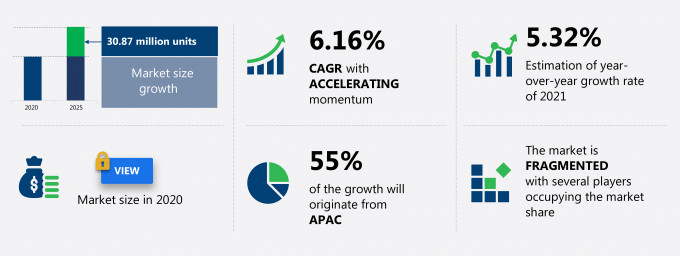

The automotive instrument panel market share is expected to increase by 30.87 million units from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 6.16%.

This automotive instrument panel market research report provides valuable insights on the post-COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers automotive instrument panel market segmentation by application (passenger cars and commercial vehicles) and geography (APAC, North America, Europe, South America, and MEA). The automotive instrument panel market report also offers information on several market vendors, including Continental AG, DENSO Corp., Faurecia SE, IAV GmbH, International Automotive Components Group SA, Johnson Controls International Plc, Marelli Holdings Co. Ltd., Motherson Sumi Systems Ltd., Nihon Plast Co. Ltd, and Robert Bosch GmbH among others.

What will the Automotive Instrument Panel Market Size be During the Forecast Period?

Download Report Sample to Unlock the Automotive Instrument Panel Market Size for the Forecast Period and Other Important Statistics

Automotive Instrument Panel Market: Key Drivers, Trends, and Challenges

The demand for advanced vehicle features in safety and comfort controls is notably driving the automotive instrument panel market growth, although factors such as a rise in car-sharing or pooling services in several countries may impede the market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the automotive instrument panel industry. The holistic analysis of the drivers will help deduce end goals and refine marketing strategies to gain a competitive edge.

Key Automotive Instrument Panel Market Driver

Demand for advanced vehicle features in display and infotainment is one of the major drivers impacting the automotive instrument panel market. During 2006-2010, the infotainment market witnessed advancements in technology and the introduction of telematics with phone integration and navigation systems. Currently, the systems are shifting toward embedded and phone-based applications. Some of the leading automobile manufacturers, such as Volkswagen, Ford, Mahindra and Mahindra, Tata Motors, and General Motors, are collaborating with in-vehicle infotainment systems and software manufacturers to provide infotainment solutions in mid-range vehicles. The demand for mid-range vehicles is increasing in APAC, especially in India and China, owing to the improving economic conditions in these countries, which are increasing the disposable income of consumers. Therefore, the demand for telematics, which includes navigation systems and wireless connectivity, is increasing in mid-range vehicles. This, in turn, is expected to boost the market focus significantly during the forecast period.

Key Automotive Instrument Panel Market Trend

Product developments and innovations in the design of instrument panels are one of the major trends influencing the automotive instrument panel market. Advancements in technology and product innovations are changing the global automotive instrument panel market. Automobile instrument panels are now being equipped with additional features, such as ashtrays, larger glove boxes, defrost systems, airbags, and air outlets. Therefore, the housing requirements for instrument panels are on the rise. Vendors are investing in the development of new products and technologies to be competitive in the market, thereby creating demand from various segments. They are focusing on expanding product portfolios and increasingly investing in developing instrument panel materials with specific properties for specific end-user applications. Increased competition in the market has also resulted in innovations in products, cost-effective production, and equipment used for production, which favor market growth.

Key Automotive Instrument Panel Market Challenge

The rise in car-sharing or pooling services in several countries is one of the major challenges impeding the automotive instrument panel market. People who need to commute can choose to carpool and reach their destination without owning a car. Sharing allows the users to avoid the investment needed to buy the vehicle. Instead, the users can pay for the service only when needed. With carpooling gaining popularity, it is expected that the vehicle's sales may go down during the forecast period. Moreover, the rising cost of fuel and stringent emissions regulations are encouraging carpooling, thereby reducing the number of vehicle sales and posing a challenge to the automotive instrument panel market. The growth of international tourism will impact the global automotive instrument panel market. In 2019, the tourism industry witnessed significant growth globally, which resulted in more than 400 million tourists across the world. Tourists prefer various ridesharing service apps, such as Uber, Lyft, and Gett, for their commute. Hence, the increasing number of tourists will impact the global demand for vehicles, which in turn will drive global automotive sales, as well as the global automotive instrument panel market.

This automotive instrument panel market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes the global automotive instrument panel market as a part of the global automotive components and accessories market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the automotive instrument panel market during the forecast period.

Who are the Major Automotive Instrument Panel Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- Continental AG

- DENSO Corp.

- Faurecia SE

- IAV GmbH

- International Automotive Components Group SA

- Johnson Controls International Plc

- Marelli Holdings Co. Ltd.

- Motherson Sumi Systems Ltd.

- Nihon Plast Co. Ltd

- Robert Bosch GmbH

This statistical study of the automotive instrument panel market encompasses successful business strategies deployed by the key vendors. The automotive instrument panel market is fragmented and the vendors are deploying growth strategies such as product innovation to compete in the market.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The automotive instrument panel market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Automotive Instrument Panel Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the automotive instrument panel market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of the automotive components and accessories market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Service

- Support activities

- Innovation

The report has further elucidated other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

Which are the Key Regions for Automotive Instrument Panel Market?

For more insights on the market share of various regions Request PDF Sample now!

55% of the market’s growth will originate from APAC during the forecast period. China, Japan, and South Korea (Republic of Korea) are the key markets for the automotive instrument panel market in APAC. Market growth in this region will be faster than the growth of the market in other regions.

Government incentives, low costs, and raw material advantages will facilitate the automotive instrument panel market growth in APAC over the forecast period. To garner further competitive intelligence and regional opportunities in store for vendors, which will assist in creating efficient business plans.

COVID Impact and Recovery Analysis

The APAC market witnessed a significant decline in revenue, owing to the outbreak of the COVID-19 pandemic in 2020. In addition, automotive sales dropped, which led to a decline in the demand for instrument panels. However, in the last quarter of 2020, many countries in APAC lifted the restrictions on various businesses. The vendors were then able to resume their routine operations by adhering to the COVID-19 guidelines. Vendors mandated social distancing and restricted the entry of non-essential visitors to their facilities. In-person interactions in workplaces were limited, and daily temperature monitoring was mandated at the entry points. Such initiatives are expected to help vendors remain operational and allow the market to recover slowly during the forecast period. The easing of lockdown restrictions and usage of COVID vaccines are expected to promote the sales of the automotive instrument panels in APAC, which will drive the growth of the market focus during the forecast period.

What are the Revenue-generating Application Segments in the Automotive Instrument Panel Market?

To gain further insights on the market contribution of various segments Request PDF Sample

The automotive instrument panel market share growth in the passenger cars segment will be significant during the forecast period. The primary reason for the global automotive instrument panel market earning more revenue from passenger cars is their higher production and sales volume in the global automotive market. The increasing demand for safety and comfort features in passenger cars and the strong focus of OEMs on product differentiation drive the global automotive instrument panel market.

This report provides an accurate prediction of the contribution of all the segments to the growth of the automotive instrument panel market size and actionable market insights on the post-COVID-19 impact on each segment.

|

Automotive Instrument Panel Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.16% |

|

Market growth 2021-2025 |

30.87 million units |

|

Market structure |

Fragmented |

|

YoY growth (%) |

5.32 |

|

Regional analysis |

APAC, North America, Europe, South America, and MEA |

|

Performing market contribution |

APAC at 55% |

|

Key consumer countries |

China, US, Japan, Germany, and South Korea (Republic of Korea) |

|

Competitive landscape |

Leading companies, Competitive Strategies, Consumer engagement scope |

|

Key companies profiled |

Continental AG, DENSO Corp., Faurecia SE, IAV GmbH, International Automotive Components Group SA, Johnson Controls International Plc, Marelli Holdings Co. Ltd., Motherson Sumi Systems Ltd., Nihon Plast Co. Ltd, and Robert Bosch GmbH |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for the forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Automotive Instrument Panel Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive automotive instrument panel market growth during the next five years

- Precise estimation of the automotive instrument panel market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the automotive instrument panel industry across APAC, North America, Europe, South America, and MEA

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of automotive instrument panel market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch