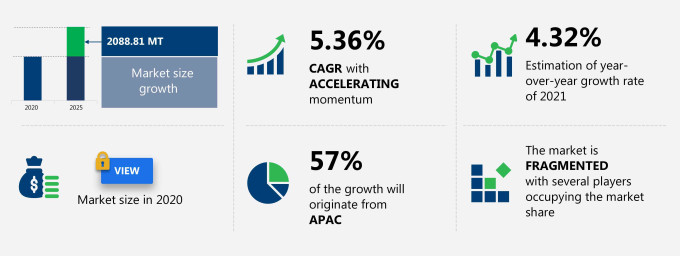

The automotive carbon fiber components market share is expected to increase by 2088.81 MT from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 5.36%. This automotive carbon fiber components market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. The automotive carbon fiber components market report also offers information on several market vendors, including Altair Engineering Inc., DuPont de Nemours Inc., Hexcel Corp., Mitsubishi Chemical Corp., Plasan Carbon Composites Inc., SGL Carbon SE, Solvay SA, Teijin Ltd., Toray Industries Inc., and Voith GmbH & Co. KGaA among others. Furthermore, this report extensively covers automotive carbon fiber components market segmentation by application (powertrain, exterior, and interior) and geography (APAC, Europe, North America, South America, and MEA).

What will the Automotive Carbon Fiber Components Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Automotive Carbon Fiber Components Market Size for the Forecast Period and Other Important Statistics

Automotive Carbon Fiber Components Market: Key Drivers, Trends, and Challenges

Based on our research output, there has been a negative impact on the market growth during and post COVID-19 era. The growing use of carbon fiber materials in the automotive industry is notably driving the automotive carbon fiber components market growth, although factors such as high price of carbon fibers and expensive r&d may impede market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the automotive carbon fiber components industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Automotive Carbon Fiber Components Market Driver

The growing use of carbon fiber materials in the automotive industry is a major driver fueling the automotive carbon fiber components market growth. Carbon fibers are highly preferred materials for automotive applications owing to their high strength-to-weight ratio to metals, and because of this fact, they are 20% lighter than conventional materials, such as aluminum and titanium. This property of carbon fibers offers fuel efficiency and improves agility, maneuverability, and vehicle safety. Carbon fibers have wide applications in performance sports cars and SUVs. The rise in demand for supercars and the growing popularity of hypercars are fueling the sales of the global automotive carbon fiber components market. The properties of reinforced carbon fiber such as light-weightiness, high stiffness, strength, and outstanding fatigue and abrasion resistance have increased the scope of its use in various sports car components. The application of carbon fibers is increasing in the automotive industry, with the growing integration of reinforced carbon fiber body panels and monocoque chassis in numerous high-performance cars and few SUVs. In addition, different forms of carbon fiber, such as epoxy-based carbon fibers, are used in automotive applications for enhanced toughness. Carbon fibers used, along with bismaleimide-based products, offer high thermal resistance. All these factors are driving the use of carbon fibers in automotive component designs.

Key Automotive Carbon Fiber Components Market Trend

The growing use of nanotechnology in drive shafts for better performance is another driver of automotive carbon fiber components market growth. The axial and hoop moduli of carbon fiber materials, such as drive shaft, do not depend only on the winding pattern but also on the resin matrix modulus, which affects the lamina transverse and shear stiffness strongly. The use of nanotechnology in carbon fiber materials will improve their performance by increasing the component's longitudinal and hoop stiffness for a specific winding pattern. For instance, QA1, which is one of the automotive drive shaft manufacturers, has worked closely with 3M Aerospace and Commercial Transportation Division for testing and developing a 3M's 4831 epoxy. It contains silica nanoparticles such as Nano silica, which increase the shaft's longitudinal and hoop stiffness for a fixed winding pattern, fiber type, and fiber content. 4831 epoxy can be used to manufacture an automotive component that is more durable and has greater abrasion resistance than the components made with an unmodified resin. The company has used T700 standard-modulus polyacrylonitrile carbon fiber, whereas other types of fiber are under evaluation. The company has researched the use of high-stiffness, pitch-based carbon fiber, and a combination of fibers of different modules in a single part to increase the performance. Though this incurs high manufacturing costs, the demand for high performance can be achieved without any compromise. This trend is expected to positively impact the global automotive carbon fiber components market during the forecast period.

Key Automotive Carbon Fiber Components Market Challenge

The increasing application of advanced manufacturing technologies is a major hindrance to automotive carbon fiber components market growth. The high costs associated with the design and development of carbon fibers limit their applications across the global automotive industry. The R&D and manufacturing of carbon fibers are highly expensive than that of other conventional materials such as cast iron or steel. Rising prices of raw materials such as resins and carbon fibers have increased the procurement costs for vendors. A minor share of the increased procurement costs is absorbed by vendors of carbon fibers, with the major share being translated to higher prices for customers. Hence, this is foreseen to be a challenge in the future. Moreover, the large volume production of these products can become challenging with the increasing demand. Technological advances have enabled the automated production processes of carbon fibers. However, manual processes dominate the market and contribute to increased product costs, thereby hindering the wide-scale adoption of carbon fiber components. Moreover, with the increasing demand from automotive applications, the large volume production of carbon fibers at economical prices will become a challenge.

This automotive carbon fiber components market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes the global automotive carbon fiber components market as a part of the global automotive components and accessories market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the automotive carbon fiber components market during the forecast period.

Who are the Major Automotive Carbon Fiber Components Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Altair Engineering Inc.

- DuPont de Nemours Inc.

- Hexcel Corp.

- Mitsubishi Chemical Corp.

- Plasan Carbon Composites Inc.

- SGL Carbon SE

- Solvay SA

- Teijin Ltd.

- Toray Industries Inc.

- Voith GmbH & Co. KGaA

This statistical study of the automotive carbon fiber components market encompasses successful business strategies deployed by the key vendors. The automotive carbon fiber components market is fragmented and the vendors are deploying growth strategies such as product launches and business expansions to compete in the market.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The automotive carbon fiber components market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Automotive Carbon Fiber Components Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the automotive carbon fiber components market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the global automotive components and accessories market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Service

- Support activities

- Innovation

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

Which are the Key Regions for Automotive Carbon Fiber Components Market?

For more insights on the market share of various regions Request for a FREE sample now!

57% of the market’s growth will originate from APAC during the forecast period. China, Japan, and India are the key markets for automotive carbon fiber components in APAC. Market growth in APAC will be faster than the growth of the market in other regions.

The high automobile production in China, Japan, and India will facilitate the automotive carbon fiber components market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

The outbreak of COVID-19 negatively impacted the automotive carbon fiber components market in APAC during the first half of 2020. The rising number of COVID-19 cases in the region compelled governments of various countries to restrict international trade and impose lockdowns. The closure of international trading led to a decline in the demand for automotive carbon fiber components from different exporters. In addition, the temporary shutdown of various offline distributors led to a reduction in the sales of automotive carbon fiber components in APAC. In addition, the second wave of the pandemic in many countries in the region has obstructed auto sales and decreased the demand for automotive carbon fiber components in Q1 2021. However, the reopening of international boundaries for trading is likely to enhance the demand for automotive carbon fiber components in APAC during the forecast period.

What are the Revenue-generating Application Segments in the Automotive Carbon Fiber Components Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The automotive carbon fiber components market share growth by the powertrain segment will be significant during the forecast period. Among carbon fibers, metal metrics, and ceramic metrics composites, carbon fibers are mostly used for the manufacturing of powertrains and structural components. Government and environmental regulations such as the Kyoto protocol and corporate average fuel economy (CAFÉ) are promoting the development of hybrid powertrains, which are likely to drive the global carbon fiber components market by powertrain during the forecast period.

This report provides an accurate prediction of the contribution of all the segments to the growth of the automotive carbon fiber components market size and actionable market insights on post COVID-19 impact on each segment.

|

Automotive Carbon Fiber Components Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.36% |

|

Market growth 2021-2025 |

2088.81 MT |

|

Market structure |

Fragmented |

|

YoY growth (%) |

4.32 |

|

Regional analysis |

APAC, Europe, North America, South America, and MEA |

|

Performing market contribution |

APAC at 57% |

|

Key consumer countries |

China, US, Japan, Germany, and India |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Altair Engineering Inc., DuPont de Nemours Inc., Hexcel Corp., Mitsubishi Chemical Corp., Plasan Carbon Composites Inc., SGL Carbon SE, Solvay SA, Teijin Ltd., Toray Industries Inc., and Voith GmbH & Co. KGaA |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Automotive Carbon Fiber Components Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive automotive carbon fiber components market growth during the next five years

- Precise estimation of the automotive carbon fiber components market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the automotive carbon fiber components industry across APAC, Europe, North America, South America, and MEA

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of automotive carbon fiber components market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch