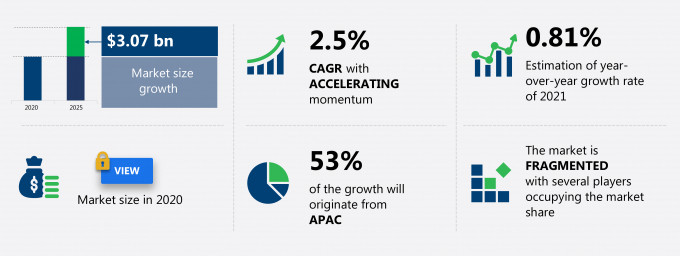

The automotive bumpers market share is expected to increase by USD 3.07 billion from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 2.5%.

This automotive bumpers market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers automotive bumpers market segmentation by material (plastic and others), application (passenger cars and commercial vehicles), and geography (APAC, Europe, North America, South America, and MEA). The automotive bumpers market report also offers information on several market vendors, including Benteler International AG, COMPAGNIE PLASTIC OMNIUM SE, Fab Fours Inc., FLEX-N-GATE Corp., Futaba Industrial Co. Ltd., Hyundai Mobis Co. Ltd., Magna International Inc., SMP Deutschland GmbH, Toray Industries Inc., and Toyota Motor Corp. among others.

What will the Automotive Bumpers Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Automotive Bumpers Market Size for the Forecast Period and Other Important Statistics

Automotive Bumpers Market: Key Drivers, Trends, and Challenges

The government regulations pertaining to vehicle bumpers are notably driving the automotive bumpers market growth, although factors such as increasing cost pressure for OEMs may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the automotive bumpers industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Automotive Bumpers Market Driver

Government regulations pertaining to vehicle bumpers are a major driver fueling the automotive bumpers market growth. Government regulations play a significant role in driving the production of automotive components. Governing bodies of various countries have implemented mandates to ensure that automotive bumpers do not increase damage, rather they absorb maximum impact. For instance, in 2018, the Government of India passed a regulation banning the use of modified vehicle bumpers. Passenger cars in various countries are forbidden to change or modify their stock-fitted automotive bumpers as the modified bumpers might interfere with the effectiveness in which the crumple zone was designed. This increases the chances of the accident's impact on the passenger cabin and may cause serious injury to the vehicle occupants. Additionally, governing bodies of developed regions, such as the US and European countries, have banned the use of metal bumpers within passenger cars, as they increase the intensity of injury to pedestrians. The rising stringency of government regulations regarding vehicle crash tests and vehicle crumple zone designs are expected to drive the adoption of denser automotive bumpers, which are lighter and strong.

Key Automotive Bumpers Market Trend

The development of smart automotive bumpers is a major trend influencing the automotive bumpers market growth. Technological advancement is a major strategy used by automotive manufacturers to develop automotive components with increased functionalities. Automotive manufacturers have developed smart automotive bumpers, which have an integrated radar, a front grill with the de-icing system, a lighting system based on flexible optical fibers, along with impact detection and absorption system. A smart bumper or intelligent bumper is a structure designed to absorb the impact of a road accident and offers protection through various pedestrian safety and driver assistance systems. Automotive OEMs are combining automatic braking systems with pneumatic bumpers that can decrease the amount of personal injury by absorbing a major portion of the force being transmitted to the passenger cabin. The rising penetration of advanced driver assist systems is causing vehicle makers to include smart bumpers as a part of the offering for protecting the relays, radars, cameras, and sensors integrated with the front part of vehicles.

Key Automotive Bumpers Market Challenge

Increasing cost pressure for OEMs is a major hindrance to the automotive bumpers market growth. The development of technology and new fabrics are increasing production costs borne by OEMs. The increasing competition among automotive manufacturers to gain a competitive advantage through product differentiation is forcing manufacturers to install side airbags in addition to frontal airbags. The deployment of side airbags is an addition to the volume of total airbags deployed per vehicle, which raises the procurement costs for OEMs. Adding side airbags is increasing the cost to OEMs from 50% to 70%. The adoption of curtain airbags increases the cost of the vehicle, which automotive OEMs cannot transfer to the buyers due to the increasing intensity of competition. Such factors decrease the profit margin of OEMs and suppliers as the pressure of reducing the cost of these airbags is distributed across the value chain. Hence, OEMs and suppliers should focus on reducing costs to capture a larger market base and remain competitive in the market. Thus, all these factors have the potential to impede the growth of the auto parts and equipment market during the forecast period.

This automotive bumpers market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes the global automotive bumpers market as a part of the global automotive components and accessories market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the automotive bumpers market during the forecast period.

Who are the Major Automotive Bumpers Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Benteler International AG

- COMPAGNIE PLASTIC OMNIUM SE

- Fab Fours Inc.

- FLEX-N-GATE Corp.

- Futaba Industrial Co. Ltd.

- Hyundai Mobis Co. Ltd.

- Magna International Inc.

- SMP Deutschland GmbH

- Toray Industries Inc.

- Toyota Motor Corp.

This statistical study of the automotive bumpers market encompasses successful business strategies deployed by the key vendors. The automotive bumpers market is fragmented and the vendors are deploying various organic and inorganic growth strategies to compete in the market.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The automotive bumpers market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Automotive Bumpers Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the automotive bumpers market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the automotive components and accessories market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Service

- Support activities

- Innovation

The report has further elucidated other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

Which are the Key Regions for Automotive Bumpers Market?

For more insights on the market share of various regions Request for a FREE sample now!

53% of the market’s growth will originate from APAC during the forecast period. China, the US, Germany, Japan, South Korea (Republic of Korea), and India are the key markets for the automotive bumpers market in APAC. Market growth in this region will be faster than the growth of the market in regions.

Government regulations pertaining to vehicle bumpers will facilitate the automotive bumpers market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

The outbreak of COVID-19 negatively impacted the automotive bumpers market in APAC during the first half of 2020. The rising number of COVID-19 cases in the region compelled governments of various countries to restrict international trade and impose lockdowns. The closure of international trading led to a decline in the demand for automotive bumpers from different exporters. In addition, the temporary shutdown of various offline distributors led to a reduction in the sales of automotive bumpers in APAC. In addition, the second wave of the pandemic in the majority of countries in APAC has obstructed auto sales and decreased the demand for automotive bumpers in Q1 2021. However, the reopening of international boundaries for trading is likely to enhance the demand for automotive bumpers in APAC during the forecast period. Furthermore, developed economies in APAC, such as Japan, South Korea, and Australia, were able to control the COVID-19 outbreak in 2020, which was a positive factor for the growth of the market in focus in these countries during the forecast period. China also contained the spread of COVID-19, and manufacturing and retail activities are peaking steadily in the country. Hence, the market in APAC is expected to witness a low impact of the pandemic during the forecast period, which will help in the growth of the regional market.

What are the Revenue-generating Material Segments in the Automotive Bumpers Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The automotive bumpers market share growth in the plastic segment will be significant during the forecast period. Automotive bumpers are integrated with the front and rear ends of vehicles to absorb impact in minor collisions. Automotive bumpers are important components of the automotive front-end and rear-end modules.

This report provides an accurate prediction of the contribution of all the segments to the growth of the automotive bumpers market size and actionable market insights on post COVID-19 impact on each segment.

|

Automotive Bumpers Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.5% |

|

Market growth 2021-2025 |

$ 3.07 billion |

|

Market structure |

Fragmented |

|

YoY growth (%) |

0.81 |

|

Regional analysis |

APAC, Europe, North America, South America, MEA, APAC, Europe, North America, South America, and MEA |

|

Performing market contribution |

APAC at 53% |

|

Key consumer countries |

China, US, Germany, Japan, South Korea (Republic of Korea), and India |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Benteler International AG, COMPAGNIE PLASTIC OMNIUM SE, Fab Fours Inc., FLEX-N-GATE Corp., Futaba Industrial Co. Ltd., Hyundai Mobis Co. Ltd., Magna International Inc., SMP Deutschland GmbH, Toray Industries Inc., and Toyota Motor Corp. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Automotive Bumpers Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive automotive bumpers market growth during the next five years

- Precise estimation of the automotive bumpers market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the automotive bumpers industry across APAC, Europe, North America, South America, MEA, APAC, Europe, North America, South America, and MEA

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of automotive bumpers market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch