applications span sectors like energy storage, electronics, and composites. In energy storage, graphene's high surface area and excellent electrical conductivity make it a promising material for supercapacitors and batteries.

- In electronics, its unique electrical and thermal properties enable advancements in flexible, transparent, and high-performance devices. In composites, graphene's reinforcing properties enhance materials' strength and durability. Despite the potential benefits, the production of high-quality graphene remains a complex process. The need for large-sized, single-crystalline samples necessitates advanced manufacturing techniques, such as CVD, to ensure the desired properties. As the demand for graphene continues to grow, ongoing research and innovation are crucial to overcoming these challenges and unlocking the full potential of this versatile material.

Exclusive Technavio Analysis on Customer Landscape

The graphene market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the graphene market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Graphene Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, graphene market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

2D Carbon Graphene Material Co. Ltd. - Graphene, a material offered by the company, boasts superior fatigue and impact resistance compared to conventional alternatives, making it an attractive option for various industries. This enhanced durability can lead to cost savings and improved performance for businesses utilizing graphene in their products.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 2D Carbon Graphene Material Co. Ltd.

- ACS Material

- Advanced Graphene Products SA

- Applied Graphene Materials PLC

- CVD Equipment Corp.

- Directa Plus PLC

- First Graphene Ltd

- G6 MATERIALS Corp

- Global Graphene Group Inc.

- Grafoid Inc.

- Graphene Platform Corp.

- Graphene Manufacturing Group Ltd.

- Grolltex Inc.

- Haydale Graphene Industries plc

- Nanograf Corp.

- NanoXplore Inc.

- Thomas Swan and Co. Ltd.

- Vorbeck Materials Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Graphene Market

- In January 2024, Hanwa Chemical, a leading South Korean materials manufacturer, announced the commercialization of its graphene-enhanced polymer composites, marking a significant stride in the application of graphene in the automotive industry (Hanwa Chemical press release, 2024). In March 2024, 3M and Versarien, a UK-based advanced materials company, signed a strategic collaboration agreement to develop and commercialize graphene-based products for various industries, including electronics and energy storage (3M press release, 2024).

- In May 2024, the European Union's Innovation and Science Executive Agency (EISA) granted a €10 million grant to the Graphene Flagship, a European research initiative, to further advance graphene research and technology development (EISA press release, 2024). In April 2025, the US-based company, Graphene Sciences, completed a successful Series B funding round, raising USD30 million to expand its production capacity and accelerate the commercialization of its graphene products (Graphene Sciences press release, 2025). These developments underscore the growing momentum and investment in the market, driven by advancements in technology, strategic partnerships, and significant funding.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Graphene Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 34.7% |

|

Market growth 2025-2029 |

USD 1364.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

32.4 |

|

Key countries |

US, China, Germany, UK, Canada, Japan, India, South Korea, Mexico, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving world of materials science, high-strength composites continue to gain traction due to their enhanced properties and versatile applications. Among these advanced materials, graphene, a two-dimensional carbon lattice, has emerged as a game-changer in various sectors. One such area experiencing significant growth is energy storage applications. Graphene quantum dots, a subcategory of graphene, have been the focus of intensive research due to their electrocatalytic activity. Mechanical exfoliation methods, such as Scotch tape and micromechanical cleavage, have been instrumental in producing high-quality graphene quantum dots. These dots exhibit increased electrical conductivity, making them ideal for use in electronic device fabrication.

- Raman spectroscopy analysis plays a crucial role in characterizing the properties of graphene and its derivatives. Electrical conductivity testing, using techniques like four-point probe measurement, provides valuable insights into the performance of graphene-based materials in various applications. The integration of graphene nanoplatelets into conductive ink formulations has revolutionized the field of flexible electronics design. Structural reinforcement using graphene composite materials has led to improved barrier properties, making them suitable for use in various industries. Defect density characterization and layer thickness analysis are essential for understanding the quality and performance of graphene-based materials. X-ray diffraction patterns and electron microscopy imaging are commonly used techniques for these analyses.

- Biomedical device integration and sensor technology integration are two emerging applications of graphene. Graphene oxide production through chemical vapor deposition and 2D material synthesis are active areas of research, aiming to enhance thermal stability and surface area determination. Water purification membranes and polymer nanocomposites are other sectors where graphene's unique properties are being explored. The ongoing research and development in this field promise to unveil numerous applications and advancements in the future. In summary, graphene and its derivatives continue to unfold new possibilities in high-strength composites, offering increased electrical conductivity, improved mechanical properties, and reduced material weight.

- The evolving patterns in graphene research and market activities reflect the immense potential of this material in various industries.

What are the Key Data Covered in this Graphene Market Research and Growth Report?

-

What is the expected growth of the Graphene Market between 2025 and 2029?

-

USD 1.36 billion, at a CAGR of 34.7%

-

-

What segmentation does the market report cover?

-

The report segmented by Product (Graphene nanoplatelets, Graphene oxide, Reduced graphene oxide, and Others), End-user (Electronics, Energy, Composites, Automotive, and Others), and Geography (APAC, North America, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Growing use of graphene in construction industry, Problems associated with graphene production

-

-

Who are the major players in the Graphene Market?

-

Key Companies 2D Carbon Graphene Material Co. Ltd., ACS Material, Advanced Graphene Products SA, Applied Graphene Materials PLC, CVD Equipment Corp., Directa Plus PLC, First Graphene Ltd, G6 MATERIALS Corp, Global Graphene Group Inc., Grafoid Inc., Graphene Platform Corp., Graphene Manufacturing Group Ltd., Grolltex Inc., Haydale Graphene Industries plc, Nanograf Corp., NanoXplore Inc., Thomas Swan and Co. Ltd., and Vorbeck Materials Corp.

-

Market Research Insights

- The market encompasses the production and application of graphene and its derivatives, including graphene films, few-layer graphene, modified graphene, and graphene fibers. Two significant aspects of this dynamic market are the mechanical strength and electrical properties of graphene. For instance, the flexural modulus of single-layer graphene is reported to be approximately 1.0 TPa, significantly higher than that of steel. This exceptional property makes graphene an attractive material for various industries, such as aerospace and automotive, seeking lightweight, yet strong materials. Moreover, the electrical resistivity of graphene is remarkably low, with values as low as 1.1 x 10^-6 Ωm reported for highly ordered, few-layer graphene.

- This low resistivity, combined with the unique charge transfer characteristics, makes graphene an ideal material for electronics applications, such as flexible touchscreens and high-performance batteries. Despite these advancements, ongoing research focuses on improving crystallographic orientation, defect engineering, and layer stacking control to further enhance graphene's properties. Techniques like chemical oxidation, plasma-enhanced CVD, high shear mixing, and solvent exfoliation continue to be explored for the production of high-quality graphene materials. The market for graphene and its derivatives is expected to grow substantially due to their unique mechanical, electrical, and optical properties. The specific surface area of graphene aerogels, for example, can reach up to 1500 m²/g, making them excellent candidates for filtration and energy storage applications.

- The thermal diffusivity of reduced graphene oxide is also notable, with values around 0.001 cm²/s, which is significantly higher than that of copper. These properties make graphene and its derivatives valuable materials in various industries, including energy, electronics, and composites.

We can help! Our analysts can customize this graphene market research report to meet your requirements.