Process Analyzer Market Size 2024-2028

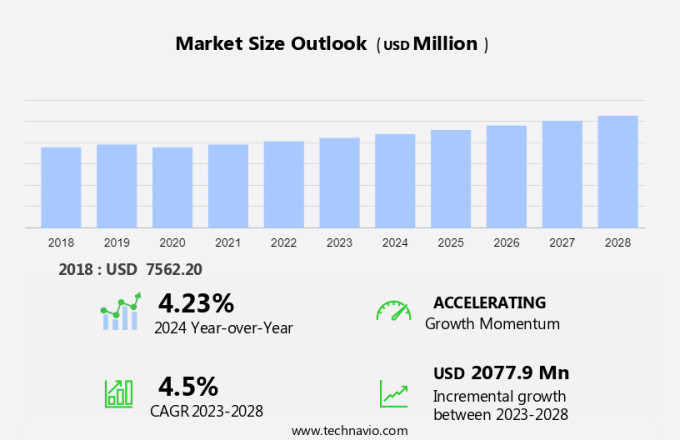

The process analyzer market size is forecast to increase by USD 2.08 billion at a CAGR of 4.5% between 2023 and 2028.

- Process analyzers are used in laboratories and remote areas for various applications, including calibration, sensor placement, process control, maintenance, and troubleshooting. Market trends include the increasing demand for portable process analyzers due to their ease of installation and flexibility. However, the adoption rate is relatively low in small-scale industrial facilities in developing countries. Market growth is driven by capacity additions in major end-user industries, including pharmaceuticals, food and beverage, and chemicals. companies are focusing on enhancing the cooling capabilities and power efficiency of process analyzers to meet the stringent environmental regulations. Protected cabinets are becoming a standard feature to ensure the accuracy and reliability of process measurements. The market is expected to grow steadily, with a focus on reducing power consumption and maintaining consistent temperature control.

What will be the Size of the Market During the Forecast Period?

- The market plays a pivotal role in ensuring the quality and efficiency of pharmaceutical manufacturing and bioprocessing. These technologies are essential for monitoring and optimizing various parameters in the production process, including pressure, flow rates, chemical composition, and water quality. In the context of pharmaceutical manufacturing, process analyzers are instrumental in maintaining the desired quality of drugs. The need for precise control and monitoring is especially crucial in light of freshwater availability concerns, climatic changes, and weather patterns that can impact water supply. Moreover, process analyzers help mitigate the risks associated with water pollution and ensure public health safety.

- Bioprocessing, a critical aspect of the pharmaceutical industry, also benefits significantly from process analyzers. These technologies enable the optimization of processes, ensuring energy efficiency, and enhancing overall productivity. In addition, process analyzers are essential for monitoring hazardous substances and ensuring compliance with documentation and reporting requirements. Process analyzers are also indispensable in remote areas where access to advanced analytical instruments may be limited. These technologies offer the advantage of real-time monitoring and remote access, making them ideal for applications in such locations. Calibration is a crucial aspect of process analyzer usage. Regular calibration ensures accurate and reliable measurements, which is essential for maintaining the desired quality of pharmaceutical products and bioprocessing outputs.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Oil and gas

- Chemical and petrochemical

- Healthcare

- Water and wastewater treatment

- Others

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- APAC

By End-user Insights

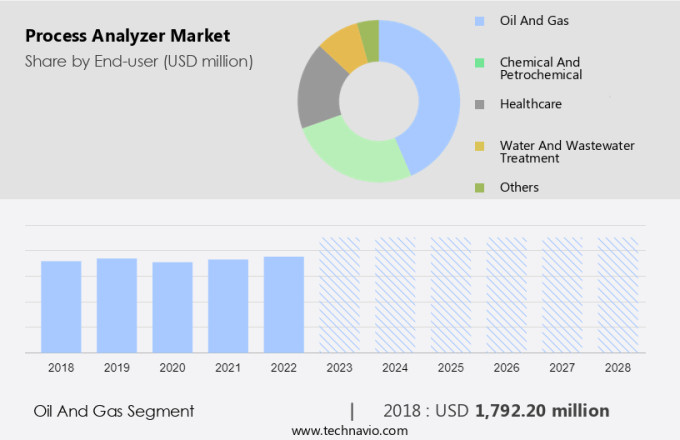

- The oil and gas segment is estimated to witness significant growth during the forecast period.

Process analyzers play a crucial role in the oil and gas industry, particularly in the upstream and midstream sectors. In the exploration phase of upstream operations, these analyzers are employed to identify the composition of various gases, including carbon dioxide, sulfur oxides, and nitrogen oxides. Accurate gas analysis is essential for ensuring safety, health, and environmental protection, as these gases can pose significant risks. Moving on to the midstream sector, process analyzers are indispensable in pipelines and liquefied natural gas (LNG) transportation. Their primary function is to prevent pipeline corrosion and ensure efficient LNG transportation. By monitoring the composition of the gas, process analyzers enable effective process control, maintenance, and troubleshooting, reducing operational costs and minimizing malfunctions.

Remote monitoring and calibration of process analyzers are increasingly gaining popularity due to their ability to provide real-time data from even the most remote areas. This not only enhances operational efficiency but also facilitates timely maintenance and troubleshooting, further reducing downtime and operational costs. Incorporating advanced analyzer technology into process control systems is a smart investment for oil and gas companies, ensuring optimal performance and reducing the risk of potential issues. By leveraging process analyzers, companies can maintain a competitive edge in the industry while ensuring safety, efficiency, and environmental compliance.

Get a glance at the market report of share of various segments Request Free Sample

The oil and gas segment was valued at USD 1.79 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

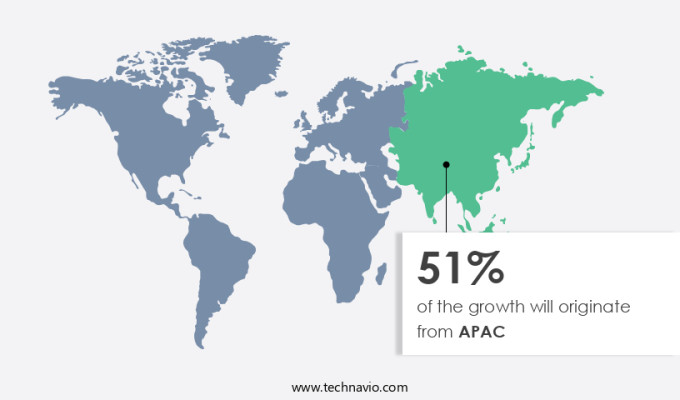

- APAC is estimated to contribute 51% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In Asia-Pacific (APAC), home to approximately 60% of the global population, increasing urbanization and rising disposable incomes are leading to significant growth in various sectors. Developing countries such as China, India, Indonesia, Pakistan, Bangladesh, and Vietnam are witnessing increased investments in transportation and warehousing capacity, enhancing the supply chain infrastructure. The demand and availability of processed food and personal care products have risen due to these factors, leading to increased investments in the processed food and fast-moving consumer goods (FMCG) sectors. This trend underscores the growing importance of sustainability and efficiency in the production and distribution of processed food and FMCG products in APAC.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Process Analyzer Market?

Capacity additions in major end-user industries is the key driver of the market.

- Process analyzers play a crucial role in various industries, particularly in sectors such as pharmaceuticals and biotech, which are integral to drug development and bioprocessing. The increasing research and development activities in these fields are driving the demand for analytical instruments to ensure product quality and adherence to regulatory standards. Additionally, factors such as freshwater availability, climatic changes, and weather patterns, as well as pollution, necessitate the use of process analyzers to monitor and maintain optimal process conditions. In the industries such as healthcare, food and beverages, and petrochemicals are significant consumers of process analyzers.

- Petrochemicals are derived from fossil fuels like crude oil, natural gas, and coal, as well as agricultural produce such as corn and sugarcane. The two major classes of petrochemicals are olefins and aromatics. Olefins include ethylene, propylene, and methane, while aromatics consist of benzene, toluene, and xylene. These chemicals are used to manufacture a multitude of industrial and consumer products, including fertilizers, dyes, paints, solvents, auto parts, home appliances, and detergents. To maintain the quality and efficiency of these manufacturing processes, process analyzers are essential tools.

What are the market trends shaping the Process Analyzer Market?

Companies introducing portable process analyzers is the upcoming trend in the market.

- Process analyzers are essential tools used in various industries for measuring and monitoring emissions, temperature, and other process parameters. companies are focusing on developing portable versions of these analyzers, such as TECsoft's testing and emission compliance software for Testo SE & Co. KGaA's testo 350 portable emission analyzer. This software enhances the testing and data handling capabilities of the portable analyzer, increasing its utility for end-users. Portable analyzers enable on-site sample analysis, eliminating the need to transport samples to laboratories.

- On-site analysis provides more accurate results than laboratory analysis due to the absence of transportation-related variables. Protected cabinets and cooling capabilities are essential features of process analyzers, ensuring power efficiency and reducing power consumption. Compliance with environmental regulations is crucial, and process analyzers play a significant role in measuring pollutant levels and ensuring adherence to emission standards. With the increasing focus on reducing emissions and improving process efficiency, the demand for process analyzers is expected to grow.

What challenges does Process Analyzer Market face during its growth?

Low adoption by small-scale industrial facilities in developing countries is a key challenge affecting market growth.

- Process analyzers play a crucial role in ensuring the quality and safety of water sources, particularly in large industrial facilities such as water supply systems, rainwater harvesting, and wastewater treatment. These facilities face stringent requirements from their clients, including households and businesses, to provide safe drinking water and maintain optimal production costs. For instance, a sugar manufacturer supplying sugar to a processed food company must adhere to specific sugar quality standards set by their clients. In contrast, a sugar manufacturer selling sugar in an unregulated market does not have the same level of scrutiny.

- Gas analyzers, a type of process analyzer, are essential tools in ensuring the accuracy and reliability of water treatment processes. Innovations in process analyzer technology continue to improve efficiency and effectiveness in water supply, rainwater harvesting, and wastewater treatment. The use of process analyzers in these industries not only ensures consistent product quality but also helps in maintaining regulatory compliance. Large industrial facilities, including those supplying water to households and businesses, require consistent quality output and optimum production costs due to their service level agreements (SLAs) with their clients. For instance, a sugar manufacturer selling sugar to a processed food company must adhere to specific sugar quality standards set by their client.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Agilent Technologies Inc.

- AMETEK Inc.

- Aneolia SARL

- Bruker Corp.

- Danaher Corp.

- Emerson Electric Co.

- Endress Hauser Group Services AG

- Honeywell International Inc.

- KROHNE Messtechnik GmbH

- Metrohm AG

- Mettler Toledo International Inc.

- Modcon Systems Ltd.

- Perkin Elmer Inc.

- Schneider Electric SE

- Siemens AG

- Spectris Plc

- Teledyne Analytical Instruments

- Testo SE and Co. KGaA

- Thermo Fisher Scientific Inc.

- Yokogawa Electric Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for analytical instruments in various industries, including bioprocessing and pharmaceutical manufacturing. The need for ensuring quality and compliance with regulatory standards in these sectors is driving the adoption of process analyzers. Factors such as freshwater availability, climatic changes, and weather patterns are also influencing the market's growth, as process analyzers play a crucial role in monitoring water sources and ensuring safe drinking water. Process analyzers are essential for measuring temperature, pressure, flow rates, chemical composition, and other parameters in various industrial processes. They help in reducing operational costs by enabling real-time monitoring and predictive maintenance.

Furthermore, innovation and reliability are key factors that make process analyzers an attractive investment for industries. Gas analyzers, such as oxygen analyzers and combustion process analyzers, are gaining popularity due to their ability to monitor flammable gases and ensure combustion efficiency in boilers and reflow furnaces. Environmental regulations and the need for sustainability are also driving the demand for process analyzers in environmental monitoring applications. They offer features such as protected cabinets, cooling capabilities, power efficiency, and remote monitoring, making them an ideal choice for industries looking for accurate and reliable process measurements.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market Growth 2024-2028 |

USD 2.08 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

China, US, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch