Atomic Spectroscopy Market Size 2024-2028

The global atomic spectroscopy market size is estimated to grow by USD 2.46 billion at a CAGR of 7.29% between 2023 and 2028. The market is experiencing significant expansion due to increased government funding for environmental testing and product safety, as well as the rapid growth of end-user industries. This expansion is driven by rising consumer awareness toward advanced instruments and the need for validation, calibration, and safety of equipment. However, market growth is hampered by the high cost of advanced atomic spectroscopy instruments and maintenance services. Stringent regulatory norms further add to the market's complexity, requiring skilled professionals to ensure compliance. Despite these challenges, the Atomic Spectroscopy Market continues to evolve, offering opportunities for innovation and growth in the field of analytical science.

What will be the Size of the Atomic Spectroscopy Market During the Forecast Period?

To learn more about this report, Download Report Sample

Market Segmentation by Technology, End-User, and Geography Analysis

Technology Analysis

The technology segment is fragmented into atomic absorption, X-ray fluorescence, X-ray diffraction, and others. In the dynamic and evolving landscape of analytical science, the Atomic Spectroscopy Market occupies a pivotal role, particularly in sectors such as the petrochemical industry, academia, and environmental regulations. This market encompasses cutting-edge technologies like elemental analyzers, laboratory automation, and elemental imaging, which are indispensable for multielemental analysis in various applications.

The petrochemical industry relies heavily on atomic spectroscopy for process optimization and quality control. In the realm of academics, this technology is a cornerstone for research and development in fields like precision agriculture, drug safety, and remote sensing. Environmental regulations mandate stringent monitoring of pollutants, making atomic spectroscopy an essential tool for industry compliance. Telemetry integration and precision are key factors driving the growth of the atomic spectroscopy market. Industry partnerships, investments from funds and grants, and company analysis dashboards provide valuable insights for research analysts. Food safety concerns necessitate the use of high-cost equipment for rigorous testing and analysis.

The atomic spectroscopy market caters to a diverse range of industries, including but not limited to, petrochemicals, agriculture, pharmaceuticals, and food safety. Its applications extend beyond traditional boundaries, with potential in telecommunications, telemetry, and other emerging sectors.

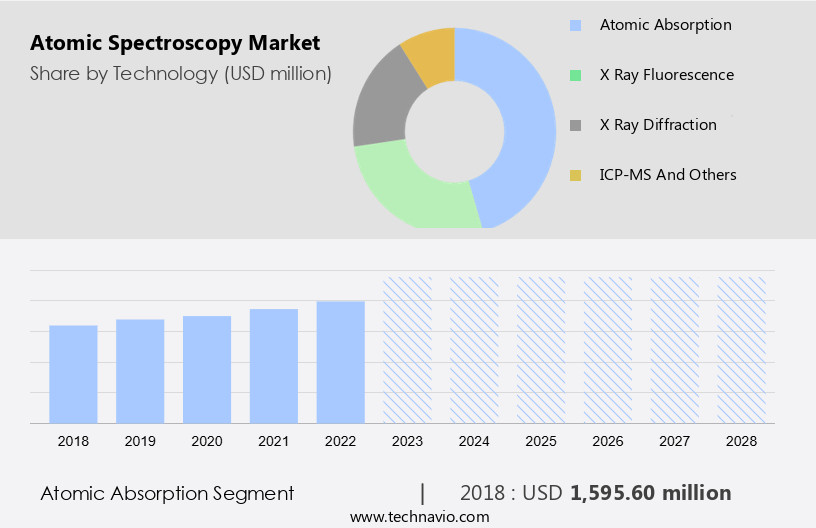

Atomic Absorption

The atomic absorption segment showed a gradual increase in the market share of USD 1.59 billion in 2018 and continue to grow by 2022. Atomic absorption is a type of quantitative analysis used to detect or record a specific light wavelength absorbed by atoms in a neutral state. The increasing use of atomic absorption spectrometers by a variety of industries, including biomonitoring, chemical, food, and many others, will be a major factor in the growth of the global atomic absorption segment. The market for atomic absorption spectroscopy is expected to grow due to the expansion of the pharmaceutical and environmental testing industries, which is primarily driven by the global incidence of various diseases and environmental problems such as ozone layer depletion. The atomic absorption segment is expected to grow at a rate of 5.48% between 2022 and 2027, based on the most recent Technavio analysis.

Get a glance at the market contribution of various segments Download PDF Sample

X-ray fluorescence

X-ray fluorescence technology has matured as an analytical tool for routine quality controls in a variety of industries and research laboratories. The advancements in biological sciences that require constant integration in sub-components widely use X-ray fluorescent, which is propelling the market growth.

X-ray diffraction and Others

X-ray diffraction is a popular technique for determining the crystallinity and structure of solid samples. The technique is primarily used to identify and characterize compounds based on their diffraction pattern. Newer techniques that are variations in X-ray diffraction are being investigated. Such developments are expected to drive the growth of the X-ray diffraction segment of the market during the forecast period. The others segment consists of ICP-MS, ICP-OES, microwave-included plasma optical, glow discharge optical emission, and laser. The developments in these domains are expected to drive market growth.

End-User Analysis

End User is bifurcated into pharmaceutical and biotechnology testing, food and beverage testing, environmental testing, and others.

Pharmaceutical and biotechnology testing

Atomic spectroscopy is used in the pharmaceutical industry for elemental analysis in drug development, research, and production, which includes testing of new molecular entities and ingredients, followed by production and quality control testing for determining the number of impurities. The major focus of pharmaceutical manufacturers can be observed in the innovative development of first-in-class drugs. These factors are driving the market growth.

Food and beverage testing

The technology offers an efficient solution for the detection of heavy metals, nutrient content, toxins, and pesticides in food samples, which makes it a widely adopted technique for regulatory compliance in the food and beverage industry. The demand for atomic spectroscopy systems in food and beverage testing is expected to increase during the forecast period, owing to the rising demand for processed foods and beverages and increasing food consumption. For instance, according to the Food and Agricultural Organization (FAO), food demand is expected to increase due to the rising world population.

Environmental testing

The Clean Air Act, Clean Water Act, Toxic Substances Control Act by the US-based Environment Protection Agency (EPA), environmental policies of the EU, and Environment Protection Act, 1986 formulated by the Government of India are some of the regulatory norms mandated by various governments. Industries and organizations that come under these acts need to collect emission data consistently to check and comply with permissible limits. This has burdened the laboratories with a large amount of work, creating a demand for more advanced systems that can perform multiple analyses simultaneously, thereby realizing the potential for these systems such as ICP-MS and ICP-OES in their settings.

Others

This segment includes the application of these technologies in the petrochemical, semiconductor, mining, metal processing, and production industries. The technology is largely utilized in the petrochemical industries for quality control. ICP-MS is used to accurately measure the concentration of metal components present in petrochemicals such as diesel, crude oil, jet fuel, gasoline, natural gas, and kerosene, as the presence of analytes in petroleum products can lead to degradation and contamination, resulting in quality issues. The demand in so many domains is expected to drive market growth.

Regional Analysis

For more insights about the market share of various regions Download PDF Sample now!

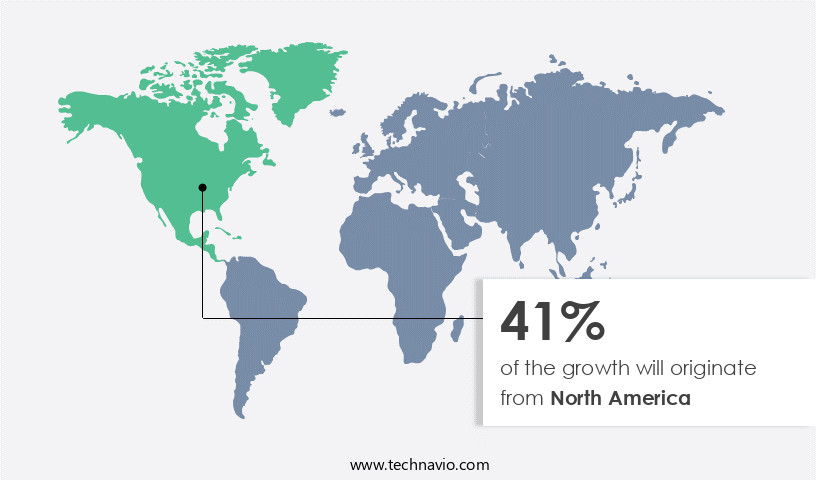

North America is estimated to contribute 41% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers will shape the market during the forecast period.

North America's market is mainly driven by the US, which contributes significantly to the revenue. The region boasts numerous system manufacturers, such as Agilent Technologies, PerkinElmer, Bruker, Rigaku Corp., and Thermo Fisher Scientific, which fuel market growth. These companies prioritize developing atomic spectroscopy-based products that meet the specific needs of end-users and comply with the relevant standards, like USP 232 and USP 233. For example, the US market has compliant spectroscopy like 7900 ICP-MS and 5110 Synchronous Vertical Dual View (SVDV) ICP-OES from Agilent Technologies, NexION 350 ICP-MS and Optima 8x00 ICP-OES from PerkinElmer, and iCE3500 AAS from Thermo Fisher Scientific.

Market players in this region also engage in various events, including conferences, seminars, and workshops, to increase end-user awareness of their advanced instruments. Thermo Fisher Scientific, for instance, presented its ICP-MS and ICP-OES technologies and solutions at the 2018 Winter Conference on Plasma Spectrochemistry, held in the US at Amelia Island. Additionally, market players sponsor seminars and workshops related to the technology to offer training and education and to cultivate a skilled workforce in the region. For example, Agilent Technologies sponsored a free seminar in April 2019, which discussed the latest solutions and applications of ICP-MS technology and a workshop on multi-application ICP-OES.

Buy Full Report Now

Key Market Players

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The report also includes detailed analyses of the competitive landscape of the market and information about 20 market companies, including:

A KRUSS Optronic GmbH, Agilent Technologies Inc., AMETEK Inc., Aurora Biomed Inc., Avantor Inc., Bruker Corp., Buck Scientific Instrument Manufacturing Co. AA, Endress Hauser Group Services AG, GBC Scientific Equipment, Hitachi High Tech Corp., HORIBA Ltd., PerkinElmer Inc., Rigaku Corp., SAFAS SA, Shimadzu Corp., Teledyne Technologies Inc., and Thermo Fisher Scientific Inc.

A KRUSS Optronic GmbH- The company offers atomic spectroscopy solutions such as optical spectroscopy. The product segment focuses on manufacturing laboratory and analytical instruments.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Dynamics and Customer Landscape

Atomic spectroscopy is a crucial analytical chemistry technique that utilizes electromagnetic radiation to identify and quantify trace elements in various matrices, including drug products, APIs, raw materials, intermediates, and food products. This technology plays a significant role in ensuring food safety and complying with stringent regulations in the pharmaceutical and metallurgy sectors. ICP spectrometers, such as Inductively Coupled Plasma Atomic Emission Spectroscopy (ICP-AES) and Inductively Coupled Plasma Mass Spectrometry (ICP-MS), are popular instruments used in atomic spectroscopy. These instruments provide isotopic information and help determine concentrations of molecules by analyzing spectral lines. Agilent Technologies and other technological innovators offer advanced solutions in atomic spectroscopy, including Atomic Absorption Spectroscopy (AAS), Atomic Fluorescence Spectroscopy (AFS), and Graphite Furnace Atomic Absorption Spectroscopy (GFAAS). These techniques offer high sensitivity and accuracy, making them essential tools for pharmaceutical organizations and metallurgy sector companies. In conclusion, the atomic spectroscopy market is driven by the increasing demand for trace element analysis in various industries, stringent regulations, and advancements in technology. Trained professionals continue to play a vital role in the implementation and operation of these sophisticated instruments. Our researchers analyzed the market research and growth data with 2023 as the base year, along with the key market growth analysis, trends, and challenges. A holistic analysis of drivers, trends, and challenges will help companies refine their marketing strategies to gain a competitive advantage.

Key Driver

Increased funding by government organizations for environmental testing and product safety is driving the market growth. The technology is a primary analytical technique that plays a crucial role in the elemental analysis of contaminants in various sources such as food, water, soil, and air. The growth of this market is expected to receive a boost from government organizations that fund analytical testing projects focused on ensuring the safety and quality of end-user products and the environment. Industries that are primarily involved in this process include food and agriculture, healthcare, and environmental testing organizations. These funding programs are aimed at creating contaminant-free, safe, and high-quality industrial output while minimizing the impact on the environment. For example, a collaborative program between the FAO and the International Atomic Energy Agency (IAEA) focuses on achieving the shared goal of food security. One of the objectives of this program is to promote the international standard of validation and its acceptance for assisting agricultural and food safety, using techniques like isotope ratio mass spectrometry. The FAO and the IAEA provide an annual allocation of approximately USD 16.03 million, with the FAO contributing 16% and the IAEA contributing between 50% and 74% towards about 220 regional and national projects. The aforementioned factors are expected to drive market growth.

Significant Trends

Increasing R&D investments by analytical instrument manufacturers is a major trend in the market. To stay competitive in the global market, several conglomerate companies are increasing their focus on research and development (R&D) investments. Companies such as Agilent Technologies, PerkinElmer, and Bruker are seen to be allocating a significant portion of their revenue toward generating technical competencies in their various business segments, including analytical tools and instruments. These players consistently strive to create growth opportunities and gain a competitive edge in the oligopolistic market by continuously increasing their budgetary allocations for R&D on a year-over-year basis. For instance, in 2022, Agilent Technologies spent USD 467 million on R&D, which was a 5.9% increase over 2021. Similarly, Thermo Fisher Scientific Inc. allocated USD 351 million towards R&D in October 2022, which accounted for approximately 3.3% of the business's overall revenue for the year. The increased investment in R&D is expected to drive the entry of innovative products and novel applications into the market and upgrade existing products to the latest standards, thereby creating new growth prospects for the global market during the forecast period.

Major Challenge

The high cost of advanced instruments and maintenance services is hindering market growth. One of the major hindrances for end-users to adopt advanced systems is the high cost of running and maintenance. While the introduction of compact and portable systems has made onsite testing more convenient, their adoption is being hampered by the high maintenance expenses involved. For instance, repairing a detector can cost up to USD 10,000, which is a significant expense. Consequently, users are opting for low-cost systems, which is impeding the growth of sophisticated systems such as ICP-MS and ICP-OES. These factors are expected to limit the market's growth during the forecast period.

You may also be interested in:

Spectrometry Market - Spectrometry Market - North America, Europe, EMEA, APAC : US, Canada, China, Germany, UK - Forecast

Total Reflection X-Ray Fluorescence Spectrometer Market - Total Reflection X-Ray Fluorescence Spectrometer Market by End-user, Type and Geography - Forecast and Analysis

Quantum Sensors Market - Quantum Sensors Market Analysis Europe, North America, APAC, Middle East and Africa, South America - US, China, Japan, UK, Germany - Size and Forecast

Market Customer Landscape

The market report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their growth strategies.

Customer Landscape

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Technology Outlook

- Atomic absorption

- X-ray fluorescence

- X-ray diffraction

- Others

- End-user Outlook

- Pharmaceutical and biotechnology testing

- Food and beverage testing

- Environmental testing

- Others

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- Asia

- Chile

- Argentina

- Brazil

- ROW

- Argentina

- Australia

- Rest of the World

- North America

Market Analyst Overview

Atomic Spectroscopy is a critical analytical technique used to identify and quantify various elements in a sample. This market encompasses several techniques such as Atomic Absorption Spectroscopy (AAS), Inductively Coupled Plasma Mass Spectrometry (ICP-MS), and X-Ray Fluorescence (XRF). The market for Atomic Spectroscopy is driven by the increasing demand for accurate and efficient elemental analysis in various industries, including Chemicals, Environmental, and Pharmaceuticals. Elemental analysis plays a pivotal role in numerous applications, including quality control, process optimization, and research and development. The market is expected to grow significantly due to the rising awareness of the importance of elemental analysis in ensuring product safety and regulatory compliance.

Additionally, advancements in technology, such as the miniaturization of instruments and the integration of automation, are expected to further boost market growth. Applications of Atomic Spectroscopy include the analysis of metals, alloys, minerals, and various other materials. The technique's ability to provide high-resolution, high-precision, and high-throughput analysis makes it an indispensable tool in various industries. Furthermore, the technique's versatility and ability to analyze a wide range of elements make it a valuable asset in research and development activities. In conclusion, the Atomic Spectroscopy market is poised for significant growth due to the increasing demand for accurate and efficient elemental analysis in various industries. The market's growth is driven by factors such as regulatory compliance, product safety, and technological advancements. The technique's versatility and ability to analyze a wide range of elements make it an essential tool in numerous applications.

|

Atomic Spectroscopy Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

185 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.29% |

|

Market growth 2024-2028 |

USD 2.46 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.66 |

|

Regional analysis |

North America, Europe, Asia, and Rest of World (ROW) |

|

Performing market contribution |

North America at 41% |

|

Key countries |

US, Canada, Germany, France, and China |

|

Competitive landscape |

Leading Vendors, Market Positioning of Vendors, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

A KRUSS Optronic GmbH, Agilent Technologies Inc., AMETEK Inc., Aurora Biomed Inc., Avantor Inc., Bruker Corp., Buck Scientific Instrument Manufacturing Co. AA, Endress Hauser Group Services AG, GBC Scientific Equipment, Hitachi High Tech Corp., HORIBA Ltd., PerkinElmer Inc., Rigaku Corp., SAFAS SA, Shimadzu Corp., Teledyne Technologies Inc., and Thermo Fisher Scientific Inc. |

|

Market dynamics |

Parent market analysis, market growth and trends, market forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period. |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

Download Sample PDF at your Fingertips

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2024 and 2028

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market industry across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market’s competitive landscape and detailed information about vendors

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market vendors