Automotive Airbag Electronic Control Unit (ECU) Market Size 2025-2029

The automotive airbag electronic control unit (ecu) market size is forecast to increase by USD 1.98 billion at a CAGR of 4.6% between 2024 and 2029.

- The market is driven by stringent regulations mandating the integration of airbags in vehicles. These regulations ensure passenger safety, leading to a significant increase in the demand for airbag ECUs. Another key trend influencing the market is the integration of airbag ECUs in Autonomous Vehicles (AVs). As AVs gain popularity, the need for advanced safety systems, including airbags, is becoming increasingly important. However, the market also faces challenges, primarily the growing complexity and number of ECUs in vehicles. The increasing number of electronic systems in modern vehicles results in a higher number of interconnected components, increasing the complexity of the airbag ECU system.

- This complexity poses challenges in terms of design, development, and manufacturing, requiring significant investments and resources from market participants. Companies seeking to capitalize on market opportunities and navigate challenges effectively must focus on developing advanced technologies to address the complexity issue while ensuring compliance with safety regulations. Additionally, collaboration with regulatory bodies and industry associations can help companies stay updated on the latest regulations and trends, enabling them to innovate and remain competitive in the market.

What will be the Size of the Automotive Airbag Electronic Control Unit (ECU) Market during the forecast period?

- The market continues to evolve, driven by advancements in vehicle safety technology and the increasing demand for enhanced in-vehicle experiences. The ECU plays a crucial role in collision detection and deployment sequence, integrating seamlessly with interior and body electronics, powertrain controllers, and engine management systems. The market dynamics are shaped by various factors, including vehicle production, vehicle performance, mileage, and fuel efficiency. Turbocharged engines and electric vehicles are gaining popularity, necessitating ECUs capable of handling complex powertrain systems and optimizing fuel efficiency. The luxury light-duty vehicle segment is a significant contributor to the market growth, with automobile manufacturers investing heavily in advanced safety features and in-vehicle experiences.

- The integration of augmented reality and infotainment systems into conventional cockpits further enhances the consumer appeal. However, the market faces challenges such as data theft, security breaches, and purchasing power disparities in developed and developing economies. ECU consolidation and the production of automobiles in developing economies are key trends shaping the market. The ECU's role extends beyond collision safety, as it also impacts drivetrain performance and engine failure prevention. The raw materials used in ECU manufacturing and the development of electric vehicles further influence market trends. In the evolving automotive landscape, the ECU remains a critical component, ensuring vehicle safety, optimizing vehicle performance, and enhancing the in-vehicle experience.

How is this Automotive Airbag Electronic Control Unit (ECU) Industry segmented?

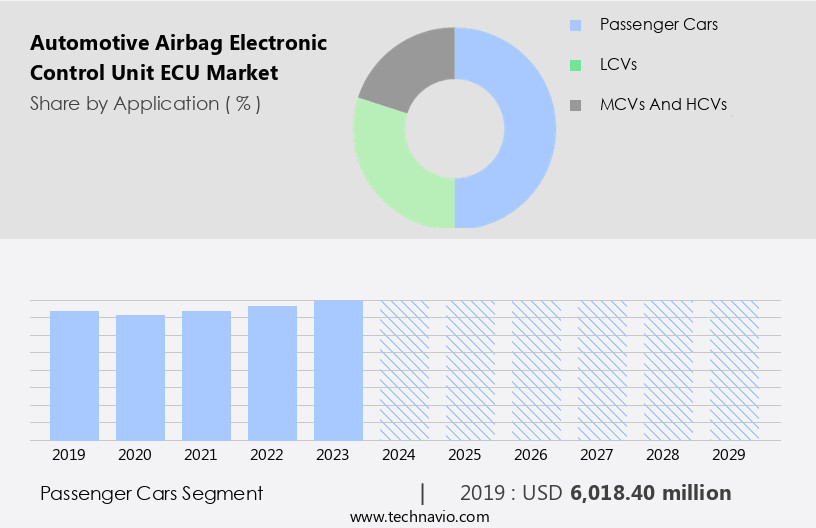

The automotive airbag electronic control unit (ecu) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Passenger cars

- LCVs

- MCVs and HCVs

- Product Type

- Standard

- Premium

- Technology

- Advanced

- Basic

- Integrated ADAS

- Type

- Frontal airbags

- Side airbags

- Others

- Channel

- OEM

- Aftermarket

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- The Netherlands

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The passenger cars segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth, driven by the increasing demand for passenger cars in developed and developing economies. This trend is expected to continue in the forecast period. In the luxury segment, the market remains robust as luxury vehicles remain popular in both developed and developing economies. Automakers such as BMW, Mercedes-Benz, and Audi dominate the luxury car market, contributing to the growth of the global Automotive Airbag ECU market. Modelwise analysis reveals that the interior and body electronics of modern vehicles are becoming increasingly complex, with airbags being a crucial safety feature.

The Powertrain controller and ECU consolidation are also significant factors driving market growth. Engine failure and collision deployment sequences are critical functions of the airbag ECU, making it an essential component of vehicle safety. Fuel efficiency and horsepower are essential factors for consumers, particularly in the light-duty vehicle segment. Turbocharged engines and electric vehicles are gaining popularity, leading to an increase in demand for advanced safety features, including airbags. The Uconnect platform and infotainment systems are also influencing the market, in-vehicle experience for occupants. The production of automobiles is a significant raw material input for the automotive airbag ECU market.

Developing economies are becoming major players in vehicle production, leading to increased competition and innovation in the market. However, security breaches and remapping concerns are potential challenges that need to be addressed to ensure the safety and reliability of the airbag ECU systems. In conclusion, the global automotive airbag ECU market is experiencing significant growth, driven by the increasing demand for passenger cars, particularly in the luxury segment. The market is influenced by factors such as vehicle production, fuel efficiency, horsepower, and safety concerns. The integration of advanced safety features, such as airbags, in modern vehicles is essential to meet the evolving needs and expectations of consumers.

The Passenger cars segment was valued at USD 6.02 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 72% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic automotive industry, the market for Airbag Electronic Control Units (ECUs) in APAC is experiencing notable growth. Factors such as increasing disposable income and purchasing power in developing economies like China, Japan, India, South Korea, and Indonesia are driving the expansion of the automobile industry in this region. This economic growth is propelling the demand for automobiles, particularly luxury light-duty vehicles, which in turn is fueling the need for advanced safety features, including airbags. Safety concerns are a top priority for consumers, leading to stringent governmental regulations and mandatory safety features in vehicles. Airbag ECUs, which are integral to vehicle safety, are increasingly being adopted in APAC.

Furthermore, the integration of advanced technologies like Augmented Reality, Uconnect platform, and horsepower optimization in airbags is enhancing the in-vehicle experience for occupants. The automotive industry's shift towards electric vehicles and the consolidation of ECUs are also influencing market trends. While raw material costs and deployment sequence optimization are critical considerations for automobile manufacturers, security breaches and remapping concerns are emerging as significant challenges. The integration of body electronics, powertrain controllers, and drivetrain systems into airbag ECUs is streamlining vehicle production and improving vehicle performance, mileage, and fuel efficiency, especially for turbocharged engines. In conclusion, the automotive airbag ECU market in APAC is witnessing significant growth due to the increasing demand for safety features, the proliferation of advanced technologies, and the evolving needs of consumers in the region.The market's future trajectory is shaped by the adoption of electric vehicles, the consolidation of ECUs, and the ongoing efforts to address security concerns.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Automotive Airbag Electronic Control Unit (ECU) Industry?

- The regulation mandating the installation of airbags in vehicles is the primary driving force behind the market's growth. This legislative requirement has significantly contributed to the increasing demand for airbags in the automotive industry.

- Airbags are crucial safety components in automobiles that help minimize injuries during accidents. Mandated by safety concerns and regulations, all vehicles are required to have airbags. A typical vehicle may contain 2-6 airbags, including frontal, knee, and curtain airbags. Luxury vehicles may feature up to 10 airbags. Each vehicle with multiple airbags is equipped with a single Airbag Electronic Control Unit (ECU), managing the deployment of all airbags during collisions. Airbag ECUs adhere to varying regulatory safety standards worldwide.

- The integration of advanced safety features, such as Augmented Reality, into vehicles enhances the in-vehicle experience. Moreover, infotainment systems like Uconnect platform are increasingly popular in automobiles, offering horsepower information and other functionalities. The airbag ECU plays a vital role in ensuring the safety of vehicle occupants while enhancing the overall in-vehicle experience.

What are the market trends shaping the Automotive Airbag Electronic Control Unit (ECU) Industry?

- The integration of autonomous vehicles (AVs) is a significant market trend that is mandated by industry professionals. This development signifies a major shift towards advanced transportation solutions.

- The market is experiencing significant growth, particularly in the context of electric vehicles and developing economies. As electric vehicles become increasingly popular in developed economies, the demand for advanced safety technologies, such as airbag ECUs, is on the rise. The consolidation of the conventional cockpit with embedded displays and advanced features is driving the market forward. In light-duty vehicles, the airbag ECU plays a crucial role in ensuring the safety of occupants by deploying airbags strategically based on real-time sensor data.

- The integration of airbag ECUs into autonomous vehicles is a notable trend, as they can adapt to different deployment methods in both manual and autonomous modes. Despite the increasing production of automobiles, the focus on safety and the importance of protecting occupants remains a top priority.

What challenges does the Automotive Airbag Electronic Control Unit (ECU) Industry face during its growth?

- The increasing complexity and rising number of Electronic Control Units (ECUs) in vehicles pose a significant challenge to the industry's growth, necessitating advanced engineering solutions and continuous innovation to ensure seamless integration and optimal functionality.

- The market has experienced significant growth due to the increasing complexity of vehicles, with the number of airbags per vehicle rising in response to the demand for enhanced safety features in both mass-produced and luxury vehicles. The electrification of vehicles has added to the intricacy of ECUs, as they now play a crucial role in various systems, including active and passive safety components, pre-crash systems, chassis control, and longitudinal dynamics. The sophistication of these systems, such as damping control systems, adaptive cruise controls, and airbag modules, has led to an average of 70 ECUs being used in high-end vehicles.

- Consumers seek benefits like improved driving experience and fuel efficiency, necessitating simplification of the ECU framework. ECUs are integral to turbocharged engines, which prioritize mileage and engine performance. This market trend is driven by the increasing focus on vehicle production and the development of advanced technologies to cater to evolving consumer demands.

Exclusive Customer Landscape

The automotive airbag electronic control unit (ecu) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive airbag electronic control unit (ecu) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive airbag electronic control unit (ecu) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ZF Friedrichshafen AG - The company provides advanced airbag electronic control units, such as the ADXL251, which offers cost-effective solutions for front and side impact airbags, as well as satellite sensor and electronic control unit integration. This technology ensures enhanced safety features, enabling precise deployment and optimization of airbag systems. By utilizing state-of-the-art components and innovative design, the company caters to the evolving needs of the automotive industry, delivering reliable and efficient solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ZF Friedrichshafen AG

- Continental AG

- Robert Bosch GmbH

- Denso Corporation

- Autoliv Inc.

- Aptiv Plc

- Hyundai Mobis Co. Ltd.

- Joyson Safety Systems

- Valeo S.A.

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Texas Instruments Incorporated

- Renesas Electronics Corporation

- STMicroelectronics N.V.

- Mitsubishi Electric Corporation

- Hitachi Automotive Systems Ltd.

- Hella GmbH & Co. KGaA

- Magneti Marelli S.p.A.

- Visteon Corporation

- Harman International Industries Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Airbag Electronic Control Unit (ECU) Market

- In February 2024, Bosch, a leading global technology company, announced the launch of its new generation of automotive airbag ECUs, featuring advanced safety functions and improved connectivity (Bosch press release). This innovation marks a significant technological advancement in the airbag ECU market, as these new units can communicate with other vehicle systems in real-time, enhancing overall safety and performance.

- In June 2025, Continental AG and Autoliv, two major players in the automotive safety systems industry, entered into a strategic partnership to jointly develop and produce advanced driver assistance systems (ADAS) and airbag ECUs (Autoliv press release). This collaboration aims to strengthen both companies' positions in the growing market for advanced safety technologies, allowing them to offer more comprehensive solutions to automakers.

- In October 2024, Magna International, a global automotive supplier, announced a USD200 million investment in its airbag ECU manufacturing facility in Mexico, expanding its production capacity and enabling it to meet the increasing demand for advanced safety systems (Magna press release). This expansion represents a key geographic entry and significant investment in the airbag ECU market, positioning Magna as a major player in the production of these critical safety components.

- In March 2025, the European Union passed new regulations mandating the installation of advanced airbag systems, including side airbags and advanced airbag ECUs, in all new passenger vehicles starting from 2027 (European Parliament press release). This regulatory approval marks a significant shift in the airbag ECU market, as it will drive demand for more advanced safety technologies and push automakers to invest in the development and production of these systems.

Research Analyst Overview

The Automotive Airbag ECU market is witnessing significant advancements, with the integration of technologies such as the Uconnect platform and embedded displays transforming the conventional cockpit experience. The market is expanding beyond traditional light-duty vehicles, with electric vehicles and luxury models also adopting these technologies. Turbocharged engines and increased horsepower are driving the need for advanced safety features, including ECUs, in vehicle production. Data theft and security breaches are growing concerns, leading to the mandatory incorporation of data triangulation and ECU consolidation. The in-vehicle experience is becoming more personalized, with modelwise analysis and remapping offering customized vehicle performance and fuel efficiency.

Chinese players are making strides in the market, offering cost-effective solutions without compromising on safety features. The drivetrain and powertrain controller are critical components of the ECU, with augmented reality technology enhancing the interior experience by providing real-time vehicle performance data. The market is witnessing a trend towards advanced safety features, with ECUs playing a crucial role in ensuring vehicle safety and reducing accidents. The integration of raw materials, such as sensors and microcontrollers, is essential to the production of high-performance ECUs. In summary, the Automotive Airbag ECU market is undergoing significant changes, with the integration of advanced technologies, increasing focus on vehicle safety, and growing concerns around data security shaping market dynamics.

The market is expanding beyond traditional vehicle types, with electric vehicles and luxury models adopting these technologies to enhance the in-vehicle experience. ECUs are becoming essential components in ensuring vehicle performance, fuel efficiency, and safety, making them a critical investment for automakers.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Airbag Electronic Control Unit (ECU) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

258 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 1984 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.4 |

|

Key countries |

US, China, Germany, Japan, UK, India, Canada, Brazil, UAE, Australia, Saudi Arabia, France, South Korea, Mexico, and The Netherlands |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Airbag Electronic Control Unit (ECU) Market Research and Growth Report?

- CAGR of the Automotive Airbag Electronic Control Unit (ECU) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive airbag electronic control unit (ecu) market growth of industry companies

We can help! Our analysts can customize this automotive airbag electronic control unit (ecu) market research report to meet your requirements.