Medical Active Air Sampling System Market Size 2024-2028

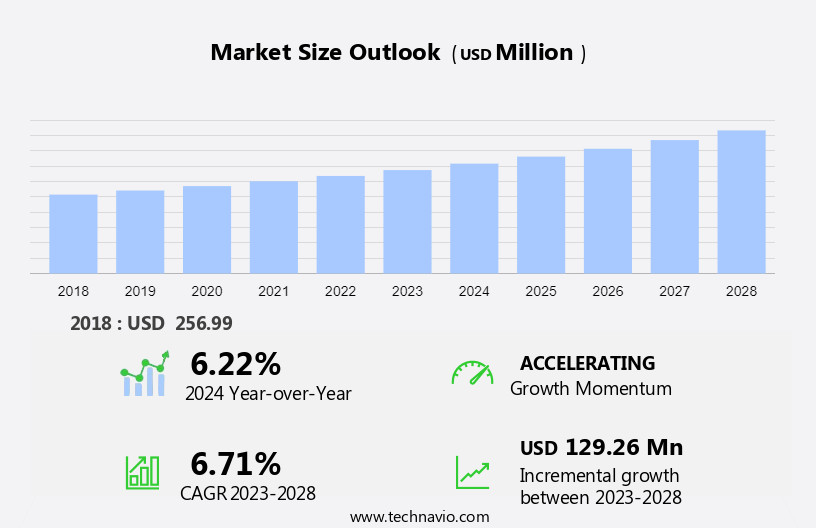

The medical active air sampling system market size is forecast to increase by USD 129.26 million, at a CAGR of 6.71% between 2023 and 2028.

- Active air sampling systems have witnessed significant growth In the medical industry due to the increased requirement for microbiological monitoring to ensure patient safety and maintain a clean environment. The integration of the Internet of Things (IoT) and connectivity In these systems enables real-time monitoring and data analysis, enhancing their efficiency and accuracy. However, the high initial investments associated with active air sampling systems may hinder market growth for some healthcare facilities. Despite this challenge, the benefits of these systems, such as early detection and prevention of airborne infections, make them an essential investment for healthcare providers seeking to maintain optimal indoor air quality and protect patient health.

What will be the Size of the Medical Active Air Sampling System Market During the Forecast Period?

- The market encompasses technologies and solutions designed for the detection and analysis of airborne contaminants in healthcare settings. This market exhibits strong growth due to increasing awareness of indoor air quality and the potential health risks associated with airborne pollutants. Factors driving market expansion include the proliferation of advanced technologies, such as real-time monitoring systems and sensor technologies, which enable early detection and mitigation of contaminants. Additionally, the growing prevalence of healthcare-associated infections and the need for stringent regulatory compliance are key market growth drivers.

- The market scope includes various applications, such as the detection of bacteria, viruses, and volatile organic compounds (VOCs), including those derived from fuel sources like gasoline, ethanol, methanol, and natural gas. These fuels undergo processes like fermentation, refining, and distillation, producing by-products that can impact indoor air quality. Market trends include the development of multi-parameter monitoring systems and the integration of artificial intelligence and machine learning algorithms for enhanced data analysis and interpretation.

How is this Medical Active Air Sampling System Industry segmented and which is the largest segment?

The medical active air sampling system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Pharmaceuticals and biotechnology

- Hospitals and clinics

- Others

- Type

- Portable microbial sampling system

- Desktop microbial sampling system

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

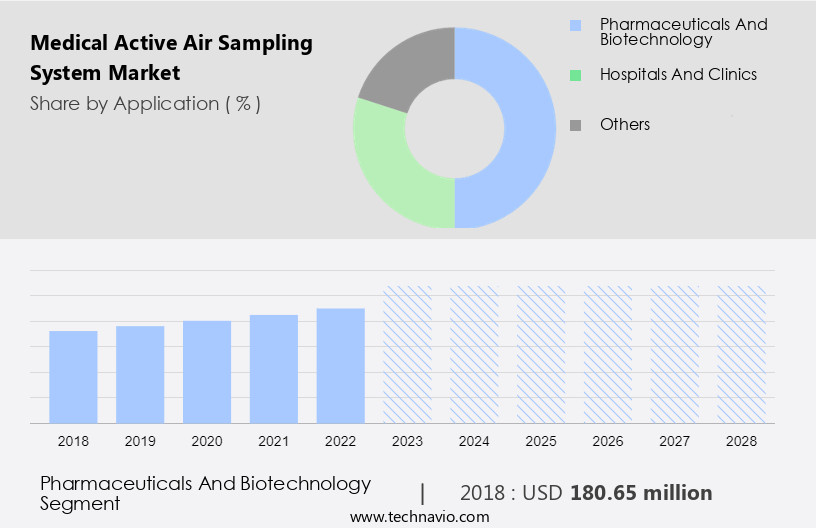

By Application Insights

- The pharmaceuticals and biotechnology segment is estimated to witness significant growth during the forecast period.

In the pharmaceutical and biotechnology sectors, active air sampling systems are essential for maintaining the sterility and quality of production facilities. These systems are crucial in pharmaceutical plants, where the production of medicines and pharmaceutical products directly impacts public health. Biotechnology laboratories, as hubs of innovation, deal with delicate biological materials, cell cultures, and genetic materials that are susceptible to contamination. Active air sampling systems provide real-time data on airborne particles and microorganisms, enabling researchers to maintain experiment sterility and prevent cross-contamination. These systems are particularly important in high-risk locations where contamination can have severe consequences. Active and passive sampling methods, including impaction samplers and settle plates, are used for microbial monitoring.

Calibration, microbial growth identification, and trend analyses are critical components of a monitoring plan. Compliance with regulations, such as those related to environmental monitoring and risk assessment, requires frequent testing and adherence to purity limits. Air sampling techniques, including CFUs (colony-forming units) and quantitative and qualitative results, are essential for ensuring the effectiveness of active air sampling systems.

Get a glance at the Medical Active Air Sampling System Industry report of share of various segments Request Free Sample

The pharmaceuticals and biotechnology segment was valued at USD 180.65 million in 2018 and showed a gradual increase during the forecast period.

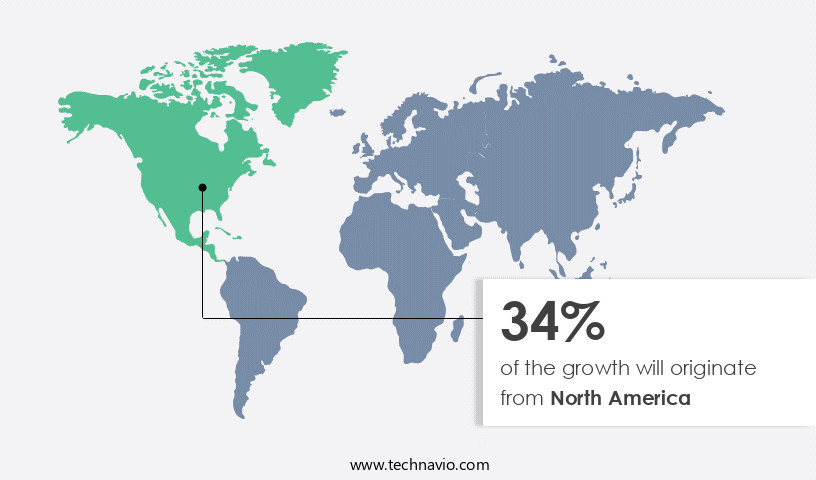

Regional Analysis

- North America is estimated to contribute 34% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market holds a prominent position due to advanced healthcare infrastructure, rigorous infection control regulations, and technological innovation. As a significant player In the global healthcare sector, North America prioritizes patient safety and quality of care, fostering the adoption of advanced air quality management solutions. In the US and Canada, hospitals, clinics, research institutions, and pharmaceutical companies recognize the importance of active air sampling systems in safeguarding patient health and preventing infection spread. Key drivers include the colorless liquid solvents used in medical applications, such as grain alcohol, methanol, and methyl alcohol, which require monitoring for potential contamination.

Air sampling methods, including impaction samplers and settle plates, provide quantitative and qualitative results for microbial growth identification in accordance with 17025 accredited laboratory standards. Regular testing for contaminants like bacteria, yeast, mold, and fungi is essential for risk assessment and trend analyses. The frequency of testing depends on the purity limits and contamination levels set by regulations for high-risk locations. Companies offering air sampling services, such as Trace Analytics and AirCheck Team, provide resources like instructional documents, webinars, and videos to support clients in maintaining environmental monitoring and quality control.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Medical Active Air Sampling System Industry?

Increased requirement for microbiological monitoring is the key driver of the market.

- In the realm of microbiological monitoring, medical active air sampling systems play a pivotal role in ensuring the cleanliness and safety of healthcare facilities. These systems are essential in areas such as operating rooms, laboratories, and patient care units, where airborne microorganisms, including bacteria and viruses, can pose significant risks to patients and healthcare personnel. Microbiological monitoring is a systematic and standardized process that involves collecting and analyzing air samples to assess contamination levels. It is a critical component of quality control (QC) in industries like biotechnology, healthcare, and pharmaceuticals, which are subject to stringent regulations from organizations such as the Health and Safety Executive (HSE) In the UK and the Occupational Safety and Health Administration (OSHA) In the US.

- Grain alcohol, a flammable, colorless liquid, is often used as a solvent or fuel in various applications, including fermentation processes that convert sugars derived from corn or sugarcane into ethanol. Ethanol, which can be found in fuels like gasoline (E10), octane, flex-fuel vehicles (E85), and cellulosic ethanol, can also serve as a fuel source for microbial growth. Other fuels, such as natural gas, methanol (methyl alcohol), methyl alcohol (wood alcohol), and biodiesel derived from vegetable oil, can also contribute to microbial contamination. To mitigate the risks associated with microbial growth and contamination, it's essential to implement a monitoring plan that includes regular air sampling using tools like impaction samplers and settle plates.

- This approach allows for both qualitative and quantitative results, enabling the identification of microorganisms like bacteria, yeast, and mold, as well as determining the concentration of contaminants. Calibration, microbial growth identification, and quality control are all essential aspects of microbiological monitoring. A 17025 accredited laboratory can provide the necessary expertise and resources, including instructional documents, webinars, and videos, to help organizations develop and implement effective monitoring plans. Frequency of testing, purity limits, and trend analyses are also crucial factors to consider when implementing a monitoring program.

What are the market trends shaping the Medical Active Air Sampling System Industry?

Integration of IoT and connectivity in active air sampling systems is the upcoming market trend.

- IoT-integrated active air sampling systems offer healthcare facilities real-time insights into air quality parameters, enhancing infection control efforts. These systems collect and transmit data seamlessly, allowing for prompt responses to potential threats, such as increased pathogen levels or contaminants. Administrators and healthcare personnel receive alerts and updates in real-time, enabling proactive measures to prevent infection spread. The integration of IoT also introduces new connectivity dimensions, enabling remote management and monitoring, freeing personnel from manual data collection tasks, and enabling informed decision-making. Grain alcohol, a flammable, colorless liquid used in fermentation processes, is among the contaminants that active air sampling systems can monitor.

- Other fuels, such as gasoline, E10, octane, flex-fuel vehicles, E85, E15, cellulosic ethanol, natural gas, methanol, methyl alcohol, and wood alcohol, can also be monitored. Additionally, antifreeze, solvents, windshield wiper fluid, and corrosion byproducts from gasoline refining and crude oil can be detected. Regulations require regular monitoring for microorganisms, including bacteria, yeast, and mold contamination. Monitoring plans include air sampling using impaction samplers and settle plates, with CFUs and quantitative/qualitative results. Calibration, microbial growth identification, and quality control in 17025 accredited laboratories ensure accurate and reliable results. Frequency of testing, trace analytics, and trend analyses are essential components of a comprehensive environmental monitoring and risk assessment strategy.

What challenges does the Medical Active Air Sampling System Industry face during its growth?

High initial investments associated with active air sampling systems is a key challenge affecting the industry growth.

- Active air sampling systems play a crucial role in ensuring the air quality in healthcare facilities meets stringent infection control standards. However, the initial investment for purchasing and installing these systems can be substantial. The cost includes not only the acquisition of the systems but also installation, personnel training, and ongoing maintenance. The total cost of ownership, which includes calibration and potential upgrades, can strain healthcare budgets, especially in regions with limited funding or financial pressures. Despite the financial commitment, the long-term value of these systems in preventing microbial contamination and ensuring patient safety is significant. Key components of active air sampling systems include impaction samplers, settle plates, and calibration.

- These tools enable the detection of microorganisms such as bacteria, yeast, and mold, providing both qualitative and quantitative results. Proper implementation of a monitoring plan, including regular testing and trend analyses, is essential for maintaining optimal air quality and complying with regulations. Key considerations include purity limits, frequency of testing, and the use of 17025 accredited laboratories for quality control and environmental monitoring. In high-risk locations, passive sampling methods may also be employed in conjunction with active sampling for comprehensive air quality assessment.

Exclusive Customer Landscape

The medical active air sampling system market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the medical active air sampling system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, medical active air sampling system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aquaria Srl

- Bertin Technologies SAS

- Cantium Scientific Ltd.

- Climet Instruments Co.

- Emtek LLC

- IUL SA

- Lighthouse Worldwide Solutions Inc.

- Merck KGaA

- Neu tec Group Inc.

- Orum International Srl

- SARSTEDT AG and Co. KG

- Spectris Plc

- Thermo Fisher Scientific Inc.

- Tisch Environmental Inc.

- TSI Inc.

- Veltek Associates Inc.

- Acquisition Systems Ltd

- Avantor Inc

- bioMerieux SA

- Sartorius AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses technologies designed to detect and quantify various contaminants present In the air for healthcare applications. These systems play a crucial role in maintaining a clean and safe environment in hospitals, laboratories, and other healthcare facilities. The market dynamics are driven by several factors, including the increasing focus on infection control, stringent regulations, and advancements in technology. The need for effective air quality management in healthcare facilities is a primary driver for the growth of the market. The presence of microorganisms such as bacteria, yeast, and mold In the air can lead to contamination, which can result in adverse health effects for patients and staff.

Further, active air sampling systems employ techniques that actively draw air through a filter or sorbent material to collect contaminants, providing quantitative and qualitative results for a more comprehensive understanding of the air quality. Passive air sampling systems, on the other hand, rely on the natural movement of air to collect contaminants on a sorbent material. While passive sampling systems are less expensive and require minimal maintenance, they may not provide accurate results in high-risk locations or when real-time monitoring is necessary. The market is influenced by various regulations that mandate regular monitoring and reporting of air quality in healthcare facilities.

In addition, these regulations ensure that healthcare providers maintain a clean and safe environment for their patients and staff. Compliance with these regulations can help healthcare facilities avoid costly fines and reputational damage. Advancements in technology have led to the development of more sophisticated air sampling systems that can detect a wider range of contaminants, including volatile organic compounds (VOCs) and particulate matter. These systems can provide real-time monitoring, enabling healthcare facilities to take corrective action promptly and maintain optimal air quality. The market is also influenced by the availability of resources such as instructional documents, webinars, and videos that help healthcare facilities understand the importance of air quality monitoring and the best practices for implementing an effective monitoring plan.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.71% |

|

Market Growth 2024-2028 |

USD 129.26 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.22 |

|

Key countries |

US, Canada, Germany, UK, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Medical Active Air Sampling System Market Research and Growth Report?

- CAGR of the Medical Active Air Sampling System industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the medical active air sampling system market growth of industry companies

We can help! Our analysts can customize this medical active air sampling system market research report to meet your requirements.