Automatic Floodgate Market Size 2025-2029

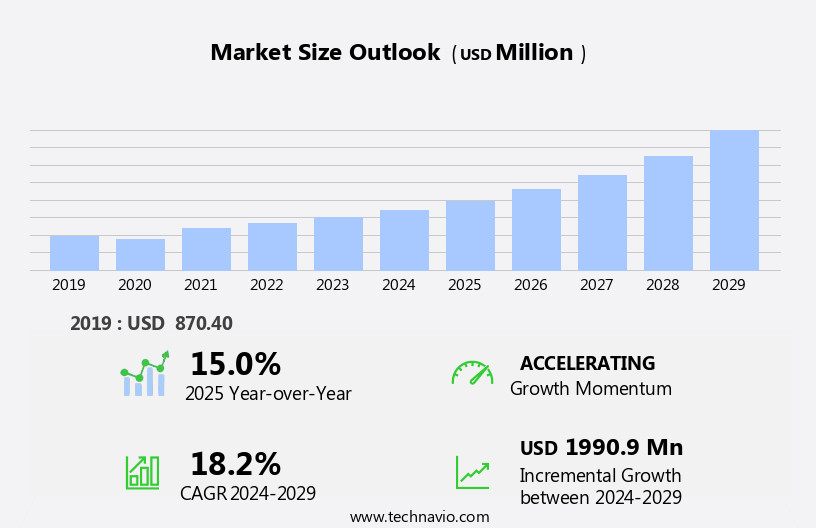

The automatic floodgate market size is forecast to increase by USD 1.99 billion at a CAGR of 18.2% between 2024 and 2029.

What will be the Size of the Automatic Floodgate Market During the Forecast Period?

How is this Automatic Floodgate Industry segmented and which is the largest segment?

The automatic floodgate industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Commercial

- Residential

- Geography

- Europe

- Germany

- UK

- North America

- Canada

- US

- APAC

- China

- India

- Japan

- Middle East and Africa

- South America

- Brazil

- Europe

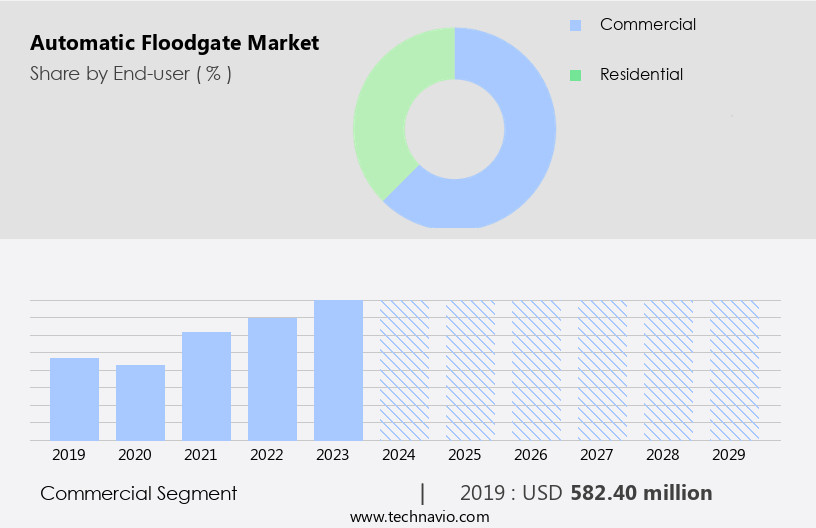

By End-user Insights

- The commercial segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth due to the increasing demand for advanced flood control solutions in commercial sectors. With the rise in urbanization and infrastructure development, the risk of flood damage to commercial buildings, such as offices and shopping malls, is increasing. Floodgates are becoming a crucial component of flood risk management systems to protect these structures from extreme weather events. Automatic floodgates offer the advantage of remote control systems for easy deployment during floods, ensuring infrastructure resilience and disaster preparedness. These floodgates are available in various installation types, including fixed, mobile, and modular, catering to diverse flood risk management needs.

The market demand for automatic floodgates is driven by the need for cost-effective and efficient flood protection solutions, as well as the increasing importance of real-time monitoring and automated deployment in flood management. Key applications of automatic floodgates include flood risk management for homes, effluent floodgates, intelligent floodgates, and flood defense systems for communities. Floodgates are essential for mitigating flood damage to commercial properties and ensuring community safety. Insurance coverage for flood damage is a significant factor driving the adoption of automatic floodgates. Infrastructure development and flood management initiatives are also expected to boost market growth.

Get a glance at the Automatic Floodgate Industry report of share of various segments Request Free Sample

The Commercial segment was valued at USD 582.40 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- Europe is estimated to contribute 72% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The European the market is projected to dominate the global landscape due to the region's significant flood risk. Factors contributing to this market growth include the increasing frequency of extreme weather events, such as heavy rainfall and rising sea levels, which have led to an elevated risk of flooding in countries like the UK, Germany, and the Netherlands. Europe's aging drainage systems and flood defense infrastructure, coupled with a high number of buildings located in flood-prone areas and increased urbanization, further exacerbate the issue. In response, European governments have prioritized infrastructure investments to enhance flood resilience, driving demand for advanced floodgate solutions.

These include automatic, intelligent, and modular installations, such as vertical lift, hinged, and sliding floodgates, which offer cost-effective, real-time monitoring, and automated deployment capabilities. Additionally, collaborations between industry players and local authorities are crucial in implementing effective flood risk management strategies, ensuring community safety, and minimizing potential flood damage.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automatic Floodgate Industry?

Shift in global climatic conditions is the key driver of the market.

What are the market trends shaping the Automatic Floodgate Industry?

Certifications for floodgates is the upcoming market trend.

What challenges does the Automatic Floodgate Industry face during its growth?

High initial cost is a key challenge affecting the industry growth.

Exclusive Customer Landscape

The automatic floodgate market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automatic floodgate market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automatic floodgate market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

AWMA Pty Ltd - The company provides electric and hydraulic tilting flood barriers, acting as effective solutions to isolate areas from encroaching flood levels. These actuated barriers are engineered to prevent access to flood-prone regions, safeguarding infrastructure and properties from potential damage.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AWMA Pty Ltd

- EKO SYSTEM s r o

- Flood Control International Ltd

- FloodBreak

- Floodgates Ireland

- Hitachi Zosen Corp.

- Hunton Engineering Design Ltd

- Jay R Smith Mfg Co. Inc

- MM Engineered Solutions Ltd

- Orange Flood Control LLC

- Self Closing Flood Barrier

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Automatic floodgates have emerged as a critical component of infrastructure resilience In the face of increasing flood risk. These control mechanisms, designed to manage stormwater and prevent flooding, have gained significant attention due to their ability to provide effective flood protection solutions in various applications. Floodgates are essential for both residential and commercial sectors, with the demand for automatic models on the rise. The infrastructure development and urbanization trends have led to an increased focus on flood risk management and the implementation of smart city solutions. Automatic floodgates offer several advantages over traditional fixed installations. Their remote control systems enable real-time monitoring and automated deployment during extreme weather events, ensuring infrastructure resilience and disaster preparedness.

These systems can be installed in various ways, including mobile, modular, and vertical lift designs, catering to diverse flood risk management needs. The innovation in floodgate technology has led to the development of intelligent and effluent models. These advanced floodgates can be integrated with treatment systems and drainage networks, enhancing their functionality and contributing to overall water management. The market for automatic floodgates is driven by several factors, including the rising sea levels and consumer preference for cost-effective and efficient flood protection solutions. Collaborations between industry players and research institutions continue to push the boundaries of floodgate technology, leading to new advancements and improvements.

Infrastructure resilience is a critical concern for insurance companies, as flood damage can result in significant financial losses. Automatic floodgates play a crucial role in mitigating these risks, making them an essential investment for both homeowners and businesses. Despite their advantages, the installation and maintenance of automatic floodgates require careful planning and consideration. Factors such as water level control, hinged or sliding designs, and cost-effectiveness must be taken into account when selecting the appropriate floodgate solution for a given application. In conclusion, automatic floodgates represent a significant advancement in flood risk management, offering cost-effective, efficient, and innovative solutions for both residential and commercial sectors.

Their remote control systems, real-time monitoring capabilities, and integration with treatment systems and drainage networks make them an essential component of infrastructure resilience and disaster preparedness.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

164 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.2% |

|

Market growth 2025-2029 |

USD 1990.9 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

15.0 |

|

Key countries |

US, UK, The Netherlands, Japan, Germany, Canada, China, India, Saudi Arabia, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automatic Floodgate Market Research and Growth Report?

- CAGR of the Automatic Floodgate industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automatic floodgate market growth of industry companies

We can help! Our analysts can customize this automatic floodgate market research report to meet your requirements.