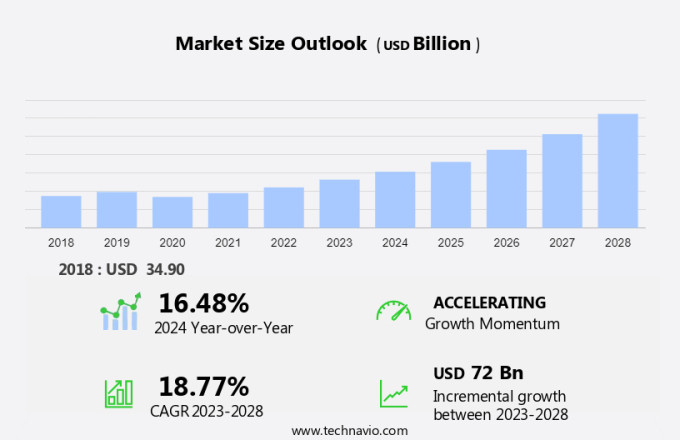

Next Generation Lithium Batteries Market Size 2024-2028

The next generation lithium batteries market size is forecast to increase by USD 72 billion, at a CAGR of 18.77% between 2023 and 2028. The market is experiencing significant growth due to several key drivers. One of these factors is the increasing demand for clean energy solutions and the need for more efficient and high-performing batteries. companies are responding to this trend by investing heavily in research and development to create advanced battery chemistries, such as magnesium ion batteries, next-generation batteries, and solid electrolyte batteries, face challenges, including material availability and the high cost of producing these next-generation batteries. Cylindrical lithium-ion batteries continue to dominate the market, but alternative technologies like metal-air batteries are gaining traction in specific industries, such as aerospace and defense.

What will be the Size of the Market During the Forecast Period?

The market is witnessing significant advancements with the development of next-generation batteries. These advanced batteries are expected to revolutionize various industries, including electric vehicles (EVs), portable electronics, and renewable energy storage. In this context, several types of next-generation batteries are gaining attention, such as lithium-ion (Li-ion), lithium sulfur (Li-S), magnesium ion, nickel-metal hydride (NiMH), ultra-capacitors, solid electrodes, metal air, and aluminum-air batteries. Li-ion batteries, currently the market leader, offer high energy density, long cycle life, and excellent power output. However, they face challenges such as safety concerns and limited resource availability.

Li-S batteries, on the other hand, have the potential to offer higher energy density and lower environmental impact compared to Li-ion batteries. They are still under development and require further research to overcome challenges related to stability and durability. Magnesium ion batteries are another promising technology, as they offer higher energy density, lower cost, and improved safety compared to Li-ion batteries. However, they are still in the research and development stage and face challenges related to scalability and manufacturing. NiMH batteries have been a popular choice for portable electronics due to their high energy density and environmental friendliness.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Automotive

- Consumer electronics

- Energy storage systems

- Aerospace and defense

- Others

- Type

- Advanced lithium-ion batteries

- Lithium-sulfur batteries

- Lithium-air batteries

- Geography

- APAC

- China

- Japan

- Europe

- Germany

- France

- North America

- US

- South America

- Middle East and Africa

- APAC

By Application Insights

The automotive segment is estimated to witness significant growth during the forecast period. The automotive sector holds a crucial position in the international market, propelling the industry's expansion as the transportation sector moves towards sustainable solutions. With the increasing focus on reducing carbon emissions and combating climate change, next-generation lithium batteries are indispensable for the rising number of electric cars, buses, and trucks. Advanced battery technologies, including Li-ion, solid-state, and innovative chemistries, are being engineered and introduced to cater to the specific demands of electric vehicles. A significant trend in the automotive segment of The market is the evolution of Li-ion batteries with enhanced energy density, improved safety features, and quicker charging capabilities. This progression is vital in addressing the unique challenges of powering electric vehicles and driving advancements in this sector. Furthermore, the industrial, oil and gas, and consumer electronics sectors also contribute significantly to the growth of the market. Energy storage systems, particularly in renewable energy applications, are another substantial market for these advanced batteries.

Get a glance at the market share of various segments Request Free Sample

The automotive segment accounted for USD 15.20 billion in 2018 and showed a gradual increase during the forecast period.

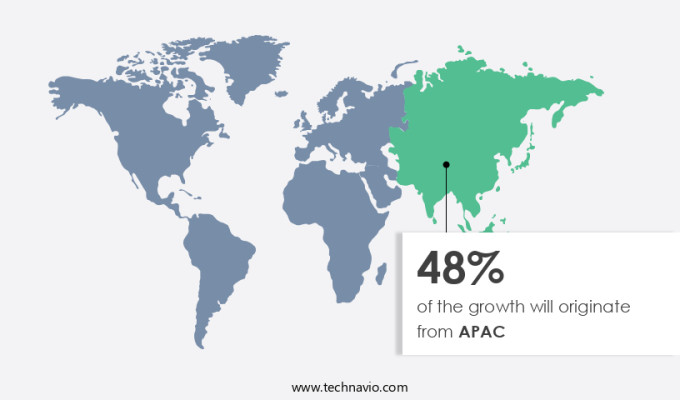

Regional Insights

APAC is estimated to contribute 48% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Next-Generation Lithium Batteries are gaining significant traction in the global energy storage market. These advanced batteries include Nickel-metal hydride, Ultra-capacitors, Lithium Sulphur (Li-S), Magnesium ion, and Lithium-ion (Li) batteries, among others. The Asia Pacific (APAC) region is poised for substantial growth in the next few years due to the escalating demand for electronics and electric vehicles (EVs). In countries such as India, China, Japan, South Korea, and Thailand, the number of smartphones and tablet users is projected to reach new heights.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The rise in strategic partnership among market companies is the key driver of the market. The market in the United States has experienced significant growth, with an increasing number of strategic collaborations among market participants. This trend is fueled by the escalating demand for advanced energy storage solutions, evolving market landscapes, and the continuous quest for technological innovations. Next generation lithium batteries encompass various chemistries and applications, necessitating a multidisciplinary approach to research and development. In response, market players are recognizing the importance of collaboration and pooling their resources and expertise to drive progress.

Moreover, strategic partnerships enable these companies to combine their strengths in areas such as materials science, engineering, manufacturing, and market access, fostering a collaborative ecosystem that expedites the commercialization of cutting-edge battery technologies. These alliances not only bolster the competitiveness of market players but also contribute to the overall growth and maturity of the market. Market segments include Metal Air, Lithium-ion batteries, and lithium-sulfur batteries. Applications span across Electric vehicles, Smart appliances, and Electronic gadgets, including laptops. Key players in the market include, but are not limited to, Li-Cycle, Sila Nanotechnologies, and QuantumScape.

Market Trends

An increase in research and development efforts toward creating more advanced battery chemistries is the upcoming trend in the market. The market has witnessed significant advancements in battery technology, driven by the increasing demand for high-performance, clean energy storage solutions. Companies are investing heavily in research and development to address the limitations of traditional Lithium ion (Li) batteries, such as low power density, charging speed, cycle life, and safety concerns. Magnesium ion batteries, next-generation flow batteries, solid electrolyte batteries, and metal air batteries are some of the emerging battery chemistries that offer improved performance characteristics. These advanced battery technologies are expected to revolutionize various industries, including electric vehicles, renewable energy integration, consumer electronics, and aerospace and defense. The market is anticipated to grow significantly due to the increasing focus on sustainable and cost-effective energy storage solutions.

Further, taditional cylindrical lithium-ion batteries have served the industry well, but they are no longer sufficient to meet the evolving energy storage requirements. As such, the development of next-generation batteries is crucial to ensuring the continued growth and success of the clean energy sector. In summary, the market is experiencing a rise in innovation, driven by the need for high-performance, sustainable, and cost-effective energy storage solutions. The quest for enhanced power density, charging speed, cycle life, and safety is leading to the development of advanced battery chemistries, such as magnesium ion batteries, next-generation flow batteries, solid electrolyte batteries, and metal-air batteries.

Market Challenge

An increase in concerns regarding material availability and high cost of next-generation lithium batteries is a key challenge affecting the market growth. The market has experienced notable growth due to the escalating demand for advanced battery technology in various sectors, including mobile phones, cameras, drones, electric vehicles, consumer electronic appliances, and the e-mobility industry. However, the market expansion is faced with challenges, primarily due to the reliance on critical raw materials such as lithium, cobalt, nickel, and rare earth elements.

Further, the burgeoning demand for these materials, fueled by the expansion of the electric vehicle market, renewable energy systems, and consumer electronics, has resulted in supply chain constraints, price volatility, and concerns regarding resource availability. Semiconductor industries and battery manufacturers are under pressure to innovate and find alternative, sustainable solutions to mitigate these challenges and ensure the scalability and commercial viability of next-generation lithium batteries.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Amprius Technologies Inc. - The company offers next generation lithium batteries such as SiMaxx batteries, which deliver up to 450 Wh/kg and 1,150 Wh/L, with third-party validation of 500Wh/kg and 1,300 Wh/L.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aquion Energy

- Bollore SE

- BYD Co. Ltd.

- Contemporary Amperex Technology Co. Ltd.

- Enevate Corp.

- Enovix Corp.

- Farasis Energy GanZhou Co. Ltd

- GS Yuasa International Ltd.

- Ilika

- Johnson Controls International Plc.

- Johnson Matthey Plc

- LG Corp.

- Lohum Cleantech Pvt. Ltd.

- Lyten Inc.

- Northvolt AB

- Panasonic Holdings Corp.

- ProLogium Technology Co. Ltd.

- Rimac Group Ltd.

- Samsung SDI Co. Ltd.

- Solid Power Inc.

- StoreDot.

- Sunwoda Electronic Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Next-generation batteries are revolutionizing various industries, including electric vehicles (EVs), consumer electronic appliances, and the e-mobility industry. These advanced batteries offer enhanced performance and longer runtimes compared to traditional batteries such as nickel-metal hydride, nickel cadmium, and lithium-ion. Next-generation batteries include lithium sulfur (Li-S), magnesium ion, and solid electrolyte batteries. Li-S batteries promise higher energy density and lower cost, making them ideal for EVs and portable electronics. Magnesium ion batteries offer superior safety and environmental benefits, making them a promising alternative to lithium-ion batteries. Solid electrolyte batteries ensure improved safety and longer cycle life. Metal air batteries, such as aluminum-air, are another type of next-generation batteries that offer high energy density and low cost.

In addition, these batteries are ideal for various applications, including electric vehicles and consumer electronics. The battery market is witnessing significant growth due to the increasing demand for clean energy and high-performance batteries. The semiconductor industries are also investing in next-generation batteries to improve the power density of their products. The automotive sector, aerospace and defense, industrial, oil and gas, and consumer electronics are some of the major industries adopting next-generation advanced batteries. Next-generation batteries are expected to play a crucial role in the renewable energy storage market, enabling the integration of renewable energy into the power grid. Gigafactories are being set up to mass-produce these batteries, further driving down their cost and increasing their availability.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.77% |

|

Market Growth 2024-2028 |

USD 72 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

16.48 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 48% |

|

Key countries |

China, US, Germany, Japan, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Amprius Technologies Inc., Aquion Energy, Bollore SE, BYD Co. Ltd., Contemporary Amperex Technology Co. Ltd., Enevate Corp., Enovix Corp., Farasis Energy GanZhou Co. Ltd, GS Yuasa International Ltd., Ilika, Johnson Controls International Plc., Johnson Matthey Plc, LG Corp., Lohum Cleantech Pvt. Ltd., Lyten Inc., Northvolt AB, Panasonic Holdings Corp., ProLogium Technology Co. Ltd., Rimac Group Ltd., Samsung SDI Co. Ltd., Solid Power Inc., StoreDot., and Sunwoda Electronic Co. Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.