TPEE Market In Automotive Industry Size 2024-2028

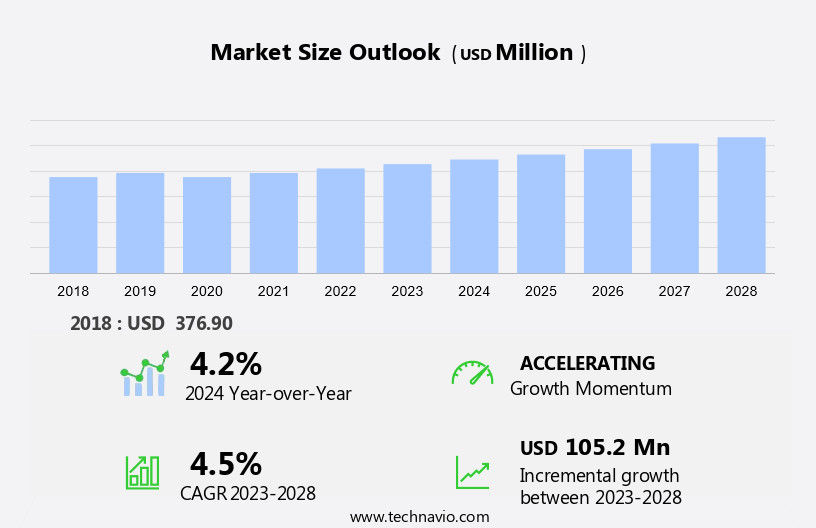

The TPEE market in the automotive industry size is forecast to increase by USD 105.2 million at a CAGR of 4.5% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. The superior quality of TPEEs offers enhanced durability, flexibility, and resistance to various environmental conditions, making them an ideal choice for automotive applications. TPEs have expanded their reach beyond traditional applications in the automotive sector, finding a place in consumer goods and other industries such as electronics and medical devices. Additionally, the increasing opportunities in the Asia-Pacific region, particularly in China and India, are driving market growth as automakers seek to expand their presence in these emerging markets. their compatibility with oils and solvents further broadens their applicability in the automotive industry. Furthermore, stringent safety legislation on production is leading to the adoption of TPEEs in the automotive industry due to their ability to meet safety standards and improve vehicle safety.

What will be the Size of the TPEE in Automotive Industry During the Forecast Period?

- In the dynamic automotive industry market, thermoplastic elastomers (TPEs), specifically elastomers like thermoplastic copolyesters and block copolymers, have gained significant traction due to their versatility in manufacturing various automotive components. These polymers, composed of polyether and polymer segments, offer a unique blend of flexibility, elasticity, mechanical strength, and durability.

- Moreover, the biocompatibility of TPEs, coupled with their ability to withstand sterilization processes, makes them suitable for use in medical devices. TPEs also exhibit excellent chemical and heat resistance, enabling their use in various automotive applications, including sealing systems, gaskets, and under-the-hood components. The continuous research and development in TPE technology ensures their relevance in the evolving automotive market.

How is this TPEE in Automotive Industry segmented and which is the largest segment?

The market report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Injection molding grade

- Extrusion grade

- Blow molding grade

- Geography

- APAC

- China

- Japan

- Europe

- Germany

- UK

- North America

- Canada

- US

- Middle East and Africa

- South America

- APAC

By Type Insights

- The injection molding grade segment is estimated to witness significant growth during the forecast period.

Injection molding is a crucial manufacturing process in the automotive industry for producing components through the injection of molten materials into molds. TPEE pellets, a type of thermoplastic elastomer, are utilized in this process due to their superior properties, including flexibility, elasticity, mechanical strength, and durability. These characteristics enable the production of automotive parts with high corrosion resistance, improved design flexibility, and enhanced safety. The resulting components offer reduced noise, vibrations, and vehicle weight, making them indispensable in modern automobile manufacturing. The demand for TPEE injection molding grades continues to increase, contributing significantly to the overall growth of the automotive industry.

Get a glance at the TPEE In Automotive Industry Industry report of share of various segments Request Free Sample

The injection molding grade segment was valued at USD 139.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

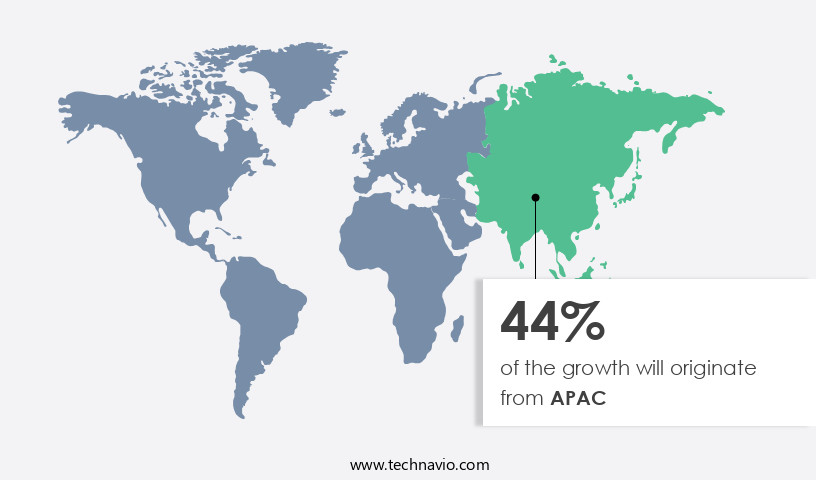

- APAC is estimated to contribute 44% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The TPEE (Thermoplastic Elastomer Engineering Polymers) market in the automotive industry is anticipated to expand during the forecast period due to the growing demand from sectors such as automotive, industrial machinery, packaging, and electrical and electronics. In the automotive sector, TPEEs contribute to lighter vehicle weight for enhanced fuel efficiency and improved productivity, leading to energy savings and reduced environmental impact. Their superior strength-to-weight ratio makes them an ideal choice for various automotive applications, including hoses, seals, gears, and brake systems. The increasing popularity of TPEEs in the automotive industry is attributed to their recyclability and the ability to produce sustainable polymers through processes like copolyesters and melt oligomer polycondensation using naturally derived feedstocks. The regional market growth is driven by the rising manufacturing sector needs and the increasing adoption of TPEEs in various industries.

Market Dynamics

Our industry market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of TPEE in Automotive Industry?

Superior quality of TPEE and better performance is the key driver of the market.

- In the automotive industry market, thermoplastic elastomers (TPEs), specifically TPEE (Thermoplastic Polyester Elastomer), have gained significant attention due to their unique properties and versatility. TPEEs are a type of copolyester that exhibit both the processability of thermoplastics and the elasticity of elastomers. They are composed of a block copolymer structure, featuring a hard phase of crystallized PBT (Polybutylene Terephthalate) and a soft phase of amorphous PBBS (Polybutylene Succinate). TPEEs offer superior mechanical properties, including high tensile and tear strength, flexibility, and elasticity. They can withstand multiple flex cycles and resist a wide range of chemicals, heat, oils, solvents, and fuels.

- Furthermore, these features make TPEEs an ideal choice for automotive components, such as seals, gaskets, and insulators, where durability and flexibility are essential. Moreover, TPEEs are suitable for various industries, including consumer goods and electronics, due to their biocompatibility, sterilization compatibility, and recyclability. TPEEs can undergo melt oligomer polycondensation, a polymerization process, to enhance their mechanical properties and reduce the polycondensation time and molar ratio. The resulting TPEEs exhibit excellent elongation at break and can be processed using injection molding techniques. TPEEs are also sustainable polymers, as they can be derived from biobased blocks, such as PBT oligomer and PBBS oligomer.

What are the market trends shaping the TPEE In Automotive Industry?

Increasing opportunities in APAC is the upcoming market trend.

- In the automotive industry, thermoplastic elastomers (TPEEs) have gained significant attention due to their versatility in manufacturing various components. These elastomers, which are a type of copolymer, offer unique properties such as flexibility, elasticity, mechanical strength, durability, and resistance to chemicals, oils, solvents, fuels, and heat. TPEEs are extensively used in automotive components, including hoses, insulators, seals, bushes, and engine mounts, due to their ability to withstand extreme temperatures and maintain their shape. The automotive industry's growth in the Asia Pacific (APAC) region is expected to fuel the demand for TPEEs among automotive manufacturers in the area during the forecast period.

- Moreover, China, in particular, is a significant market due to its high sales volume and government support, including tax incentives, which encourage local production of automobiles. The increasing demand for locally produced automobiles in countries like China, India, and others, is anticipated to boost the demand for TPEEs, as they are essential in the production of components that require high temperature resistance. TPEEs are available in various compositions, including thermoplastic copolyesters, polyether, and block copolymers. Their production involves melt oligomer polycondensation, which results in PBT oligomer and PBBS oligomer. The block structure of TPEEs consists of a hard phase, such as crystallized PBT, and a soft phase, such as amorphous PBBS.

What challenges does the TPEE in Automotive Industry face during its growth?

Stringent safety legislation on production is a key challenge affecting the industry growth.

- TPEE, or Thermoplastic Elastomer Elastomers, plays a significant role in the automotive industry market due to its versatility in manufacturing various automotive components. TPEE is a type of copolyester, which is a polymer composed of polyether and polyester blocks. The block copolymer structure provides TPEE with unique mechanical properties, including flexibility, elasticity, mechanical strength, durability, tensile strength, and tear strength. TPEE is used extensively in the automotive industry for producing parts that require both elasticity and strength, such as seals, gaskets, and under-the-hood components. Additionally, TPEE is used in consumer goods, electronics, medical devices, and other industries due to its biocompatibility and resistance to chemicals, heat, oils, solvents, fuels, and other harsh environments.

- Moreover, the production of TPEE involves melt oligomer polycondensation, where PBT oligomer and PBBS oligomer are used to form the block structure. The hard phase is typically crystallized PBT, while the soft phase is amorphous PBBS. The mechanical properties of TPEE can be manipulated by adjusting the polycondensation time, molar ratio, and other factors. The automotive industry's TPEE market faces regulatory challenges due to the chemical composition of TPEE. In North America, the US Environmental Protection Agency (EPA) and the US Food and Drug Administration (FDA) have imposed regulations on the use of hazardous raw materials in TPEE production.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market research report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Celanese Corp.

- Cesium Inc.

- Chang Chun Group

- DuPont de Nemours Inc.

- Eastman Chemical Co.

- Koninklijke DSM NV

- Kraton Corp.

- LCY Chemical Corp.

- Mitsubishi Chemical Corp.

- Radici Partecipazioni Spa

- Saudi Basic Industries Corp.

- SK Chemicals Co. Ltd.

- Spiratex

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Thermoplastic elastomers (TPE-E), a class of polymers, have gained significant attention in various industries due to their unique properties. These materials offer the elasticity and flexibility of rubber, combined with the processability and mechanical strength of thermoplastics. In the automotive sector, TPE-E plays a crucial role in manufacturing components that require both durability and flexibility. TPE-E is a type of copolymer, which is formed by the combination of two or more different types of monomers. The composition of TPE-E can vary, with some containing thermoplastic copolyesters, polyether, or block copolymers.

Furthermore, the block structure of TPE-E consists of a hard phase and a soft phase. The hard phase is typically crystallized polybutylene terephthalate (PBT), while the soft phase is amorphous polybutadiene-styrene (PBS) or polyether. The versatility of TPE-E is evident in its wide range of applications in the automotive industry. These materials are used in various components, such as seals, gaskets, and insulators. TPE-E offers excellent mechanical properties, including high tensile strength, tear strength, and chemical resistance. It can withstand exposure to harsh environments, including extreme temperatures, oils, solvents, fuels, and various chemicals. Moreover, TPE-E's processability is another significant advantage in the automotive industry.

In addition, it can be easily processed using various methods, including injection molding, extrusion, and blow molding. This versatility allows for the production of complex shapes and designs, making it an ideal choice for automotive manufacturers. Sustainability is a growing concern in the automotive industry, and TPE-E offers several eco-friendly alternatives. Sustainable polymers, such as biobased blocks and copolyesters, are increasingly being used to produce TPE-E. These materials are derived from renewable resources, reducing the carbon footprint of the manufacturing process. Furthermore, TPE-E's recyclability is another factor that makes it an attractive choice for the automotive industry. It can be recycled using various methods, including mechanical and chemical recycling.

|

TPEE In Automotive Industry Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

144 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 105.2 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

4.2 |

|

Key countries |

China, US, Japan, Germany, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the TPEE In Automotive Industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the TPEE in automotive industry growth of industry companies

We can help! Our analysts can customize this TPEE in automotive industry research report to meet your requirements.