Automated Food Sorting Machines Market Size 2024-2028

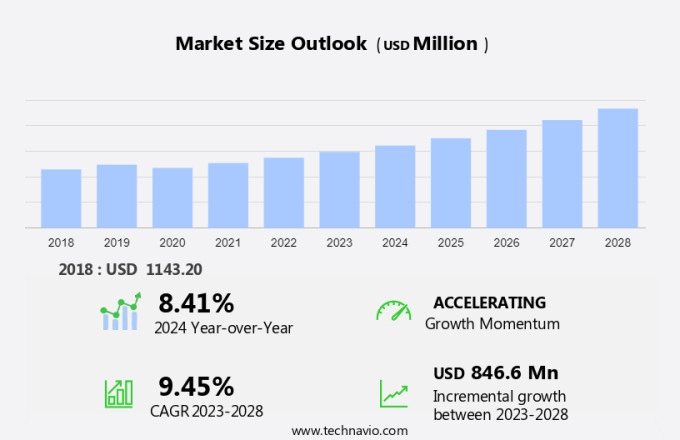

The automated food sorting machines market size is forecast to increase by USD 846.6 million at a CAGR of 9.45% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for improved food quality and safety. Manual sorting processes, which are labor-intensive and prone to errors, are being replaced by advanced sorting mechanisms. These machines offer higher sorting accuracy and throughput rates, reducing food waste management and increasing efficiency in processing food products such as seeds, grains, and prepared foods. However, the high implementation cost of these machines presents a challenge for smaller businesses. Food safety regulations and hygiene requirements also necessitate the use of automated sorting machines to ensure the highest standards are met. In the market, this trend is driven by the need for increased productivity, reduced labor costs, and enhanced food safety. Automated sorting machines offer a solution to these challenges, making them an essential investment for food processing businesses.

The food processing industry is witnessing a significant shift towards automation, with food sorting machines gaining popularity as a solution to manual labor-intensive processes. These machines utilize advanced technologies such as machine vision, artificial intelligence, and robotics to sort food products, including packaged snacks, beverages, and other packaged food items. Automated food sorting machines offer numerous benefits to food manufacturers. By implementing these systems, they can optimize their processes, reduce waste, and improve food safety. Machine learning algorithms and sensor technologies enable the machines to identify and sort food products based on various parameters, such as size, shape, color, and weight. This results in improved quality control and the elimination of contaminated or defective products from the production line. Food sorting machines also contribute to cost and labor efficiency. By automating the sorting process, food manufacturers can reduce their reliance on manual labor and save on associated labor costs.

Additionally, these machines are designed with energy-efficient components and eco-friendly materials, making them a sustainable investment for food processing facilities. The automation trend in the food processing industry is driven by the growing demand for convenient eating habits and healthy food ingredients. Consumers are increasingly seeking out packaged snacks and beverages that meet their dietary needs and offer quick and easy solutions for busy lifestyles. Automated food sorting machines enable food manufacturers to meet this demand by streamlining their production processes and ensuring a consistent product output. Moreover, food manufacturers are under increasing pressure to reduce waste and improve food safety. Automated food sorting machines help address these challenges by identifying and removing contaminated or defective products from the production line, reducing the risk of recalls and minimizing waste.

In conclusion, automated food sorting machines are a valuable investment for food manufacturers looking to streamline their production processes, improve quality control, and reduce waste. By utilizing advanced technologies such as machine vision, artificial intelligence, and robotics, these machines offer a cost-effective and sustainable solution to manual labor-intensive sorting processes. As the demand for convenient and healthy food products continues to grow, the adoption of automated food sorting machines is expected to increase, making them an essential component of modern food processing facilities.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Belt-sorter

- Free-fall sorter

- Gravity separator

- Others

- Application

- Dry food and packaged food processing

- Fruits and vegetable processing

- Dairy product processing

- Fats and oil processing

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- India

- South America

- Middle East and Africa

- North America

By Product Insights

The belt-sorter segment is estimated to witness significant growth during the forecast period. In the realm of food processing and packaging, Automated Food Sorting Machines have gained significant traction in various industries, including pharmaceuticals and food & beverage. These machines employ advanced technologies such as sensors and cameras to ensure high-quality food production and maintain stringent regulations. The use of these systems is particularly prevalent in eCommerce and food processing industries, where the need for efficient and accurate sorting of food items is paramount. Belt sorters are a common type of Automated Food Sorting Machines, capable of sorting food items with varying shapes, colors, and sizes. These machines are utilized in sorting a wide range of food items, such as carrots, potatoes, garlic, cashews, and almonds.

Further, the optical system-enabled belt sorter offers high accuracy and speed, making it an ideal solution for sorting elongated and differently colored food items. Moreover, belt sorters provide a high payload capacity and efficiency, allowing them to sort both large and small food items with ease. With food safety and hygiene being of utmost importance in the food industry, automation offers a reliable and efficient solution to maintain these standards while ensuring a consistent production line. By employing the latest inspection technologies, these machines help ensure the highest quality food products reach consumers.

Get a glance at the market share of various segments Request Free Sample

The belt-sorter segment accounted for USD 356.60 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

North America is estimated to contribute 30% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the market holds a significant share due to stringent food regulations and the region's high consumption of processed food. The food industry's rapid industrialization and urbanization have led to a high demand for automated sorting systems. These machines offer precision and efficiency, making them an essential investment for food processing companies. Although the upfront costs of installing these systems can be a barrier to entry for smaller firms, the long-term benefits, including reduced labor costs and improved product quality, outweigh the initial investment. The advanced sorting technologies used in these machines require regular training and maintenance to ensure optimal performance. The food industry in North America, which is the largest producer of meat, fish, and seafood processed food, has integrated these automated machines and technologies to enhance production processes and meet consumer demands for high-quality, safe food products.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increased focus on quality and safety of food products is the key driver of the market. The food industry has witnessed significant changes due to shifting consumer preferences and the increasing demand for high-quality, safe food products. With growing disposable income and diverse food choices, manufacturers are prioritizing the production of nutritious foods. However, ensuring product safety and maintaining quality standards remains a challenge, particularly in labor-intensive processes. To address these concerns, the food industry is embracing automation, specifically automated food sorting machines. These machines utilize advanced technologies, such as machine learning algorithms and sensor technologies, to sort products based on specific criteria. Machine learning algorithms analyze data to identify patterns and make accurate decisions, while sensor technologies detect defects or contamination.

Additionally, automated sorting machines minimize the risk of human error and contamination, ensuring a safer production environment. In conclusion, the adoption of automated food sorting machines is a response to the increasing demand for high-quality, safe food products and the need to streamline labor-intensive processes. These machines utilize advanced technologies, such as machine learning algorithms and sensor technologies, to sort products based on specific criteria, ensuring consistent product quality and minimizing the risk of contamination. By improving cost and labor efficiency, manufacturers can remain competitive and meet the evolving demands of consumers.

Market Trends

Advanced detection technology of food sorting machines is the upcoming trend in the market. In today's food industry, the emphasis on producing high-quality and safe food products has led to the adoption of advanced sorting technologies. Traditional methods of sorting food items, such as manual labor, are being replaced by automated and intelligent machines. The agricultural sector's use of pesticides and chemicals can impact the quality of raw materials, making it essential for the food processing industry to identify healthy produce.

Further, automated food sorting machines have become a crucial investment for manufacturers to ensure the production of healthy and safe food products. According to industry reports, the market is projected to expand at a steady pace, driven by factors such as increasing health consciousness, growing demand for convenience foods, and the need for food safety and quality assurance.

Market Challenge

The high implementation cost of automated food sorting machines is a key challenge affecting the market growth. Automated food sorting machines have become increasingly popular in the food processing industry due to their ability to enhance sorting accuracy and throughput rates. However, the initial investment required for implementing these machines is higher than traditional labor-intensive methods. This cost barrier prevents many small and medium enterprises (SMEs) from adopting the technology. The food industry is characterized by a large number of SMEs that prioritize cost-effectiveness over advanced technologies. Despite the benefits of automated sorting mechanisms in reducing food wastage and ensuring food safety regulations, many food processing businesses continue to rely on manual labor for sorting seeds, grains, and processed food products.

Further, the implementation of automated machines is a significant investment, and SMEs often prefer to allocate resources towards labor instead. The food industry, which includes dairy and meat processing applications, has been in existence for a long time, and many businesses are hesitant to abandon traditional methods. However, with increasing awareness of the importance of food safety and hygiene, there is a growing trend towards automation in the food processing sector.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- Ellips BV - The company offers the best software, hardware, and retrofit grading and sorting technology for fruits and vegetables.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AGCO Corp.

- Allgaier Werke GmbH

- Amandus Kahl GmbH and Co. KG

- ANHUI JIEXUN OPTOELECTRONIC TECHNOLOGY Co. Ltd.

- ATS Automation Tooling Systems Inc.

- Aweta G and P BV

- Buhler AG

- De Greefs Wagen Carrosserie en Machinebouw BV

- Duravant LLC

- Futura Srl

- Heat and Control Inc.

- Hefei Meyer Optoelectronic Technology Inc.

- John Bean Technologies Corp.

- Kind Technologies B.V.

- Maf Roda

- Orange Sorting Machines

- Promech Industries Pvt. Ltd.

- Satake Corp.

- Tomra Systems ASA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Automated food sorting machines have become increasingly popular in the food and beverage industry due to the growing demand for high-quality food products, convenient eating habits, and stringent food safety regulations. With the rise of packaged food products, snacks, beverages, and ecommerce, the need for efficient and accurate sorting systems has become essential for food manufacturers. Industrial processes have been rapidly industrializing and urbanizing, leading to an automation trend in food sorting. Automated machinery, including sensors, cameras, machine vision, and artificial intelligence, are being used to sort fruits, vegetables, seeds and grains, and other food products. These sophisticated sorting systems help reduce labor requirements, minimize manual flaws, and ensure consistent quality control.

Additionally, food safety and hygiene are top priorities in the food industry, and automated sorting machines help minimize contamination risks and ensure product quality. These machines use advanced sorting algorithms and sensor technologies to detect and remove defective products, ensuring only high-quality food products reach consumers. The upfront costs of installing and training staff to operate these machines can be a barrier to entry for smaller companies. However, the long-term benefits of increased cost efficiency, labor efficiency, and optimized processes make the investment worthwhile. Additionally, the use of eco-friendly materials and energy-efficient components in these machines aligns with the industry's focus on sustainability and waste reduction.

Further, governing bodies impose penalties for contaminated products, making it crucial for food manufacturers to invest in advanced sorting technologies to maintain consistent quality control and processing time. The use of machine learning algorithms and robotics in food sorting machines is a game-changer, enabling rapid sorting and resource utilization while minimizing waste management and recycling costs.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

181 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.45% |

|

Market growth 2024-2028 |

USD 846.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.41 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 30% |

|

Key countries |

US, China, Germany, UK, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AGCO Corp., Allgaier Werke GmbH, Amandus Kahl GmbH and Co. KG, ANHUI JIEXUN OPTOELECTRONIC TECHNOLOGY Co. Ltd., ATS Automation Tooling Systems Inc., Aweta G and P BV, Buhler AG, De Greefs Wagen Carrosserie en Machinebouw BV, Duravant LLC, Ellips BV, Futura Srl, Heat and Control Inc., Hefei Meyer Optoelectronic Technology Inc., John Bean Technologies Corp., Kind Technologies B.V., Maf Roda, Orange Sorting Machines, Promech Industries Pvt. Ltd., Satake Corp., and Tomra Systems ASA |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch