Workwear Market Size 2025-2029

The workwear market size is forecast to increase by USD 5.96 billion, at a CAGR of 5.4% between 2024 and 2029.

- The market is driven by the strict implementation of workplace safety standards in developed countries, prioritizing employee well-being and regulatory compliance. In contrast, emerging economies face challenges with the poor implementation of workplace safety norms, creating a significant disparity in market dynamics. This dichotomy necessitates a strategic approach for companies seeking to capitalize on opportunities and navigate challenges. An increasing focus on emergency management in the wake of natural disasters and industrial accidents further underscores the importance of workwear in ensuring employee safety.

- However, the inconsistent application of safety regulations in developing countries poses a significant challenge. Companies must navigate this complex landscape by implementing robust corporate social responsibility initiatives and collaborating with local governments to promote adherence to safety standards. By doing so, they can not only mitigate risks but also contribute to the development of a safer and more responsible workwear industry.

What will be the Size of the Workwear Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic trends shaping its various sectors. Workwear fashion embraces innovation, with designs incorporating functionality and comfort. Fabrics, such as moisture-wicking and flame-resistant, cater to diverse industries and climate conditions. Safety regulations play a crucial role, driving the demand for protective work wear gear, including safety helmets and gloves. Workwear wash cycles are optimized for durability and cost-effectiveness, while weatherproof workwear ensures employee safety and productivity. Industrial apparel manufacturers integrate smart workwear technology, enabling data analytics and performance tracking. Certifications and compliance standards ensure safety and quality, while workwear distributors and retailers streamline supply chain operations.

Sustainability is a growing concern, with eco-friendly workwear materials and manufacturing processes gaining popularity. Workwear customization, from branding to size and design, caters to unique business needs. Safety footwear, workwear accessories, and high-visibility clothing further expand the market's scope. Workwear maintenance and repair services ensure longevity and cost savings. Workwear value is a continuous focus, balancing performance, cost, and sustainability. Market activities unfold, with ongoing collaborations, mergers, and acquisitions shaping the competitive landscape. Workwear trends reflect the industry's commitment to employee safety, comfort, and productivity.

How is this Workwear Industry segmented?

The workwear industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Men

- Women

- Product

- Apparel

- Footwear

- Distribution Channel

- Offline

- Online

- Application

- Construction

- Oil and gas

- Chemicals

- Healthcare

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

.

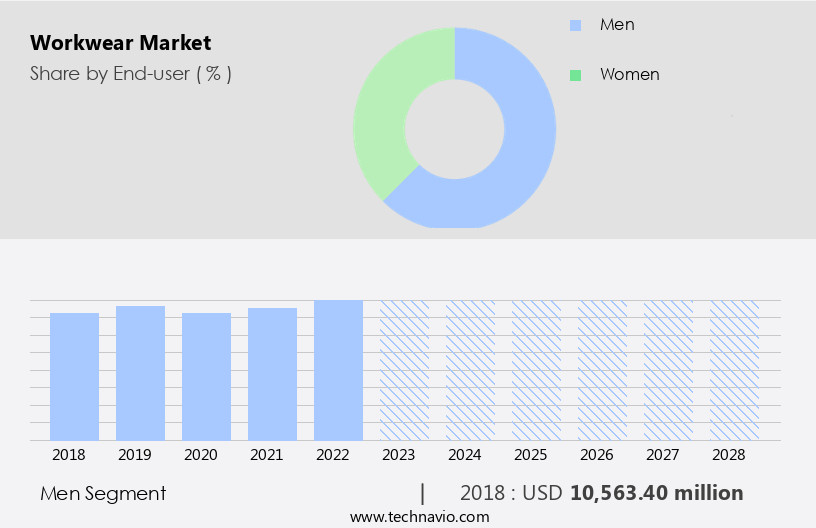

By End-user Insights

The men segment is estimated to witness significant growth during the forecast period.

Men comprise a significant portion of the market, driven by the reliance of various industries such as manufacturing, oil and gas, transportation, and construction on male labor. These sectors prioritize workwear that ensures safety and durability to protect their workers from hazards. The product range for men's workwear includes high-visibility clothing, safety helmets, work trousers, uniforms, and protective coveralls. The expanding workforce and increasing awareness of workplace safety regulations further fuel the demand for workwear that meets these requirements. Manufacturers focus on delivering innovative, comfortable, and functional workwear solutions to cater to this market. Workwear fabrics, such as flame-resistant and moisture-wicking, are essential considerations for industries with hazardous conditions.

Workwear technology, including data analytics and smart workwear, enhances performance and safety. Workwear supply chains prioritize compliance with industry standards and certifications to ensure quality and safety. Workwear cost is a crucial factor, with wholesalers and retailers offering various pricing strategies to cater to different market segments. Anti-static workwear and protective gear, such as gloves and safety footwear, are essential components of the market. Workwear maintenance and innovation are ongoing priorities, with manufacturers investing in sustainable materials and advanced technologies to improve workwear durability and value. Trends in workwear fashion and design continue to evolve, with an increasing focus on comfort, functionality, and branding.

Workwear wash cycles and weatherproof capabilities are essential features for industries with demanding work environments. In conclusion, The market is dynamic and diverse, driven by the need for safety, durability, and functionality in various industries. Manufacturers, distributors, and retailers are continuously innovating to meet the evolving demands of the market, ensuring workers remain protected and productive.

The Men segment was valued at USD 11.05 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 46% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In The market, APAC is a significant player due to its large industrial workforce. Despite having a lower penetration rate compared to North America and Europe, developing countries in APAC, such as India, are prioritizing workplace safety norms. This shift has led to market growth in the region, surpassing other geographies. Strict supervision and increased compliance with occupational health and safety laws have contributed to this improvement. The workwear industry in APAC is witnessing advancements in various areas. For instance, the transportation sector's growing investments and expanding warehousing capacity have enhanced the supply chain infrastructure.

Additionally, the production and availability of processed food and personal care products have increased significantly in the region. Workwear fabrics, sizing, and compliance with safety regulations are essential considerations for manufacturers. Flame-resistant and moisture-wicking fabrics are popular choices due to their protective qualities. Workwear trousers, uniforms, and safety helmets are common items in the market. Innovations in workwear technology include connected workwear, high-visibility clothing, and smart workwear. Workwear trends include customization, sustainability, and workwear fashion. Certifications and compliance with various standards, such as OSHA and ISO, are crucial for manufacturers and distributors. Workwear maintenance and durability are essential factors for both employers and employees.

Workwear accessories, gloves, and jackets are essential components of the industry. Protective coveralls and safety footwear are crucial for industries with hazardous environments. Workwear wash cycles and weatherproof workwear are essential considerations for workwear retailers and wholesalers. Workwear value, performance, and functionality are critical factors for workwear buyers. Compliance with safety regulations and workwear certifications are essential for manufacturers and distributors. Workwear brands are investing in technology and design to meet the evolving needs of industries and workers. The market is diverse and dynamic, with various trends and innovations shaping its future. Workwear manufacturers and distributors must stay informed about the latest developments to remain competitive.

Workwear data analytics and performance metrics are increasingly important for optimizing workwear supply chains and enhancing worker safety.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Workwear Industry?

- In developed countries, the stringent enforcement of workplace safety standards serves as the primary catalyst for the market's growth.

- The demand for workwear in developed countries, including the US, is on the rise due to a growing focus on workplace safety and the strict enforcement of regulations. Organizations are investing in high-visibility clothing, protective gear, and workwear performance to ensure the safety of their employees from thermal, chemical, and biological hazards. Workwear data analytics is also gaining popularity, allowing companies to monitor the maintenance and usage of their workwear to optimize performance and extend the life of their investment. Connected workwear, which integrates technology into protective coveralls and other garments, is another emerging trend in the workwear industry. Workwear manufacturers are innovating to meet the evolving needs of industries, creating harmonious and immersive designs that prioritize both safety and comfort.

- The Occupational Safety and Health Administration (OSHA) in the US has established regulations for personal protection equipment (PPE), including workwear, under 29 CFR 1910. These regulations mandate the use of certified workwear to ensure workplace safety. Workwear distributors play a crucial role in providing certified workwear and offering maintenance services to help organizations comply with regulations and maintain their workwear inventory.

What are the market trends shaping the Workwear Industry?

- Emergency management is gaining significant attention in the current market, with a growing focus on preparedness and response strategies. It is essential for organizations and individuals to prioritize emergency planning to mitigate potential risks and ensure business continuity.

- The demand for workwear is on the rise due to the increasing focus on workplace safety and the need for durable, weatherproof apparel for various industries. Workwear fashion continues to evolve, with an emphasis on smart workwear that adheres to safety regulations. Flame-resistant fabrics and workwear accessories, such as gloves, are essential components of industrial apparel. The value of workwear is not only in its functionality but also in its ability to withstand demanding wash cycles. Weatherproof workwear is particularly important for industries exposed to harsh weather conditions. Workwear design is becoming increasingly innovative, with a focus on comfort, functionality, and style.

- Safety regulations play a significant role in the market, with stringent requirements for flame resistance, chemical resistance, and other protective features. Smart workwear is also gaining popularity, with the integration of technology to enhance functionality and safety. In conclusion, the market is driven by the need for durable, functional, and safe apparel in various industries. The increasing focus on workplace safety, coupled with the evolving demands of different industries, is expected to continue fueling the growth of the market. The importance of workwear extends beyond functionality, with an emphasis on comfort, style, and innovation.

What challenges does the Workwear Industry face during its growth?

- The lack of effective implementation of workplace safety standards in developing countries poses a significant challenge to the expansion and growth of the industry.

- Workwear is essential protective clothing designed for professionals in various industries. Functionality and comfort are key considerations in workwear, with customization and moisture-wicking fabrics becoming increasingly popular. Brands prioritize safety features, including safety footwear, in their offerings. Workwear wholesalers and retailers cater to diverse industries, ensuring hygiene and workwear jackets that meet specific requirements. In developing countries, workplace safety regulations and their implementation remain a concern. Unlike established agencies like the Occupational Safety and Health Administration (OSHA) in the US and the Health and Safety Executive (HSE) in the UK, some countries have multiple regulatory bodies with unclear roles.

- For instance, Kenya has three agencies overseeing health and safety in the oil and gas sector: the Energy and Petroleum Regulatory Authority (EPRA), the Directorate of Occupational Safety and Health Services (DOSHS), and the National Environment Management Authority (NEMA). Ensuring stringent enforcement of regulations and clear roles for regulatory bodies is crucial to promote a safe and productive work environment. Sustainability is also a growing concern, with an increasing focus on eco-friendly and ethically-produced workwear.

Exclusive Customer Landscape

The workwear market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the workwear market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, workwear market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The company specializes in providing top-tier workwear solutions, featuring 3M's disposable chemical protective coveralls. Our inventory encompasses two options: the 3M 4565 BLK L, designed for regular-sized individuals, and the 3M 4565 XXL, catering to larger workers. These coveralls prioritize safety, offering effective protection against chemicals. By incorporating these high-quality workwear items into your operations, you can enhance your team's safety standards and maintain a professional image.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- A. LAFONT SAS

- Aditya Birla Management Corp. Pvt. Ltd.

- Ansell Ltd.

- Ben F. Davis Co.

- Berne Apparel

- Carhartt Inc.

- Delta Plus Group

- H T Hughes and Co. Ltd.

- Harveys of Oldham Holdings Ltd.

- HejMar AB

- Honeywell International Inc.

- Hultafors Group AB

- J and A International Ltd.

- Lakeland Industries Inc.

- Portwest Clothing Ltd.

- Sioen Industries NV

- VF Corp.

- W. L. Gore and Associates Inc.

- Wearwell Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Workwear Market

- In March 2024, Carhartt, a leading workwear brand, introduced its new line of flame-resistant coveralls, designed to meet the increasing demand for safety clothing in the construction industry (Carhartt Press Release). This expansion underscores the market's focus on safety and compliance.

- In July 2024, W.L. Gore & Associates, a materials science company, announced a strategic partnership with 3M to develop advanced workwear using Gore's GORE-TEX technology and 3M's Scotchlite reflective technology. This collaboration aims to create high-performance workwear with enhanced protection and visibility (Gore Press Release).

- In October 2025, VF Corporation, a global apparel company, completed the acquisition of Dickies, a prominent workwear brand. This acquisition strengthened VF's position in the market and expanded its product offerings (VF Corporation SEC Filing).

- In December 2025, the European Union passed the new Personal Protective Equipment Regulation (EU) 2025/1234, which sets new standards for workwear safety and testing. This regulation is expected to drive innovation and investment in the European the market (European Parliament Press Release).

Research Analyst Overview

- In the dynamic the market, hand protection and respiratory protection remain essential categories for ensuring employee safety. Workwear labels prioritize arc rating, tear resistance, and abrasion resistance to meet industry standards. Wind resistance and moisture management are key features in workwear fabrics, enhancing comfort and productivity. Bio-based workwear and recycled materials are gaining traction, driving workwear sustainability. Safety glasses, hearing protection, and body protection are crucial components of a comprehensive safety strategy. Workwear innovation includes advanced foot protection with anti-slip properties, reflective materials for enhanced visibility, and workwear printing for customization. Eye protection and head protection complete the range of essential protective gear.

- Workwear stitching and embroidery ensure durability, while water repellency and arc rating offer additional layers of protection.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Workwear Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

222 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.4% |

|

Market growth 2025-2029 |

USD 5957.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.1 |

|

Key countries |

China, US, Japan, Germany, India, Canada, South Korea, UK, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Workwear Market Research and Growth Report?

- CAGR of the Workwear industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the workwear market growth of industry companies

We can help! Our analysts can customize this workwear market research report to meet your requirements.