Ambient Lighting Market Size 2024-2028

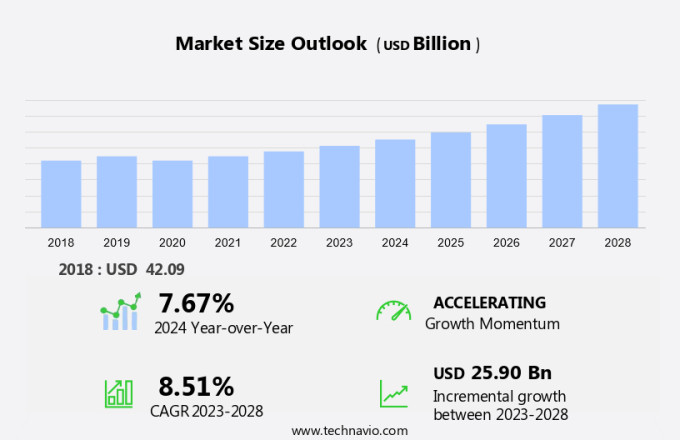

The ambient lighting market size is forecast to increase by USD 25.90 billion at a CAGR of 8.51% between 2023 and 2028. The market is experiencing significant growth due to several key drivers. Urbanization and digitization are major factors fueling market expansion, as the demand for energy-efficient lighting solutions increases in both residential and commercial applications. Government initiatives aimed at reducing electric power consumption and greenhouse gas (GHG) emissions using renewable energy are also contributing to market growth. However, the lack of common standards for LED drivers and hardware components poses a challenge to market participants. This approach not only benefits consumers by offering more choices but also supports the long-term sustainability of the market.

What will be the Size of the Market During the Forecast Period?

The market is experiencing significant growth due to the increasing demand for energy-efficient and intelligent lighting solutions. This market encompasses various types of lighting technologies, including incandescent, halogen, compact fluorescent lamps (CFLs), and light-emitting diodes (LEDs). Incandescent and halogen lamps, once the industry standard, are gradually being replaced by more energy-efficient alternatives. The Department of Energy (DOE) has set regulations to phase out the production and sale of traditional incandescent bulbs due to their high energy consumption and carbon dioxide emissions. Smart lighting systems are gaining popularity in both residential and commercial applications.

Furthermore, these systems offer energy savings, improved lighting quality, and the ability to control lighting levels and color temperatures remotely. Consumer preferences are shifting towards LED A-type lamps due to their longer lifespan, lower energy consumption, and reduced UV radiation. The Lighting Controls Association (LCA) reports that LED light-emitting diodes (LEDs) are the fastest-growing segment in the market. LEDs offer numerous advantages, including energy efficiency, longevity, and the ability to create a desired ambiance. Glare reduction and improved color rendering are essential considerations in the market. LEDs, with their directional light emission and high color rendering index (CRI), offer significant improvements over traditional lighting technologies.

Moreover, the residential segment is a significant contributor to the market's growth. Homeowners are investing in energy-efficient and intelligent lighting solutions to reduce energy consumption and enhance the interior designing experience. The hospitality, retail, commercial, and healthcare sectors are also adopting ambient lighting systems to create a welcoming and inviting atmosphere for their customers and employees. Tactotek's IMSE technology is an innovative development in the market. This technology allows for the creation of flexible, thin, and transparent lighting panels, offering endless design possibilities for interior designers and architects. In conclusion, the market is witnessing steady growth due to the increasing demand for energy-efficient and intelligent lighting solutions. The shift towards LEDs, smart lighting systems, and innovative technologies such as Tactotek's IMSE technology is driving the market forward. The focus on energy savings, improved lighting quality, and consumer preferences for ambiance and design are key factors contributing to the market's growth.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Lamps and luminaries

- Lighting controls

- Surface mounted lights

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Middle East and Africa

- South America

- North America

By Product Insights

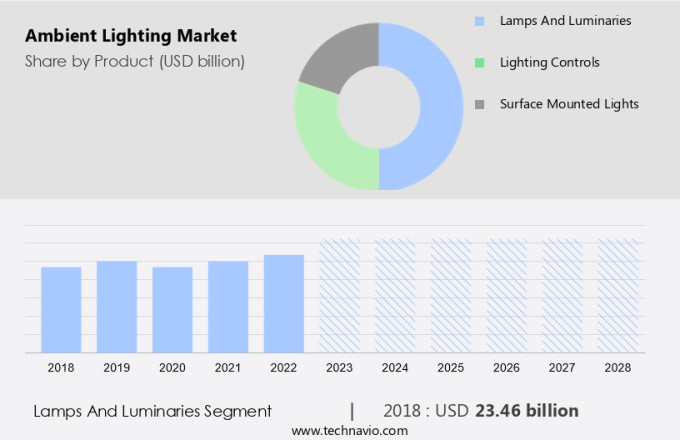

The lamps and luminaries segment is estimated to witness significant growth during the forecast period.The market experienced significant growth in the lamps and luminaries segment in 2023, with incandescent lamps, halogen lamps, fluorescent lamps, and LEDs being the primary contributors. New-age lamps and luminaires, which offer superior performance, precision, and seamless integration with existing systems, are propelling the market's expansion. However, the trend towards a connected society and the increasing demand for energy conservation necessitate further innovation in LED lighting and the creation of more intelligent lighting solutions. LED lighting systems consume up to 50% less energy than traditional compact fluorescent lamps (CFLs) and cold-cathode fluorescent lamps (CCFLs) to generate the same level of illumination.

Moreover, TactoTek's IMSE technology is a game-changer in this regard, as it enables the production of flexible, thin, and lightweight LED lighting components that can be easily integrated into various applications, including residential, hospitality, retail, commercial, and healthcare sectors. This technological advancement is expected to further fuel the market's growth.

Get a glance at the market share of various segments Request Free Sample

The lamps and luminaries segment accounted for USD 23.46 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

North America is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the market for ambient lighting has experienced significant growth due to the region's high disposable income and increasing focus on interior decoration. Notable companies in this market offer a range of products, including lighting controls, surface-mounted lights, lamps, and luminaries. Ceiling-mounted or recessed fixtures, wall sconces, and floor-lamp torchieres are popular design trends. As energy efficiency becomes a priority, LED technology is increasingly integrated into ambient lighting solutions.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Rapid urbanization and digitization is the key driver of the market. The global lighting market is experiencing heightened competition as innovative ideas and new players enter the industry. Simultaneously, population growth and urbanization have led to a significant increase in the demand for lighting. According to the United Nations (UN), the global population is projected to reach 9.7 billion by 2050, with approximately 70% of people residing in cities and metropolitan areas. This increasing demand for lighting, coupled with resource constraints, has made energy-efficient options increasingly popular for both public and private use. With the world becoming increasingly digital, the demand for intelligent, connected lighting systems and applications that extend beyond illumination is expected to increase.

Furthermore, the Energy Information Administration (EIA) reports that lighting accounts for around 12% of the total energy consumption in the United States. As a response, the Department of Energy (DOE) has implemented regulations to phase out the use of inefficient lighting technologies such as Incandescent and Halogen bulbs, and promote the adoption of energy-efficient alternatives like Compact Fluorescent Lamps (CFLs), LED A-type lamps, and Smart lighting systems. These initiatives aim to reduce energy consumption and carbon dioxide emissions, making energy-efficient lighting a crucial consideration for businesses and homeowners alike.

Market Trends

Government initiatives for energy savings is the upcoming trend in the market. The global shift towards sustainable energy sources and the need to minimize greenhouse gas (GHG) emissions have brought about significant changes in the electric power industry. One potential solution is the integration of renewable energy sources into smart grids. EPRI estimates that this could lead to a reduction of 19-37 million metric tons of GHG emissions annually by 2030. The transition from traditional utility systems to smart grids, which generate electricity from renewable sources, is a crucial step towards achieving this goal.

Moreover, by localizing the production of these components, these companies can reduce the carbon footprint associated with transportation and logistics. This not only helps to minimize GHG emissions but also supports the growth of local economies. Incorporating energy-efficient solutions into electric power systems is a critical step towards creating a more sustainable future.

Market Challenge

Lack of common standards is a key challenge affecting the market growth. The market faces a challenge due to the absence of standardized protocols for LED and other light sources. This issue results in a multitude of products catering to various location and regulatory requirements. To address this inefficiency, lighting system manufacturers are focusing on the creation of open protocol devices. Adherence to industry standards is essential for lighting product manufacturers to ensure global market access. The lack of uniformity in lighting technology can lead to confusion among consumers and hinder the widespread adoption of energy-efficient lighting solutions.

Moreover, by implementing standardized protocols, the industry can save energy, align with consumer preferences in interior designing, and improve the functionality of automotive lighting systems.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Acuity Brands Inc. - The company offers wide range of ambient lighting such as ENVEX Recessed Ambient Series and VERTEX series.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ams OSRAM AG

- Bridgelux Inc.

- Corsair Gaming Inc.

- General Electric Co.

- IDEAL INDUSTRIES Inc.

- Nirvana Light

- NZXT Inc.

- SCHOTT AG

- SEAT SA

- Sigma International Inc.

- Signify NV

- Stanley Electric Co. Ltd.

- Technical Consumer Products Inc.

- Toyoda Gosei Co. Ltd.

- VAIS Technology

- VIBIA LIGHTING Ltd.

- Zumtobel Group AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing awareness and preference for energy-efficient lighting solutions. General lighting technologies like incandescent and halogen lamps are being replaced by energy-efficient alternatives such as LED A-type lamps and compact fluorescent lamps. The Department of Energy's Energy Star program is driving the adoption of energy-efficient lighting, which in turn is reducing carbon dioxide emissions and minimizing UV radiation. Smart lighting systems are gaining popularity due to their ability to control lighting based on occupancy and ambient light levels. LED drivers, a crucial hardware component in LED lighting, are improving energy savings and reducing GHG emissions.

Moreover, LED lamps, including recessed lights, are being used extensively in residential, hospitality, retail, commercial, healthcare, and automotive applications. Lighting controls association is promoting the use of lighting controls to optimize energy usage and enhance the ambient experience. Tactotek's IMSE technology and Flexvision display are revolutionizing the lighting industry by providing customizable and interactive lighting solutions. The market is localizing components to cater to specific geographies and consumer preferences. Light-emitting diodes (LEDs) are replacing traditional lighting technologies due to their energy efficiency and long lifespan. Acuity Brands and Hubbell Lighting are some of the key players in the market. The market is witnessing innovation in various lighting fixtures like chandeliers, ceiling-mounted fixtures, wall-mounted fixtures, track lights, spotlights, hanging fixtures, and post lanterns. The market is expected to grow further due to the increasing demand for ambient lighting solutions that provide a superior ambient experience.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

138 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.51% |

|

Market growth 2024-2028 |

USD 25.90 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.67 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 35% |

|

Key countries |

US, China, UK, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Acuity Brands Inc., ams OSRAM AG, Bridgelux Inc., Corsair Gaming Inc., General Electric Co., IDEAL INDUSTRIES Inc., Nirvana Light, NZXT Inc., SCHOTT AG, SEAT SA, Sigma International Inc., Signify NV, Stanley Electric Co. Ltd., Technical Consumer Products Inc., Toyoda Gosei Co. Ltd., VAIS Technology, VIBIA LIGHTING Ltd., and Zumtobel Group AG |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch