Lithium Solid-State Battery Market Size 2024-2028

The lithium solid-state battery market size is forecast to increase by USD 398.26 thousand at a CAGR of 42% between 2023 and 2028. The market is experiencing significant growth due to several key factors. companies are increasingly launching solid-state batteries to meet the demand for extended range and environmentally friendly rechargeable battery options. This trend is particularly relevant in the context of the growing popularity of electric vehicles (EVs) and the need for high-energy-density batteries. However, the market also faces challenges, including the lack of charging infrastructure for EVs and the need to improve supply chain efficiencies in the production of solid-state batteries, which are currently more complex than traditional lithium-ion batteries. Lithium polymer batteries, a type of solid-state battery, offer potential solutions with their solid electrodes and higher energy density. To remain competitive, market participants must focus on addressing these challenges and continuing to innovate in the development of solid-state batteries.

What will be the Size of the Market During the Forecast Period?

The market is experiencing significant growth due to the increasing demand for high-performance, safe, and long-lasting energy storage solutions. These batteries offer several advantages over traditional lithium-ion batteries, including improved energy density, safety, and longevity. Solid electrolytes, a key component of solid-state batteries, enable faster charging times and increased safety features. The use of solid electrolytes eliminates the risk of thermal runaway, a common issue in lithium-ion batteries. Furthermore, solid-state batteries are more environmentally friendly as they do not contain liquid electrolytes, reducing the potential for leaks and environmental hazards.

Further, the electric vehicle (EV) adoption rate is on the rise, and the need for batteries with extended range and shorter charging times is becoming increasingly important. Solid-state batteries are expected to address these challenges, providing EV manufacturers with a competitive edge. The renewable energy(renewable energy market) sector is another major market for solid-state batteries. Energy storage systems are crucial for the integration of renewable energy sources into the power grid. Solid-state batteries offer the potential for greater energy density, enabling larger capacity energy storage systems and improving the overall efficiency of the grid. Government funding and venture capital investments are playing a significant role in the development of solid-state batteries.

Additionally, these investments are driving technological expertise and manufacturing capabilities, with several companies establishing pilot production lines. Consumer electronics are also expected to benefit from solid-state batteries due to their high-energy density and long-lasting nature. Thin-film batteries, a type of solid-state battery(battery market), are particularly suitable for use in consumer electronics due to their thin and flexible design. The transportation sector is another potential market for solid-state batteries. High-performance batteries are essential for electric buses, trains, and heavy-duty vehicles. Solid-state batteries offer the potential for increased energy density, longer range, and faster charging times, making them an attractive option for transportation applications.

In conclusion, regulatory support is crucial for the widespread adoption of solid-state batteries. Governments and regulatory bodies are recognizing the potential benefits of solid-state batteries and are providing incentives and guidelines to encourage their development and use. In conclusion, the market is poised for significant growth due to its potential to offer high-performance, safe, and long-lasting energy storage solutions. Applications in the EV, renewable energy, consumer electronics, and transportation sectors are expected to drive market growth. Investments in research and development, manufacturing capabilities, and regulatory support are crucial for the successful commercialization of solid-state batteries.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD thousand" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Polyethylene-oxide

- Lithium phosphorus oxy-nitride

- Sulfide glass

- End-user

- Transportation

- Consumer electronics

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- Norway

- North America

- US

- South America

- Middle East and Africa

- APAC

By Type Insights

The polyethylene-oxide segment is estimated to witness significant growth during the forecast period. The market is experiencing notable progress, particularly with polyethylene oxide (PEO)-based materials gaining prominence. PEO materials are becoming increasingly recognized for their role as polymer hosts in solid-state electrolytes, essential for high-energy density secondary lithium batteries. This segment boasts several distinct advantages, making PEO a compelling option in the market. PEO-based materials offer significant benefits that make them a desirable choice in The market. Their excellent safety profile is a critical consideration in battery technology. Furthermore, the simplicity of fabricating PEO-based materials is an added advantage, streamlining manufacturing processes. In the context of transportation and renewable energy, sustainable energy solutions are of utmost importance. Moreover, PEO-based batteries are suitable for clean energy applications, flexible and lightweight devices, and wearable (wearable technology market)

Additionally, lithium solid-state batteries, with their lightweight and flexible designs, are well-positioned to meet these requirements. Silicon anode batteries, a subset of solid-state batteries, are particularly noteworthy for their high energy density and long cycle life. As the world transitions towards reducing carbon emissions, these advancements in battery technology are crucial. In summary, the market is undergoing significant developments, with PEO-based materials emerging as a key segment. Their high safety profile, ease of fabrication, and potential to enhance battery performance make them an attractive choice for various applications, including transportation and renewable energy.

Get a glance at the market share of various segments Request Free Sample

The polyethylene-oxide segment was valued at USD 15.32 thousand in 2018 and showed a gradual increase during the forecast period.

Regional Insights

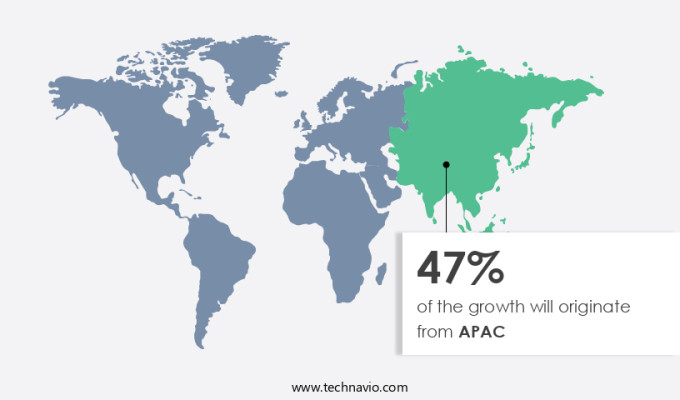

APAC is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The Asia Pacific region is playing a crucial role in The market, with both government and private sectors driving its growth. In China, there are ongoing initiatives to use all-solid-state batteries (SSBs) in electric vehicles (EVs) by 2027, with mass production planned by 2030. The primary motivation behind this push is the attractive features of sulfide-based all-SSBs, which offer an energy density of approximately 400 watt-hours per kilogram (Wh/kg). This high energy density is essential for improving the efficiency and driving range of EVs, making all-SSBs a game-changer in the automotive industry. China intends to employ a dual-track strategy for the development of EV batteries.

Moreover, the Chinese government is investing heavily in research and development, while private companies are focusing on commercialization. The favorable properties of all-SSBs, including their superior safety and longevity due to the use of solid electrolytes, make them an attractive alternative to lithium-ion batteries. As the world transitions to cleaner energy sources, the demand for batteries with enhanced performance and safety is increasing, and all-SSBs are well-positioned to meet this need.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The launch of lithium solid-state battery by market vendors is the key driver of the market. The global market for lithium solid-state batteries (SSBs) is experiencing substantial growth due to advancements in this technology by various companies. SSBs are poised to revolutionize energy storage systems by offering enhanced performance, safety, and energy density, making them an attractive option for consumer electronics and the renewable energy sector.

Moreover, Sakuu Corporation, a pioneer in additive manufacturing, has recently unveiled a 3Ah lithium-metal SSB. This new battery technology, which features a proprietary printed ceramic separator, aims to surpass the capabilities of current lithium-ion batteries. Sakuu's first-generation SSBs, comprised of 30 sub-cells, are scheduled for commercial launch by the end of this year. Venture capital investments continue to fuel the development of high-performance batteries, further driving the market's expansion.

Market Trends

The growing requirement for long-range EVs is the upcoming trend in the market. The market is experiencing substantial growth due to the escalating demand for extended-range electric vehicles (EVs) in the United States. Traditional lithium-ion batteries, while widely used in rechargeable batteries, have limitations such as finite range and extended charging times. To address these challenges, researchers and manufacturers are focusing on solid-state lithium batteries as a viable alternative. Notable advancements in this field include the anticipated commercialization of these batteries by major automotive companies, such as Toyota Motor Corporation. By 2027, Toyota aims to introduce solid-state batteries for commercial use. These high-energy-density batteries, featuring solid electrodes instead of the liquid or polymer electrolytes found in lithium-ion batteries, offer several advantages.

Also, they are environmentally friendly due to their non-toxic nature and reduced risk of thermal runaway. Additionally, they can potentially provide longer ranges and faster charging times. The transition towards sustainable energy solutions in the automotive sector is driving the growth of the market. As the industry continues to prioritize eco-friendly options, solid-state batteries are becoming increasingly attractive due to their potential to overcome the limitations of current lithium-ion batteries.

Market Challenge

The lack of EV charging infrastructure is a key challenge affecting the market growth. The electric vehicle (EV) market in the United States is experiencing steady growth, yet the industry encounters a substantial challenge: inadequate charging infrastructure. This issue hinders the widespread adoption of EVs, as revealed in various studies. For example, a recent survey indicated that 27% of potential buyers cited the lack of charging stations as their primary concern. This concern overshadows other obstacles, such as range anxiety (25%) and lengthy charging times (18%).

Moreover, the high cost of battery replacement, which affects 26% of prospective buyers, adds to the complexity of their purchasing decision. Technological advancements in solid-state lithium batteries offer a promising solution. With the establishment of pilot production lines, regulatory support, and a focus on clean energy, these batteries could significantly reduce charging times and enhance safety features. As a result, they may alleviate the concerns of consumers and accelerate the adoption of EVs. The US government and industry leaders must collaborate to invest in the development and deployment of these advanced batteries to meet the growing demand for sustainable transportation solutions.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Altairnano - The company offers advanced lithium-ion battery application kits for use in microgrids, offshore oil and gas facilities, transportation, and other areas.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ampcera Inc.

- Beijing Weilan New Energy Technology Co., Ltd

- Bollore SE

- BYD Co. Ltd.

- Future Electronics

- Ganfeng Lithium Group Co., Ltd

- Hitachi Zosen Corp.

- Ilika

- Ion Storage Systems

- Johnson Energy Storage Inc.

- LG Energy Solution Ltd.

- Murata Manufacturing Co. Ltd.

- Poly Plus Battery Co.

- ProLogium Technology Co. Ltd.

- Samsung SDI Co. Ltd.

- Solid Power Inc.

- STMicroelectronics International N.V.

- TDK Corp.

- Toyota Motor Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for high-performance batteries in various sectors. These batteries offer several advantages over traditional lithium-ion batteries, including higher energy density, improved safety, and longer lifespan. The use of solid electrolytes in these batteries eliminates the risk of thermal runaway and enhances overall safety. The market is driven by the growing adoption of electric vehicles (EVs) and the renewable energy sector. Government funding and venture capital investments are playing a crucial role in the development of this technology. Consumer electronics, medical devices, and transportation industries are also adopting lithium solid-state batteries due to their extended range, faster charging times, and environmental friendliness.

Lithium solid-state batteries (SSBs) are revolutionizing the energy storage landscape with their potential to offer superior performance and efficiency in various applications, including electric vehicles (EVs) and wearable devices. The electric vehicle adoption is surging, and SSBs' ability to provide longer range, faster charging, and greater safety makes them an ideal choice for the automotive industry. Moreover, SSBs contribute to supply chain efficiencies by eliminating the need for liquid electrolytes, reducing production costs, and minimizing environmental impact. These batteries are also lightweight, making them suitable for urbanization and the growing demand for environmentally friendly options in smart gadgets. Regulatory criteria and battery safety are crucial considerations in the adoption of SSBs. Thin film batteries, a type of SSB, are gaining attention due to their potential to meet these requirements. The electrolyte type plays a significant role in determining the performance and cost of SSBs.

The market for SSBs is expanding beyond traditional applications, with emerging countries playing a pivotal role in its growth. The integration of SSBs in urban transportation systems, smart grids, and wearable devices is expected to drive the market's growth in the coming years. In conclusion, lithium solid-state batteries are poised to transform the energy storage landscape, offering flexible, lightweight, and environmentally friendly solutions for electric vehicles and smart gadgets.

Moreover, manufacturing capabilities and technological expertise are critical factors in the market's growth. Companies are setting up pilot production lines and investing in research and development to improve battery performance and reduce production costs. The regulatory support for clean energy and the increasing focus on reducing carbon emissions are also contributing to the market's growth. Shelf life, safety features, and charging times are some of the key considerations for consumers when choosing lithium solid-state batteries. The market offers various types of batteries, including thin-film batteries, silicon anode batteries, and lithium polymer batteries, catering to different applications and requirements. The market is expected to continue its growth trajectory in the coming years, driven by advancements in technology and increasing demand from various industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

204 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 42% |

|

Market growth 2024-2028 |

USD 398.26 thousand |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

34.4 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 47% |

|

Key countries |

China, US, Japan, South Korea, Norway, India, Germany, Australia, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Altairnano, Ampcera Inc., Beijing Weilan New Energy Technology Co., Ltd, Bollore SE, BYD Co. Ltd., Future Electronics, Ganfeng Lithium Group Co., Ltd, Hitachi Zosen Corp., Ilika, Ion Storage Systems, Johnson Energy Storage Inc., LG Energy Solution Ltd., Murata Manufacturing Co. Ltd., Poly Plus Battery Co., ProLogium Technology Co. Ltd., Samsung SDI Co. Ltd., Solid Power Inc., STMicroelectronics International N.V., TDK Corp., and Toyota Motor Corp. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch