Livestock Monitoring Market Size 2024-2028

The livestock monitoring market size is forecast to increase by USD 15.56 billion, at a CAGR of 30.1% between 2023 and 2028.

- The market is driven by growing regulations concerning animal welfare and the adoption of advanced technologies, such as big data, to optimize farming practices. Farmers are increasingly investing in real-time monitoring systems to ensure the wellbeing of their livestock and improve overall productivity. However, challenges persist, particularly in rural areas where poor internet connectivity hampers the effective implementation of these technologies. Regulations mandating improved animal welfare standards are pushing farmers to adopt more sophisticated monitoring systems, while the use of big data enables real-time analysis of livestock health and behavior patterns, leading to enhanced farm management and increased profitability.

- Despite these opportunities, the lack of reliable internet connectivity in rural farming communities poses a significant challenge, limiting the widespread adoption of advanced livestock monitoring systems. Companies seeking to capitalize on this market must address this connectivity issue and develop innovative solutions to ensure seamless integration of their technologies into rural farming operations.

What will be the Size of the Livestock Monitoring Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and the growing demand for efficient and effective farm management. Livestock behavior analysis, facilitated by farm management software and wireless sensor networks, provides valuable insights into animal welfare and productivity. Animal welfare indicators, such as activity level detection and GPS livestock location, enable farmers to ensure optimal living conditions and prevent health issues. Herd management strategies, bolstered by data security protocols and mobile application interfaces, allow for real-time monitoring and intervention. Disease outbreak detection, livestock performance metrics, and remote health monitoring are integral components of this dynamic market.

Sensor data integration and data analytics platforms enable health event prediction and milk yield prediction, leading to mortality rate reduction and increased productivity. IOT device deployment, environmental monitoring, weight monitoring sensors, and remote diagnostic tools further enhance the capabilities of livestock monitoring systems. Breeding management systems, data visualization dashboards, predictive maintenance models, and precision livestock farming are some of the emerging trends shaping the market. Automated feeding systems, animal identification tags, heat stress detection, rumination monitoring systems, RFID animal tracking, location-based alerts, feed intake measurement, and geofencing technology are all essential elements that seamlessly integrate into this continuously evolving landscape.

How is this Livestock Monitoring Industry segmented?

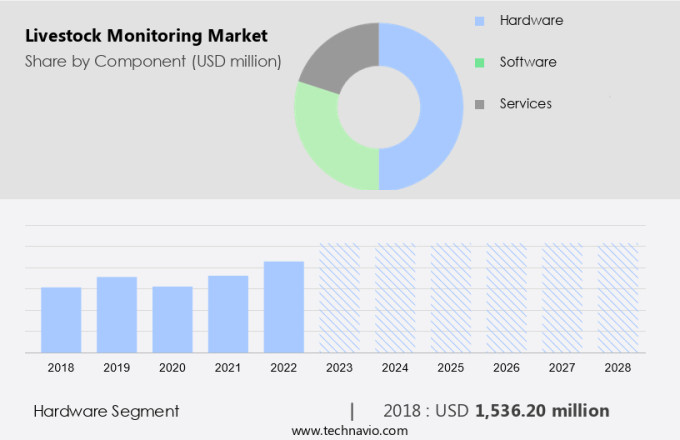

The livestock monitoring industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Component

- Hardware

- Software

- Services

- Geography

- North America

- US

- Europe

- France

- Germany

- APAC

- Australia

- China

- Rest of World (ROW)

- North America

By Component Insights

The hardware segment is estimated to witness significant growth during the forecast period.

In the realm of modern farming, livestock monitoring has evolved significantly, integrating advanced technologies to enhance productivity, animal welfare, and disease prevention. Wearable gear, including RFID tags and sensors embedded in collars, serve as the primary hardware for monitoring livestock behavior and vital signs. Smart cameras and GPS systems are installed on farms to track animal location and activity level. These devices collect and transmit data on various aspects, such as feeding patterns, health status, reproduction, nutrition quality, and environmental conditions. This data empowers farmers to make informed decisions on herd management strategies, optimizing feed intake, and implementing preventive measures against diseases.

Real-time location tracking and geofencing technology enable farmers to monitor the whereabouts of their livestock and receive location-based alerts for specific events. Remote health monitoring and disease outbreak detection systems help prevent the spread of illnesses, reducing mortality rates and improving overall herd health. Data analytics platforms integrate sensor data, enabling predictive maintenance models, milk yield predictions, and heat stress detection. IoT device deployment and data visualization dashboards offer farmers a comprehensive understanding of their herd's performance metrics, enabling them to make data-driven decisions and improve overall efficiency in their farming operations.

The Hardware segment was valued at USD 1.54 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

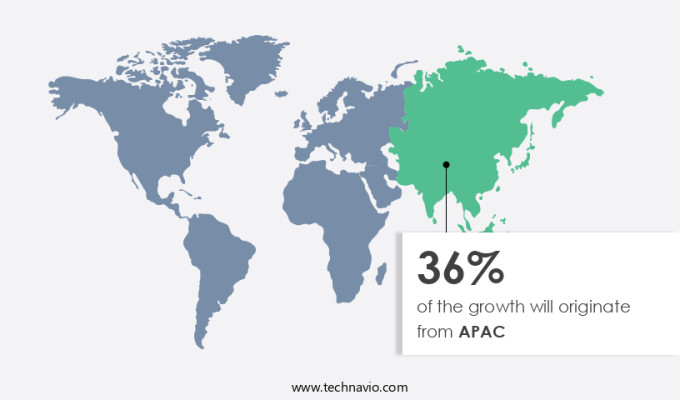

APAC is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic US livestock farming industry, precision technologies are increasingly adopted to optimize input management and enhance productivity. Over 50,000 concentrated animal feeding operations in the US and numerous livestock farms in neighboring Canada utilize advanced farming solutions. These technologies facilitate real-time location tracking, activity level detection, and health monitoring through wireless sensor networks and GPS livestock location systems. Herd management strategies are streamlined with animal identification tags, heat stress detection, and rumination monitoring systems. Data security protocols ensure the confidentiality of sensitive information, while mobile application interfaces enable remote access to data analytics platforms for health event prediction and milk yield prediction.

IoT device deployment supports predictive maintenance models, automating feeding systems, and environmental monitoring. Sensor data integration and data visualization dashboards provide farmers with valuable insights into livestock performance metrics, disease outbreak detection, and mortality rate reduction. Remote diagnostic tools and breeding management systems further optimize herd management, while RFID animal tracking and location-based alerts ensure efficient feed intake measurement and geofencing technology implementation. The integration of these technologies fosters a harmonious balance between livestock welfare indicators and operational efficiency, shaping the evolving trends in precision livestock farming.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Livestock Monitoring Industry?

- Compliance with regulations concerning animal welfare is the primary factor influencing market trends.

- The livestock industry is experiencing a rise in the number of animals produced for human consumption, putting pressure on farmers to manage larger herds. This overstocking situation necessitates constant monitoring to ensure animal health and wellbeing. Chronic diseases, such as anthrax and various viral and bacterial infections, have become increasingly prevalent among livestock, necessitating proper identification and regular monitoring. Animal welfare organizations have called for regulations in livestock rearing due to concerns regarding animal care in the face of overcapacity production units. To address these challenges, advanced technologies like animal identification tags, heat stress detection systems, rumination monitoring systems, RFID animal tracking, location-based alerts, and feed intake measurement are gaining traction.

- Geofencing technology is another innovative solution that enables real-time monitoring and alerts farmers to potential issues, ensuring prompt intervention and improving overall herd management efficiency. These technologies not only enhance animal welfare but also contribute to increased productivity and profitability for farmers.

What are the market trends shaping the Livestock Monitoring Industry?

- The utilization of big data in livestock monitoring is an emerging market trend. This innovative approach leverages advanced data analytics to enhance productivity and efficiency in the livestock industry.

- The market is witnessing significant growth due to the adoption of advanced technologies such as livestock behavior analysis, farm management software, wireless sensor networks, and GPS livestock location. These technologies enable farmers to monitor and manage their herds more effectively, using real-time data on animal welfare indicators, activity level detection, and herd management strategies. Data security protocols are also essential to protect the sensitive information collected. Farmers can access this data through mobile application interfaces, allowing them to make informed decisions on feeding, breeding, and health management. Big data applications in livestock farming offer opportunities for improving efficiency, reducing costs, and optimizing production.

- By analyzing historical data, farmers can identify trends and patterns, enabling them to make data-driven decisions and implement proactive measures to prevent potential issues. Moreover, wireless sensor networks can monitor environmental conditions, such as temperature, humidity, and air quality, ensuring optimal living conditions for the animals. The integration of GPS technology in livestock monitoring systems allows farmers to track the location and movement of their herds, enhancing herd management strategies and ensuring animal safety. Overall, the use of technology in livestock monitoring is transforming the industry, offering numerous benefits to farmers and contributing to the sustainable growth of the livestock sector.

What challenges does the Livestock Monitoring Industry face during its growth?

- Rural areas face significant challenges in industrial growth due to inadequate internet connectivity, which hinders productivity and limits access to essential digital resources.

- The global livestock industry faces the challenge of meeting the increasing demand for meat products due to population growth. Precision livestock farming methods, such as remote health monitoring and disease outbreak detection, are essential to increasing farm capacity. However, the deployment of these technologies is limited by the lack of internet connectivity in rural areas where most farms are located, particularly in developing countries. For instance, initiatives like the Indian government's push for broadband connectivity in rural areas aim to address this issue.

- Livestock performance metrics, such as milk yield prediction and mortality rate reduction, can be monitored in real-time using data analytics platforms. Health event prediction and sensor data integration are crucial components of these systems. By leveraging advanced technologies like the Internet of Things (IoT) and data analytics, farmers can improve livestock health and productivity, ultimately contributing to the sustainability and growth of the livestock industry.

Exclusive Customer Landscape

The livestock monitoring market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the livestock monitoring market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, livestock monitoring market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Afimilk Ltd. - This company specializes in livestock monitoring, providing innovative solutions like AfiFarm. AfiFarm is a comprehensive herd management software, enabling farmers to efficiently track milk production, animal health, and reproductive cycles.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Afimilk Ltd.

- CowManager BV

- Dairymaster

- Fancom BV

- Fullwood Ltd.

- Gallagher Group Ltd.

- GAO RFID Inc.

- GEA Group AG

- HID Global Corp.

- Hokofarm Group

- IceRobotics Ltd.

- Lely International NV

- Madison One Holdings LLC

- Merck and Co. Inc.

- Nedap NV

- Phonetics Inc.

- Quantified AG

- Sum-It Computer Systems Ltd.

- Tetra Laval SA

- URUS Group LP

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Livestock Monitoring Market

- In January 2024, Agrotech Innovations, a leading livestock monitoring solutions provider, announced the launch of its new IoT-based real-time livestock monitoring system, "SmartHerd." This system utilizes advanced sensors to track animal health, feeding patterns, and behavior, aiming to improve farm productivity and reduce losses (Agrotech Innovations Press Release).

- In March 2024, TechGiant Corporation, a global technology leader, entered into a strategic partnership with Livestock Monitoring Solutions (LMS), a key player in the market. The partnership aimed to integrate TechGiant's advanced data analytics capabilities into LMS's livestock monitoring solutions, enhancing the overall value proposition for farmers (TechGiant Corporation Press Release).

- In May 2024, AgroMonitor, a major livestock monitoring solutions provider, raised a Series C funding round of USD 30 million from a consortium of investors, including venture capital firms and strategic investors. The funds will be used to expand the company's global footprint and accelerate product development (AgroMonitor Press Release).

- In February 2025, the European Commission approved the use of remote monitoring systems, including livestock monitoring solutions, under the Common Agricultural Policy (CAP). This approval is expected to significantly boost the adoption of livestock monitoring technologies in Europe, particularly in countries with large livestock populations (European Commission Press Release).

Research Analyst Overview

- In the dynamic market, farming operations are leveraging advanced technologies to enhance farm productivity and optimize resource utilization. Feeding efficiency analysis and real-time herd management enable farmers to improve animal welfare and resource allocation. Data analytics solutions facilitate early warning systems for disease prevention strategies and proactive health management. Remote veterinary consultation and individual animal tracking enable farmers to make informed decisions and reduce labor costs. Livestock traceability systems ensure sustainability and environmental impact assessment, while optimized breeding programs and precision feeding techniques boost farm efficiency.

- Integrated farm management incorporates advanced sensor technology for body condition scoring, automated data collection, and enhanced farm productivity. Smart livestock farming employs sustainable practices, such as optimized resource utilization and disease prevention strategies, to minimize risks and promote animal health. Overall, these innovations contribute to the market's growth and evolution, shaping the future of livestock farming.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Livestock Monitoring Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

137 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 30.1% |

|

Market growth 2024-2028 |

USD 15563.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

23.2 |

|

Key countries |

US, China, Germany, France, and Australia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Livestock Monitoring Market Research and Growth Report?

- CAGR of the Livestock Monitoring industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the livestock monitoring market growth of industry companies

We can help! Our analysts can customize this livestock monitoring market research report to meet your requirements.