Managed File Transfer Software Market Size 2025-2029

The managed file transfer software market size is forecast to increase by USD 542.7 million at a CAGR of 9.5% between 2024 and 2029.

- The market is driven by the increasing demand for secure and efficient data exchange solutions. With the digital transformation of businesses and the rise of big data, managing and transferring large files securely has become a critical challenge. Integration with smart applications is another key driver, enabling automation and streamlining of file transfer processes. However, the transfer of large files continues to pose difficulties, necessitating robust solutions that can handle high volumes and complex data formats. Despite these opportunities, the market faces significant challenges.

- Security remains a top priority, with the need to protect sensitive data during transfer and ensure compliance with various regulations. Additionally, the complexity of managing multiple transfer protocols and integrations can be a barrier to adoption. Companies must navigate these challenges to effectively capitalize on the market's potential and stay competitive in the evolving digital landscape. Business continuity, data security, and advanced encryption standards are vital for maintaining data confidentiality.

What will be the Size of the Managed File Transfer Software Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market is witnessing significant activity and trends, with a focus on enhancing security and streamlining operations. The Cloud Security Alliance highlights the importance of secure file transfer solutions, driving demand for features like multi-factor authentication, penetration testing, and vulnerability management. Technical support and customer service are crucial, with centralized management and real-time monitoring enabling efficient problem resolution. Distributed architecture and deployment automation are key trends, allowing for seamless integration with software defined networking and virtual private networks. Automated testing, version control, and change management ensure compliance and reduce errors.

Service level agreements, incident management, and single sign-on provide a superior user experience. Data analytics and data visualization offer valuable insights, while threat intelligence and professional services help organizations stay ahead of potential risks. Maintenance contracts, software licensing, and application programming interfaces facilitate easy integration and customization. Extensible markup language and XML-based configurations enable flexibility and scalability. With the digital transformation of businesses and the rise of big data, managing and transferring large files securely has become a critical challenge.

How is this Managed File Transfer Software Industry segmented?

The managed file transfer software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Sector

- Large enterprises

- SMEs

- Component

- Software

- Services

- Deployment

- Cloud-based

- On-premises

- Hybrid

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Sector Insights

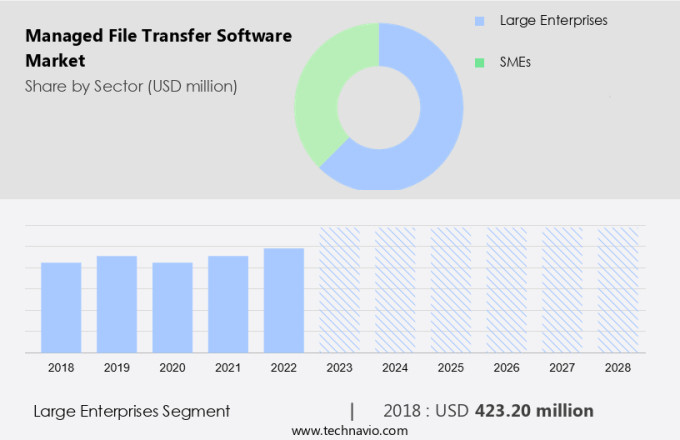

The Large enterprises segment is estimated to witness significant growth during the forecast period. In today's data-driven business landscape, managing file transfers is a crucial aspect for enterprises. Merely transferring files from one place to another is no longer sufficient. Advanced technologies are essential for businesses to automate and secure file transfers while gaining insights into employee interactions with data. The evolution of file transfer protocols began with FTP, which lacked security features. Subsequently, secure protocols like SFTP and FTPS emerged, providing end-to-end encryption and safeguarding data during transfer over public networks. Enterprise-level file transfer involves several critical considerations. Automation and workflow are essential to manage complex business operations, ensuring seamless file access and transfer.

Data integrity is paramount, with validation, error handling, and file integrity checks in place. On-premise deployment and high availability ensure business continuity. Cloud integration and hybrid deployments enable flexibility and scalability. Threat modeling, PCI DSS, intrusion detection systems, and network security protect against potential threats. Data transformation, masking, and encryption standards secure sensitive data. Disaster recovery, audit trails, digital signatures, and data governance ensure compliance and regulatory adherence. Load balancing and secure copy protocols maintain system performance and availability. Workflow automation streamlines processes, while file transfer protocols ensure secure data exchange.

Access control, certificate authority, key management, and role-based access ensure secure handling of data. Public key infrastructure further enhances security. These technologies and practices are shaping the file transfer market, addressing the evolving needs of enterprise businesses.

The Large enterprises segment was valued at USD 454.10 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 48% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, particularly in North America, which holds the largest market share and is anticipated to be the fastest-growing region. The region's data-intensive industries and advanced technological infrastructure fuel this growth. Managed file transfer software ensures data integrity during transfer, providing businesses with high availability and disaster recovery capabilities. It also offers data validation, error handling, access control, and encryption standards such as Advanced Encryption Standard (AES) and Data Encryption Standard (DES). Cloud integration, threat modeling, and PCI DSS compliance are essential features that enable businesses to secure their data during transfer. Intrusion detection systems and network security measures provide an additional layer of protection against potential threats. Cloud-based offerings are gaining popularity due to their flexibility and scalability.

Data loss prevention, data masking, and data anonymization are crucial for maintaining privacy and security. Workflow automation, secure copy protocol, and load balancing optimize business operations and improve efficiency. Role-based access control, certificate authority, and key management ensure secure data access. Public Key Infrastructure (PKI) further enhances security by implementing digital signatures and file integrity checks. Data transformation and business continuity planning are vital components of managed file transfer software, ensuring seamless data transfer and uninterrupted business operations. Managed file transfer software's ability to support hybrid deployments and file encryption further expands its appeal to businesses. Security policies and file transfer protocols, such as SFTP, ensure secure data transfer.

Overall, managed file transfer software's ability to provide robust data security solutions makes it an essential tool for businesses in North America and beyond.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Managed File Transfer Software market drivers leading to the rise in the adoption of Industry?

- The primary factor driving the market is the security benefits it offers. In today's technologically advanced business landscape, network security and data protection are paramount to mitigating potential risks and safeguarding sensitive information. With an increasing amount of data being stored across networks and cloud-based deployments, the threat of cyber-attacks, such as Denial of Service (DoS), Distributed Denial of Service (DDoS), phishing, and other online fraud, poses a significant challenge. A data breach can result in costly lawsuits, insurance claims, and reputational damage for the organization. To address these concerns, Managed File Transfer (MFT) software solutions have emerged as a critical component of an organization's data security strategy.

- These solutions offer advanced features like intrusion detection systems, data transformation, data masking, data loss prevention, disaster recovery, audit trails, digital signatures, and data encryption standards to ensure data integrity, confidentiality, and availability. By implementing these features, businesses can protect their data from unauthorized access, manipulation, and loss, while maintaining regulatory compliance and ensuring business continuity. Automation is another key trend, as organizations seek to streamline file transfer processes and reduce manual efforts.

What are the Managed File Transfer Software market trends shaping the Industry?

- Smart application integration is a significant market trend that is mandatory for businesses to adopt for staying competitive. This involves seamlessly connecting various applications to streamline processes and enhance operational efficiency. Managed File Transfer (MFT) software has gained significant traction in the business world due to its ability to securely and efficiently transfer large files between systems and users. With the integration of MFT software with Android and iOS applications, accessibility has been enhanced, attracting a large user base. This software is classified into three categories: ad-hoc, application-centric, and people-centric solutions.

- Data security is a primary concern, and MFT software employs advanced encryption standards, such as Advanced Encryption Standard (AES), to protect data during transfer. Additionally, features like data governance, load balancing, secure copy protocol, business continuity, and workflow automation ensure data integrity and availability. A hybrid deployment model allows businesses to maintain control over their on-premises infrastructure while leveraging the benefits of the cloud. Traditional file exchange methods, such as email and File Transfer Protocol (FTP), lack the necessary security and feasibility for transferring sensitive or proprietary content, as file types, sizes, and volumes continue to grow exponentially.

How does Managed File Transfer Software market face challenges during its growth?

- The transfer of large files poses a significant challenge in the industry, as it can hinder growth due to the resulting complexities and potential delays in data transmission. Managed file transfer solutions address the complexities and security concerns associated with transferring large files between internal and external networks, particularly in multinational organizations. Time constraints and file type restrictions are common challenges in digital file transfers. To mitigate these issues, managed file transfer software offers features such as file encryption, security policies, data anonymization, and file integrity checks. These solutions also incorporate certificate authority, key management, role-based access control, and public key infrastructure for enhanced security.

- By prioritizing file security and providing real-time visibility, managed file transfer software ensures the integrity and confidentiality of data during transfer. MFT software and cloud services offer a reliable alternative, enabling businesses to share critical information, including CAD/CAM designs, healthcare records, financial data, and human resources files, in a timely, secure, and dependable manner. Integration with smart applications is another important consideration, enabling seamless workflows and improving overall efficiency.

Exclusive Customer Landscape

The managed file transfer software market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the managed file transfer software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, managed file transfer software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Accellion USA LLC - This company specializes in managed file transfer solutions, including ArcESB, enabling secure, dependable, and automated data exchange between various systems, business partners, and cloud services.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Accellion USA LLC

- Advanced Systems Concepts Inc.

- ArcESB Llc.

- Axway Software SA

- Broadcom Inc.

- Cleo

- Coviant Software LLC

- International Business Machines Corp.

- Open Text Corp.

- Oracle Corp.

- Progress Software Corp.

- QlikTech International AB

- Rocket Software Inc.

- Signiant Inc.

- Software GmbH

- Thru Inc.

- TIBCO Software Inc.

- Wipro Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Managed File Transfer Software Market

- In January 2024, IBM announced the acquisition of OpenPages, a leading provider of Managed File Transfer (MFT) solutions, strengthening IBM's hybrid cloud capabilities and expanding its MFT offerings (IBM Press Release).

- In March 2024, Significant Technologies, a leading MFT company, partnered with Amazon Web Services (AWS) to offer its MFT solutions on AWS Marketplace, enabling seamless integration with AWS services (Significant Technologies Press Release).

- In May 2024, GlobalScape, a prominent MFT provider, raised USD30 million in a funding round led by Insight Partners to accelerate product innovation and expand its market presence (GlobalScape Press Release).

- In January 2025, OpenText, a global leader in Enterprise Information Management, completed the acquisition of MFT company, GXS, further broadening its portfolio and enhancing its Managed File Transfer capabilities (OpenText Press Release).

Research Analyst Overview

The market continues to evolve, with dynamic market activities shaping its landscape. Businesses across various sectors rely on this technology to ensure data integrity during the transfer process. Integral components, such as on-premise deployment, high availability, data validation, error handling, and access control, are essential for maintaining data security and ensuring seamless transfers. Cloud integration, threat modeling, PCI DSS compliance, intrusion detection systems, data transformation, data masking, network security, data loss prevention, disaster recovery, audit trails, digital signature, data encryption standard, data governance, load balancing, secure copy protocol, business continuity, and advanced encryption standard are all critical elements that are continually being refined and integrated into managed file transfer solutions.

Workflow automation, file transfer protocol, hybrid deployment, file encryption, security policies, data anonymization, file integrity check, certificate authority, key management, role-based access control, and public key infrastructure are also key features that are increasingly being adopted to enhance the functionality and efficiency of managed file transfer systems. The market's continuous evolution reflects the ever-changing needs of businesses and the importance of secure, reliable, and efficient data transfer solutions. With a high volume of data generation and consumption, North America is a technological powerhouse, making it an ideal market for managed file transfer software.

The Managed File Transfer (MFT) Software Market is expanding rapidly as organizations prioritize secure and efficient data exchange. The integration of Virtual Private Network (VPN) capabilities ensures encrypted connections, protecting sensitive data in transit. Seamless Application Programming Interface (API) support enhances interoperability between enterprise systems and external platforms. Effective system administration features empower IT teams to control, monitor, and automate file transfers with precision. Adherence to well-defined Service Level Agreements (SLAs) guarantees performance benchmarks, reliability, and uptime assurance. To maintain robust security, regular security audits are implemented, identifying vulnerabilities and reinforcing compliance.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Managed File Transfer Software Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

206 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.5% |

|

Market growth 2025-2029 |

USD 542.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

8.4 |

|

Key countries |

US, Canada, China, Japan, UK, Germany, Mexico, India, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Managed File Transfer Software Market Research and Growth Report?

- CAGR of the Managed File Transfer Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the managed file transfer software market growth of industry companies

We can help! Our analysts can customize this managed file transfer software market research report to meet your requirements.