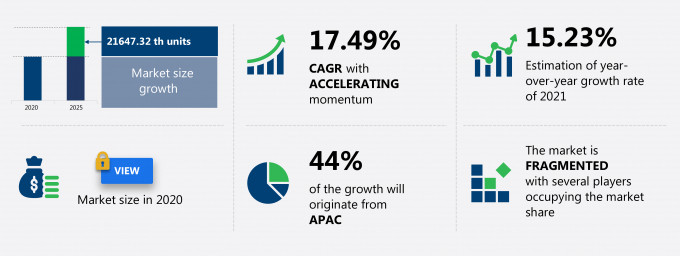

The automotive e-retail market share is expected to increase by 21647.32 thousand units from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 17.49%.

This automotive e-retail market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers automotive e-retail market segmentations by product (passenger cars and two-wheelers) and geography (North America, APAC, Europe, South America, and MEA). The automotive e-retail market report also offers information on several market vendors, including Alibaba Group Holding Ltd., Asbury Automotive Group Inc., AutoNation Inc., eBay Inc., Group 1 Automotive Inc., Hendrick Automotive Group, Lithia Motors Inc., Penske Corp., Scout24 AG, and TrueCar Inc. among others.

What will the Automotive E-retail Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Automotive E-retail Market Size for the Forecast Period and Other Important Statistics

Automotive E-retail Market: Key Drivers, Trends, and Challenges

Based on our research output, there has been a positive impact on the market growth during and post COVID-19 era. The ease and convenience of buying cars and two-wheelers online is notably driving the automotive e-retail market growth, although factors such as cost pressure on vendors due to price sensitivity may impede market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the automotive e-retail industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Automotive E-retail Market Driver

The ease and convenience of buying cars and two-wheelers online is a major factor driving the global automotive e-retail market share growth. The advantages and benefits associated with buying cars and two-wheelers online drive the growth of the global automotive e-retail market. The emergence of various e-commerce platforms has increased the sales of several products. Most products and services can be purchased online due to the wide penetration of e-commerce companies in various industries, such as electronics, apparel, groceries, and automobiles. Several new automotive retailers launched their e-commerce platforms in the last decade. The number of automotive retailers that sell cars increased due to a rise in Internet penetration, improvements in infrastructure, and changes in customer lifestyle. Customers prefer purchasing vehicles online due to convenience. They do not have to visit dealerships to compare vehicles, test drive their choices, and seek advice about financing options. On online platforms, customers can select vehicles, compare features and specifications, and request for a test drive. Most vendors allow customers to trade-in or sell their old vehicles. They also provide financing options such as EMIs and accept full online payments. Such benefits drive the growth of the global automotive e-retail market.

Key Automotive E-retail Market Trend

The popularity of automotive e-retail in APAC is another factor supporting the global automotive e-retail market share growth. APAC dominates global e-commerce sales. The presence of a large consumer base, the untapped of the market, improvements in infrastructure, increasing disposable incomes and improvements in socioeconomic conditions drive the growth of the e-commerce market in APAC. The popularity of automotive e-retail is increasing in the region, especially in fast-growing automotive markets such as China and India. For instance, Alibaba, an online retailer that is based in China, now provides vehicles on its online platform. Customers in China can book or buy new vehicles through the company's website. Several electric vehicle manufacturers that are in China have partnered with Alibaba to sell their vehicles online as the demand for electric vehicles is high in the country, which is the largest market in the world. In India, online retailers such as Paytm offer customers the option to book new vehicles of various brands through their online portal. Paytm offers various models of brands such as RIPL and Tata Motors Ltd. The popularity of online vehicle sales is expected to result in several e-commerce companies selling vehicles online, which will drive the growth of the market during the forecast period.

Key Automotive E-retail Market Challenge

The cost pressure on vendors due to price sensitivity will be a major challenge for the global automotive e-retail market share growth during the forecast period. Vendors are facing cost pressure, amid intense competition, to gain a competitive advantage. They are looking to attract new customers as well as increase sales by offering lower selling prices and discounts. However, such strategies of vendors are increasing cost pressure, which is a challenge for the growth of the market. Digitalization and improvements in Internet connectivity have widened the availability of options for customers, which can also be observed in the global automotive e-retail market, where price sensitivity is a major challenge due to the competitive pricing strategy of vendors. Competitive pricing is causing cost pressure on vendors and decreasing their operating margins. The management of inventory levels, operational costs, and human resources is also causing cost pressure. Cost pressure is also increasing due to intense competition. Therefore, cost pressure is a challenge for the growth of the global automotive e-retail market.

This automotive e-retail market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes the global automotive e-retail market as a part of the global internet and direct marketing retail market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the automotive e-retail market during the forecast period.

Who are the Major Automotive E-retail Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Alibaba Group Holding Ltd.

- Asbury Automotive Group Inc.

- AutoNation Inc.

- eBay Inc.

- Group 1 Automotive Inc.

- Hendrick Automotive Group

- Lithia Motors Inc.

- Penske Corp.

- Scout24 AG

- TrueCar Inc.

This statistical study of the automotive e-retail market encompasses successful business strategies deployed by the key vendors. The automotive e-retail market is fragmented and the vendors are deploying organic and inorganic growth strategies to compete in the market.

Product Insights and News

- Alibaba Group Holding Ltd.- The company offers platform to purchase ready to ship auto accessories with variety of categories which includes saftey and entertainment, tuning and upgrades, outdoor and travel, gifts, decoration and protection.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The automotive e-retail market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Automotive E-retail Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the automotive e-retail market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of global internet and direct marketing retail market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Service

- Support activities

- Innovation

The report has further elucidated on other innovative approaches being followed by service providers to ensure a sustainable market presence.

Which are the Key Regions for Automotive E-retail Market?

For more insights on the market share of various regions Request for a FREE sample now!

44% of the market’s growth will originate from APAC during the forecast period. China and India are the key markets for automotive e-retail market in APAC. Market growth in this region will be faster than the growth of the market in all other regions.

Intense competition leading to competitive pricing will facilitate the automotive e-retail market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

What are the Revenue-generating Product Segments in the Automotive E-retail Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The automotive e-retail market share growth by the passenger cars segment will be significant during the forecast period. The dominance of the segment is owing to the high demand for passenger cars across the world. The higher selling price of passenger cars than two-wheelers ensures that the segment contributes a major share of revenue to the global automotive e-retail market.

This report provides an accurate prediction of the contribution of all the segments to the growth of the automotive e-retail market size and actionable market insights on post COVID-19 impact on each segment.

|

Automotive E-retail Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 17.49% |

|

Market growth 2021-2025 |

21647.32 th units |

|

Market structure |

Fragmented |

|

YoY growth (%) |

15.23 |

|

Regional analysis |

North America, APAC, Europe, South America, and MEA |

|

Performing market contribution |

APAC at 44% |

|

Key consumer countries |

US, China, Canada, India, and Germany |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

Alibaba Group Holding Ltd., Asbury Automotive Group Inc., AutoNation Inc., eBay Inc., Group 1 Automotive Inc., Hendrick Automotive Group, Lithia Motors Inc., Penske Corp., Scout24 AG, and TrueCar Inc. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Automotive E-retail Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive automotive e-retail market growth during the next five years

- Precise estimation of the automotive e-retail market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the automotive e-retail industry across North America, APAC, Europe, South America, and MEA

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of automotive e-retail market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch