Alcohol Infused Sparkling Water Market Size 2024-2028

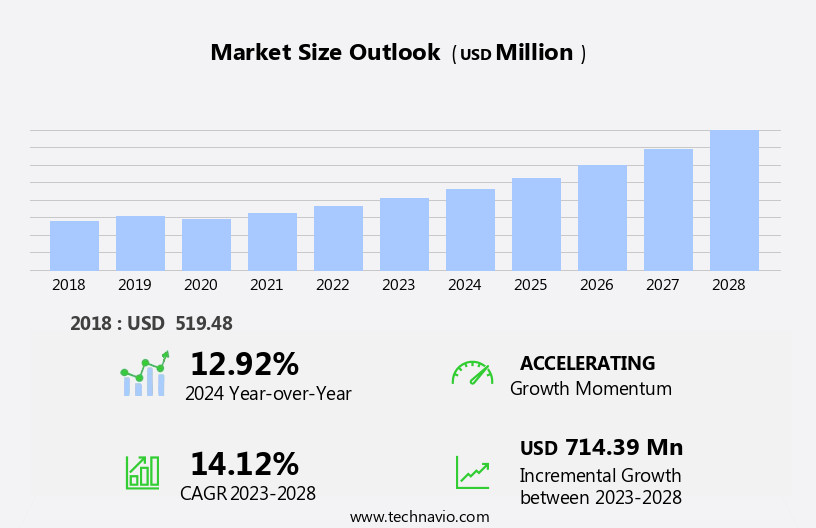

The alcohol infused sparkling water market size is forecast to increase by USD 714.39 million at a CAGR of 14.12% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the rising demand for low-calorie alcoholic beverages. Consumers are increasingly seeking healthier alternatives to traditional alcoholic drinks, and alcoholic sparkling water offers a solution with fewer calories and added health benefits from the infusion of real fruits. However, this market faces challenges as well. One major obstacle is the ongoing campaigns against alcohol consumption, which may deter some consumers from purchasing these products. Despite this, companies can capitalize on the market's opportunities by focusing on innovation and differentiation. For instance, offering unique fruit flavors or low-alcohol content could attract health-conscious consumers looking for a refreshing and socially acceptable beverage option.

- In conclusion, the market is poised for growth, with the increasing preference for low-calorie beverages and the use of real fruits as key drivers. However, companies must navigate the challenge of negative perceptions surrounding alcohol consumption to effectively tap into this market.

What will be the Size of the Alcohol Infused Sparkling Water Market during the forecast period?

- The alcohol-infused sparkling water market continues to evolve, with various sectors adopting this innovative beverage category. Sustainable packaging is a growing concern, as Gen Z consumers demand eco-friendly solutions. Distribution channels expand, with online retailers and convenience stores joining traditional retail outlets. Alcohol infusion varies from subtle to strong, catering to diverse consumer preferences. Natural flavors and taste profiles, including fruit and botanical extracts, add to the product differentiation. Craft cocktails and canned cocktails offer a convenient solution for off-premise consumption, while cocktail mixers and subscription services provide a personalized experience. Premium spirits and wine spritzers appeal to the health-conscious and socially active.

- Product innovation is key, with functional beverages and spirit-based options entering the market. Brand positioning is crucial, as companies navigate alcohol regulations and consumer trends. Price sensitivity and brand loyalty influence purchasing decisions. Social media marketing and influencer partnerships shape consumer perception. Innovation pipelines remain robust, with digital marketing and sensory evaluation playing essential roles. The market research reveals a dynamic landscape, with on-premise consumption and bars and restaurants adapting to the trend. Consumer insights indicate a shift towards lower sugar content and a focus on lifestyle trends. The continuous unfolding of market activities underscores the importance of staying attuned to evolving patterns and consumer preferences.

How is this Alcohol Infused Sparkling Water Industry segmented?

The alcohol infused sparkling water industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Off-premises

- On-premises

- Packaging

- Canned

- Bottled

- Product Type

- Low Alcohol

- Zero Alcohol

- Flavor

- Fruit-Based

- Herbal

- Spiced

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The off-premises segment is estimated to witness significant growth during the forecast period.

Alcoholic infused sparkling water has gained significant traction in the beverage market, particularly among young adults and health-conscious consumers. This category of beverages offers a unique blend of natural flavors, alcohol infusion, and carbonation, catering to various taste preferences. The distribution channels for these beverages include retail outlets, convenience stores, and online retailers. Retail outlets such as supermarkets and hypermarkets, like Tesco Plc, Carrefour SA, and Target Brands, provide a wide range of options for consumers. The rise of online sales, driven by the increasing penetration of the Internet, has further expanded distribution channels for these beverages.

Natural fruit flavors and botanical extracts are popular choices for alcoholic infused sparkling water, aligning with the health and wellness trend. Product differentiation and competitive advantage are key strategies for brands, with premium spirits and craft cocktail inspirations setting them apart. Canned cocktails and cocktail mixers are also gaining popularity for their convenience and portability. Subscription services offer regular deliveries, enhancing brand loyalty and customer engagement. Off-premise consumption, including social drinking and lifestyle trends, has contributed to the growth of alcoholic infused sparkling water. However, regulations regarding alcohol content and marketing campaigns require careful brand positioning.

Innovation pipelines include wine spritzers, hard seltzers, and functional beverages. Price sensitivity and packaging design are crucial factors influencing consumer decisions. Social media marketing and influencer collaborations are effective marketing strategies for reaching Gen Z audiences. Innovation continues to drive the market, with sensory evaluation playing a significant role in product development. Brands are focusing on product innovation, including new flavor profiles and lower sugar content, to cater to evolving consumer preferences. Bars and restaurants are also incorporating alcoholic infused sparkling water into their menus, further expanding the market. Grocery stores and spirit-based beverage retailers are key retail channels, offering a wide range of options for consumers.

The Off-premises segment was valued at USD 303.83 million in 2018 and showed a gradual increase during the forecast period.

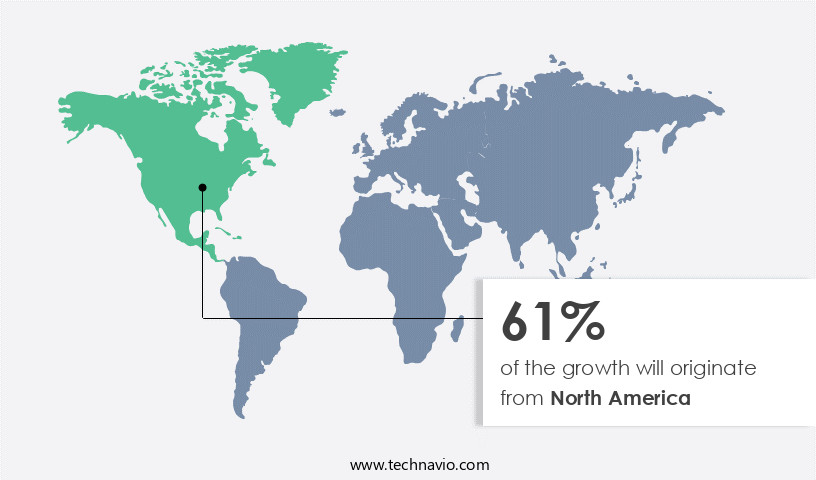

Regional Analysis

North America is estimated to contribute 61% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The alcoholic infused sparkling water market in North America is experiencing significant growth, particularly in the US, driven by shifting consumer demographics and preferences. Younger generations, including Gen Z, are increasingly seeking low-alcohol options for social drinking, aligning with health and wellness trends. This trend is fueled by the convenience of ordering through digital channels and the availability of major brewers such as AB InBev, Molson Coors, and Boston Beer. Natural flavors and taste profiles are key differentiators, with offerings ranging from fruit flavors to botanical extracts. Product innovation includes hard seltzers, canned cocktails, and cocktail mixers, as well as wine spritzers and spirit-based beverages.

Retail outlets, including convenience stores and grocery stores, cater to the demand, while bars and restaurants offer on-premise consumption. Subscription services and influencer marketing are effective strategies for reaching consumers. Alcohol regulations and sensory evaluation are crucial considerations for market entrants. The market research indicates a focus on product differentiation and competitive advantage, with premium spirits and functional beverages gaining popularity. Digital marketing and social media are essential tools for reaching consumers, while price sensitivity and packaging design remain key factors in brand positioning. Overall, the market is dynamic, with a strong innovation pipeline and a growing consumer base.

Market Dynamics

The Alcohol Infused Sparkling Water Market is booming with functional hard seltzers like probiotic-infused seltzers and vitamin-enriched seltzers, appealing to health-conscious consumers. Innovations such as AI-optimized flavor profiles, spicy jalapeño hard seltzer, and customizable seltzer flavors enhance social gatherings and casual dining. Eco-friendly canning, biodegradable packaging, and zero-waste production align with sustainable sourcing and blockchain-verified ingredients. Low-calorie hard seltzer and gluten-free hard seltzer cater to millennials and fitness enthusiasts, while augmented reality labels and smart can designs elevate branding. Subscription beverage services and premium hard seltzer brands drive online sales and nightclub appeal, with best hard seltzer suppliers delivering non-GMO seltzers and high-alcohol seltzer for festival beverages.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Alcohol Infused Sparkling Water Industry?

- The increasing preference for low-calorie alcoholic beverages is the primary market driver, as consumers seek healthier alternatives without compromising on their social drinking habits.

- The alcoholic beverage industry has seen a shift towards healthier and more convenient options, driving the growth of the market. Consumers are increasingly seeking low-calorie, low-carb, and gluten-free alternatives, leading breweries and manufacturers to introduce new natural flavors in their alcohol-infused sparkling water offerings. For instance, White Claw from Mark Anthony Group provides consumers with a range of natural flavors such as black cherry, raspberry, and natural lime, while keeping the carbohydrate count low at 2gm and the calorie count at 100 per 12oz serving with a 5% ABV. This trend is fueled by consumers' preference for healthier alcoholic beverages, growing awareness of the nutritional value of beverages, and the increasing popularity of moderation in drinking.

- Distribution channels, including retail outlets, convenience stores, and subscription services, have expanded to cater to the rising demand for canned cocktails and cocktail mixers. The market dynamics are further influenced by the popularity of sustainable packaging and the appeal of craft cocktails, which align with the health-conscious and eco-conscious mindset of consumers, particularly among the Gen Z demographic. Overall, the market for alcohol infused sparkling water is expected to continue its growth trajectory as consumers seek out lighter, healthier, and more convenient alcoholic beverage options.

What are the market trends shaping the Alcohol Infused Sparkling Water Industry?

- The use of real fruits in alcoholic seltzer beverages is gaining popularity as a market trend. This emerging trend reflects a growing consumer preference for natural and authentic ingredients in their alcoholic beverages.

- The market for alcoholic sparkling water, a popular choice among health-conscious consumers seeking low-calorie and low-carb options, is experiencing significant growth. Beyond alcohol content, innovative flavors and natural ingredients are driving consumer interest. In response to increasing competition, companies are differentiating their offerings by introducing hard sparkling water with real fruits and no added sugars. For instance, Briggs Hard Seltzer launched three new products in 2018, including Briggs Hard Seltzer Pineapple and Briggs Hard Seltzer Grapefruit, all made with 100% real fruit, 5% alcohol, and no artificial flavors or preservatives. These product innovations provide a competitive advantage, catering to the evolving preferences of consumers in the health and wellness sector.

- Market research indicates that off-premise consumption, particularly through online retailers, is on the rise for these beverages. Casual dining establishments are also embracing hard sparkling water, further expanding its reach. Influencer marketing and consumer insights continue to shape the market dynamics, making it an exciting space for growth in the health-conscious beverage industry.

What challenges does the Alcohol Infused Sparkling Water Industry face during its growth?

- The growth of the industry is significantly impacted by campaigns advocating for reduced alcohol consumption.

- The alcoholic infused sparkling water market faces challenges due to growing consumer awareness and concerns regarding the health effects of alcohol, particularly among young adults. Social organizations in the US, such as the Substance Abuse and Mental Health Services Administration (SAMHSA), are launching campaigns to minimize underage drinking and substance use. SAMHSA's 'Talk. They Hear You.' initiative empowers parents and caregivers to educate children about the risks of alcohol and other substances. This trend reflects broader lifestyle trends towards healthier choices and increased focus on functional beverages. Brands in the market must effectively position themselves to appeal to this demographic, utilizing digital marketing strategies and innovative flavor profiles, including botanical extracts.

- Alcohol regulations also impact market dynamics, necessitating careful brand positioning and value proposition development. Despite these challenges, the market continues to grow, driven by consumer trends towards social drinking and the appeal of sparkling water as a refreshing and lower-alcohol alternative to traditional alcoholic beverages.

Exclusive Customer Landscape

The alcohol infused sparkling water market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the alcohol infused sparkling water market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, alcohol infused sparkling water market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Anheuser-Busch InBev SA/NV - The company introduces a line of alcoholic sparkling water products, including organic hard seltzers, under its Michelob Ultra brand. These beverages offer a unique fusion of refreshment and alcohol content, appealing to health-conscious consumers seeking an alternative to traditional alcoholic beverages.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anheuser-Busch InBev SA/NV

- Asahi Group Holdings Ltd.

- Boston Beer Co. Inc.

- Brown-Forman Corp.

- Carlsberg A/S

- Coca-Cola Co.

- Constellation Brands Inc.

- Diageo Plc

- E. & J. Gallo Winery

- Heineken NV

- Kirin Holdings Co. Ltd.

- Mark Anthony Brands

- Molson Coors Beverage Co.

- Naked Collective Ltd.

- PepsiCo Inc.

- Pernod Ricard SA

- Phusion Projects LLC

- Polar Beverages

- Suntory Holdings Ltd.

- White Claw Seltzer Works

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Alcohol Infused Sparkling Water Market

- In February 2024, major beverage company Anheuser-Busch InBev (AB InBev) announced the global launch of its new alcoholic sparkling water brand, Bon & Viv SpikedSeltzer, extending its market presence in the growing alcohol-infused beverage sector (Anheuser-Busch InBev press release). This strategic move aimed to cater to the increasing consumer preference for low-calorie, low-alcohol beverage options.

- In October 2024, Molson Coors Beverage Company and Starbucks Corporation entered into a strategic partnership to produce and distribute Starbucks' new line of Hard Seltzer beverages, Starbucks Hard Seltzer, under the Molson Coors umbrella (Molson Coors Beverage Company press release). This collaboration combined the brand recognition of Starbucks with Molson Coors' expertise in brewing and distribution, targeting the expanding alcohol-infused beverage market.

- In March 2025, Boston Beer Company, the leading craft brewer in the U.S., reported a significant investment of USD100 million to expand its production capacity for its Truly Hard Seltzer brand (Boston Beer Company SEC filing). This investment demonstrated the company's commitment to meeting the growing demand for alcohol-infused sparkling water and maintaining its market leadership.

- In July 2024, the Alcohol and Tobacco Tax and Trade Bureau (TTB), the U.S. Regulatory agency responsible for alcohol, approved the labeling of White Claw's new Hard Seltzer product line, White Claw Hard Seltzer Surge, which contains higher alcohol content (TTB approval notice). This approval marked a significant shift in the market, as it expanded the offerings within the alcohol-infused sparkling water segment to cater to consumers seeking stronger beverage options.

Research Analyst Overview

The alcohol-infused sparkling water market showcases dynamic innovation, with taste perception playing a pivotal role in the development of new products. Brands employ infusion technology and various carbonation methods to create unique aroma profiles, catering to evolving consumer preferences. The industry trends favor aluminum cans due to their lightweight and recyclable nature, enhancing customer retention and brand awareness. Storage conditions are meticulously managed to preserve the sales performance and shelf life of these beverages. Non-alcoholic options continue to gain traction, as innovation roadmaps expand to include plant-based ingredients and alternative flavor compounds. Brand storytelling and product positioning are essential for growth strategies, targeting a diverse audience seeking healthier and more sophisticated alcohol alternatives.

The future of the market hinges on continued innovation, as companies explore new flavor extraction techniques and explore glass bottles for premium offerings. Consumer preferences for sustainable packaging materials also influence the use of eco-friendly materials in the market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Alcohol Infused Sparkling Water Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

158 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.12% |

|

Market growth 2024-2028 |

USD 714.39 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

12.92 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Alcohol Infused Sparkling Water Market Research and Growth Report?

- CAGR of the Alcohol Infused Sparkling Water industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the alcohol infused sparkling water market growth of industry companies

We can help! Our analysts can customize this alcohol infused sparkling water market research report to meet your requirements.