Amphibious Landing Craft Market Size 2025-2029

The amphibious landing craft market size is forecast to increase by USD 577.4 million at a CAGR of 2.7% between 2024 and 2029.

- The market is witnessing significant growth due to the upgrading of capabilities to counter emerging threats. One of the key trends in this market is the integration of advanced technologies such as All-Weather Landing Systems and air cushion vehicles, which enable amphibious assault vehicles to operate in harsh weather conditions and challenging terrains. These vehicles can transport armored combat vehicles, power generators, and other logistics equipment, making them indispensable for modern military operations. Additionally, the global macroeconomic environment is influencing the procurement of amphibious landing craft, with defense budgets and geopolitical tensions playing a crucial role. Another trend gaining traction is the integration of directed-energy weapons (DEWs) to enhance the defensive capabilities of these crafts. As the need for amphibious warfare continues to grow, the market for amphibious landing craft is expected to experience steady expansion.

What will be the Size of the Market During the Forecast Period?

- The market encompasses a diverse range of vessels designed for transporting military personnel and equipment from ships to land. These craft play a crucial role in various applications, including countering terrorism threats, resolving maritime boundary conflicts, and supporting seaborne trading. Amphibious assault ships, such as the Indian Navy's INS Lalit, serve as the primary platform for deploying amphibious landing craft. These versatile vessels enable multi-role activities, including beaching operations, search and rescue, disaster relief, supply and replenishment, and surveillance. Seaborne trading demands continue to drive the market, as the world's coastlines become increasingly important economic zones. Amphibious landing craft, equipped with air cushion technology, amphibious vehicles, waterproof screens, telescopic snorkels, and other advanced features, facilitate efficient and effective operations.

- Additionally, the integration of modern ships and military vehicles, such as the M-1 Abrams tank and hovercraft, enhances the capabilities of amphibious landing craft in amphibious warfare. Overall, the market is expected to grow steadily, driven by the increasing need for versatile and adaptable maritime solutions.

How is this Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Military

- Commercial

- Type

- Amphibious ACVs and APCs

- Air cushion vehicle

- LCU and LCM

- Usage

- Amphibious operations

- Naval operations

- Maritime security

- Others

- End-user

- Vehicle transportation

- Infantry transportation

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- India

- Japan

- South America

- Brazil

- Middle East and Africa

- North America

By Application Insights

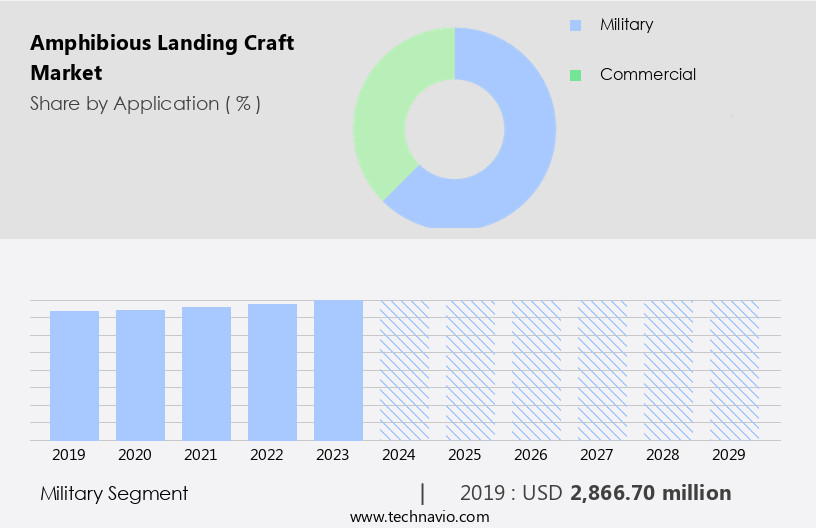

- The military segment is estimated to witness significant growth during the forecast period.

The market is primarily driven by the military segment due to increasing defense spending by governments worldwide. Amphibious combat vehicles (ACVs), a type of military-related amphibious vehicle, offer optimal balance between land and marine mobility, survivability, and adaptability to future missions. The ACV platform can be enhanced with advanced capabilities as technology advances, such as Unmanned Aircraft Systems (UAS) integration, electronic warfare, and reconnaissance. These are essential for countering terrorism threats, maritime boundary conflicts, and providing logistical support for seaborne trading, disaster relief operations, and search and rescue missions.

Get a glance at the market report of share of various segments Request Free Sample

The military segment was valued at USD 2.87 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

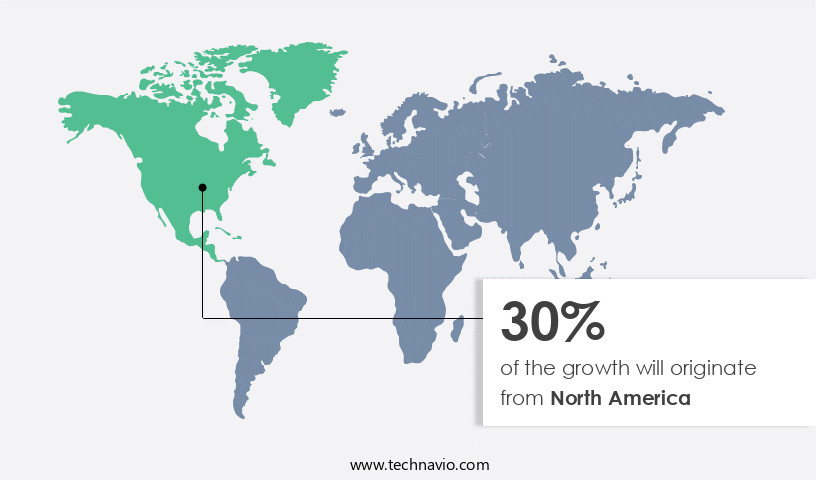

- North America is estimated to contribute 30% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is witnessing significant growth due to the increasing demand for amphibious warfare ships and their associated capabilities. In North America, the United States is a major consumer and exporter of amphibious landing craft, with a focus on enhancing its naval capabilities to counter terrorism threats, maritime boundary conflicts, and support seaborne trading. The US military utilizes various types of landing craft, including air cushion technology-based hovercraft, amphibious vehicles with waterproof screens, and large tanks with telescopic snorkels. These vessels support multi-role activities, including beaching operations, search and rescue, disaster relief, supply and replenishment, and surveillance. The US Navy's amphibious assault ships and amphibious warfare ships accommodate modern military vehicles, power generators, logistics operations, unmanned amphibious vehicles, fuel supply, medical evacuation, and surveillance payloads.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Amphibious Landing Craft Industry?

Upgrade of capabilities to counter emerging threats is the key driver of the market.

- The global market for amphibious landing craft is experiencing significant growth due to the increasing need for advanced transportation systems for military forces In the face of rising terrorist threats. Terrorist organizations have targeted military convoys with devastating consequences, leading governments to invest in amphibious assault vehicles (AAVs) for safer transportation near coastlines. These vehicles, which use air cushion technology and can carry military vehicles such as M-1 Abrams tanks, are essential for modern amphibious warfare. Governments worldwide are modernizing their landing craft fleets to enhance safety and mission readiness. Amphibious landing craft, which can perform beaching operations, search and rescue, disaster relief, supply and replenishment, and surveillance, offer versatility and multi-role activities.

- In addition, these vehicles are also used for seaborne trading and can be equipped with sophisticated electronic systems, power generators, and unmanned amphibious vehicles for logistics operations. The market for amphibious landing craft is driven by the demand for alternative transportation methods, endurance, durability, and cutting-edge propulsion systems. These vehicles can carry armored combat vehicles, large tanks, and waterproof screens, making them ideal for various professional purposes, including sports, mountaineering, exploration, excavation, and medical evacuation variations. Additionally, the integration of sensors, surveillance payloads, and telescopic snorkels enhances their capabilities, making them indispensable for government authorities in countering terrorism threats, maritime boundary conflicts, and other modern challenges.

What are the market trends shaping the Amphibious Landing Craft Industry?

Integration of directed-energy weapons (DEWs) is the upcoming market trend.

- Amphibious landing craft play a crucial role in modern military operations, particularly in countering terrorism threats and addressing maritime boundary conflicts. These versatile vessels enable amphibious assault ships to carry out beaching operations, search and rescue missions, disaster relief operations, supply and replenishment, and surveillance activities. The Indian Navy, among other forces, has integrated amphibious landing craft into its multi-role activities, enhancing its capabilities in amphibious warfare. Advancements in technology have significantly impacted the design and functionality of amphibious landing craft. These include the integration of air cushion technology, which allows for hovercraft capabilities, and the use of large tanks, waterproof screens, telescopic snorkels, and sophisticated electronic systems.

- Modern amphibious landing craft also accommodate military vehicles such as M-1 Abrams tanks and armored combat vehicles, as well as power generators and logistics operations. Unmanned amphibious vehicles and electrically-powered alternatives are gaining popularity due to their endurance, durability, and affordability. These vehicles offer alternatives to traditional military convoys and can reduce casualties in high-risk situations. Moreover, they can be used for professional purposes beyond military applications, such as sports, mountaineering, exploration, excavation, and engine maintenance. The demand for seaborne trading and surveillance capabilities continues to grow, necessitating the development of cutting-edge propulsion systems, such as high-tech hybrid-based engines and advanced sensors.

What challenges does the Amphibious Landing Craft Industry face during its growth?

Global macroeconomics affecting procurement of global market is a key challenge affecting the industry growth.

- Amphibious landing craft play a pivotal role in countering terrorism threats and addressing maritime boundary conflicts. These versatile vessels support amphibious assault ships in executing multi-role activities, including beaching operations, search and rescue, disaster relief operations, and supply and replenishment. The seaborne trading demands have increased the significance of amphibious landing craft, which are equipped with advanced features such as air cushion technology, large tanks, waterproof screens, and telescopic snorkels. Amphibious warfare ships and amphibious landing craft enable ground forces to deploy swiftly and effectively, making them indispensable in modern military operations. Military vehicles, such as M-1 Abrams tanks and power generators, are transported using these landing craft for logistics operations.

- Unmanned amphibious vehicles and fuel supply systems further enhance their capabilities. Amphibious landing craft have various applications beyond military purposes, including commercial applications, electrically-powered vehicles, and alternative transportation methods. Their endurance, durability, and sophisticated electronic systems make them suitable for sports, mountaineering, exploration, excavators, engines, and other professional purposes. Government authorities utilize these vessels for surveillance capabilities, sensors, and technical breakthroughs in cutting-edge weapons. Despite the economic slowdown in major economies, the demand for amphibious landing craft remains strong due to the rising threats from terrorist organizations and the need for alternative transportation methods. The market is driven by the increasing need for affordable vehicles and the integration of high-tech propulsion systems, such as hybrid-based engines.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Abu Dhabi Ship Building PJSC - The company offers amphibious landing craft such as 60M FALAJ 3 naval patrol vessel which is designed and equipped suitably not only for advanced naval duties but also for tackling the present day challenges of asymmetric warfare.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Almaz Shipbuilding Co.

- BAE Systems Plc

- Bland Group

- CNH Industrial NV

- CNIM SA

- Damen Shipyards Group

- Fincantieri Spa

- Goa Shipyard Ltd.

- Huntington Ingalls Industries Inc.

- L3Harris Technologies Inc.

- Marine Alutech Oy Ab

- Marine Inland Fabricators

- Navantia SA

- Rostec

- Singapore Technologies Engineering Ltd.

- Strategic Marine S Pte Ltd.

- Textron Inc.

- Wetland Equipment Co.

- Wilco Manufacturing LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Amphibious landing craft have gained significant importance in modern maritime operations due to their versatility and capability to transport personnel and cargo between land and water. These vessels play a crucial role in various applications, including countering terrorism threats, conducting surveillance, and supporting seaborne trading. The demand for amphibious landing craft is driven by the need for efficient and effective military operations. These craft are essential for amphibious assault ships and provide the means for ground forces to be deployed ashore. They are also utilized for beaching operations, search and rescue, disaster relief, and logistics support. Amphibious landing craft come in various sizes and configurations, catering to different requirements.

In addition, some are designed for multi-role activities such as electronic warfare, offering surveillance capabilities, sensors, and technical breakthroughs. Others are optimized for supply and replenishment, with large fuel tanks and power generators. Unmanned amphibious vehicles are also gaining popularity for their ability to reduce risks and increase efficiency. The world's coastlines present unique challenges for military and commercial applications. Amphibious landing craft offer an alternative transportation method, enabling access to remote and hard-to-reach areas. They are also used for commercial applications, such as seaborne trading, and can be adapted for sports, mountaineering, exploration, and excavation. Modern amphibious landing craft are equipped with advanced electronic systems in military logistics, sophisticated propulsion systems, and high-tech engines.

Furthermore, these features enhance their endurance, durability, and maneuverability, making them an essential asset for government authorities and professional purposes. The market for amphibious landing craft is continuously evolving, with new technological advancements and alternative power sources, such as electrically-powered vehicles, being explored. These developments offer improved performance, reduced environmental impact, and cost savings. Despite the benefits, amphibious landing craft face challenges, including rising threats from terrorist organizations and the need for affordability. Military convoys and large amphibious warfare ships are vulnerable to attacks, making the need for cutting-edge weapons and protective measures essential.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

237 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.7% |

|

Market growth 2025-2029 |

USD 577.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.6 |

|

Key countries |

US, UK, China, Canada, France, Germany, Japan, Italy, Brazil, and India |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.