Shipping Software Market Size 2025-2029

The shipping software market size is forecast to increase by USD 561.6 billion at a CAGR of 8.4% between 2024 and 2029.

- The market is experiencing significant growth due to increasing globalization and trade activities. This trend is driven by the need for delivery reliability and efficient freight management in various industries, including retail and e-commerce. Multi-carrier shipping solutions and shipment tracking have become essential for businesses to streamline their logistics operations and enhance customer satisfaction. Additionally, cloud services have gained popularity due to their flexibility and cost-effectiveness. However, the market faces challenges such as the threat of cyber attacks and security which can compromise sensitive shipping documents and data. Third-party logistics (3PL) and contract logistics providers, as well as courier services, play crucial roles in the shipping industry's supply chain. Overall, the market is expected to continue growing as businesses seek to optimize their shipping processes and improve their competitive edge.

What will be the Size of the Market During the Forecast Period?

- The market plays a crucial role in the e-commerce sector, facilitating seamless logistics and supply chain management. This software enables businesses to streamline their operations, ensuring efficient delivery solutions for their customers. Digital tools have become indispensable in today's business landscape, with shipping software being no exception. These platforms offer real-time integration with carriers, inventory systems, and customer relationship management solutions. By integrating these systems, businesses can optimize their operations, minimize errors, and enhance their overall performance. E-commerce businesses dealing with cross-border transactions require shipping software to navigate the complexities of international logistics.

How is this market segmented and which is the largest segment?

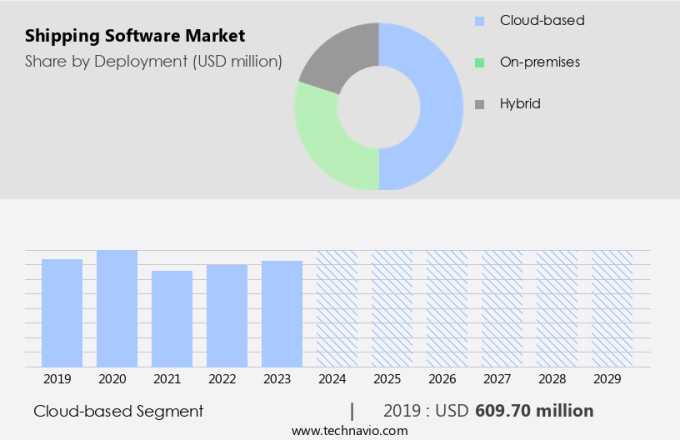

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- Cloud-based

- On-premises

- Hybrid

- End-user

- E-commerce and retail

- Logistics and transportation

- Manufacturing

- Healthcare and pharmaceuticals

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- India

- Japan

- Middle East and Africa

- South America

- Brazil

- North America

By Deployment Insights

- The cloud-based segment is estimated to witness significant growth during the forecast period.

Cloud-based shipping software is a substantial sector within the international the market. These solutions manage various logistics functions, such as inventory systems and order tracking, via cloud computing technology. Deploying software in the cloud enables businesses to simplify their supply chain activities, as they can access applications over the Internet without requiring extensive internal infrastructure or hardware. One of the major benefits of cloud-based shipping software is its capacity to optimize logistics operations extensively. For instance, advanced systems can intelligently select transport providers and services based on multiple factors, including cost, delivery time, quality, and customized rules. In the realm of cross-border e-commerce, multi-carrier solutions have gained immense popularity.

These solutions allow businesses to manage shipping processes with multiple carriers through a single platform, streamlining the logistics workflow. Furthermore, the integration of artificial intelligence (AI) and machine learning algorithms in shipping software has led to route optimization and predictive analytics, enhancing the overall efficiency of logistics operations. Software-as-a-Service (SaaS) is a preferred deployment model for shipping software due to its flexibility and cost-effectiveness. This model allows businesses to access software applications on a subscription basis, enabling them to scale their logistics operations as needed without significant upfront investment. In conclusion, cloud-based shipping software plays a pivotal role in the market, offering businesses the ability to manage their logistics operations more effectively and efficiently through advanced features like AI, machine learning, and predictive analytics.Multi-carrier solutions further simplify cross-border e-commerce logistics, while the SaaS deployment model ensures flexibility and cost savings.

Get a glance at the market report of share of various segments Request Free Sample

The Cloud-based segment was valued at USD 609.70 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 38% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the market is experiencing notable growth due to technological advancements and the expanding logistics sector. Notable developments from major players, such as Pitney Bowes Inc., based in Stamford, Connecticut, are driving this regional market growth. In June 2024, Pitney Bowes inaugurated a new 45,000-square-foot Presort Services operating center in St. Louis, Missouri. This state-of-the-art facility processes over 100,000 mail pieces on its first day, with daily volumes reaching up to 1.2 million. The center's automation capabilities significantly enhance operational capacity, addressing the increasing demand for efficient mail processing solutions. Cross-border logistics, a crucial aspect of the market, is also gaining traction in North America.

Advanced technologies like Artificial Intelligence (AI), Internet of Things (IoT), Blockchain, and Robotics are transforming the industry, enabling seamless cross-border transactions and real-time tracking. Cloud-based solutions are increasingly popular due to their flexibility and scalability, enhancing the delivery experience for customers. Trade documents, a significant component of cross-border logistics, are being digitized, making the process more efficient and error-free. The integration of AI and machine learning algorithms in shipping software is streamlining document verification and validation, reducing manual intervention, and minimizing errors. In conclusion, the North American the market is witnessing significant growth due to advancements in technology and the expanding logistics sector.

The increasing adoption of automation, AI, IoT, Blockchain, and cloud-based solutions is transforming the industry, enhancing operational efficiency, and improving the delivery experience for customers. The role of shipping software in facilitating cross-border logistics and streamlining document processing is becoming increasingly crucial.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage. Shipping software offers tracking metrics, real-time shipment monitoring, and documentation management, ensuring compliance with regulations and smooth delivery of goods. Transport management platforms and logistics management systems are integral components of shipping software. They help businesses manage their delivery routes, optimize their inventory control, and streamline order processing. Label printing and delivery management features further simplify the shipping process, reducing manual effort and potential for errors. Logistics providers also benefit from shipping software, as it enables them to manage their carrier networks, optimize delivery routes, and monitor assets in real-time. This leads to improved operational efficiency and enhanced customer satisfaction. Inventory control and order management software are essential components of shipping software, allowing businesses to manage their stock levels and process orders efficiently. Multi-channel integration ensures that all sales channels are synced, reducing the need for manual data entry and minimizing the risk of stock discrepancies. Pre-delivery software offers additional features such as order processing and delivery management, ensuring that businesses can provide accurate delivery estimates to their customers and streamline the last mile of the delivery process. Shipping software offers numerous benefits, from real-time tracking and delivery management to inventory control and order processing. By implementing these solutions, businesses can optimize their logistics and supply chain operations, enhance their customer experience, and gain a competitive edge in the e-commerce industry.

What are the key market drivers leading to the rise in adoption of Shipping Software Market ?

Rising globalization and trade activities is the key driver of the market.

- The market is experiencing significant growth due to the increasing interconnectedness of international markets and the escalating demand for efficient logistics solutions. According to the World Trade Organization, global trade in commercial services experienced an 8% increase in the first quarter of 2024 compared to the same period in 2023. With China as the leading exporter, valued at approximately USD3,380,024 million, and the US and Germany following closely, the volume of international trade necessitates advanced shipping software to manage the complexities of global logistics. This includes features such as pricing management, order processing, label printing, delivery management, and integration with logistics providers.

- Additionally, the use of generative AI can optimize delivery routes and fuel consumption, providing cost savings and improved efficiency. Shipping carriers and businesses alike benefit from the implementation of these solutions to streamline operations and ensure compliance with international trade regulations.

What are the market trends shaping the Shipping Software Market?

Product innovations is the upcoming trend in the market.

- The market in the United States is experiencing notable progress due to continuous innovation, aimed at improving business efficiency and customer satisfaction. One significant trend is the integration of advanced technologies, such as machine learning and artificial intelligence, into shipping software solutions. This technological integration is revolutionizing the way companies manage and optimize their shipping processes. For instance, a leading shipping software provider, ShipStation, unveiled a new feature in September 2024. This feature allows seamless integration with Google Merchant Center via Google's Content API for Shopping. By doing so, users can now provide precise, location-specific delivery predictions directly on Google, offering shoppers essential information during the purchasing process.

What challenges does Shipping Software Market face during the growth?

Threat of cyber attacks is a key challenge affecting the market growth.

- The market in the United States is essential for ensuring delivery reliability in retail and e-commerce industries. Freight management, multi-carrier shipping, and shipment tracking are key functions of shipping software that enhance logistics efficiency. Cloud services enable real-time access to shipping documents and facilitate collaboration between 3PLs, contract logistics providers, and courier services. However, the market faces significant challenges due to cybersecurity threats. In January 2023, a ransomware attack affected approximately 1,000 vessels through a prominent software supplier for ships, causing disruption to global shipping operations. This incident underscores the importance of robust cybersecurity measures to protect shipping software from cyber-attacks and safeguard critical data.

- Shipping software solutions offer several benefits, including streamlined freight management, automated document processing, and real-time shipment tracking. These features are crucial for retailers and e-commerce businesses seeking to meet customer demands for fast and reliable shipping. However, the market faces significant cybersecurity challenges, as highlighted by a major ransomware attack in January 2023. Prioritizing cybersecurity measures is crucial for maintaining operational integrity and protecting sensitive data.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

AfterShip Group - This company provides shipping software solutions for US eCommerce businesses, seamlessly integrating with over 100 carriers for efficient fulfillment. The software automates label generation and offers real-time carrier rate comparisons, ensuring optimal shipping costs and streamlined operations. By leveraging these features, businesses can enhance their logistics processes and improve customer satisfaction.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AfterShip Group

- Auctane Inc.

- Descartes Systems Group Inc.

- E2open Parent Holdings Inc.

- FreightWise LLC

- Manhattan Associates Inc.

- Mecalux SA

- Metapack

- Oracle Corp

- Ordoro Inc.

- Pitney Bowes Inc.

- Proship Inc.

- SAP SE

- ShipHawk Inc.

- Simpler Postage Inc.

- Webgility Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Shipping software plays a crucial role in the seamless functioning of e-commerce and logistics industries. This digital toolset facilitates real-time integration with carriers, inventory systems, and delivery solutions, ensuring efficient tracking and documentation of shipments. The software caters to various sectors, including cross-border e-commerce, multi-carrier solutions, and international shipping. Advanced features such as route optimization, predictive analytics, and machine learning enhance the capabilities of shipping software. Artificial intelligence and machine learning algorithms help in optimizing delivery routes, reducing fuel consumption, and improving delivery reliability. These software-as-a-service (SaaS) solutions offer cloud deployment and on-premise deployment options, ensuring flexibility for businesses.

Data security and cybersecurity are integral components of shipping software, safeguarding sensitive information and trade documents. The software also supports multi-channel integration, enabling seamless order processing, label printing, and delivery management. Last mile delivery and post-delivery software solutions further enhance the delivery experience, ensuring accurate tracking metrics and efficient communication between logistics providers and customers. Freight management systems, pricing management, and inventory control are other essential features of shipping software, catering to the needs of retail and e-commerce businesses, logistics providers, and shipping carriers. The incorporation of IoT, blockchain, robotics, and cloud-based solutions further bolsters the capabilities of these platforms, enabling businesses to streamline their operations and improve overall efficiency.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

213 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.4% |

|

Market growth 2025-2029 |

USD 561.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.0 |

|

Key countries |

US, China, Germany, Canada, UK, India, France, Brazil, Japan, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch