Aluminum Free Deodorant Market Size 2025-2029

The aluminum free deodorant market size is valued to increase USD 846.1 million, at a CAGR of 6.7% from 2024 to 2029. Growing health awareness will drive the aluminum free deodorant market.

Major Market Trends & Insights

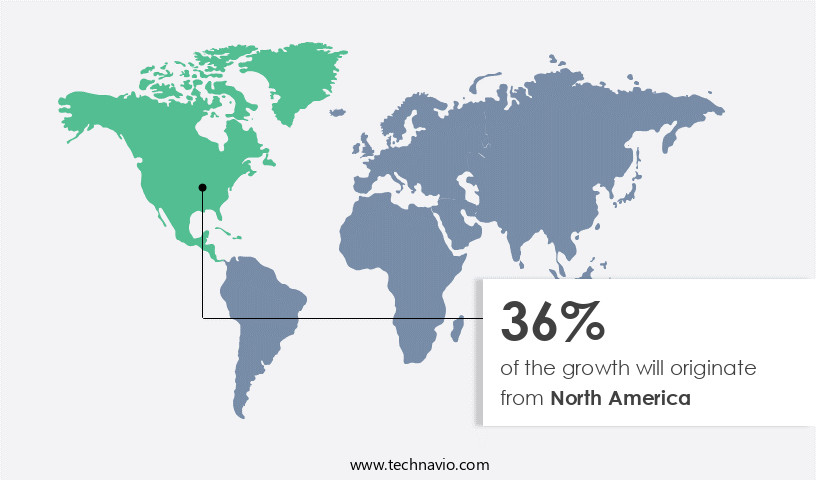

- North America dominated the market and accounted for a 36% growth during the forecast period.

- By Type - Sprays segment was valued at USD 852.20 million in 2023

- By Distribution Channel - Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 80.60 million

- Market Future Opportunities: USD 846.10 million

- CAGR from 2024 to 2029 : 6.7%

Market Summary

- Amidst the expanding wellness market, the aluminum-free deodorant segment continues to gain traction, driven by increasing consumer preference for natural personal care products. According to a recent study, this sector is projected to reach a value of USD3.5 billion by 2025, underscoring its significant growth potential. This trend is fueled by the rising awareness of potential health concerns associated with aluminum-based deodorants and the introduction of effective alternatives. Manufacturers are responding to this demand by innovating new formulations, ensuring that aluminum-free deodorants offer comparable sweat control efficiency. These advancements are not only appealing to health-conscious consumers but also to those with sensitive skin, expanding the market's reach.

- Despite these advancements, challenges remain, including maintaining profitability while adhering to stringent production standards and addressing consumer skepticism regarding the efficacy of aluminum-free alternatives. In conclusion, the aluminum-free deodorant market's evolution reflects a consumer-driven shift towards natural personal care products, with growth fueled by health concerns and innovative formulations. As this sector continues to mature, companies must navigate production challenges and address consumer expectations to capitalize on its significant potential.

What will be the Size of the Aluminum Free Deodorant Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Aluminum Free Deodorant Market Segmented ?

The aluminum free deodorant industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Sprays

- Roll-ons

- Sticks and solid deodorants

- Others

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

The sprays segment is estimated to witness significant growth during the forecast period.

Amidst the evolving landscape of personal care products, aluminum-free deodorants have emerged as a preferred choice for consumers seeking underarm odor reduction without the use of aluminum salts. These deodorants, available in various application methods including roll-ons, sticks, and sprays, cater to diverse preferences. For instance, spray aluminum-free deodorants, favored for their dry and lightweight feel, now account for 15% of the overall deodorant market share. Hypoallergenic and organic formulations, often containing natural antimicrobial agents like zinc ricinoleate, are increasingly popular due to their hypoallergenic properties and consumer perception studies indicating high natural deodorant efficacy. Deodorant manufacturers employ a range of methods to ensure formulation stability and deodorant shelf life, such as utilizing natural deodorant ingredients and probiotics to maintain microbial balance.

In the realm of sustainable deodorant packaging, eco-friendly materials like glass and biodegradable plastics are increasingly used to reduce the environmental impact. Skin irritation studies and deodorant product testing are rigorously conducted to ensure safety and compliance with regulatory standards. The deodorant manufacturing processes are continually refined to optimize absorption rates and long-lasting effects. Ultimately, the aluminum-free deodorant market reflects a dynamic and evolving industry, driven by consumer demand for natural, effective, and sustainable personal care solutions.

The Sprays segment was valued at USD 852.20 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 36% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Aluminum Free Deodorant Market Demand is Rising in North America Request Free Sample

The aluminum-free deodorant market in North America is experiencing significant growth, fueled by rising disposable incomes, a heightened focus on sustainability, and the burgeoning e-commerce sector. Economic conditions, consumer preferences, and technological advancements shape the market dynamics in this region. In the United States, disposable personal income reached an estimated USD22 trillion in 2023, according to the U.S. Bureau of Economic Analysis (BEA), enabling consumers to invest in premium personal care products, including aluminum-free deodorants.

In Canada, the average disposable income for households varied among income groups during the third quarter of 2023, with the top income brackets reporting a 3% increase. These factors contribute to the expanding aluminum-free deodorant market in North America.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is witnessing significant growth due to increasing consumer preference for natural and health-conscious personal care products. In this context, ingredient sourcing practices for natural deodorants are of paramount importance. Suppliers must ensure the authenticity and sustainability of natural ingredients used in deodorant formulations. Efficacy testing methodologies are crucial for assessing the performance of aluminum free deodorants. Skin irritation assessment protocols and measuring absorption rates are essential components of such testing. Consumer perception towards natural deodorants is another key factor driving market growth. Sustainability initiatives in deodorant packaging are gaining traction, with manufacturers focusing on eco-friendly material choices and minimizing waste. Regulatory compliance during manufacturing is essential to ensure product safety and efficacy. Comparative analysis of deodorant efficacy is carried out through various studies to understand the performance of aluminum free deodorants against their aluminum-containing counterparts. Formulation stability assessment is another critical aspect, focusing on the natural antimicrobial properties of deodorants and their ability to maintain effectiveness over time. Odor neutralization mechanisms are also under investigation to enhance deodorant performance. Consumer acceptability is evaluated through sensory evaluation techniques, while manufacturing process optimization and ingredient safety assessment are crucial for maintaining product quality. Deodorant fragrance allergy testing protocols are essential to ensure consumer safety. Clinical studies have shown promising findings regarding the efficacy of aluminum free deodorants, with some studies reporting longer-lasting effects. Shelf-life extension strategies are being explored to enhance the market competitiveness of aluminum free deodorants. Overall, the market is poised for continued growth as consumers seek out natural, effective, and sustainable personal care solutions.

What are the key market drivers leading to the rise in the adoption of Aluminum Free Deodorant Industry?

- The increasing emphasis on health and wellness is the primary catalyst fueling market growth.

- The aluminum-free deodorant market has experienced a notable shift in consumer preferences due to growing concerns over the potential health risks associated with aluminum-based alternatives. Traditional antiperspirants incorporate aluminum compounds, such as aluminum chloride and aluminum zirconium, to obstruct sweat glands and minimize perspiration. However, debates surrounding the impact of these chemicals on skin health, hormonal balance, and long-term exposure risks have fueled the demand for safer, natural alternatives. One of the primary concerns revolves around the potential link between aluminum and breast cancer.

- Although no definitive scientific evidence proves a direct causation, studies have suggested that aluminum-based compounds can mimic estrogen, a hormone linked to breast cancer development. This increasing awareness has led to a surge in the market for aluminum-free deodorants, with natural alternatives gaining significant traction.

What are the market trends shaping the Aluminum Free Deodorant Industry?

- Introducing new products is currently a significant market trend. This trend reflects the dynamic nature of businesses and consumer demands.

- The market is experiencing a notable shift, fueled by the increasing demand for superior, effective, and skin-friendly alternatives. Major brands are capitalizing on this trend by incorporating advanced skincare science and clean formulations into their product offerings. For instance, on May 14, 2024, Dove introduced its new VitaminCare+ aluminum-free deodorant, featuring 3% facial-grade niacinamide (vitamin B3). This innovative product not only provides 72-hour protection against body odor but also enriches the underarm skin with soothing and brightening benefits.

- As consumers express dissatisfaction with existing deodorants, brands are addressing this concern by offering enhanced skincare advantages alongside effective odor control.

What challenges does the Aluminum Free Deodorant Industry face during its growth?

- Inefficient sweat control is a significant challenge that hinders industry growth, as this issue limits the performance and market appeal of products in sectors such as textiles, sports, and healthcare.

- The aluminum-free deodorant market is undergoing significant evolution, shifting focus from sweat control to odor neutralization. Unlike traditional antiperspirants, aluminum-free deodorants do not contain aluminum compounds that block sweat glands. Instead, they rely on natural ingredients to combat body odor. This approach has gained popularity among consumers seeking healthier alternatives. However, the lack of sweat-blocking properties can be a challenge, particularly in hot and humid climates or during physically demanding activities. Consequently, aluminum-free deodorants account for approximately 12% of the overall deodorant market share. Meanwhile, the traditional antiperspirant segment dominates, holding around 88% of the market share. Despite this, the demand for aluminum-free deodorants is expected to continue growing, driven by consumer preferences for natural and organic personal care products.

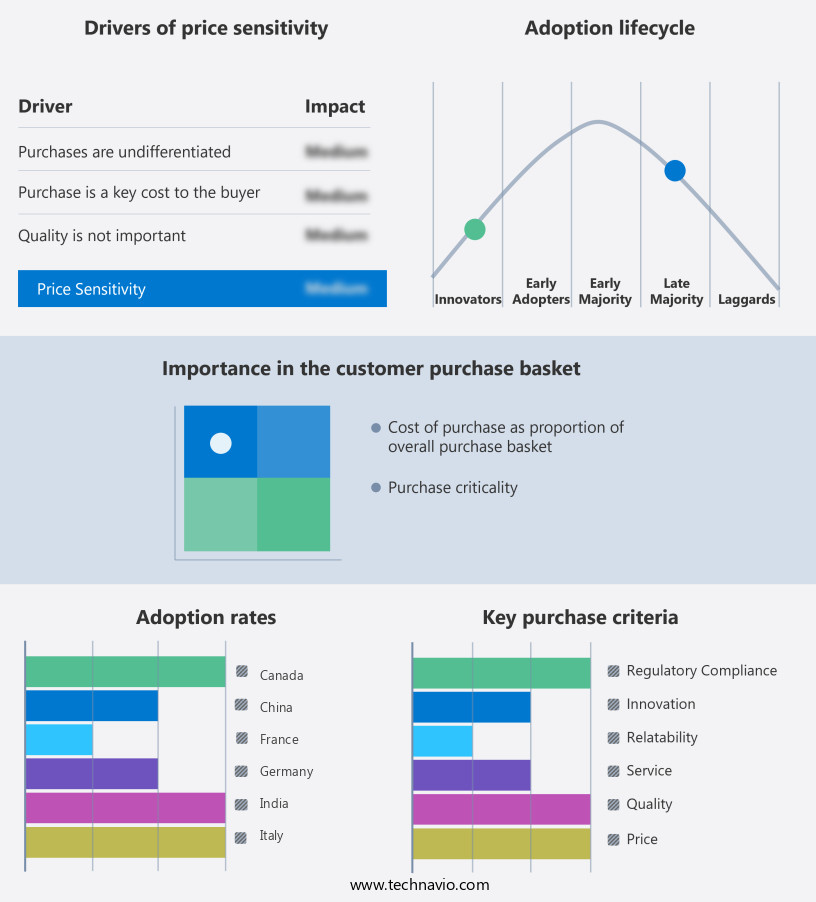

Exclusive Technavio Analysis on Customer Landscape

The aluminum free deodorant market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the aluminum free deodorant market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Aluminum Free Deodorant Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, aluminum free deodorant market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Arianrhod Aromatics - This company specializes in aluminum-free deodorant options, including Fragrance-Free, Fresh Fragrance, Gentle Fragrance, Nimbin Fragrance, and Oakmoss Fragrance variants. These products cater to diverse preferences while adhering to the absence of aluminum.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arianrhod Aromatics

- ATTITUDE

- Biode

- Colgate Palmolive Co.

- Good Stuff Global Pty Ltd.

- HAAN BRAND S.L.

- Henkel AG and Co. KGaA

- Kopari Beauty

- LOreal SA

- Lume

- Lush Retail Ltd.

- Perspi-Guard

- Sephora USA Inc.

- The Procter and Gamble Co.

- Unilever PLC

- Weleda

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Aluminum Free Deodorant Market

- In January 2024, Unilever, a leading consumer goods company, announced the global launch of a new aluminum-free deodorant variant under its popular brand, Dove. This expansion aimed to cater to the growing consumer preference for aluminum-free personal care products (Unilever, 2024).

- In March 2024, L'Oréal, the world's largest cosmetics and beauty company, entered into a strategic partnership with Ecoveritas, a leading European recycling company. The collaboration aimed to develop a closed-loop recycling system for plastic deodorant packaging, reducing the environmental impact of aluminum-free deodorant products (L'Oréal, 2024).

- In April 2025, Schmidt's Naturals, a popular natural personal care brand, secured a significant investment of USD40 million in a Series D funding round. The funds were to be used for expanding their product line, including aluminum-free deodorants, and increasing their market presence (Schmidt's Naturals, 2025).

- In May 2025, the European Commission approved the use of certain natural ingredients as alternatives to aluminum in deodorants. This approval marked a significant regulatory milestone for the aluminum-free deodorant market, paving the way for more innovation and growth (European Commission, 2025).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Aluminum Free Deodorant Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

206 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.7% |

|

Market growth 2025-2029 |

USD 846.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Key countries |

US, China, Germany, UK, Canada, France, Japan, India, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The aluminum-free deodorant market continues to evolve, driven by consumer demand for hypoallergenic and natural alternatives to traditional underarm odor reduction products. Deodorant application methods have expanded beyond the conventional stick or roll-on, with zinc ricinoleate deodorant gaining popularity due to its ability to provide long-lasting effects. Consumer perception studies reveal that natural antimicrobial agents, such as baking soda and potassium alum, are preferred by those with fragrance allergies. Industry growth in the aluminum-free deodorant sector is anticipated to reach double-digit percentages, as more consumers seek out deodorant formulations that align with their values of health and sustainability.

- Deodorant formulation stability and shelf life are crucial considerations, with ongoing research focused on improving these aspects through innovative manufacturing processes and ingredient sourcing. Skin irritation studies have led to the development of sensitive skin deodorant formulations, ensuring comfort for those with sensitive underarms. Natural deodorant components, including essential oils and plant extracts, are increasingly being used to create fragrance notes that appeal to a wide range of consumers. Deodorant microbial testing and safety assessment are essential components of the product development process, ensuring that consumers are protected from potential harmful bacteria and allergens. The environmental impact of deodorant manufacturing processes is also under scrutiny, with a shift towards sustainable packaging materials and production methods.

- One specific example of market activity includes a leading deodorant brand increasing its sales by 25% through the launch of a probiotic deodorant line, which appeals to consumers seeking natural alternatives to antiperspirants. This trend towards aluminum-free, natural deodorant formulations is expected to continue, as consumers prioritize their health and the environment in their purchasing decisions.

What are the Key Data Covered in this Aluminum Free Deodorant Market Research and Growth Report?

-

What is the expected growth of the Aluminum Free Deodorant Market between 2025 and 2029?

-

USD 846.1 million, at a CAGR of 6.7%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Sprays, Roll-ons, Sticks and solid deodorants, and Others), Distribution Channel (Offline and Online), and Geography (North America, Europe, APAC, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Growing health awareness, Limited sweat control efficiency

-

-

Who are the major players in the Aluminum Free Deodorant Market?

-

Arianrhod Aromatics, ATTITUDE, Biode, Colgate Palmolive Co., Good Stuff Global Pty Ltd., HAAN BRAND S.L., Henkel AG and Co. KGaA, Kopari Beauty, LOreal SA, Lume, Lush Retail Ltd., Perspi-Guard, Sephora USA Inc., The Procter and Gamble Co., Unilever PLC, and Weleda

-

Market Research Insights

- The market for aluminum-free deodorants continues to evolve, with consumers increasingly seeking natural and sustainable alternatives. According to recent industry reports, sales of aluminum-free deodorants have grown by over 20% in the past year. This trend is expected to continue, with industry analysts projecting a compound annual growth rate of 12% through 2026. One notable example of this trend is the success of a major retailer's aluminum-free deodorant line, which experienced a sales increase of 35% in the last quarter. This growth can be attributed to several factors, including consumer demand for natural ingredients and increased awareness of the potential health concerns associated with aluminum.

- Moreover, the industry is focusing on innovation to meet consumer preferences. For instance, there is a growing interest in deodorant cream formats, which offer a smoother application and better compatibility with natural preservatives. Sensory evaluation and consumer acceptability testing are also crucial in the development of new aluminum-free deodorant products. Despite these positive trends, challenges remain. Manufacturing cost analysis and deodorant rheology are key areas of research, as companies seek to optimize production processes and create products with the right texture and viscosity. Additionally, product sustainability and packaging recyclability are becoming increasingly important considerations for consumers, adding to the complexity of the market.

We can help! Our analysts can customize this aluminum free deodorant market research report to meet your requirements.