Agricultural Drones Market Size 2025-2029

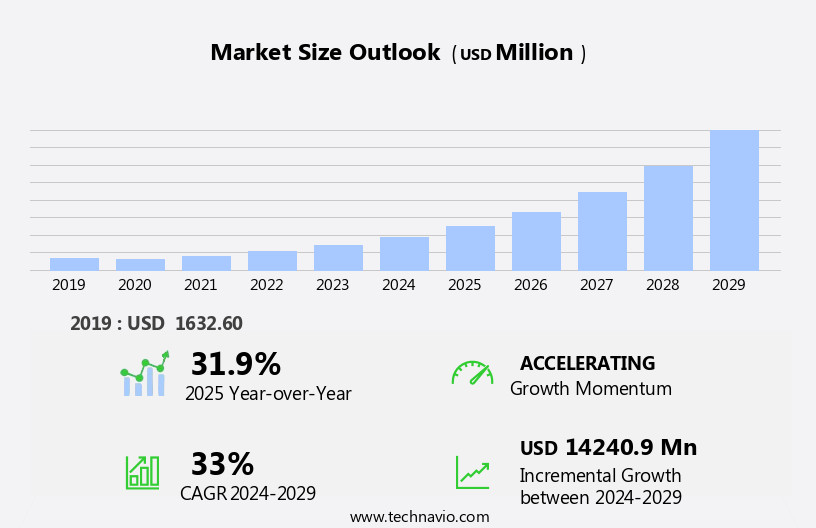

The agricultural drones market size is forecast to increase by USD 14.24 billion at a CAGR of 33% between 2024 and 2029.

- The market is experiencing significant growth, driven by increased funding for UAV manufacturers and the introduction of new agricultural drone models. These innovations offer farmers improved precision in crop monitoring, irrigation management, and yield estimation. However, the market faces challenges, including regulatory restrictions and concerns regarding data privacy and security. This targeted application leads to environmental benefits, including reduced use of agrochemicals and improved resource management. As the industry evolves, companies must navigate these challenges while capitalizing on opportunities for cost savings, increased efficiency, and enhanced agricultural productivity. Strategic partnerships, technological advancements, and a focus on customer needs will be essential for market success. The future of agricultural drones lies In their ability to provide actionable insights and drive sustainable farming practices, making this an exciting and dynamic market for investors and industry players alike.

What will be the Size of the Agricultural Drones Market during the forecast period?

- The market is experiencing significant growth due to the increasing adoption of precision agriculture techniques to optimize crop yields and reduce costs. Drones equipped with advanced cameras, sensors, and navigation systems enable farmers to monitor crops in real-time, identify issues, and apply fertilizers, pesticides, and water more precisely and efficiently. The market encompasses both fixed wing and rotary wing drones, each offering unique advantages for various agricultural applications. Flight control systems and propulsion technologies facilitate seamless drone operation. Furthermore, professional and managed services provide farmers with expert assistance in drone acquisition, training, and implementation.

- Data analytics plays a crucial role In the market, as the collected data is used to inform decision-making processes and enhance overall farm productivity. The market's continued expansion is driven by the potential for substantial cost savings, increased efficiency, and the ability to address evolving agricultural challenges.

How is this Agricultural Drones Industry segmented?

The agricultural drones industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Component

- Hardware

- Software

- Services

- Product

- Multi-rotor

- Fixed-wing

- Hybrid

- Deployment

- Outdoor

- Indoor

- Application

- Crop management

- Field mapping

- Crop spraying

- Variable rate application

- Livestock monitoring

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Middle East and Africa

- North America

By Component Insights

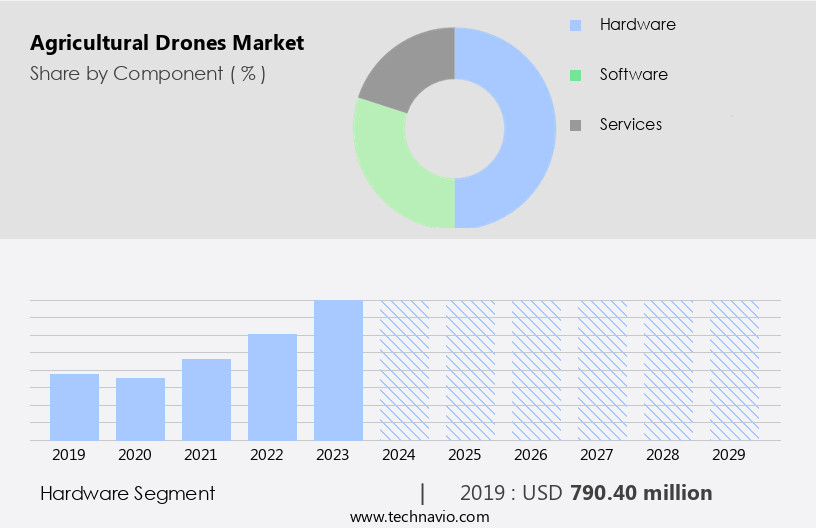

The hardware segment is estimated to witness significant growth during the forecast period. The market encompasses the sales of hardware components, including cameras, sprayers, radio receivers, motors, batteries, sensors, and crop scouting equipment, for customized drone usage in agriculture applications. The demand for advanced hardware components is escalating due to the increasing need to build and fly UAVs for precision agriculture, optimized crop yields, cost savings, and environmental benefits. Companies such as SZ DJI Technology Co. Ltd., Parrot Drones, and AgEagle Aerial Systems provide hardware components for customized drone solutions. DJI, a leading player, offers a range of hardware components, including flight control systems, navigation systems, and propulsion systems, to enhance drone functionality.

Get a glance at the market report of share of various segments Request Free Sample

The hardware segment was valued at USD 790.40 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

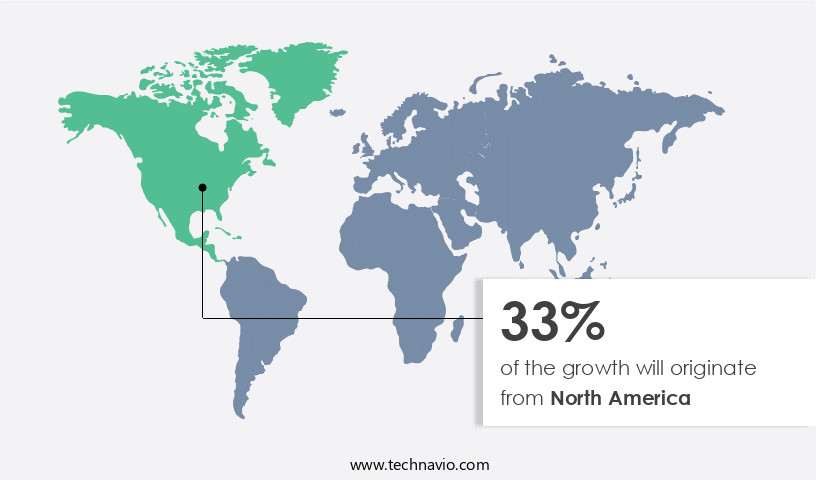

North America is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in the region is experiencing significant growth due to the increasing adoption of precision agriculture for optimized crop yields and cost savings. Agricultural drones are increasingly used for crop monitoring, spraying fertilizers and pesticides, and field mapping, providing real-time data for targeted application and resource allocation. These drones are equipped with advanced features such as flight control systems, navigation systems, and professional services for managed farming operations in both indoor and outdoor environments. The environmental benefits of drone technology, including reduced water usage and improved nutrient efficiency, further contribute to the market's growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Agricultural Drones Industry?

- Rise in funding for UAV manufacturers is the key driver of the market. The market is experiencing notable expansion due to increased funding for UAV manufacturers. This financial influx permits innovations in drone technology, specifically for agricultural applications, such as precision farming, crop monitoring, and irrigation management. These advancements boost drone efficiency, dependability, and accessibility for farmers, enabling them to assess crop health, optimize resource utilization, and augment yields.

- Furthermore, governments and private investors acknowledge the transformative potential of UAVs in agriculture, offering financial assistance and incentives to fuel progress.The competition among manufacturers, fueled by this investment, results in cost reductions and enhanced features in agricultural drones.

What are the market trends shaping the Agricultural Drones Industry?

- Introduction of new agricultural drones is the upcoming market trend. The market is witnessing significant advancements as major players introduce innovative products to gain a competitive edge. For instance, in November 2023, DJI, a prominent market participant, launched the T60 agriculture drone, featuring a virtual pan-tilt-zoom capability, suitable for farmland spraying and aerial seeding. Similarly, in December 2023, XAG Co Ltd, a significant Chinese agricultural drone manufacturer, introduced the P150 and P60 drones.

- The P150 model offers functions such as spraying, sowing, transportation, and aerial surveying, with a maximum payload of 70 kilograms and a spraying flow rate of 30 liters per minute. These developments underscore the dynamic nature of the market.

What challenges does the Agricultural Drones Industry face during its growth?

- Concerns regarding use of agricultural drones is a key challenge affecting the industry growth. Agricultural drones have gained significant attention due to their potential benefits in farming operations. However, privacy concerns remain a notable challenge. Drones can record audio and video, raising issues about personal freedom and property rights.

- Furthermore, there are allegations that drones might be used for spying purposes by various entities. In response, regulatory bodies have implemented measures to address these concerns. For instance, in India, the Directorate General of Civil Aviation (DGCA) mandates registration of all drones, except for nano drones and non-commercial drones under specific weight thresholds, on the Digital Sky platform. This registration ensures compliance with safety and privacy standards. The DGCA has also introduced stricter guidelines to enhance the security of drone operations and mitigate privacy concerns.

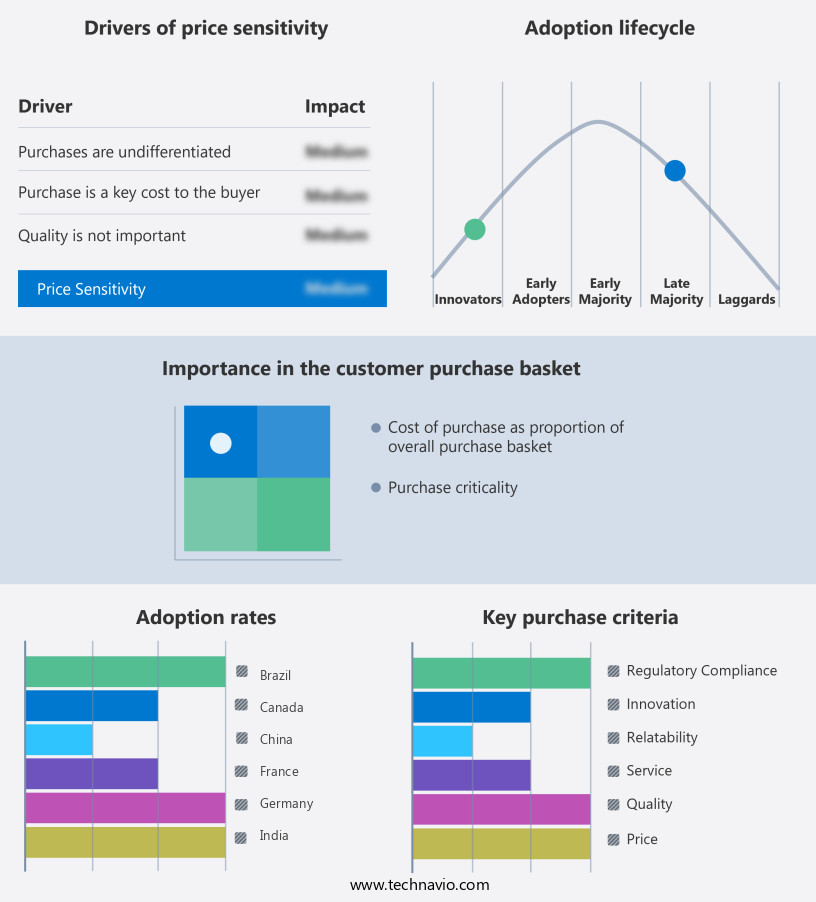

Exclusive Customer Landscape

The agricultural drones market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the agricultural drones market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, agricultural drones market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Aeronavics - The company offers agricultural drones such as Aeronavics Navi mapping and planning drone that can take payload of upto 2 kg, fly for 30 minutes and reaches speed of 100 km per hour.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AeroVironment Inc.

- AgEagle Aerial Systems Inc.

- DELAIR SAS

- Drone Volt SA

- FlyGuys

- Harris Aerial

- ideaForge Technologies Pvt. Ltd.

- Kray Technologies

- Nextech

- Parrot Drones SAS

- Sentera Inc.

- Shenzhen GC electronics Co. Ltd.

- Skyfront

- SZ DJI Technology Co. Ltd.

- Vision Aerial Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The agricultural drones market is experiencing significant growth as farmers seek to optimize crop yields and reduce costs through advanced aerial technology. Drones offer numerous benefits for agricultural operations, including real-time data collection, environmental sustainability, and targeted application of fertilizers and pesticides. One of the primary applications of agricultural drones is crop monitoring. These unmanned aerial vehicles (UAVs) equipped with high-resolution cameras and sensors can capture detailed images of crops, allowing farmers to identify nutrient deficiencies, pest infestations, and other issues that may impact yield. By addressing these issues in a timely manner, farmers can minimize losses and maximize their returns.

Another key benefit of agricultural drones is cost savings. Traditional methods of crop monitoring, such as manual inspections or satellite imagery, can be time-consuming and expensive. Drones offer a more cost-effective solution, enabling farmers to survey large areas quickly and efficiently. Additionally, drones can help farmers save on inputs such as fertilizers and pesticides by allowing for targeted application based on real-time data. Environmental benefits are also a significant driver of the agricultural drone market. Drones can help farmers reduce their environmental footprint by providing precise data on crop health and resource allocation. By optimizing the use of fertilizers and water, farmers can minimize waste and reduce the amount of chemicals that leach into the soil and water supply.

Furthermore, the agricultural drone market is diverse, with applications ranging from indoor farming to vertical farming and greenhouse operations. Fixed wing drones are particularly well-suited for large-scale outdoor farming operations due to their long flight times and ability to cover large areas quickly. These drones are equipped with advanced flight control systems and navigation systems, enabling them to fly autonomously and collect high-resolution data. Professional services and managed services are also becoming increasingly important In the agricultural drone market. As the technology becomes more complex, farmers are turning to experts for help with drone selection, training, and maintenance.

In addition, these services can help farmers maximize the value of their investment in drone technology and ensure that they are getting the most accurate and actionable data possible. Drones offer a range of benefits, including real-time data collection, targeted application of inputs, and environmental sustainability. The market is diverse, with applications ranging from indoor farming to large-scale outdoor farming operations, and professional services and managed services are becoming increasingly important to help farmers get the most value from their investment in drone technology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

238 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 33% |

|

Market growth 2025-2029 |

USD 14.24 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

31.9 |

|

Key countries |

US, Canada, UK, Germany, China, Italy, Brazil, France, Japan, and India |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Agricultural Drones Market Research and Growth Report?

- CAGR of the Agricultural Drones industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the agricultural drones market growth of industry companies

We can help! Our analysts can customize this agricultural drones market research report to meet your requirements.