Automotive Automatic Transmission (AT) Market Size 2022-2026

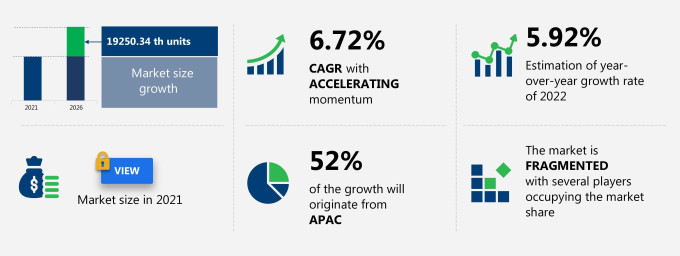

The automotive automatic transmission (AT) market share is expected to increase to 19250.34 thousand units from 2021 to 2026, and the market's growth momentum will accelerate at a CAGR of 6.72%.

The Automotive Automatic Transmission (AT) Market is evolving with advancements in automatic systems and innovations in battery technology to meet the growing demand for electric vehicles (EVs) and hybrid vehicles. As consumer preferences shift towards easy-to-use vehicles, the market is witnessing a surge in electric powertrains and dual-clutch transmissions, offering smoother gear shifts and enhancing driving comfort. The development of advanced automatic technologies and electric vehicle (EV) transmissions, such as single-speed and continuously variable transmissions, is revolutionizing the driving experience by providing seamless shifts and better driving performance in urban driving conditions.

As urbanization increases, busy lifestyles demand vehicles that offer convenient, smoother gear shifts, and better driving experience. Hybrid vehicles and electric cars are becoming more popular due to the efficiency of their battery electric vehicle (BEV) powertrains, making them ideal for urban driving conditions. Automated manual systems and torque converters are also being integrated to improve fuel efficiency, reduce drag, and comply with emission control regulations. Additionally, high-strength steel composites, magnesium, and lightweight vehicles help reduce manufacturing costs while enhancing structural integrity.

What will the Automotive Automatic Transmission (AT) Market Size be During the Forecast Period?

Download the Free Report Sample

The automotive transmission market is also benefiting from government incentives that promote the adoption of eco-friendly and CO2 emissions-reduced technologies. The rise of autonomous driving systems further fuels the demand for automatic transmission systems that offer driver comfort and ease of use. As the market continues to evolve, manufacturers are exploring patent applications and leveraging additive manufacturing to improve the design and functionality of shift elements, contributing to a more sustainable. The automotive industry is experiencing rapid advancements in sustainable transportation solutions, driven by eco-friendly vehicles and green transportation initiatives. With the rise of electric vehicle (EV) and hybrid vehicle technologies, vehicle electrification trends are reshaping the automotive technology landscape. Fuel efficiency improvements, vehicle comfort, and smart car technology are enhancing the driving experience, while connected car features and automation offer a more reliable and efficient future of mobility.

As vehicle size and weight reduction become key focuses in automotive innovation, manufacturers are incorporating automatic vs manual transmission systems, optimizing vehicle stability, handling, and performance. Vehicle price and cost remain significant factors, making affordable electric vehicles a priority for the industry. With ongoing research and development and system innovations, the industry continues to improve fuel economy and impact on emissions through advanced component manufacturing and system design.

Automotive Automatic Transmission (AT) Market Dynamics

Based on our research output, there has been a negative impact on the market growth during and post COVID-19 era. The technological developments in AT leading to fuel-efficient engines is notably driving the automotive automatic transmission (AT) market growth, although factors such as the declining use of DCT in the US market may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the automotive automatic transmission (AT) industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Automotive Automatic Transmission (AT) Market Driver

The technological developments in AT leading to fuel-efficient engines is one of the key drivers supporting the automotive automatic transmission (AT) market growth. OEMs are now focusing on improving transmission designs to comply with the norms implemented by regulatory bodies across different countries in the world. Meanwhile, CVTs are improving by delivering better gear shifts with improved fuel efficiency. They also consume less fuel as they are lighter and more compact than standard AT and MT systems. As there are no gears in a CVT transmission system, the engine speed can be changed to harness greater power. In addition, CVT provides quicker acceleration than conventional AT or MT systems. Such advantages of CVT will drive the automotive AT market growth during the forecast period.

Key Automotive Automatic Transmission (AT) Market Trend

The development of auto-shift MT system with adaptive transmission control is one of the key automotive AT market trends contributing to market growth. Primarily, the auto-shift MT system works on the principle of Shift by wire electronic control system, which completely removes the manual gear lever shifting, allowing the driver to keep both hands on the steering wheel. The system basically uses the clutch to start and stop the vehicle, and when the vehicle is in motion. Furthermore, an AT control mechanism that uses an onboard computer to gather information related to the driver's driving pattern and style has been developed, thereby aiding in delivering optimum shift timing for superior performance. Hence, such development will augment the growth of the global automotive AT market during the forecast period.

Key Automotive Automatic Transmission (AT) Market Challenge

The declining use of DCT in the US is one of the factors hampering the automotive AT market growth. There was a time when DCT was highly popular when it entered the US market owing to its better fuel efficiency and faster gear shifts. However, growing issues related to system efficiency and quality of products have led to DCT's downfall in the US automotive market. Further, US consumers are now not able to adapt to a DCT from a manual or AT. In some cases, proper engagement of the gear teeth is also an issue. Hence, the unpleasant experiences with DCT by the US consumers may hinder the growth of the global DCT system market, which in turn will hamper the growth of the global automotive automatic transmission market during the forecast period.

This automotive automatic transmission (AT) market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2022-2026.

Parent Market Analysis

Technavio categorizes the global automotive automatic transmission (AT) market as a part of the global automotive components and accessories market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the automotive automatic transmission (AT) market during the forecast period.

Who are the Major Automotive Automatic Transmission (AT) Market Vendors?

The report analyzes the market's competitive landscape and offers information on several market vendors, including:

- Aisin Corp.

- Allison Transmission Holdings Inc.

- AVL List GmbH

- BorgWarner Inc.

- Eaton Corp. Plc

- EXEDY Corp.

- Grupo KUO SAB de CV

- Hyundai Transys

- Magna International Inc.

- NSK Ltd.

- OC Oerlikon Corp. AG

- Porsche Automobil Holding SE

- Renault sas

- Schaeffler AG

- Valeo SA

- Voith GmbH and Co. KGaA

- WeiChai Holding Group Co. Ltd.

- Xtrac Ltd.

- ZF Friedrichshafen AG

- Aviation Industry Corp. of China Ltd.

This statistical study of the automotive automatic transmission market encompasses successful business strategies deployed by the key vendors. The automotive automatic transmission market is fragmented and the vendors are deploying organic and inorganic growth strategies to compete in the market.

Product Insights and News

- Aisin.com - The company offers automotive automatic transmission such as eAxle, 1 motor hybrid transmission, High Torque Capacity RWD Multi Stage Hybrid Transmission, and Direct Shift CVT.

- Allisontransmission.com - The company offers automotive automatic transmission such as eGen Power series which features fully integrated electric motors, a multi-speed gearbox, an oil cooler, and a pump, providing industry high performance and efficiency.

- Eaton.com - The company offers automotive automatic transmission such as DualTronic Clutch System, and One Way Clutches.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The automotive automatic transmission (AT) market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Automotive Automatic Transmission (AT) Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the automotive automatic transmission market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

Which are the Key Regions for Automotive Automatic Transmission (AT) Market?

For more insights on the market share of various regions Request for a FREE sample now!

52% of the market's growth will originate from APAC during the forecast period. China, Japan, and South Korea are the key markets for the automotive automatic transmission (AT) market in APAC. Market growth in this region will be faster than the growth of the market in other regions.

Improving economic conditions and the evolving automotive industry will facilitate the automotive automatic transmission (AT) market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

In 2020, the regional market witnessed a significant decline in revenue, owing to the outbreak of the COVID-19 pandemic. However, the lifting of lockdowns and proliferation of vaccines stabilized the growth of the market in 2021. Moreover, rising demand for vehicles and investments by major automobile companies in the region will augment the growth of the automotive AT market in APAC during the forecast period.

What are the Revenue-generating Type Segments in the Automotive Automatic Transmission (AT) Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The automotive automatic transmission (AT) market share growth by the hydraulic AT segment will be significant during the forecast period. Modern cars using hydraulic AT systems use sensor-based technology to monitor and detect the throttle position, engine speed, vehicle speed, and load correctly. This has made hydraulic transmission systems more efficient in terms of gear shifts and fuel consumption. Moreover, increasing sales of passenger cars and the rising trend of using light commercial vehicles across developed and developing countries across the globe are expected to propel the growth of the hydraulic AT segment of the global automotive AT transmission market during the forecast period.

This report provides an accurate prediction of the contribution of all the segments to the growth of the automotive automatic transmission market size and actionable market insights on post COVID-19 impact on each segment.

|

Automotive Automatic Transmission (AT) Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.72% |

|

Market growth 2022-2026 |

19250.34 th units |

|

Market structure |

Fragmented |

|

YoY growth (%) |

5.92 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 52% |

|

Key consumer countries |

US, China, Japan, South Korea, and Germany |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Aisin Corp., Allison Transmission Holdings Inc., AVL List GmbH, BorgWarner Inc., Eaton Corp. Plc, EXEDY Corp., Grupo KUO SAB de CV, Hyundai Transys, Magna International Inc., NSK Ltd., OC Oerlikon Corp. AG, Porsche Automobil Holding SE, Renault sas, Schaeffler AG, Valeo SA, Voith GmbH and Co. KGaA, WeiChai Holding Group Co. Ltd., Xtrac Ltd., ZF Friedrichshafen AG, and Aviation Industry Corp. of China Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Automotive Automatic Transmission (AT) Market Report?

- CAGR of the market during the forecast period 2022-2026

- Detailed information on factors that will drive automotive automatic transmission (AT) market growth during the next five years

- Precise estimation of the automotive automatic transmission (AT) market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the automotive automatic transmission (AT) industry across APAC, Europe, North America, South America, and Middle East and Africa

- A thorough analysis of the market's competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of automotive automatic transmission (AT) market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch