Remittance Market Size 2024-2028

The remittance market size is forecast to increase by USD 57 bn at a CAGR of 13.54% between 2023 and 2028.

What will be the Size of the Remittance Market During the Forecast Period?

How is this Remittance Industry segmented and which is the largest segment?

The remittance industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Method

- Non-digital

- Digital

- Type

- Inward

- Outward

- Geography

- North America

- US

- Europe

- UK

- APAC

- Middle East and Africa

- South America

- North America

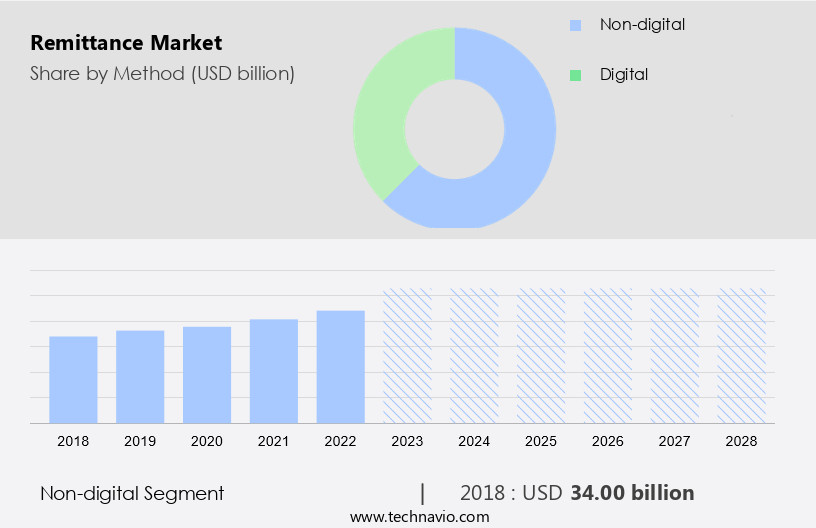

By Method Insights

The non-digital segment is estimated to witness significant growth during the forecast period. The non-digital segment dominates The market, accounting for the largest revenue share in 2023. Traditional methods such as Automated Teller Machines (ATMs) and cheques offer accessibility to senders and recipients, flexible remittance channels, and fund accessibility to recipients. The sense of security experienced through offline transactions is a significant factor contributing to the growth of this segment. Prior to the emergence of digital channels, non-digital methods were the only means for international remittances. Key advantages of non-digital remittance include ease of use, convenience, and the absence of digital barriers for international residents. These factors are expected to drive the growth of the non-digital segment In the market during the forecast period.

Cross-border transactions continue to be a crucial aspect of the international economy, with migratory workers playing a significant role in driving remittance volumes. Regulators play a crucial role in ensuring financial security and preventing money laundering and terrorism funding through digital remittance services. Digital payment solutions, including mobile wallets and blockchain technology, are gaining popularity but still trail behind non-digital methods in terms of market share.

Get a glance at the market report of various segments Request Free Sample

The Non-digital segment was valued at USD 34.00 bn in 2018 and showed a gradual increase during the forecast period.

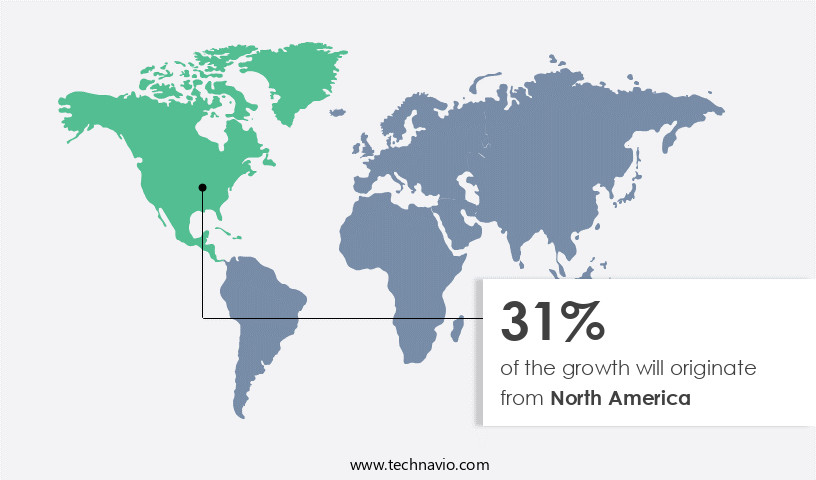

Regional Analysis

North America is estimated to contribute 31% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The digital the market is experiencing significant growth due to the increasing number of migratory workers requiring cross-border transactions. Digital transfer platforms and online transactions have become increasingly popular, facilitated by the widespread use of electronic devices. Cross-border payments are now easier and more convenient than ever before, with digital remittance services offering financial security and anonymity. However, the use of mediators and extra fees can be a barrier for some customers. Regulators play a crucial role In the digital remittance business, ensuring compliance with international regulations and addressing concerns related to money laundering and terrorism funding. The market is driven by the adoption of digital payments by international residents, including banks, financial organizations, wire transfer services, money transfer operators, online platforms, electronic wallets, and software.

B2B clients and financial professionals also rely on money transfer software for efficient transactions. The market is expected to continue growing, driven by the increasing popularity of mobile wallets and the potential of blockchain technology.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Remittance Industry?

- Technological advancements is the key driver of the market.The market is experiencing significant growth due to the increasing digitization of cross-border transactions. Migratory workers rely heavily on money transfer services to send funds back home, and the availability of digital transfer platforms and online transactions via electronic devices has made the process more convenient. Cross border payments through digital remittance services offer financial security and anonymity, making them increasingly popular among international residents. However, the use of mediators and extra fees, as well as the requirement for extensive paperwork, can be barriers to entry. Regulators play a crucial role In the digital remittance business, ensuring compliance with anti-money laundering and terrorism funding regulations.

Blockchain technology is being explored for its potential to revolutionize the industry, offering secure, decentralized, and transparent digital payment solutions such as mobile wallets and blockchain-based platforms. Despite regulatory uncertainty, these innovations are gaining traction among startups and traditional financial organizations, including banks and money transfer operators, indicating a promising future for the digital the market.

What are the market trends shaping the Remittance market?

- Government initiatives to promote online payment is the upcoming market trend.The digital the market has witnessed significant growth due to increasing cross-border transactions facilitated by migratory workers. Governments in developing countries like India, Mexico, and Brazil have initiated digital payment programs to encourage cashless money transfers. For instance, India's Digital India campaign and the Bharat Interface for Money (BHIM) app aim to promote digital remittance services. Similarly, the Central Bank of Brazil introduced the Brazilian Instant Payment Scheme (PIX), enabling instant cross-border payments for individuals, companies, and governmental entities. These digital transfer platforms cater to the growing demand for online transactions using electronic devices. Money transfer costs, including transfer fees, have become a critical concern for international residents, leading to the increased adoption of digital remittance services.

However, financial security and anonymity remain essential considerations, with mediators playing a crucial role in ensuring regulatory compliance and security barriers against money laundering and terrorism funding. Financial organizations, wire transfer services, money transfer operators, and online platforms offer digital remittance solutions, including electronic wallets, software, and mobile wallets. B2B clients and financial professionals rely on money transfer software for efficient and secure transactions. Blockchain technology is also gaining traction In the digital remittance business due to its transparency and security features. Regulators play a vital role in overseeing the digital remittance business, ensuring adherence to international remittance regulations and maintaining financial security.

What challenges does the Remittance Industry face during its growth?

- Rising illicit financial flows is a key challenge affecting the industry growth.The market faces significant challenges from the increasing prevalence of illicit financial flows. These flows encompass funds that are illegally earned, transferred, or used. As digital technologies continue to gain prominence, the role of information and communication networks in facilitating these illicit activities is becoming increasingly concerning. Digital platforms enable organized cybercrimes and offer opportunities for fraud, corruption, tax evasion, and other criminal acts. Consequently, the rise of illicit financial flows poses a significant hindrance to the expansion of the market over the forecast period. Migratory workers, international residents, and businesses are increasingly relying on digital transfer platforms, online transactions, electronic devices, and digital remittance services for cross-border transactions.

However, the anonymity offered by these services can be exploited for nefarious activities, leading regulators to scrutinize the digital remittance business closely. Mediators, banks, financial organizations, wire transfer services, money transfer operators, online platforms, electronic wallets, and software are all subject to increased regulatory oversight to prevent money laundering and terrorism funding. Extra fees, paperwork, and security barriers are other challenges In the market. Money transfer costs, including transfer fees, can be a significant deterrent for customers, particularly for smaller transactions. Lack of knowledge and understanding of digital payment solutions among financial professionals and B2B clients can also hinder market growth.

Blockchain technology, which offers enhanced security and transparency, is being explored as a potential solution to address some of these challenges. Overall, the market is evolving rapidly, with digital payments and mobile wallets gaining popularity. However, the threat of illicit financial flows and the need for robust security measures remain key challenges.

Exclusive Customer Landscape

The remittance market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the remittance market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, remittance market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Bank of America Corp. - The company provides various remittance solutions, including outbound domestic wire transfers, catering to the global money transfer market. These services enable individuals to securely and efficiently transfer funds internationally or domestically, addressing the growing demand for seamless cross-border transactions. By leveraging advanced technology and a global network, the company ensures swift and reliable money transfers, enhancing financial connectivity for its clients.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bank of America Corp.

- Citigroup Inc.

- Digital Wallet Co. Ltd.

- Euronet Worldwide Inc.

- Flywire Corp.

- JPMorgan Chase and Co.

- MoneyGram Payment Systems Inc.

- Nium Pte. Ltd.

- OzForex Ltd.

- PayPal Holdings Inc.

- Ripple Labs Inc.

- SingX Pte Ltd.

- TransferGo Ltd.

- Wells Fargo and Co.

- Western Union Holdings Inc.

- Wise Payments Ltd.

- WorldRemit Ltd.

- ZEPZ

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses money transfers initiated by individuals and businesses across international borders. This market caters to the needs of migratory workers seeking to send funds back to their home countries, as well as businesses engaging in cross border transactions. Digital transfer platforms have emerged as a popular solution for these transactions, enabling online and mobile device usage for electronic money transfers. The digital remittance business has experienced significant growth due to its convenience and accessibility. Financial security and anonymity are key considerations for users, leading to the increasing adoption of digital remittance services. However, the use of digital platforms also brings challenges, such as extra fees, paperwork, and regulatory compliance.

Mediators play a crucial role In the market, facilitating transactions between senders and receivers. These entities may charge additional fees for their services, adding to the overall cost of international money transfers. Regulators also impose fees and regulations on money transfer operators to mitigate risks associated with money laundering and terrorism funding. Despite the benefits of digital remittance services, some users may lack the necessary knowledge or access to electronic devices to utilize these platforms. Additionally, security barriers, such as concerns over data privacy and hacking, may deter some individuals from using digital payment solutions. Banks and financial organizations offer wire transfer services as an alternative to digital remittance platforms.

Money transfer operators and online platforms also compete In the market, offering various digital wallets, software, and electronic wallets to cater to the needs of their customers. B2B clients and financial professionals may prefer money transfer software to streamline their cross border payment processes. The market continues to evolve, with emerging technologies such as blockchain technology offering potential solutions to address challenges such as transaction speed, security, and cost. In conclusion, the market is a dynamic and complex ecosystem, driven by the needs of migratory workers, businesses, and financial professionals for secure and efficient cross border transactions. Digital remittance services have gained popularity due to their convenience and accessibility, but challenges such as fees, paperwork, and security concerns persist.

Regulatory compliance and emerging technologies continue to shape the market, offering opportunities for innovation and growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

154 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.54% |

|

Market growth 2024-2028 |

USD 57 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.89 |

|

Key countries |

US, UK, Saudi Arabia, and United Arab Emirates |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Remittance Market Research and Growth Report?

- CAGR of the Remittance industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the remittance market growth of industry companies

We can help! Our analysts can customize this remittance market research report to meet your requirements.