Mobile Hotspot Market Size 2024-2028

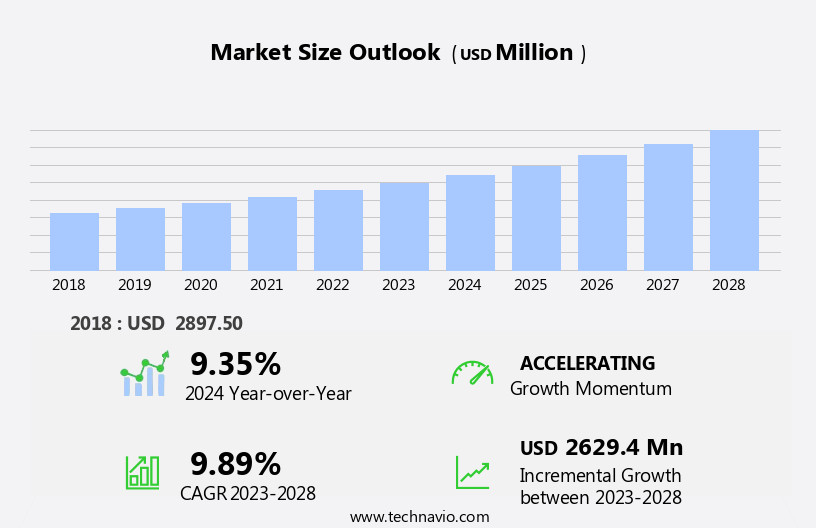

The mobile hotspot market size is forecast to increase by USD 2.63 billion at a CAGR of 9.89% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing development of smart cities and the expanding integration of Internet of Things (IoT) and smart devices. With the proliferation of connected devices, the need for reliable and portable internet connectivity solutions has become essential. Mobile hotspots, as a result, have gained immense popularity among individuals and businesses. Technological advancements continue to shape the market landscape, with improvements in battery life, network speed, and compatibility with various devices. However, challenges persist, particularly in ensuring seamless operating experiences across different mobile hotspot models and mobile network providers.

- Companies seeking to capitalize on market opportunities must focus on addressing these compatibility issues and delivering user-friendly solutions. Additionally, strategic partnerships and collaborations with mobile network operators and IoT device manufacturers can provide significant competitive advantages. Overall, the market presents a promising growth trajectory, offering opportunities for innovation and strategic investments.

What will be the Size of the Mobile Hotspot Market during the forecast period?

- The market encompasses a range of portable devices and solutions that provide wireless internet connectivity, merging the capabilities of cellular data networks and Wi-Fi. These devices cater to the growing demand for reliable internet access on-the-go, particularly among remote workforces, smart devices, and travelers. The market is driven by the integration of 5G technology, which offers faster speeds and lower latency, enhancing the overall user experience. Software companies, network operators, telecom service providers, equipment manufacturers, managed service providers, and wireless hotspot controller companies contribute to the market's growth.

- Mobile hotspot devices, such as pocket routers, travel routers, MIFIs, and portable Wi-Fi hotspots, are increasingly popular due to their ability to create a local Wi-Fi network using 3G/4G signals, LTE, or even VPN connections. Centralized hotspot management and advanced security features are also essential aspects of the market, ensuring secure and efficient wireless network usage.

How is this Mobile Hotspot Industry segmented?

The mobile hotspot industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Mobile hotspot router

- USB stick

- End-user

- Commercial use

- Personal use

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Middle East and Africa

- UAE

- Rest of World

- North America

By Type Insights

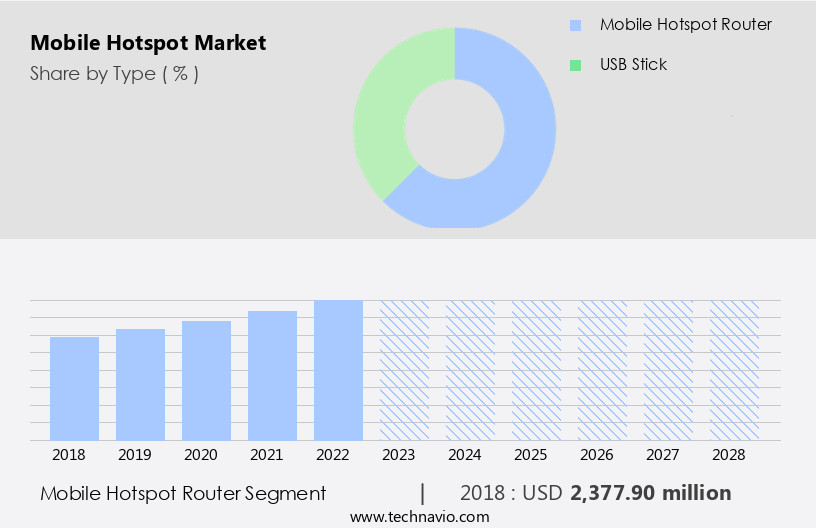

The mobile hotspot router segment is estimated to witness significant growth during the forecast period.

Mobile hotspot routers play a pivotal role in the expansion of the market. These devices cater to the demands of travelers, remote workers, and businesses requiring uninterrupted Internet connectivity in areas with limited or unreliable broadband options. Mobile hotspot routers offer numerous advantages, including portability, user-friendliness, and support for multiple device connections. Notable companies, such as NETGEAR and TP-Link, provide mobile hotspot routers with impressive features. For instance, NETGEAR's Nighthawk M6 offers high-performance capabilities, supporting Gigabit LTE speeds for fast and dependable Internet access. It also boasts an extended battery life and the capacity to connect up to 20 devices, making it a versatile solution for personal and professional use.

As businesses undergo digital transformation, the need for reliable mobile connectivity solutions, like mobile hotspots, becomes increasingly essential for various industries, including finance, healthcare, hospitality, transportation, and communication services. With the integration of 5G technology, mobile hotspots are expected to deliver enhanced download and upload speeds, further boosting their popularity. Additionally, security features, such as VPNs and IoT technologies, are becoming increasingly important to protect against cyber threats and ensure the safety of cloud-based applications, virtual learning, and other digital services. Mobile hotspot devices and wireless hotspot gateways, along with Wi-Fi security software, cloud-based hotspot management, and professional services, are essential components of the mobile hotspot ecosystem.

Network operators, telecom service providers, equipment manufacturers, managed service providers, and wireless hotspot controller companies contribute to the market's growth.

Get a glance at the market report of share of various segments Request Free Sample

The Mobile hotspot router segment was valued at USD 2.38 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

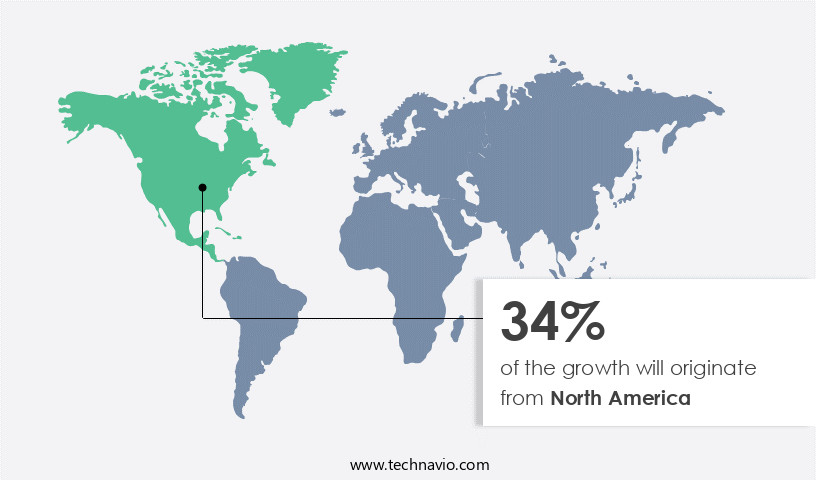

North America is estimated to contribute 34% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The North American the market is experiencing significant growth and innovation, driven by the widespread use of portable devices and the increasing demand for dependable Internet connectivity. With a mature and competitive market landscape, the region, encompassing the US and Canada, is characterized by high smartphone penetration, robust network infrastructure, and a rising need for high-speed wireless transmission. The adoption of mobile hotspots is escalating due to the flexibility they offer for remote work, online education, and digital entertainment. The number of connected devices per household is increasing, necessitating stable and high-speed Internet connections that mobile hotspots can deliver.

The integration of 5G technology into mobile hotspots, such as the Nighthawk M6, is further enhancing download and upload speeds, providing enhanced security features, and supporting multiple device connectivity. The market caters to various industries, including enterprise, healthcare, financial services, hospitality, transportation, communication service providers, and more. The market is served by software companies, network operators, telecom service providers, equipment manufacturers, managed service providers, wireless hotspot controllers, and mobile hotspot device and gateway manufacturers. The market is also witnessing the emergence of cloud-based hotspot management, professional services, installation services, and consulting services. As businesses undergo digital transformation, mobile hotspots have become an essential component of network infrastructure, ensuring network performance optimization, integrated services, and business continuity.

The market is also witnessing the integration of IoT technologies, VPNs, and 5G networks, further expanding its scope and applications.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Mobile Hotspot Industry?

- Increase in development of smart cities is the key driver of the market. The market is witnessing significant growth due to the increasing demand for reliable internet access on portable devices. With the proliferation of wireless networks such as Wi-Fi and cellular data networks, remote work solutions have become a necessity for both commercial and domestic users. Smart devices, including laptops, tablets, and smartphones, require constant connectivity for cloud-based applications, virtual learning, travel, and digital transformation. The integration of 5G technology into mobile hotspots offers enhanced download and upload speeds, making them indispensable for enterprises, healthcare, and other industries vulnerable to cyber threats.

- Moreover, equipment manufacturers, software companies, network operators, telecom service providers, and managed service providers are investing in mobile hotspots to cater to the demand for mobile connectivity. Portable and compact routers like the Nighthawk M6 are popular choices for their portability, multi-functional capabilities, and long battery life. Standalone and bundled devices offer flexibility in terms of data plans and usage. The market for mobile hotspots is expected to grow further with the increasing adoption of 5G technology and the need for secure and reliable internet access for smart homes and remote working. Thus, such factors are driving the growth of the market during the forecast period.

What are the market trends shaping the Mobile Hotspot Industry?

- Growing integration of IoT and smart devices is the upcoming market trend. The market is experiencing significant growth due to the increasing demand for reliable internet access on portable devices. With the proliferation of wireless networks, Wi-Fi and cellular data networks have become essential for remote work solutions, smart devices, and digital transformation. As businesses and individuals continue to rely on cloud-based applications, virtual learning, and travel, the need for mobile connectivity has become a necessity. 5G integration is revolutionizing the market with enhanced download and upload speeds, making it an attractive option for enterprise, healthcare, and commercial applications. The demand for portable and compact routers, such as the Nighthawk M6, is increasing due to their multi-functional capabilities and long battery life. Software vendors, network operators, telecom service providers, equipment manufacturers, and managed service providers are investing in the development of standalone and bundled devices to cater to the commercial and domestic markets.

- However, with the increasing use of mobile hotspots, cyber threats have become a significant concern. Therefore, manufacturers are integrating enhanced security features to ensure data privacy and protection. The Wi-Fi Hotspot market is expected to grow exponentially in the coming years, driven by the digital transformation, 4G technology, and the rollout of 5G technology. The market is also witnessing the emergence of smart homes, Mobile applications, and IoT, further fueling the demand for mobile hotspots. Thus, such trends will shape the growth of the market during the forecast period.

What challenges does the Mobile Hotspot Industry face during its growth?

- Technological advancements and compatibility issues in operating mobile hotspots is a key challenge affecting the industry growth. The market is witnessing significant growth due to the increasing demand for reliable internet connectivity on portable devices. With the proliferation of wireless networks, Wi-Fi and cellular data networks are becoming essential for remote work solutions and connecting smart devices. As digital transformation continues to gain momentum, the need for mobile connectivity is becoming increasingly important for enterprise, healthcare, education, and travel sectors. 5G integration is expected to enhance the market growth by providing faster download and upload speeds, enabling cloud-based applications and virtual learning.

- Moreover, enhanced security features are also a key consideration for businesses and individuals, especially in the face of increasing cyber threats. Equipment manufacturers, software vendors, network operators, telecom service providers, and managed service providers are all playing a crucial role in the development of the Mobile Hotspot market. Standalone and bundled devices, such as the Nighthawk M6, offer portability, multi-functionality, and long battery life, making them popular choices for both commercial and domestic use in smart homes and remote working environments. Hence, the above factors will impede the growth of the market during the forecast period.

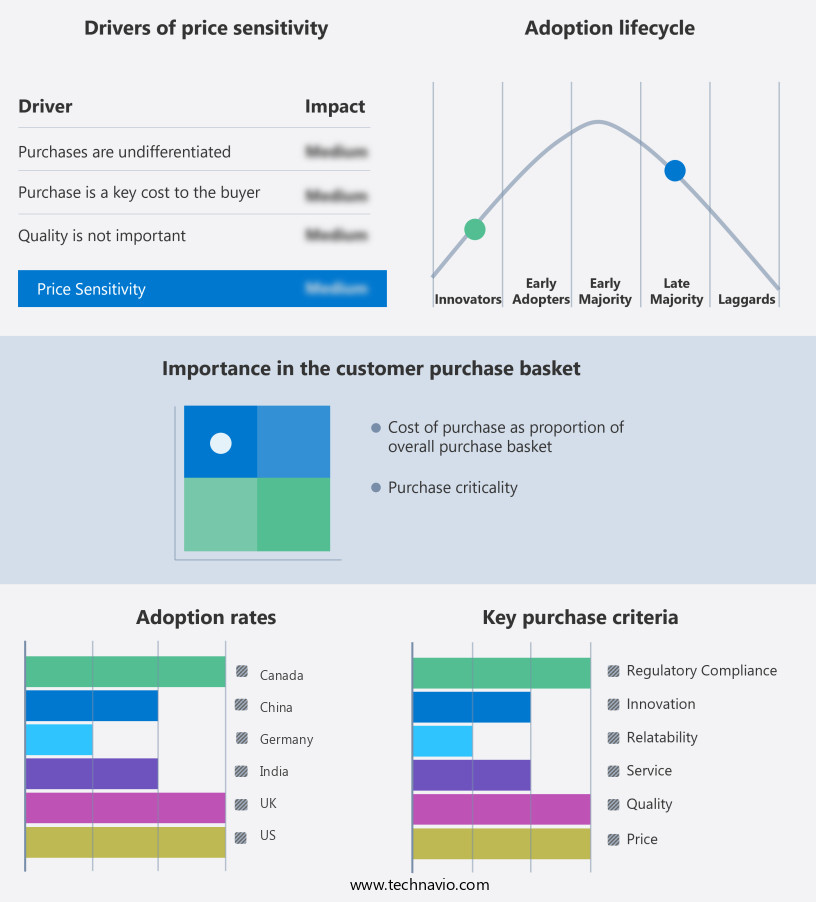

Exclusive Customer Landscape

The mobile hotspot market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the mobile hotspot market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, mobile hotspot market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Acer Inc. - The company provides mobile hotspot solutions, including the AT&T Hotspot MiFi Liberate and similar offerings, enabling users to access the internet on-the-go with ease and flexibility. These portable devices offer reliable connectivity, making them an essential tool for professionals and travelers alike. With a user-friendly interface and robust network capabilities, the company's mobile hotspot services ensure uninterrupted internet access, allowing users to stay productive and connected anytime, anywhere.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acer Inc.

- AT and T Inc.

- D Link Corp.

- GlocalMe

- HTC Corp.

- Huawei Technologies Co. Ltd.

- Inseego Corp.

- KonnectONE

- Linksys Holdings Inc.

- Netgear Inc.

- Orbic

- Samsung Electronics Co. Ltd.

- Simo Holdings Inc.,

- T Mobile US Inc.

- Telstra Corp. Ltd.

- TP Link Corp. Ltd.

- United Telecom LLC

- Verizon Communications Inc.

- Vodafone Group Plc

- Zyxel Communications Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of portable devices that provide wireless internet connectivity, enabling users to access the internet through cellular data networks or Wi-Fi. These devices cater to various sectors, including remote work solutions, smart homes, travel, and enterprise applications. The demand for reliable internet access continues to grow as businesses undergo digital transformation and embrace cloud-based applications, virtual learning, and telecommuting. Mobile hotspot devices offer a flexible and convenient solution for businesses and individuals seeking high-speed wireless transmission and enhanced security features. The integration of 5G technology into mobile hotspot devices promises faster download and upload speeds, lower latency, and improved network performance optimization.

This technology is particularly beneficial for businesses that rely on real-time data transfer and virtual collaboration. Manufacturers, network operators, telecom service providers, software companies, managed service providers, and wireless hotspot controller companies offer a variety of mobile hotspot devices, including standalone devices and bundled solutions. These devices cater to different sectors, such as enterprise, healthcare, financial services, hospitality, transportation, communication service providers, and more. Portability and multi-functionality are essential factors in the market. Compact routers, pocket routers, and travel routers offer portability and support multiple devices, making them ideal for individuals and businesses on the go. The market for mobile hotspot devices also includes Wi-Fi security software, cloud-based hotspot management, professional services, installation services, consulting services, and managed services.

These offerings help businesses optimize network performance, ensure network security, and manage their mobile hotspot deployments effectively. The integration of IoT technologies and VPNs into mobile hotspot devices adds an extra layer of security and flexibility for businesses and individuals. The market for mobile hotspot devices is expected to grow significantly as the demand for high-speed wireless transmission and reliable internet access continues to increase. The market is dynamic, with ongoing advancements in technology and evolving business needs driving innovation and competition. Network infrastructure, connected devices, and integrated services continue to shape the market landscape, offering new opportunities for businesses and individuals seeking reliable and efficient mobile internet connectivity solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

189 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.89% |

|

Market growth 2024-2028 |

USD 2629.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.35 |

|

Key countries |

US, Japan, China, Canada, Germany, France, India, UK, Brazil, UAE, and Rest of World |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Mobile Hotspot Market Research and Growth Report?

- CAGR of the Mobile Hotspot industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the mobile hotspot market growth of industry companies

We can help! Our analysts can customize this mobile hotspot market research report to meet your requirements.