Agricultural Biotechnology Market Size 2024-2028

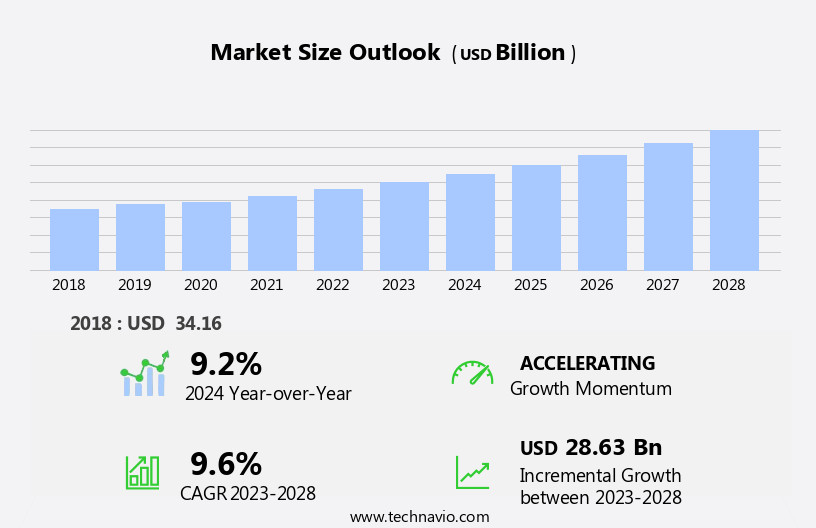

The agricultural biotechnology market size is forecast to increase by USD 28.63 billion at a CAGR of 9.6% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing demand for higher crop yield and the utilization of transgenic animals to produce recombinant proteins. This trend is particularly prominent in regions with a strong agricultural sector and a focus on food security. However, the market is not without challenges. The high costs associated with the development of agricultural biotechnology products pose a significant barrier to entry for new players. Additionally, regulatory oversight and public perception remain key challenges, as some stakeholders express concerns over the long-term health and environmental impacts of genetically modified organisms. Companies seeking to capitalize on market opportunities in Agricultural Biotechnology must navigate these challenges effectively, investing in research and development to reduce costs and build trust with consumers and regulators.

- Strategic partnerships and collaborations can also help mitigate risks and accelerate innovation. Overall, the market presents significant opportunities for companies that can effectively address these challenges and deliver sustainable, high-performing agricultural biotechnology solutions.

What will be the Size of the Agricultural Biotechnology Market during the forecast period?

- The market encompasses the development and application of technology to improve the productivity, quality, and sustainability of plants, animals, and microbes in agriculture. This dynamic industry continues to evolve, driven by the demand for desirable traits such as virus resistance, herbicide-tolerance, insect-resistance, and enhanced quality traits. Genetic engineering, genome editing, and marker-assisted breeding are key technologies shaping the market, enabling the creation of transgenic seeds, stacked traits, and synthetic biology-enabled products. Genetic modifications also extend to animals, facilitating the development of vaccines and antibiotic development.

- In addition, the market is exploring the potential of biofuels, nutritional supplements, and flower culturing. The industry's focus on environmental conditions and the development of crop protection products contributes to its significant size and growth. Overall, the market is a vital sector, continuously innovating to meet the needs of a growing global population and evolving agricultural landscape.

How is this Agricultural Biotechnology Industry segmented?

The agricultural biotechnology industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Transgenic seeds and crops

- Crop protection biochemicals

- Others

- Type

- Plants

- Microbes

- Animals

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- India

- South America

- Middle East and Africa

- North America

By Product Insights

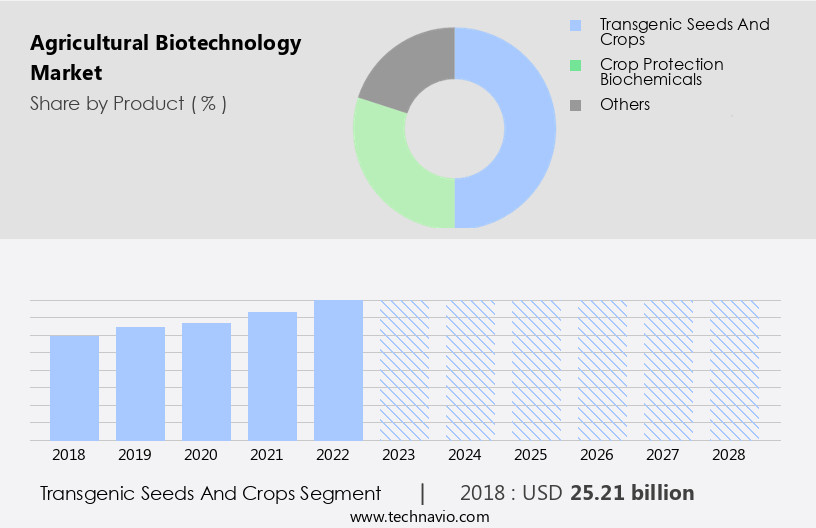

The transgenic seeds and crops segment is estimated to witness significant growth during the forecast period.

The market encompasses transgenic seeds, specifically those with herbicide-tolerant and insect-resistant traits, as well as stacked traits, which combine multiple genes. Corn, soybeans, and cotton are common crops with these characteristics. For instance, Bt seeds, a popular GM variety, incorporate parts of the Bacillus thuringiensis gene from a bacterium, producing toxins that harm specific insects, thereby enhancing insect resistance. The market dynamics include scientific methods such as genome editing, molecular methods, and marker-assisted selection, enabling the development of desirable traits in organisms. These advancements address micronutrient deficiencies, enhance nutritional value, and improve crop protection. However, there are concerns regarding the environmental impact, including potential antibiotic resistance and lack of knowledge about long-term effects.

Geographical coverage, infrastructure, pricing, raw material shortage, and trade regulations are essential factors influencing the market. Partnerships between organizations and research focus on vaccine development, synthetic biology-enabled products, and capacity expansion. The availability of crop protection products, precision farming, and the impact on food security are also significant considerations. Despite these advancements, shipping delays and price trend analysis remain challenges. Organisms such as microbes and animals are also subject to genetic modification, expanding the market's scope. The technology's potential for improving human health and addressing nutritional supplements and antibiotic development is a driving force. However, the environmental impact and potential risks must be carefully considered.

Get a glance at the market report of share of various segments Request Free Sample

The Transgenic seeds and crops segment was valued at USD 25.21 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

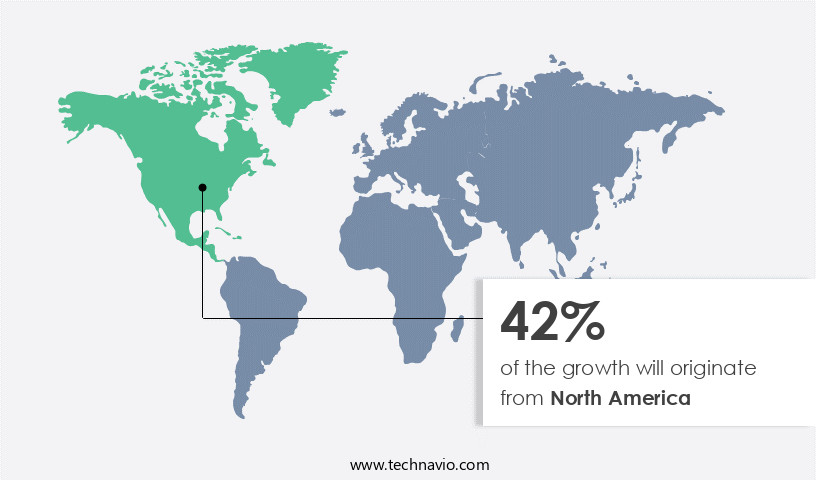

North America is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is driven by advancements in plant breeding, biofuels, and genome editing. In North America, the United States and Canada are significant contributors to the market's revenue. Technological innovations for improved cultivation practices, growing demand for eco-friendly agricultural equipment, and consumer preference for genetically modified organisms with desirable traits, such as herbicide-tolerance and insect-resistance, are key factors fueling market expansion. Furthermore, the market's less capital-intensive nature attracts both small and established companies, leading to increased competition. The US Environmental Protection Agency's approval of agricultural biotechnology, due to its reduced environmental impact, will further boost market growth during the forecast period.

Additionally, research focus on addressing micronutrient deficiencies, molecular methods like flower culturing, and developing countries' increasing demand for crop protection products contribute to the market's expansion. Price trend analysis, precision farming, shipping delays, and infrastructure development are other market dynamics shaping the agricultural biotechnology landscape. The market encompasses a wide range of organisms, from plants to animals, and covers various sectors, including trait type, research focus, genetic modification, and infrastructure. Market segmentation considers factors like trait type, pricing, raw material shortage, and environmental conditions. Synthetic biology-enabled products, such as vaccines and antibiotic development, are also gaining traction in the market.

However, concerns regarding genetic changes, environmental impact, and antibiotic resistance remain key challenges. Intelligence services and partnerships play a crucial role in market growth, while trade regulations and virus-resistant plants further impact the market's trajectory.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Agricultural Biotechnology Industry?

- Increasing demand for higher crop yield is the key driver of the market.

- The global population continues to grow, rising from 7.59 billion in 2018 to 8.1 billion in 2023. This expansion poses a significant challenge for the agricultural sector, as the demand for food increases while resources such as land and water remain constrained. The reduction in agricultural land due to urbanization is a major concern, as cities expand and farmland is converted for development. To meet the rising demand for food, farmers must maximize the productivity of their existing agricultural land. The market plays a crucial role in addressing this challenge by providing innovative solutions for increasing crop yields and reducing the need for water and other resources.

- Biotechnology enables farmers to produce crops that are more resilient to environmental stressors, such as drought and pests, ensuring food security for a growing population. The market is driven by the need to feed a growing population and the desire to reduce the environmental impact of agriculture.

What are the market trends shaping the Agricultural Biotechnology Industry?

- Use of transgenic animals to produce recombinant proteins is the upcoming market trend.

- Transgenic animals, whose genome carries foreign DNA sequences from another species, are a significant development in agricultural biotechnology. The process of transgenesis introduces these DNA sequences into the genome of transfected cells. Animal cells are utilized to synthesize recombinant proteins with proper post-translational modifications, which is essential for various applications. This technique enhances the growth rate, improves feed utilization, and increases resistance to diseases in animals. Transgenic animals have been extensively used in the food industry, including cattle, sheep, goats, chickens, cats, rats, and more.

- This application of biotechnology offers numerous benefits and is a crucial component in the agricultural sector. The use of transgenic animals contributes to the production of high-quality proteins and improved animal welfare, making it an essential area of research and development.

What challenges does the Agricultural Biotechnology Industry face during its growth?

- Higher costs for development of agricultural biotechnology products is a key challenge affecting the industry growth.

- The market faces significant challenges due to high research and development costs, particularly for the creation of new active ingredients. The European Parliament's lengthy approval process for crop protection products, which takes an average of 11 years, further increases these costs for manufacturers. With decreasing research spending by governments in developed countries, such as the US, Australia, and France, the agricultural research investment drop between 2021 and 2023 was 6%.

- This trend continues, making the market dynamic a complex one for participants. Despite these challenges, the potential benefits of agricultural biotechnology, such as increased productivity and sustainability, make it an essential sector for innovation and growth.

Exclusive Customer Landscape

The agricultural biotechnology market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the agricultural biotechnology market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, agricultural biotechnology market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

BASF SE - Agri-tech firm delivers advanced biotechnological solutions for crop protection against pests and diseases, ensuring sustainable biological control. Our offerings enhance agricultural productivity through effective, eco-friendly methods.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BASF SE

- Bayer AG

- Bioceres Crop Solutions Corp.

- Corteva Inc.

- Dow Chemical Co.

- DuPont de Nemours Inc.

- Eurofins Scientific SE

- Evogene Ltd.

- FMC Corp.

- Global Bio chem Technology Group Co. Ltd.

- Illumina Inc.

- Limagrain

- Mitsui and Co. Ltd.

- Novozymes AS

- Nufarm Ltd.

- Performance Plants Inc.

- Sumitomo Chemical Co. Ltd.

- Syngenta Crop Protection AG

- Thermo Fisher Scientific Inc.

- KWS SAAT SE and Co. KGaA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Agricultural biotechnology is a dynamic and evolving industry that encompasses various techniques and applications aimed at enhancing the productivity, sustainability, and nutritional value of crops. This sector leverages scientific methods such as genome editing, molecular breeding, and genetic engineering to develop organisms with desirable traits, including herbicide-tolerance, insect-resistance, and virus-resistance. One of the primary focus areas in agricultural biotechnology is plant breeding. This process involves the manipulation of plant genetics to produce new varieties with improved traits. Traditional selective breeding methods have been used for centuries, but the advent of molecular methods and genome editing technologies has accelerated the pace of innovation.

These advanced techniques enable the precise modification of specific genes, leading to the creation of plants with enhanced nutritional value and resistance to various environmental stressors. Another significant area of interest in agricultural biotechnology is the development of biofuels. Micronutrient deficiencies in crops can limit their yield and nutritional value, making it essential to address these issues through various means. One approach is the use of genetically modified organisms (GMOs) to produce crops with enhanced nutritional profiles. These crops can help address food security concerns in developing countries and contribute to the production of sustainable biofuels. The infrastructure required for the successful implementation of agricultural biotechnology is vast and complex.

This includes the availability of advanced research facilities, access to germplasm, and the development of partnerships with various stakeholders. Price trends, shipping delays, and raw material shortages can impact the supply chain and, in turn, the overall market dynamics. The environmental impact of agricultural biotechnology is a topic of ongoing debate. While some argue that the use of GMOs and other biotechnological interventions can help reduce the need for synthetic fertilizers and pesticides, others express concerns about the potential environmental risks associated with these technologies. Additionally, the development of antibiotic resistance in microbes and the ethical implications of genetic engineering are important considerations.

The market for agricultural biotechnology is segmented based on various factors, including trait type, geographical coverage, and application areas. The technology landscape is continually evolving, with a focus on precision agriculture, vaccine development, and synthetic biology-enabled products. The potential impact of these innovations on food security, animal health, and human health is significant, making it essential to stay informed about the latest developments in this field. In , agricultural biotechnology is a complex and multifaceted industry that offers numerous opportunities for innovation and growth. The use of advanced scientific methods, such as genome editing and molecular breeding, is driving the development of new and improved crops with enhanced nutritional value and resistance to various stressors.

The infrastructure required to support this industry is vast and intricate, and the market dynamics are influenced by various factors, including environmental conditions, pricing, and trade regulations. The potential impact of agricultural biotechnology on food security, animal health, and human health makes it a critical area of focus for researchers, policymakers, and industry stakeholders alike.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.6% |

|

Market growth 2024-2028 |

USD 28.63 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

9.2 |

|

Key countries |

US, China, India, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Agricultural Biotechnology Market Research and Growth Report?

- CAGR of the Agricultural Biotechnology industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the agricultural biotechnology market growth of industry companies

We can help! Our analysts can customize this agricultural biotechnology market research report to meet your requirements.