Laparoscopic Devices Market Size 2024-2028

The laparoscopic devices market size is forecast to increase by USD 4.76 billion at a CAGR of 8.18% between 2023 and 2028.

- The market is experiencing significant growth driven by the increasing preference for minimally invasive surgical techniques and the rising adoption of robot-assisted laparoscopic surgery. These advanced procedures offer numerous benefits, including reduced post-operative pain, faster recovery times, and lower risk of complications. The market is experiencing significant growth, driven by the increasing adoption of advanced surgical techniques in ambulatory surgical centers and the expanding demand for efficient healthcare services. However, the market faces challenges from stringent regulations on new laparoscopic devices, which necessitate extensive clinical trials and approvals before commercialization. These regulations aim to ensure patient safety and efficacy, but add to the development costs and time-to-market for new devices. Companies seeking to capitalize on this market's opportunities must navigate these regulatory hurdles while investing in research and development to innovate and differentiate their offerings.

- Additionally, collaborations and partnerships with regulatory bodies, healthcare providers, and technology companies can help streamline the approval process and accelerate market entry. Overall, the market presents significant growth potential for companies that can successfully navigate regulatory challenges and innovate to meet the evolving needs of healthcare providers and patients.

What will be the Size of the Laparoscopic Devices Market during the forecast period?

- The market encompasses a range of technologies and instruments used in minimally invasive laparoscopic surgeries. These procedures have gained significant traction due to their numerous benefits, including reduced recovery time, minimal scarring, and improved patient outcomes. The market is driven by the rising prevalence of obesity and associated diseases, such as uterine fibroids and endometriosis, leading to an increase in bariatric surgeries and weight reduction procedures. Additionally, the growing number of patients with diabetes and related complications necessitates more laparoscopic surgeries for conditions like ectopic pregnancy and hysterectomy. The market is further fueled by the adoption of energy systems and robot-assisted laparoscopic surgeries, which offer enhanced precision and flexibility.

- The market's size is substantial, with continued growth prospects due to the increasing demand for minimally invasive medical services and the availability of air freight delivery for timely access to these essential devices. Skilled professionals in the medical field continue to play a pivotal role in the successful implementation of these procedures, making the market a profitable and dynamic sector in the healthcare industry.

How is the Laparoscopic Devices Industry segmented?

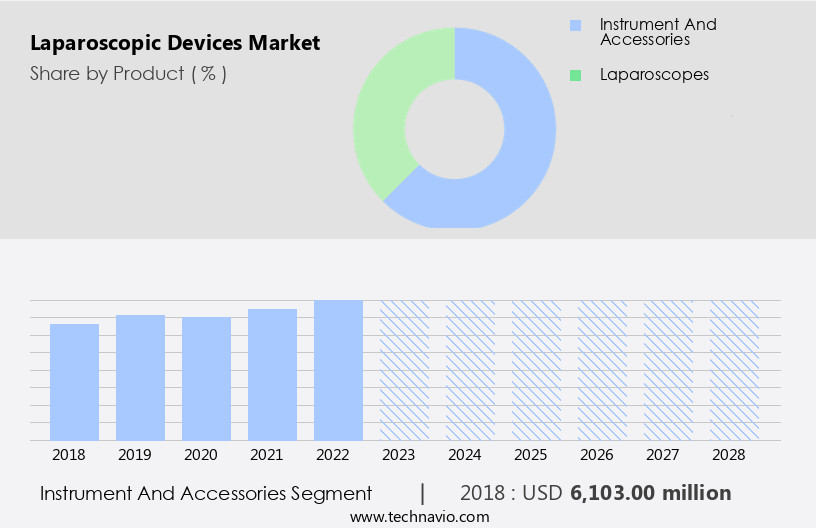

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Instrument and accessories

- Laparoscopes

- End-user

- Hospitals

- Clinics

- Ambulatory surgical centers

- Geography

- North America

- US

- Canada

- Europe

- Germany

- UK

- Asia

- Rest of World (ROW)

- North America

By Product Insights

The instrument and accessories segment is estimated to witness significant growth during the forecast period. The market encompasses insufflation/irrigation devices, closure instruments, graspers, trocars, and instruments with dissecting, suturing, and cutting capabilities, along with instrument trays, pumps, insufflators, accessories, ligature clips, light sources, needle holders, internal organ retractors, and equipment carts. Most of these instruments and accessories are disposable, generating recurring revenue. Technological advancements and a growing target population, including those with chronic diseases such as diabetes, gastrointestinal disorders, and obesity, fuel market expansion. For instance, Medtronic's Valleylab retractable laparoscopic electrodes offer enhanced features, including additional electrode tip insulation and aspiration holes, which improve laparoscopic procedures' precision, suction, and risk reduction. Ambulatory surgical centers, healthcare providers, and diagnostic centers increasingly adopt minimally invasive surgeries for procedures like appendectomy laparoscopy, cholecystectomy laparoscopy, gynecological surgery, urological surgery, and bariatric surgeries, including gastric bypass, sleeve gastrectomy, and adjustable gastric band.

The market caters to diverse patient populations, including underserved communities and veterans, and offers profitable opportunities for strategic sourcing and skilled professionals. However, the risk of infection and the need for air freight delivery pose challenges. Innovative laparoscopic devices, such as energy systems and robot-assisted laparoscopic surgeries, offer solutions to these challenges.

Get a glance at the market report of share of various segments Request Free Sample

The Instrument and accessories segment was valued at USD 6.1 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 29% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in the US is experiencing significant growth due to several factors, including the high prevalence of chronic diseases such as liver cancer and obesity, increasing healthcare expenditure, and the adoption of advanced technologies. The large patient pool resulting from these conditions presents profitable opportunities for market participants. Major companies dominate the market with their innovative and integrated laparoscopic devices, such as laparoscopes and insufflation devices. These devices facilitate minimally invasive surgeries for various conditions, including appendectomy, cholecystectomy, gynecological, urological, and bariatric procedures.

Additionally, the presence of local manufacturers and strategic sourcing initiatives further expands the market. Despite these opportunities, challenges such as the risk of infection and the need for skilled professionals remain. Market expansion also includes catering to underserved communities and diverse populations, including veterans and minorities.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Laparoscopic Devices Industry?

- The increasing popularity of MI techniques is the key driver of the market. The market is experiencing significant growth due to the increasing preference for minimally invasive (MI) procedures over traditional open surgeries. Healthcare providers are encouraging this shift as MI procedures offer several advantages over open surgeries. MI procedures are less painful and require a shorter hospital stay compared to open surgeries. The demand for MI surgeries is increasing due to the complications associated with conventional open surgeries, such as pain, blood clots, fatigue, muscle atrophy, infections, sore throat, nausea, and sleepiness from anesthesia.

- Advancements in laparoscopic technologies have led to improved precision, reduced invasiveness, and faster recovery times, making MI surgeries a preferred choice for patients. As a result, the market is poised for continued growth.

What are the market trends shaping the Laparoscopic Devices Industry?

- The growing popularity of robot-assisted laparoscopic surgery is the upcoming market trend. Laparoscopic surgery, a minimally invasive (MI) surgical procedure, utilizes laparoscopes and instruments for intricate operations. Robotic surgery, or robot-assisted laparoscopic procedures, has gained popularity among healthcare facilities due to technological advancements in visualization, ergonomics, and instrumentation.

- In March 2022, the Food and Drug Administration (FDA) approved robotically assisted surgical (RAS) devices for use in various laparoscopic surgeries in the field of general surgery. These procedures offer numerous benefits, including increased safety and effectiveness, shorter recovery time, and smaller incisions resulting in less bleeding and reduced hospital stays. The precision of robot-assisted systems significantly improves surgical outcomes, making them an increasingly preferred choice for complex procedures. The demand for MI surgeries using RAS devices continues to grow due to these advantages.

What challenges does the Laparoscopic Devices Industry face during its growth?

- Stringent regulations on new laparoscopic devices is a key challenge affecting the industry's growth. Laparoscopic devices, categorized as Class II medical devices, face rigorous regulatory approval processes. Obtaining approval for both Class II and III devices is a complex, unpredictable, and subjective process. Technical challenges during the clinical trial phase are common in all regions. Failure to produce positive clinical results in a specific region can lead to increased costs and uncertainty, potentially impacting other trials.

- Stringent regulatory frameworks and labeling requirements for laparoscopic devices pose challenges for manufacturers seeking market entry. Regulatory bodies impose these measures to ensure product safety and efficacy. These factors contribute to the difficulty of introducing new laparoscopic devices to the market.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- avateramedical GmbH

- B.Braun SE

- Becton Dickinson and Co.

- CMR Surgical Ltd.

- Conmed Corp.

- Cook Group Inc.

- FlexDex Inc.

- HOYA Corp.

- Intuitive Surgical Inc.

- Johnson and Johnson Services Inc.

- KARL STORZ SE and Co. KG

- Medtronic Plc

- Olympus Corp.

- Peters Surgical

- Richard Wolf GmbH

- Smith and Nephew plc

- Stryker Corp.

- Teleflex Inc.

- The Cooper Companies Inc.

- Titan Medical Inc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of innovative tools and technologies utilized in minimally invasive surgical procedures. These devices enable healthcare providers to perform various laparoscopic operations with precision and efficiency, leading to reduced recovery time and improved patient outcomes. The demand for laparoscopic devices is driven by several factors. The rise in chronic diseases such as diabetes and obesity has led to an increase in the number of surgeries performed for conditions like appendectomy, cholecystectomy, and gastrointestinal disorders. Furthermore, the trend towards minimally invasive surgeries and the growing number of ambulatory surgical centers have fueled market expansion.

Moreover, laparoscopic procedures offer several advantages over traditional surgeries. They result in less blood loss, reduced risk of infection, and quicker recovery times. These benefits have made laparoscopic surgeries increasingly popular for various gynecological conditions, including hysterectomy and myomectomy, as well as urological surgery for conditions like prostate laparoscopy. The market for laparoscopic devices is diverse and includes a range of products, from insufflation devices and closure devices to energy systems and suction/irrigation devices. Local manufacturers and strategic sourcing have played a significant role in the market's growth, ensuring a steady supply of high-quality equipment for healthcare providers.

Furthermore, robot-assisted laparoscopic surgeries have gained significant traction in recent years due to their increased precision and the ability to perform complex procedures with greater ease. These systems offer skilled professionals the ability to perform surgeries with minimal discomfort to patients, making them particularly attractive for procedures like bariatric surgeries, such as gastric bypass and sleeve gastrectomy, and thoracic laparoscopy. Despite the numerous benefits of laparoscopic surgeries, there are challenges to market growth. These include the high cost of equipment and the need for specialized training for surgeons. Additionally, underserved communities and veterans may face barriers to accessing these advanced surgical procedures due to financial or geographic constraints.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.18% |

|

Market growth 2024-2028 |

USD 4.76 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.4 |

|

Key countries |

US, Germany, UK, China, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Laparoscopic Devices Market Research and Growth Report?

- CAGR of the Laparoscopic Devices industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the laparoscopic devices market growth of industry companies

We can help! Our analysts can customize this laparoscopic devices market research report to meet your requirements.