Automotive Image Sensors Market Size 2024-2028

The automotive image sensors market size is forecast to increase by USD 19.92 billion at a CAGR of 41.64% between 2023 and 2028.

- The market is experiencing steady growth due to the increasing adoption of camera-based Advanced Driver-Assistance Systems (ADAS). This trend is expected to continue as automakers prioritize safety features in response to regulatory requirements and consumer demand. Another growth factor is the development of high-sensitivity CMOS image sensors with LED flicker mitigation, which enhance image quality and improve the performance of ADAS. However, the high replacement costs associated with these advanced sensors pose a challenge for market growth. Despite this, the market is anticipated to witness significant progress as technology advances and costs decrease. The market analysis report provides a comprehensive study of these trends and growth factors, offering valuable insights for stakeholders In the automotive industry.

What will be the Size of the Automotive Image Sensors Market During the Forecast Period?

- The market is experiencing significant growth due to the increasing demand for advanced driver-assistance systems (ADAS) in vehicles. Automakers are integrating image sensors into various applications, including blind-spot monitoring, parking assistance, and pedestrian detection, to enhance safety and comfort for drivers and passengers. The adoption of autonomous vehicles is further driving market expansion, with cameras, lidar, and radar technologies being key components. Image sensors are also integral to vehicle authentication and driver safety features. Advanced technologies such as lidar technology, compact sensors, energy-efficient sensors, and IoT sensor platforms are gaining popularity In the market. CCD and CMOS image sensors continue to dominate the market, but new innovations like ISocell Auto 4AC, KBV Cardinal Matrix, and Xensiv TLE4971 sensor are emerging.

- Autonomous and electric vehicles (EVs/HEVs) are expected to significantly impact the market, as they rely heavily on image sensors for perception and navigation. Adaptive cruise control, lane-keeping assist, automatic emergency braking, and other advanced features are becoming standard in modern vehicles, further increasing the demand for image sensors. Overall, the market is poised for continued growth as automakers strive to reduce CO2 emissions and improve vehicle safety and comfort.

How is this Automotive Image Sensors Industry segmented and which is the largest segment?

The automotive image sensors industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Passenger cars

- Commercial cars

- Type

- CCD

- CMOS

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- APAC

- China

- Middle East and Africa

- South America

- North America

By Application Insights

- The passenger cars segment is estimated to witness significant growth during the forecast period.

The commercial vehicle (CV) segment In the automotive market is witnessing significant growth due to the increasing focus on safety technologies. CV Original Equipment Manufacturers (OEMs) such as Daimler, Scania, DAF, Iveco, MAN, Volvo, and Scania are prioritizing safety In their manufacturing processes. This trend has led to the integration of advanced driver-assistance systems (ADAS) in CVs, which in turn is driving the demand for automotive image sensors. These sensors enable vehicle authentication, driver safety, comfort, and CO2 emissions reduction in CVs. Moreover, the increasing adoption of electric vehicles (EVs) and hybrid vehicles (HVs) In the CV segment is further fueling the market growth.

Product development in energy-efficient and cost-effective sensors, as well as the integration of LiDAR technology using compact sensors and solid-state LiDAR, is expected to provide significant opportunities for market players.

Get a glance at the Automotive Image Sensors Industry report of share of various segments Request Free Sample

The Passenger cars segment was valued at USD 1.44 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

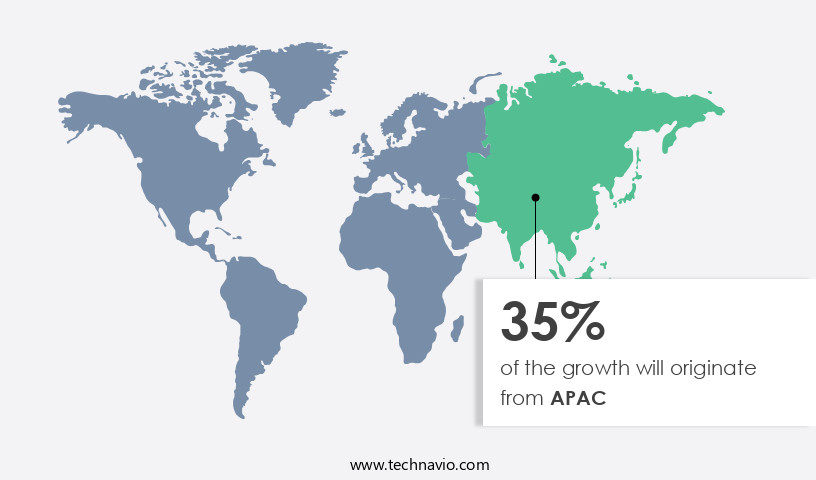

- APAC is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The automotive image sensor market in North America is experiencing growth due to the increasing production of passenger cars and light commercial vehicles (LCVs) equipped with advanced driver assistance systems (ADAS), lane departure warning, blind-spot detection, and collision avoidance systems. Major North American vehicle manufacturers, such as Ford and General Motors, are focusing on producing high-performance pickup trucks, SUVs, and crossovers, which are in high demand and contribute significantly to their sales revenue. These vehicles are designed to withstand extreme temperatures, vibrations, dust, and harsh environments, making high-reliability and durable image sensors essential. Technology advances, including automation of vehicles, data collection, and data analysis, are further driving market growth.

Market Dynamics

Our automotive image sensors market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Automotive Image Sensors Industry?

Steady growth of camera-based ADAS market is the key driver of the market.

- The market is experiencing significant growth due to the increasing demand for advanced driver-assistance systems (ADAS) in passenger vehicles, commercial vehicles, and electric vehicles (EVs) and hybrid vehicles (HVs). Automakers are integrating various camera-based ADAS technologies, including blind-spot monitoring, parking assistance, and pedestrian detection, to enhance vehicle safety and improve comfort. High-quality image sensors, such as CMOS and CCD technology-based sensors, play a crucial role In these applications. Technological advancements, including LiDAR technology, solid-state LiDAR, and MEMS accelerometers, are driving efficiency gains and process optimization In the development of cutting-edge products. Regulations and performance standards are also pushing the market forward, as vehicle safety becomes a top priority.

- The demand for real-time insights, battery health monitoring, temperature control, and charging status information is increasing, leading to the development of energy-efficient and cost-effective sensors. In-car infotainment, navigation, connectivity features, and engine management systems are also driving the market, as automakers seek to provide a more comfortable and convenient driving experience. Despite the high price tag, the market is expected to grow due to the increasing demand for safety features and autonomous driving technology. Tier-1 companies, such as Robert Bosch GmbH, ON Semiconductor, OMNIVISION, and TE Connectivity, are investing heavily in R&D and customization to meet the evolving needs of the market.

- The market is also witnessing growth In the aftermarket, as older vehicles are being retrofitted with telematics devices and parking sensors. The development of battery monitoring systems and solar charging systems is also providing opportunities for growth In the aftermarket. The market is expected to continue growing due to technology advances, the automation of vehicles, and the increasing demand for high-performance sensors. Data collection and analysis are also becoming crucial for improving fuel economy, lowering emissions, and optimizing performance. Reliability and durability are essential considerations, as sensors must perform effectively in extreme temperatures, vibrations, and harsh environments.

What are the market trends shaping the Automotive Image Sensors Industry?

Development of high-sensitivity CMOS image sensor with LED flicker mitigation is the upcoming market trend.

- The automotive industry's shift towards advanced driver-assistance systems (ADAS) and autonomous vehicles has led to a significant increase In the demand for high-quality image sensors. Automakers are integrating image sensors into various safety features such as blind-spot monitoring, parking assistance, and pedestrian detection. Technological advancements in image sensors, including the transition from CCD to CMOS technology, have resulted in more cost-effective and energy-efficient sensors. Prominent suppliers like Robert Bosch GmbH, ON Semiconductor, OMNIVISION, and TE Connectivity are investing in product development and strategic alliances to meet this demand. High-performance sensors, such as solid-state LiDAR and CMOS image sensors, are crucial for 3D mapping and object detection capabilities in autonomous vehicles.

- These sensors provide real-time insights into the vehicle's surroundings, enabling features like adaptive cruise control, lane-keeping assist, and automatic emergency braking. Regulations and performance standards continue to drive the market, with a focus on vehicle safety, control applications, fuel efficiency, and emission control. The high price tag of these sensors presents a challenge, but the potential for aftermarket opportunities, including parking sensors, battery monitoring systems, and solar charging systems, offers growth potential. The industry is also exploring the use of compact sensors, MEMS accelerometers, and efficiency gains through process optimization and cutting-edge products. The future of the market lies In the development of advanced driver-assistance systems, autonomous cars, and the integration of 5G network technologies and IoT sensor platforms.

- As the market continues to evolve, the focus will be on reliability, durability, and extreme temperature, vibration, and dust resistance.

What challenges does Automotive Image Sensors Industry face during the growth?

High replacement costs is a key challenge affecting the industry growth.

- The market is experiencing significant growth due to the increasing demand for advanced safety features in vehicles. Automakers are integrating image sensors into blind-spot monitoring, parking assistance, pedestrian detection, and autonomous vehicles systems. High-quality image sensors, such as CMOS and CCD technology, are essential for these applications, providing real-time insights into the vehicle's surroundings. Technological advancements, including LiDAR technology, compact sensors, energy-efficient sensors, and solid-state LiDAR, are driving efficiency gains and process optimization. Regulations and safety concerns are also fueling the market's growth. Vehicle demand for safety features like lane departure warning, blind-spot detection, and collision avoidance systems is increasing.

- Moreover, the integration of image sensors in electric vehicles (EVs) and hybrid vehicles (HVs) for battery monitoring systems, solar charging systems, and aftermarket car modifications is expanding the market's scope. Product development, strategic alliances, and customization are key trends In the market. Tier-1 companies like Robert Bosch GmbH, ON Semiconductor, OMNIVISION, TE Connectivity, and others are investing in research and development to bring cutting-edge products to market. The market's future growth will depend on regulatory requirements, performance standards, and aftermarket opportunities. Automotive image sensors are also used for in-car infotainment, navigation, connectivity features, and engine management. The high price tag of these sensors is a challenge, but the demand for safety and comfort features is driving up unit costs.

- Mass production and economies of scale are expected to bring down costs In the future. In conclusion, the market is a critical component of the automotive industry, driving advancements in safety, comfort, and connectivity. The market's growth is fueled by regulatory requirements, safety concerns, and technological advancements. The future of the market lies In the integration of image sensors in autonomous vehicles, electric vehicles, and hybrid vehicles, providing real-time insights into the vehicle's surroundings and enhancing the driving experience.

Exclusive Customer Landscape

The automotive image sensors market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive image sensors market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive image sensors market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Canon Inc. - The company provides advanced automotive image sensors, catering to the US market. These sensors, integral to sports applications, ensure superior image quality and real-time data processing. By leveraging cutting-edge technology, our sensors enhance vehicle safety, improve driver assistance systems, and support autonomous driving features. Our commitment to innovation and quality sets US apart In the competitive automotive industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Canon Inc.

- Continental AG

- DENSO Corp.

- Gentex Corp.

- Infineon Technologies AG

- NXP Semiconductors N.V.

- OmniVision Technologies Inc.

- ON Semiconductor Corp.

- PixArt Imaging Inc.

- PIXELPLUS Co. Ltd.

- Samsung Electronics Co. Ltd.

- Sharp Corp.

- SK hynix Co. Ltd.

- Smartway Shanghais Electronic Technology Co. Ltd.

- Sony Group Corp.

- STMicroelectronics International N.V.

- Taiwan Semiconductor Manufacturing Co. Ltd.

- Teledyne Technologies Inc.

- Texas Instruments Inc.

- Toshiba Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for advanced safety features in vehicles. These sensors play a crucial role in various applications such as blind-spot monitoring, parking assistance, and pedestrian detection. The integration of these sensors in autonomous vehicles is further propelling the market's expansion. Image sensors are essential components in various vehicle systems, including cameras, lidar, and radar. High-quality image sensors are crucial for capturing clear and accurate data, enabling advanced driver-assistance systems (ADAS) to function effectively. The technological advancements in image sensors, such as CMOS and CCD technology, have led to the development of compact, energy-efficient, and cost-effective sensors.

Regulations and performance standards are driving the adoption of image sensors in vehicles. Safety features like lane departure warning, blind-spot detection, and collision avoidance systems are becoming mandatory in many regions. Moreover, the increasing demand for electric and hybrid vehicles (EVs and HVS) is leading to the development of battery monitoring systems, solar charging systems, and aftermarket car modifications that require image sensors. The market is witnessing significant research and development efforts to meet the evolving demands of the industry. Companies are investing in testing, prototyping, and sensor designs to create cutting-edge products that offer real-time insights, battery health monitoring, temperature control, and charging status.

The market is also witnessing strategic alliances and partnerships to enhance product development and customization capabilities. The market dynamics of the automotive image sensors industry are influenced by various factors, including regulatory requirements, performance standards, and aftermarket opportunities. The high price tag of these sensors is a significant challenge, but the demand for safety and comfort features is driving the market's growth. The market is also witnessing the automation of vehicles, leading to the development of high-performance sensors for autonomous cars and autopilot applications. The market for automotive image sensors is diverse, catering to passenger vehicles, commercial vehicles, and electric vehicles.

The market is also witnessing the development of solid-state lidar, CMOS image sensors, MEMS accelerometers, and other advanced sensor technologies. These sensors offer efficiency gains, process optimization, and cost savings, making them attractive to automakers and consumers alike. The market for automotive image sensors is expected to grow significantly In the coming years, driven by the increasing demand for safety features, regulatory requirements, and technological advancements. The market is also witnessing the integration of image sensors in various vehicle systems, including engine management, comfort features, and in-car infotainment. The market is expected to offer significant opportunities for companies that can offer reliable, durable, and high-performance sensors that can operate in extreme temperatures, harsh environments, and under vibrations and dust.

In conclusion, the market is a dynamic and growing industry, driven by the increasing demand for advanced safety features, regulatory requirements, and technological advancements. The market is witnessing significant research and development efforts to create compact, energy-efficient, and cost-effective sensors that offer real-time insights, battery health monitoring, temperature control, and charging status. The market is expected to offer significant opportunities for companies that can offer reliable, durable, and high-performance sensors that can operate in extreme temperatures, harsh environments, and under vibrations and dust.

|

Automotive Image Sensors Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

181 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 41.64% |

|

Market growth 2024-2028 |

USD 19924.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

30.47 |

|

Key countries |

US, China, France, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Image Sensors Market Research and Growth Report?

- CAGR of the Automotive Image Sensors industry during the forecast period

- Detailed information on factors that will drive the Automotive Image Sensors growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive image sensors market growth of industry companies

We can help! Our analysts can customize this automotive image sensors market research report to meet your requirements.