Acrylic Sheets Market Size 2025-2029

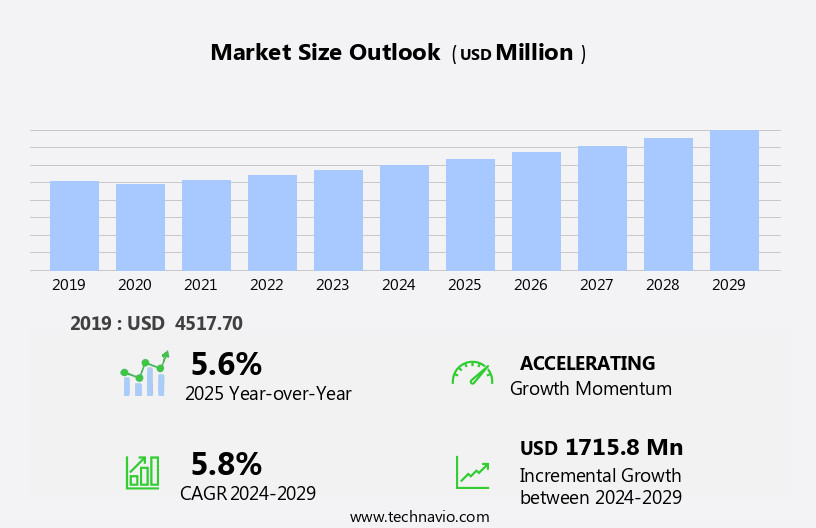

The acrylic sheets market size is forecast to increase by USD 1.72 billion at a CAGR of 5.8% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing demand for these sheets in various industries. In the spa and wellness sector, acrylic sheets are increasingly being used for constructing hot tubs and pools due to their durability and resistance to chemicals. In the furniture industry, acrylic sheets are being used to create innovative and stylish designs for chairs, tables, and other home decor items. Fluctuating crude oil prices have led to an increase In the production from acrylic acid, making them more affordable and accessible. Additionally, the use of in lighting fixtures, solar panels, and digital signage is on the rise.

- In the construction industry, they are being used for cladding, insulation, and roofing due to their lightweight and insulating properties. The orange hue is also gaining popularity in real estate for its aesthetic appeal. The market is expected to continue growing due to the increasing demand in various applications, including display cases, plastic parts, and automotive components. Despite the growth, challenges such as the high cost of raw materials and the availability of substitutes like glass and steel remain. Solvents used in the production are also a concern due to their potential environmental impact.

What will be the Size of the Acrylic Sheets Market During the Forecast Period?

- The market encompasses polymethyl methacrylate (PMMA) products, including plexiglass and acrylic, known for their lightweight, durability, and transparency. These sheets exhibit excellent UV resistance, making them ideal for various applications in construction and architecture, skylights, and UV resistant acrylic sheets. Acrylic's wearability and versatility extend to insulating properties, making it a valuable resource for thermal insulation and energy efficiency in industries like construction and architecture. Furthermore, they offer chemical resistance, impact strength, and a range of thicknesses, colors, and surface finishes, catering to diverse needs in architectural glazing, furniture & interiors, automotive segment, healthcare & medical, automotive & transportation, sanitary ware, and retail displays.

- Furthermore, the market's growth is driven by the increasing demand for lightweight, durable, and visually appealing materials in various sectors. Extruded acrylic sheets, produced through the extrusion process, and cast acrylic sheets, manufactured using the casting process, cater to the market's diverse requirements in terms of visual aesthetics and specific applications. Acrylic's versatility and adaptability make it a valuable resource in numerous industries, including automotive components, interior trims, and architectural applications.

How is this Acrylic Sheets Industry segmented and which is the largest segment?

The acrylic sheets industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Cell cast acrylic sheets

- Continuous cast acrylic sheet

- Extruded acrylic sheet

- Application

- Industrial

- Commercial

- Residential

- Distribution Channel

- Offline

- Online

- Geography

- APAC

- China

- India

- Japan

- Europe

- Germany

- UK

- France

- Italy

- North America

- Canada

- US

- South America

- Brazil

- Middle East and Africa

- APAC

By Product Insights

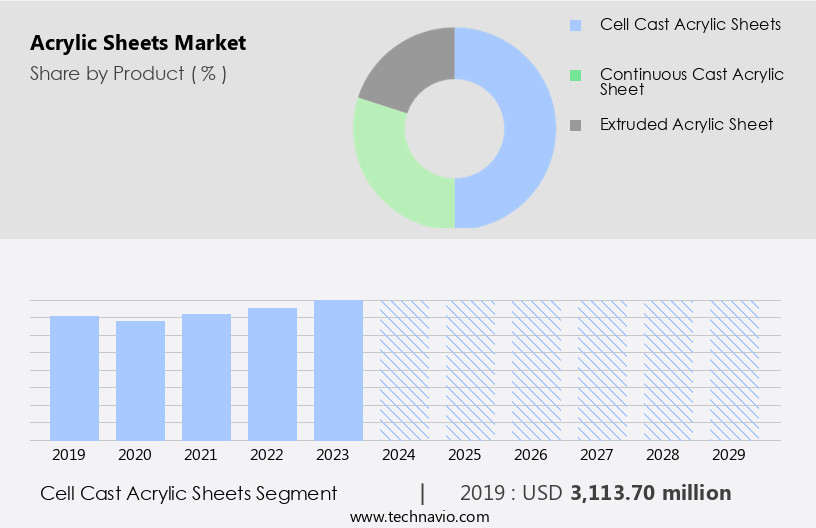

- The cell cast acrylic sheets segment is estimated to witness significant growth during the forecast period.

The market is driven by the demand for lightweight, durable, and transparent materials with excellent UV resistance and wearability. Acrylic, also known as polymethyl methacrylate (PMMA), is a versatile material used in various industries, including construction and architecture, automotive, and transportation infrastructures. The market consists of cast type extruded sheets, with cast them gaining popularity due to their superior properties. These sheets are produced using the casting process, which involves polymerizing methyl methacrylate syrup between high-quality glass sheets, resulting in high-quality sheet with excellent optical clarity, thermal stability, and resistance to solvents. The market is expected to grow significantly between 2025 and 2029 due to their use in high-end architectural projects, automotive components, and retail displays.

Get a glance at the Acrylic Sheets Industry report of share of various segments Request Free Sample

The cell cast segment was valued at USD 3.11 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

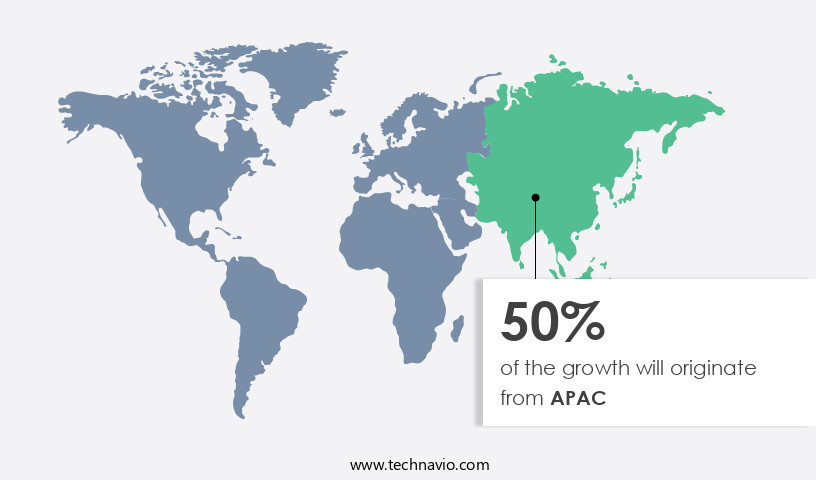

- APAC is estimated to contribute 50% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Acrylic sheets, also known as polymethyl methacrylate (PMMA) sheets, are a lightweight, durable, and transparent material widely used in various industries for their UV resistance, wearability, and shatterproof properties. These sheets are commonly referred to as Plexiglass and come in various thicknesses and colors, making them suitable for insulating properties in skylights, canopies, windshields, interior components, signage displays, lighting fixtures, decorative features, and more. Acrylic sheets are essential in construction and architecture, transportation infrastructures, furniture & interiors, automotive segment, and retail displays due to their high impact resistance, color vibrancy, and fire resistance. The Asia-Pacific region, particularly China, India, Japan, Malaysia, Thailand, Indonesia, and Vietnam, is the largest consumer, driven by infrastructure development and the automotive industry's growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Acrylic Sheets Industry?

Increasing demand for acrylic sheets in automotive industry is the key driver of the market.

- Acrylic sheets, also known as Polymethyl methacrylate (PMMA) sheets, are a popular choice in various industries for their lightweight, durable, and transparent properties. In the automotive segment, they are utilized extensively for components such as side windows, headlamp covers, and windshields due to their superior optical clarity and ease of processability. They offer several advantages over conventional materials like glass and thermoplastics. They are lighter, reducing fuel consumption and enhancing vehicle performance. They also exhibit excellent UV resistance, wearability, and impact resistance, making them ideal for exterior applications. Moreover, they are available in various thicknesses, colors, and surface finishes to cater to diverse architectural and design requirements.

- In addition, they are also used in construction and architecture for facade claddings, skylights, canopies, and insulating properties. They are also employed in interior components such as furniture & interiors, signage displays, lighting fixtures, and decorative features. The market continues to grow due to increasing demand for shatterproof materials, long-lasting displays, and innovative designs. The manufacturing processes include casting and extrusion, with cast type offering superior visual aesthetics and color compatibility. Acrylic sheets possess excellent chemical resistance, impact strength, and thermal insulation properties, making them suitable for various applications In the healthcare & medical, automotive & transportation, and sanitary ware industries.

What are the market trends shaping the Acrylic Sheets Industry?

Rising demand for signage and displays is the upcoming market trend.

- Acrylic sheets, also known as Polymethyl methacrylate (PMMA) sheets, are gaining significant traction in various industries due to their lightweight, durability, transparency, and UV resistance properties. These sheets are ideal for use in signage displays, lighting fixtures, skylights, canopies, windshields, and interior components. Acrylic's wearability and shatterproof qualities make it an excellent choice for long-lasting displays, particularly in high-traffic areas. The market is driven by the increasing demand for innovative designs in construction and architecture, transportation infrastructures, and urbanization. Acrylic sheets offer various thicknesses, colors, and surface finishes to cater to diverse applications. In the automotive segment, they are used for side windows, headlamp covers, and interactive screens, contributing to fuel efficiency and vehicle performance.

- Furthermore, acrylic sheets are also used in various industries, including retail displays, automotive components, interior trims, and solar panels. Their optical clarity, machinability, color compatibility, and chemical resistance make them a versatile material for various applications. Additionally, advancements in manufacturing processes, such as injection molding and casting, have increased production capacity and efficiency. The market is expected to grow due to their desirable properties, such as impact resistance, color vibrancy, fire resistance, antimicrobial properties, and self-cleaning capabilities. These properties make it an attractive choice for architectural glazing, furniture & interiors, and facade claddings.

What challenges does the Acrylic Sheets Industry face during its growth?

Fluctuating crude oil prices is a key challenge affecting the industry growth.

- Acrylic sheets, also known as Polymethyl methacrylate (PMMA) sheets, are valued for their lightweight, durability, transparency, and UV resistance properties. These sheets are used extensively in various industries, including construction and architecture, automotive, and transportation infrastructures. However, The market faces challenges due to the volatility of crude oil prices. As acrylic is derived from crude oil, the market dynamics are significantly influenced by its price fluctuations. When crude oil prices rise, the cost of raw materials increases, leading to higher manufacturing costs for acrylic sheets. This compels manufacturers to adopt cost-cutting measures, which can impact the quality and performance of the final product.

- Consequently, end consumers may face higher prices, potentially slowing market growth. Moreover, the uncertainty surrounding crude oil prices makes it challenging for manufacturers to plan long-term projects, as they are uncertain about future costs and profit margins. Despite these challenges, the market continues to grow due to its wide range of applications. These include skylights, canopies, windshields, interior components, signage displays, lighting fixtures, decorative features, and more. The market also benefits from technology advancements, such as injection molding, impact resistance, color vibrancy, fire resistance, antimicrobial properties, and self-cleaning capabilities. Furthermore, the increasing demand for sustainable construction, recyclability, and energy efficiency is driving market growth.

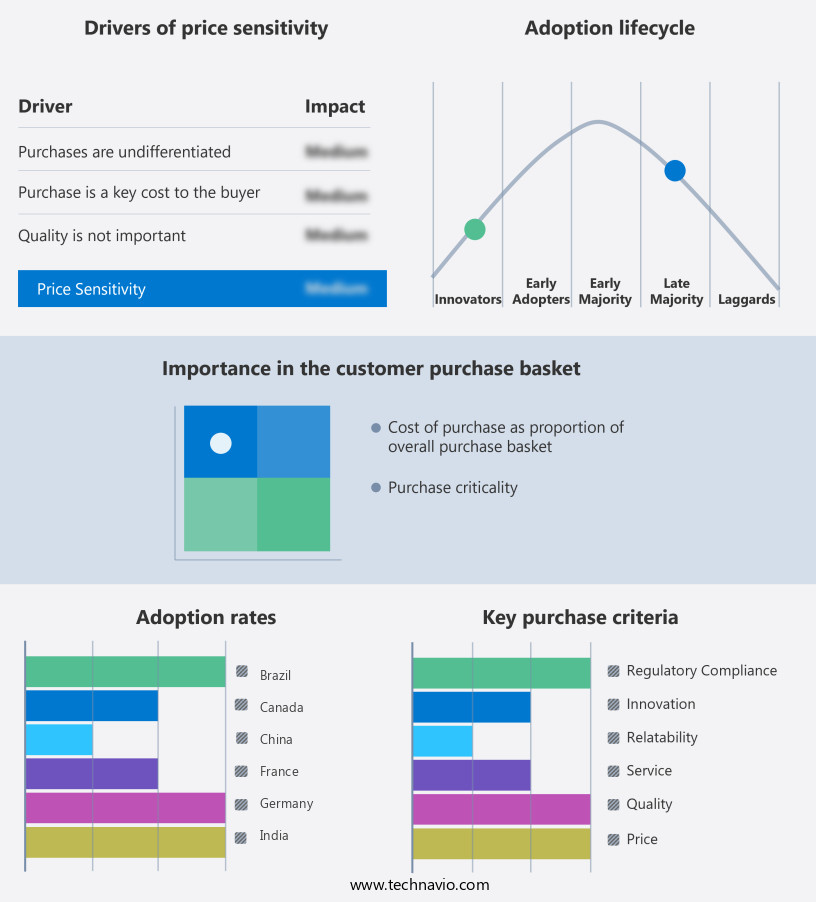

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Asia Poly Industrial Sdn Bhd - The company offers acrylic sheets such as A-Cast a cast acrylic sheet that has become synonymous with clarity, colors and choice. The versatility of the material and wide range of colors, surfaces and finishes enable designers to quickly realize their creative ideas.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Chimei Corp.

- Elastin International Corp.

- Evonik Industries AG

- Foshan Shunde Lunjiao Xishun Plastics Factory

- Gevacril Srl

- Hyundai Department Store Group Co. Ltd.

- Jumei Acrylic

- Mitsubishi Chemical Group Corp.

- Palram Industries Ltd

- Plaskolite Inc.

- PT Astari Niagara Internasional

- PT. Margacipta Wirasentosa

- Ray Chung Acrylic Enterprise Co. Ltd.

- Reynolds Polymer Technology Inc.

- Schweiter Technologies AG

- Shen Chuen Acrylic Ningbo Co., Ltd.

- Sumitomo Chemical Co. Ltd.

- Sun Acrylam Pvt. Ltd.

- Trinseo PLC

- TroGroup GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a wide range of lightweight, durable materials known for their transparency, UV resistance, and wearability. These sheets, also referred to as Plexiglass or cast acrylic, come in various thicknesses and colors, catering to diverse applications. Acrylic sheets exhibit excellent insulating properties, making them suitable for use in skylights, canopies, windshields, and interior components. In the realm of signage displays and lighting fixtures, their shatterproof nature and eye-catching visual aesthetics make them a popular choice. The manufacturing processes include casting and extrusion. Cast type are produced using the casting process, which allows for greater visual aesthetics and optical clarity.

On the other hand, extruded sheets offer better machinability and impact resistance. The versatility extends to various industries, including construction and architecture, furniture & interiors, automotive segment, and more. In construction and architecture, acrylic sheets are used for architectural glazing, facade claddings, and structural load-bearing applications. In the automotive segment, they contribute to fuel efficiency and vehicle performance through the use of side windows, headlamp covers, and interactive screens. The demand is influenced by factors such as urbanization, purchasing power, and technological advancements. Innovative designs and sustainable construction practices have led to increased use in various applications.

Moreover, it offers UV resistance, ensuring long lasting displays and reducing the need for frequent replacement. They are also weather resistant and can be used in outdoor applications, such as solar panels and aquariums. Additionally, they possess self-cleaning capabilities, making them a popular choice for various industries. Acrylic sheets exhibit excellent color compatibility, making them suitable for use in various applications where visual appeal is important. They are also resistant to chemicals and have high impact strength, making them ideal for use in industrial settings. The market is competitive, with various players offering different product offerings and manufacturing processes.

Furthermore, UV resistant sheets, for instance, have gained significant market share due to their ability to withstand prolonged exposure to sunlight. Their transparency, UV resistance, and wearability make them a popular choice for signage displays, lighting fixtures, and architectural applications. The market is influenced by factors such as technological advancements, urbanization, and purchasing power, leading to continued innovation and growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2025-2029 |

USD 1.72 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.6 |

|

Key countries |

China, US, India, Germany, France, Canada, UK, Brazil, Japan, and Italy |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Acrylic Sheets Market Research and Growth Report?

- CAGR of the Acrylic Sheets industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the acrylic sheets market growth of industry companies

We can help! Our analysts can customize this acrylic sheets market research report to meet your requirements.