Animal Biotechnology Market Size 2025-2029

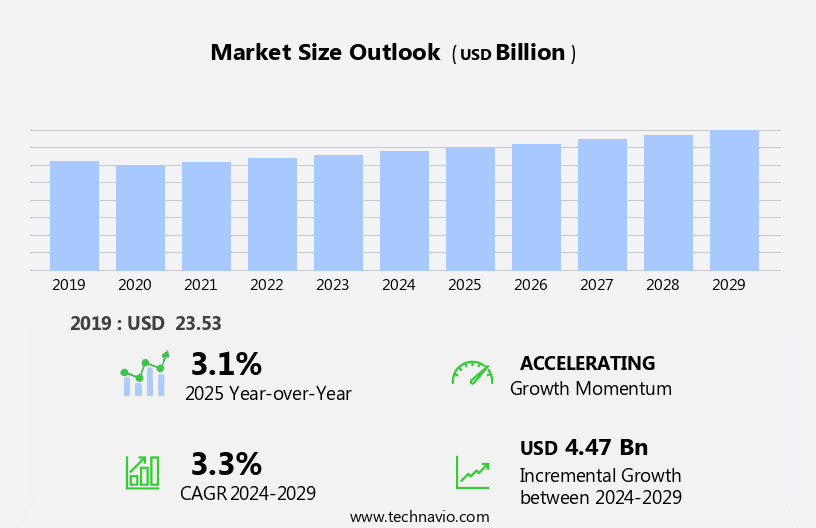

The animal biotechnology market size is forecast to increase by USD 4.47 billion at a CAGR of 3.3% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing strategies of market players to expand their product portfolios and geographical reach. This trend is particularly evident in the development of innovative solutions for animal health and productivity. However, the market also faces challenges, including the increasing prevalence of animal diseases, which necessitate the need for more accurate and timely diagnostic tests. This presents an opportunity for companies to invest in research and development of advanced diagnostic tools and services. Despite this potential, the market growth is hindered by the lack of a skilled workforce capable of performing complex diagnostic tests.

- This labor shortage can be addressed through collaborations between academia, industry, and governments to train and educate the next generation of animal biotechnology professionals. Companies seeking to capitalize on market opportunities and navigate challenges effectively should focus on building a strong workforce, investing in research and development, and collaborating with industry partners to stay ahead of the competition. By doing so, they will be well-positioned to meet the growing demand for animal health solutions and contribute to the overall growth of the market.

What will be the Size of the Animal Biotechnology Market during the forecast period?

- The market encompasses a range of applications, including genetic engineering for enhancing animal productivity, reproductive technologies, and the development of animal-based goods and derived products. This sector is driven by the growing demand for animal health solutions, as well as the potential for animal biotechnology in cancer treatment and pharmaceutical development. Public health systems and the animal feed sector also benefit from biotech solutions, such as disease resistance, therapeutic proteins, and diagnostic tests. Molecular biology plays a crucial role in advancing animal health through the identification and prevention of zoonotic diseases and the development of vaccines and drug treatments.

- Additionally, animal welfare and health management are key areas of focus, with biotech products and cloning techniques contributing to preventative care and protein synthesis. Overall, the market is experiencing significant growth, with ongoing research and innovation in areas such as disease treatment, vaccine development, and animal agriculture efficiency.

How is this Animal Biotechnology Industry segmented?

The animal biotechnology industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Drugs

- Vaccines

- Diagnostic tests

- Others

- Animal Type

- Livestock/production

- Companion

- Technology

- CRISPR-Cas9

- Gene transfer

- Genome editing

- RNA interference

- Nanotechnology

- Product Type

- Cloning services

- Embryo biotechnology

- Gene editing

- In vitro fertilization (IVF)

- Marker assisted selection (MAS)

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- Asia

- Rest of World (ROW)

- North America

By Product Insights

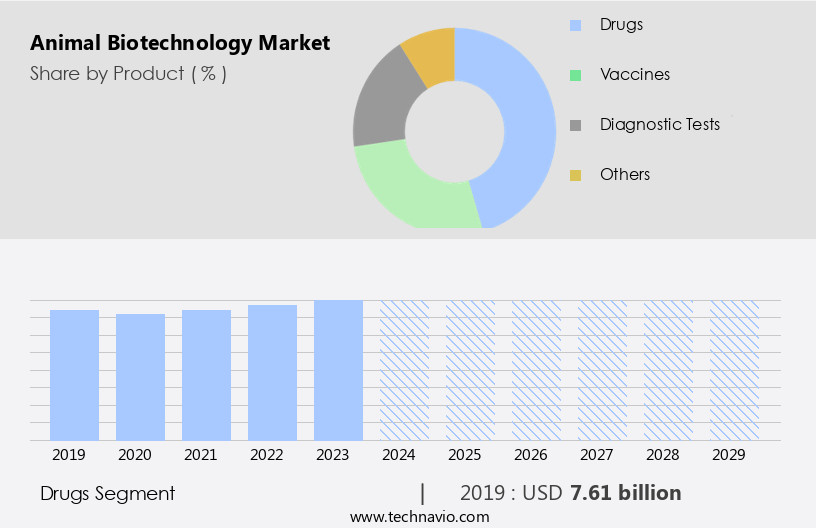

The drugs segment is estimated to witness significant growth during the forecast period.

Animal biotechnology encompasses various applications, including genetic composition, genetic engineering, reproductive technologies, animal health, animal-based goods, and animal-derived products. Genetic modification through techniques like electroporation method and random genomic integration is used to create genetically engineered animals with better nutritional profiles, disease resistance, and improved immunological responses. In vitro fertilization and genomic analytic tools are employed in clinical settings for genetic resources and diagnostics tests. Animal agriculture efficiency is enhanced through selective breeding and molecular biology, leading to improvements in cattle health, disease resistance, and the production of animal protein. Animal feed sector relies on feed additives and diagnostics tests for disease prevention and monitoring.

Veterinary laboratories and point-of-care testing facilitate quick and accurate diagnosis of animal diseases, such as zoonotic diseases like foot and mouth disease (FMD), salmonella, swine fever, avian influenza, and bovine respiratory disease (BRD). Genetically modified organisms, including genetically altered transgenic animals, are used for cancer treatment, public health systems, and drug development. The use of these technologies in animal health and agriculture is crucial for maintaining animal welfare and ensuring food security.

Get a glance at the market report of share of various segments Request Free Sample

The Drugs segment was valued at USD 7.61 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

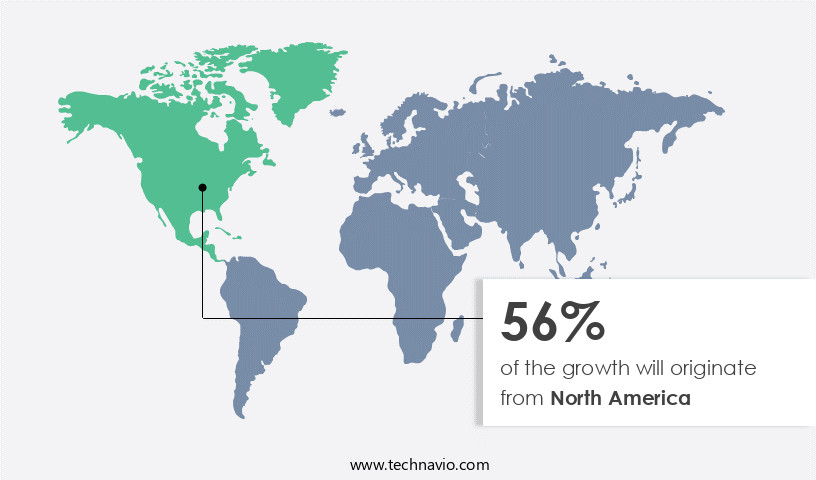

North America is estimated to contribute 56% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Animal biotechnology refers to the application of genetic resources, molecular biology, and biotechnological tools to improve animal health, productivity, and the production of animal-based goods and animal-derived products. This includes genetic composition modification through genetic engineering and reproductive technologies such as in vitro fertilization and electroporation method. Genetically engineered animals offer better nutritional profiles, disease resistance, and improved immunological responses. Animal health is enhanced through diagnostics tests, feed additives, and drug development in veterinary laboratories. In clinical settings, genomic analytic tools aid in point-of-care testing and cancer treatment in public health systems. The animal feed sector benefits from genetically modified organisms and selective breeding.

Molecular biology and genetic resources are essential in zoonotic diseases and improving cattle inventory. The diagnostics tests segment and livestock segment are significant markets in animal biotechnology. Sheep and goats, companion animals, and purebred dogs also benefit from genetic testing and DNA tests. Animal suffering is a concern, and ethical considerations are essential in genetic alteration and the creation of transgenic animals.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Animal Biotechnology Industry?

- Increasing growth strategies of market players is the key driver of the market.

- The market is witnessing significant strategic developments, with companies focusing on product enhancements and innovations to expand their offerings. These efforts aim to ensure the availability of effective drugs, vaccines, and diagnostic tests for the prevention and treatment of infectious and parasitic diseases in animals. Notable strategies include new product launches, approvals, collaborations, acquisitions, partnerships, expansions, and investments. For example, in 2024, Boehringer Ingelheim International GmbH acquired Saiba Animal Health AG, a company specializing in the development of novel therapeutic medicines for pet health.

- This trend of strategic collaborations and product developments is anticipated to fuel the growth of the market throughout the forecast period.

What are the market trends shaping the Animal Biotechnology Industry?

- Increasing prevalence of animal diseases is the upcoming market trend.

- Animal biotechnology products hold significant value in the diagnosis, treatment, and management of various animal diseases, including osteoarthritis, leptospirosis, foot-and-mouth disease (FMD), salmonella, swine fever, avian influenza, and bovine respiratory disease (BRD). The increasing prevalence of animal diseases is driving the demand for effective solutions, such as drugs, vaccines, and diagnostic tests, during the forecast period. For instance, osteoarthritis, a common condition in companion animals like cats and dogs, affects around 60% of cats older than six years and 90% of cats older than 12 years.

- Feline osteoarthritis often goes undiagnosed and undertreated due to limited safe and efficacious long-term treatment options. This unmet need presents an opportunity for animal biotechnology companies to develop and market innovative solutions.

What challenges does the Animal Biotechnology Industry face during its growth?

- Lack of skilled workforce to perform diagnostic tests is a key challenge affecting the industry growth.

- Veterinary diagnostics play a vital role in ensuring the health and well-being of companion animals, livestock, farmed poultry, captive species, and wildlife. These diagnostics require skilled professionals to perform accurate testing for inherited diseases and traits using advanced technologies and techniques. The collection of correct samples and selection of suitable tests are essential in investigating disease problems or assessing the health status of an animal or group. To carry out these diagnostic tests, professionals must possess a range of practical skills in laboratory-based veterinary virology. They must adhere to standard operating procedures (SOPs) to ensure safety and competence.

- The need for technologically advanced veterinary diagnostic and laboratory centers and skilled professionals continues to grow due to the increasing demand for accurate and timely animal health assessments. In summary, veterinary diagnostics are crucial for maintaining animal health and well-being. Skilled professionals are required to perform these tests using advanced technologies and techniques, ensuring the collection of correct samples and selection of suitable tests. The demand for technologically advanced veterinary diagnostic and laboratory centers and skilled professionals continues to grow, making this an essential market for businesses.

Exclusive Customer Landscape

The animal biotechnology market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the animal biotechnology market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, animal biotechnology market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Anicell BioTech - Bayer Animal Pharmaceuticals, a division of Bayer AG, specializes in advanced animal biotechnology solutions. Our focus includes the development and provision of effective treatments for various animal diseases. By leveraging innovative research and technology, we aim to enhance animal health and productivity for farmers and livestock producers worldwide. Our offerings span a broad range of therapeutic areas, ensuring that we cater to diverse animal health needs. We remain committed to delivering high-quality, science-driven solutions that contribute to the sustainable growth of the agricultural industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anicell BioTech

- Bayer AG

- Biogenesis Bago SA

- Boehringer Ingelheim International GmbH

- Elanco Animal Health Inc.

- EW Group GmBH

- Genus Plc

- Heska Corp.

- Hester Biosciences Ltd.

- IDEXX Laboratories Inc.

- INDICAL Bioscience GmbH

- Ivaoes LLC

- Merck and Co. Inc.

- Neogen Corp.

- Randox Laboratories Ltd.

- Santa Cruz Biotechnology Inc.

- Virbac Group

- Z Link Biotech Co. Ltd.

- Zeus Biotech Pvt. Ltd.

- Zoetis Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Animal biotechnology is a dynamic and innovative sector that leverages genetic composition and genetic engineering to enhance the productivity, health, and efficiency of land animals. This field encompasses various applications, including reproductive technologies, animal health, and the production of animal-based goods and animal-derived products. Genetic modification through techniques such as electroporation method and random genomic integration plays a significant role in animal biotechnology. These methods enable the introduction of new DNA sequences into an animal's genome, leading to genetically engineered animals with improved traits. These traits may include disease resistance, better nutritional profiles, and increased efficiency in animal agriculture.

The animal health segment is a crucial application of animal biotechnology. Genetic resources are utilized to develop diagnostics tests, feed additives, and drug development for various animal diseases. Veterinary laboratories and clinical settings employ genomic analytic tools to diagnose and treat diseases in livestock, companion animals, and zoonotic diseases that can impact public health systems. In vitro fertilization and molecular biology techniques are essential in the reproductive technologies segment. These methods enable the manipulation of animal embryos, leading to improved reproductive efficiency and the production of transgenic animals. The livestock segment, which includes cattle, sheep, and goats, is a significant market for animal biotechnology, with applications ranging from selective breeding to disease resistance.

The animal feed sector is another crucial application of animal biotechnology. Genetic testing and DNA tests are used to improve the quality and efficiency of animal feed, ensuring optimal growth and health. Purebred dogs and companion animals also benefit from animal biotechnology, with applications including diagnostics tests and genetic alteration for improved health and better breeding practices. Animal biotechnology is a complex and multifaceted industry, with various stakeholders and market dynamics. The sector is driven by the demand for more efficient and sustainable animal agriculture, as well as the growing need for advanced animal health solutions. The use of genetically modified organisms raises ethical concerns, particularly regarding animal suffering and the potential impact on public health.

In , animal biotechnology is a rapidly evolving industry that offers numerous opportunities for innovation and growth. The applications of genetic engineering, reproductive technologies, and molecular biology in animal health, animal-based goods, and animal agriculture efficiency are transforming the way we produce and care for animals. The sector's continued growth is driven by the demand for more efficient and sustainable animal agriculture and the need for advanced animal health solutions. However, ethical considerations and regulatory frameworks must be addressed to ensure the responsible and sustainable development of animal biotechnology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

252 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.3% |

|

Market growth 2025-2029 |

USD 4.47 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.1 |

|

Key countries |

US, Germany, Canada, China, UK, Brazil, France, Japan, Australia, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Animal Biotechnology Market Research and Growth Report?

- CAGR of the Animal Biotechnology industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the animal biotechnology market growth of industry companies

We can help! Our analysts can customize this animal biotechnology market research report to meet your requirements.