AC Electric Motor Sales in Oil and Gas Market Size 2024-2028

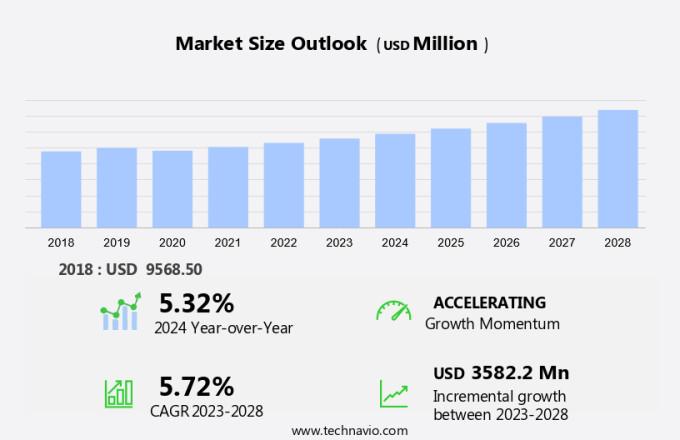

The Global AC Electric Motor Sales in Oil and Gas Market size is forecast to grow by USD 3.58 billion, at a CAGR of 5.72% between 2023 and 2028. The global oil and gas industry is experiencing a surge in demand due to increasing energy consumption and economic growth. This trend is driving a rise in Exploration and Production (E&P) activities, particularly in emerging markets. In response, there is a growing investment in refineries to meet the demand for processed petroleum products. The expansion of refining capacity is a critical component of the industry's growth strategy, ensuring a steady supply of fuel for transportation and energy for industries. Additionally, advancements in technology are improving efficiency and reducing costs, making refining a profitable venture for companies. Overall, the oil and gas industry's future looks bright, with continued growth expected in the coming years.

Market forecasting

To learn more about this report, Request Free Sample

Market Customer Landscape

The report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Market Customer Landscape

Market Dynamics

In the market, induction electric motors and synchronous electric motors are pivotal. These motors are integral to extraction and production facilities, pumping stations, and various exploration and production projects. Their high starting torque and reliability under harsh operating conditions, including extreme temperatures and corrosive atmospheres make them indispensable. Advancements in motor technology and energy efficiency improvements are crucial for reducing carbon emissions and adapting to economic uncertainties and fluctuating oil prices. Variable frequency drives enhance energy efficiency by optimizing voltage and power systems. Moreover, alternative energy storage, including batteries, supports this shift towards greener solutions. AC Electric Motors must handle bulk usage while maintaining compatibility with DC motors and other components like cranes, machine tools, and auxiliary generators. Emphasizing electromagnetic induction, these motors convert alternating current to mechanical power, driven by primary rotating magnetic fields in the stator and secondary rotating magnetic fields in the rotor.

Key Market Driver

Increasing demand for oil and gas is notably driving the market growth. Rapid urbanization in developing nations is accompanied by a significant rise in energy demand. As a result, more liquid fuels and natural gas are being consumed. Oil and natural gas are in high demand due to the rising global demand for electricity and fuel. Global liquid fuel consumption increased from 99.97 mbpd in 2018 to 100.75 mbpd in 2019, according to the US EIA. Additionally, it is anticipated that by 2021, the world will consume 102.85 mbpd of liquid fuel.

Further, the demand for E&P machines, equipment, and components is growing at the same time as the demand for oil and gas. Hence, the demand for AC electric motors, which have a variety of uses in both the upstream and downstream segments of the oil and gas industry, is also rising. Therefore, the rise in the global demand for oil and gas is driving the growth of the market during the forecast period.

Significant Market Trends

The increasing adoption of modular mini refineries is an emerging trend in the market. For producers of diesel and other petrochemicals in remote areas, modular mini refineries are a flexible and affordable supply option. The simplicity, speed, and relatively low capital cost of modular mini refineries are their main advantages. The best places to use modular mini-refineries are in remote areas and developing nations where there is a high demand for diesel, gasoline, and fuel oil.

Furthermore, refineries that are modular require less land than conventional refineries because they are smaller. The adoption of these refineries is rising because they provide process flexibility and aid in increasing refinery capacity. For instance, the Nigerian National Petroleum Company Limited (NNPC) reports that in March 2023, oil production in Nigeria averaged 1.59 million barrels per day. As the adoption of modular mini refineries in remote areas increases, the demand for modular refinery components such as AC electric motors also increases. Therefore, these factors will drive the growth of the market during the forecast period.

Major Market Challenge

Environmental impacts of oil and gas activities are major challenges impeding the market growth. In addition to being used as fuel for automobiles and buildings, oil and gas are also used in the production of goods like plastic and fertilizer. Oil and gas products certainly make life easier, but oil and gas E&P activities are bad for the environment. Oil spills, air and water pollution from toxic chemical emissions, and climate change from methane emissions are a few of the ways that oil and gas drilling activities harm the environment. Deep-water oil and gas exploration also involves firing air guns across the seabed, which causes strong shocks that can harm various marine species' hearing.

Additionally, the oil and gas industry's activities for oil refining have a significant negative impact on the environment. Different toxic chemicals, such as ammonia, hydrocarbons, sulfides, and phenol, are present in varying concentrations in the effluents of oil refineries. The refineries' ambient environment can be fatally impacted by the toxic effluents, which can also have an adverse effect on the health of the surrounding life forms. Therefore, environmental concerns have an adverse impact on oil and gas activities. It might result in the implementation of strict regulations, which could have an effect on the oil and gas sector and, as a result, would hinder the expansion of the global market during the forecast period.

Who are the Major Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

FLANDERS Inc. - The company offers motors, DC to AC upgrades, power distribution, controls and automation, field service, and drives and starters.

We also have detailed analyses of the market’s competitive landscape and offer information on 15 market companies, including:

- ABB Ltd.

- Arc Systems Inc.

- Franklin Electric Co. Inc.

- General Electric Co.

- Hitachi Ltd.

- Hoyer Motors

- Nidec Corp.

- NOV Inc.

- Parker Hannifin Corp.

- Regal Rexnord Corp.

- Rockwell Automation Inc.

- Schlumberger Ltd.

- Siemens AG

- TECO-Westinghouse

- Toshiba Corp.

Technavio report provides an in-depth analysis of the market and its players through combined qualitative and quantitative data. The analysis classifies companies into categories based on their business approaches, including pure-play, category-focused, industry-focused, and diversified. companies are specially categorized into dominant, leading, strong, tentative, and weak, based on their quantitative data analysis.

Market Segmentation

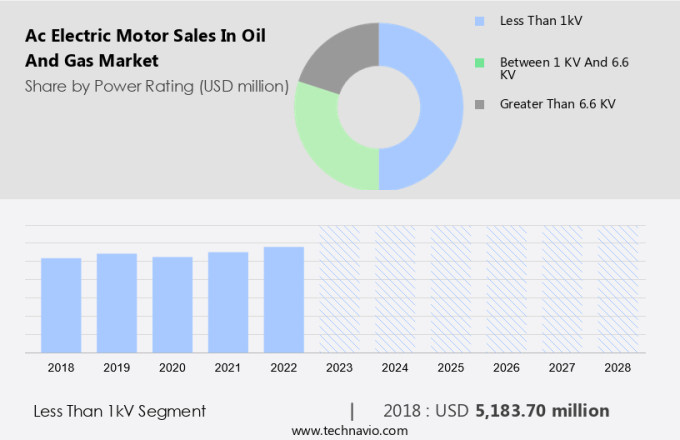

By Power Rating

The market share growth of the less than 1 kV segment will be significant during the thee forecast period. The less than 1 kV segment includes all the AC electric motors having a power rating of less than 1 kV. The less than 1 kV segment had the dominating share in the global AC electric motor sales in the oil and gas market in 2023.

Get a Customised Report as per your requirements for FREE!

The less than 1kV segment segment showed a gradual increase in market share with USD 5.18 billion in 2018. Further, electric motors play an essential role in power tools, pumps, and other machinery because of rapid industrialization, particularly in the oil and gas sector. The demand for energy-efficient motors is rising as a result of rising electricity prices and stricter power consumption regulations. The need for AC electric motors may increase in a number of industries, including oil and gas, due to the rising demand for motors with higher operating efficiencies. Other key factors that are driving the growth of the market segment are the deployment of electrical equipment and machinery in the oil and gas industries and renewable energy sectors. Hence, all these factors will fuel the segment growth during the forecast period.

Regional Analysis:

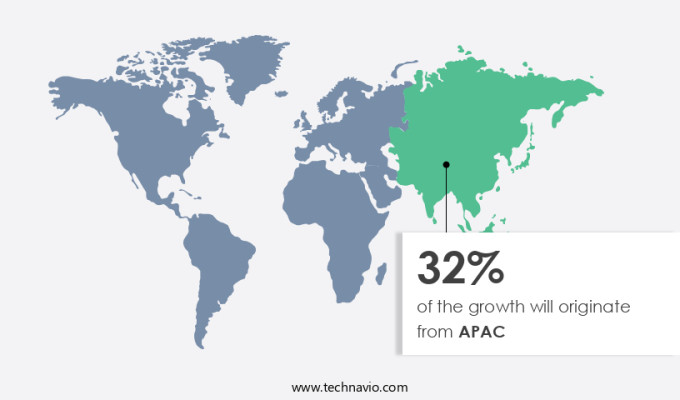

APAC is estimated to contribute 32% to the growth by 2028. Technavio’s analysts have elaborately explained the regional trends, drivers, and challenges that are expected to shape the market during the forecast period.

For more insights on the market share of various regions View PDF Sample now!

The high demand for oil and gas in APAC is the primary factor behind the high demand for AC electric motors in the region. The regional market is expanding primarily as a result of the rising demand for energy from developing nations like China and India. By 2023, this demand is anticipated to grow further. Sales of AC electric motors in the oil and gas market in the region will also rise as a result of rising investments in the oil and gas industry in China and a few other Southeast Asian nations. Furthermore, as developing nations like India and China take steps to explore the potential for unconventional oil and gas production in the region in addition to conventional production, APAC is expected to see an increase in E&P activities. The increase in E&P activities of unconventional reserves will further boost the growth of the global AC electric motor sales in the oil and gas market during the forecast period. Therefore, the factors mentioned above will drive the growth of the regional market during the forecast period.

Segment Overview

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion " for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Power Rating Outlook

- Less than 1kV

- Between 1 kV and 6.6 kV

- Greater than 6.6 kV

- Type Outlook

- Induction motor

- Synchronous motor

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- South America

- Chile

- Brazil

- Argentina

- North America

You may also interested in the below market reports

- Electric Alternating Current (AC) Motors Market Analysis APAC, Europe, North America, South America, Middle East and Africa - China, US, Japan, Germany, France - Size and Forecast

- Europe Electric Motors for Electric Vehicle (EV) Market by Application and Type - Forecast and Analysis

- Electric Vehicle (EV) Motor Market Analysis APAC, Europe, North America, South America, Middle East and Africa - China, US, Norway, Germany, France - Size and Forecast

Market Analyst Overview

The market is driven by the increasing demand for energy-efficient solutions in various applications such as drilling rigs, refineries, compressors, and midstream facilities. The use of AC electric motors, including induction and synchronous types, is essential in converting electrical energy into mechanical energy for various processes like fluid flow, pressurization, ventilation, blending, agitation, and compressor operations. Ac electric motors, particularly energy-efficient ones, help reduce power consumption and carbon emissions, making them an attractive choice for the Oil and Gas sector. Smart technologies like Variable Frequency Drives (VFDs) are increasingly being adopted to optimize motor performance and reduce energy wastage. The Oil and Gas industry's drilling and pumping operations require significant electrical power. Ac electric motors play a crucial role in these applications, ensuring efficient and reliable operation. In refineries, AC electric motors are used extensively for compressors, compressor drives, and process pumps, contributing to the market's growth. The integration of AC electric motors in petrochemical plants, midstream facilities, and other Oil and Gas applications is expected to continue, driven by the need for energy efficiency and environmental sustainability. The market is expected to grow steadily, offering significant opportunities for manufacturers and suppliers of AC electric motors.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.72% |

|

Market growth 2024-2028 |

USD 3.58 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.32 |

|

Regional analysis |

APAC, Middle East and Africa, North America, Europe, and South America |

|

Performing market contribution |

APAC at 32% |

|

Key countries |

US, China, Russia, Saudi Arabia, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ABB Ltd., Arc Systems Inc., Elektrim Motors, FLANDERS Inc., Franklin Electric Co. Inc., General Electric Co., Hitachi Ltd., Hoyer Motors, Nidec Corp., NOV Inc., Parker Hannifin Corp., Regal Rexnord Corp., Rockwell Automation Inc., Schlumberger Ltd., Siemens AG, TECO-Westinghouse, Toshiba Corp., WEG S.A, Wolong Electric Group Co. Ltd., and Yaskawa Electric Corp. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2023 and 2027

- Precise estimation of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch