Automotive LiDAR Sensors Market Size 2024-2028

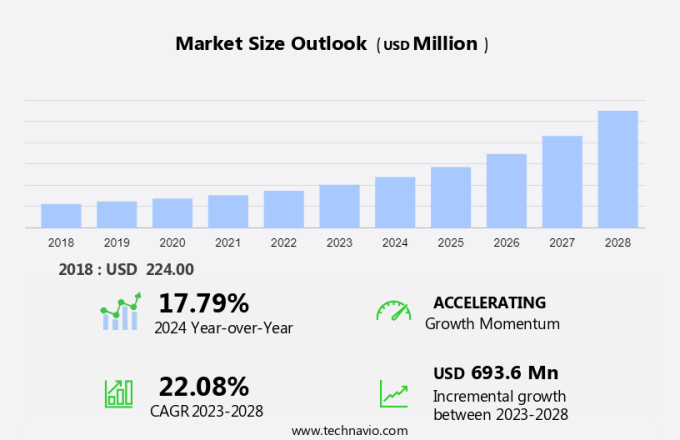

The automotive LiDAR sensors market size is forecast to increase by USD 693.6 million at a CAGR of 22.08% between 2023 and 2028. The market is experiencing significant growth due to the advancements in autonomous vehicle technology. Image type and vehicle type are two essential factors driving market growth. Image type includes LiDAR sensors that offer 3D point cloud data, which is crucial for autonomous vehicles to perceive their environment accurately. Vehicle types include passenger cars, commercial vehicles, and two-wheelers. Two leading LiDAR sensor technologies are Frequency-modulated-continuous-wave (FMCW) and solid-state. FMCW LiDAR sensors offer longer range and higher resolution, making them suitable for autonomous vehicles. Solid-state LiDAR sensors, on the other hand, are compact and cost-effective, making them ideal for mass-market applications.

The automotive industry is witnessing significant advancements in technology, with a focus on enhancing safety and enabling autonomous driving. One of the key remote sensing techniques gaining traction in this regard is the use of Automotive Lidar Scanners. These sensors employ Light Detection and Ranging (Lidar) technology to generate high-resolution 3D images of the environment surrounding a vehicle. Automotive Lidar sensors play a crucial role in autonomous vehicles by providing real-time data points to create a detailed map of the vehicle's surroundings. This data is essential for safe navigation, accident avoidance, and object detection.

Moreover, distance estimation is a critical function of these sensors, enabling vehicles to determine the proximity of objects and obstacles in their path. Object detection is another essential application of Automotive Lidar sensors. These sensors can identify and classify various objects, such as pedestrians, vehicles, and cyclists, providing the necessary data for autonomous vehicles to respond appropriately. Infineon Technologies AG, a leading technology company, is at the forefront of product development in this field. Their AURIXtm microcontroller family, including the TC4x series, is designed to support the integration of Automotive Lidar sensors in autonomous vehicles. This integration is crucial for the successful deployment of mobility solutions and the advancement of autonomous cars.

Furthermore, the market is expected to grow significantly due to the increasing demand for safer and more efficient transportation solutions. Joint ventures and collaborations between technology companies and automotive manufacturers are also contributing to the market's growth. In conclusion, Automotive Lidar sensors are a vital component of the autonomous vehicle ecosystem. They provide essential data for safe navigation, accident avoidance, and object detection, making them an indispensable technology for the future of transportation. With continuous advancements in product development and integration, the market for these sensors is poised for significant growth.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- ADAS

- Autonomous vehicle

- Technology

- Solid-state

- Electro mechanical

- Geography

- North America

- Canada

- US

- Europe

- Germany

- APAC

- China

- Japan

- Middle East and Africa

- South America

- North America

By Application Insights

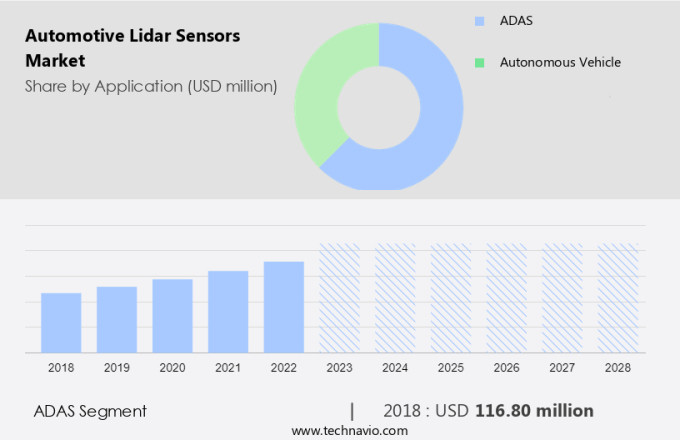

The adas segment is estimated to witness significant growth during the forecast period. The automotive industry is witnessing significant advancements with the integration of remote sensing techniques, such as Automotive LiDAR scanners, into modern vehicles. These sensors utilize distance estimation and object detection capabilities to enhance safety features, making them essential components for autonomous vehicle sensors. This growth is primarily driven by the increasing adoption of advanced telematics, such as adaptive front lights, adaptive cruise control, and collision warning systems, in vehicles.

While the demand for these advanced systems is on the rise, there is a predicted shift from pure ADAS to pure autonomy. By 2022, ADAS, as an individual offering, may begin losing ground to ADAS as a sub-offering under vehicular autonomy frameworks. This transition is expected to impact the growth rates of the market slightly, but the long-term prospects remain positive.

Get a glance at the market share of various segments Request Free Sample

The ADAS segment accounted for USD 116.80 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

North America is estimated to contribute 31% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in North America is significant due to the widespread usage of these sensors in self-driving vehicles and adverse weather conditions such as wet and foggy weather. The United States and Mexico are key contributors to this market, with a high demand for LiDAR sensors in utility vehicles like pickup trucks, SUVs, and crossovers. These vehicles are popular in North America due to their versatility for personal and commercial use and the diverse terrains, including mountains and rocky surfaces. Additionally, the focus on enhancing vehicle safety is driving the adoption of LiDAR sensors in stability control systems, particularly in mid-size and large-size SUVs.

Furthermore, the onboard computer in these vehicles processes data gathered by LiDAR sensors to ensure optimal performance and safety. The North American automotive industry's emphasis on technological advancements and safety features makes it an attractive market for LiDAR sensor manufacturers.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Rapid developments in autonomous vehicle technology is the key driver of the market. Companies including Delphi, Continental, Bosch, Daimler, Scania, and Volvo, among others, are progressing in the development of autonomous driving technology. This advancement is broadening the acceptance of semi-autonomous features in both passenger and commercial vehicles. Self-driving cars may become a tangible reality towards the end of the forecast period, and within the next decade, we can anticipate a significant number of self-driven vehicles on the road. Major automotive players are currently making substantial strides toward realizing this goal. Furthermore, the expansion of features in advanced driver-assistance systems (ADAS) and telematics/connected vehicle applications and services is expected to increase at an accelerated rate.

Furthermore, this growth trend is poised to present lucrative opportunities for automotive LiDAR sensors. Infineon Technologies AG is one of the key players in this market, with its AURIXTM microcontroller family and TC4x series contributing significantly to the development of LiDAR sensors. The increasing focus on eMobility is also expected to fuel the demand for these sensors in the automotive industry.

Market Trends

Continuous cost reduction of LiDAR sensors is the upcoming trend in the market. The automotive LiDAR sensor market is witnessing significant advancements as companies explore different design concepts for next-generation sensors. However, the success of these innovations remains uncertain. Historically, expensive hardware, such as the early Anti-Lock Braking System (ABS), has experienced significant price declines due to increased volumes and widespread adoption.

This trend is anticipated to repeat itself in the automotive LiDAR sensor industry. Various LiDAR sensor manufacturers, including those backed by the Defense Advanced Research Projects Agency (DARPA), are working on creating cost-effective LiDAR sensors by integrating all sensor components onto a single chip. This vertical integration strategy is expected to drive down the cost of LiDAR sensors, making them more accessible for Hybrid Battery Electric Vehicles (HEVs) and other automotive applications. Moreover, international labor markets and sub-contractors play a crucial role in this cost reduction process by providing cost-effective manufacturing solutions.

Market Challenge

High cost of automotive LiDAR sensors is a key challenge affecting the market growth. The market is experiencing significant growth, with various technology advancements and vehicle applications driving the demand. Two prominent LiDAR sensor technologies are Frequency-modulated-continuous-wave (FMCW) and solid-state. FMCW LiDAR uses radio waves to measure distance, while solid-state LiDAR uses laser light. Both technologies have unique advantages and are being adopted by automotive manufacturers and suppliers. Ouster, a leading LiDAR technology company, aims to make LiDAR sensors more affordable for mass automotive production. Their ES2 sensor is projected to be ready for mass production in 2024, with an initial cost of USD600 in volume. This price is expected to decrease to USD100 in subsequent years.

Furthermore, other companies with non-VCSEL LiDAR designs, such as Luminar, are also entering the market. Luminar recently announced a deal with Volvo to integrate their LiDAR technology into Volvo cars, with plans for availability in 2022. However, the high cost of LiDAR sensors remains a significant challenge for their widespread adoption in the automotive industry. In conclusion, the market is witnessing growth due to technological advancements and various vehicle applications. FMCW and solid-state LiDAR are two prominent technologies, and Ouster and Luminar are notable companies entering the market. While the affordability of LiDAR sensors remains a challenge, advancements in technology and pricing are expected to drive mass adoption in the automotive industry.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Benewake Beijing Co. Ltd- The company offers automotive LiDAR sensors such as basic flash LiDAR and 3D LiDAR.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Cepton Inc.

- Continental AG

- DENSO Corp.

- HELLA GmbH and Co. KGaA

- Ibeo Automotive Systems GmbH

- Infineon Technologies AG

- Innoviz Technologies Ltd.

- LeddarTech Inc.

- Leishen Intelligent Systems Co. Ltd.

- Lumibird Canada

- Luminar Technologies Inc.

- Ouster Inc.

- Quanergy Systems Inc.

- TE Connectivity Ltd.

- TetraVue Inc.

- Valeo SA

- Velodyne Lidar Inc.

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Autonomous vehicles are revolutionizing the automotive industry with their self-driving capabilities, and automotive lidar scanners play a crucial role in enabling safe navigation and accident avoidance. These remote sensing techniques use lidar technology to gather data points in real-time, creating high-resolution 3D images of the environment. Object detection and feature extraction are achieved through clustering and processing the lidar point clouds. Automotive lidar scanners function as essential sensors for autonomous vehicles, providing critical data for distance estimation and object detection under various weather conditions, including adverse weather such as foggy weather and wet weather. Lidar sensors come in various types, including frequency-modulated-continuous-wave (FMCW) and solid-state, as well as 2D and 3D imaging.

Moreover, product development in this field is ongoing, with companies investing in joint ventures and vertical integration. Infineon Technologies AG, for instance, offers the AurixTM microcontroller family's TC4x series for lidar applications. The technology's image type and vehicle type compatibility cater to the diverse needs of the industry. Lidar sensors are also employed in the emobility sector, contributing to the advancement of self-driving vehicles and the international labor markets. Sub-contractors and third-party contractors are essential partners in the production process. The market is witnessing significant growth driven by advancements in remote sensing techniques and the demand for high-resolution 3D images in autonomous and semi-autonomous vehicles. These sensors enable precise data gathering for advanced driver assistance systems (ADAS), enhancing safety features such as Adaptive Cruise Control (ACC) and Automatic Emergency Braking (AEB). The shift toward low-cost artificial intelligence (AI) applications is improving the performance of LiDAR systems, while smart and unique strategies are being implemented to overcome poor performance in various environments. With the evolving automotive electric-electronic (E/E) architectures, Time of Flight (ToF) sensors are playing a crucial role in 3-dimensional mapping and detection. OEMs are integrating these systems in vehicles, replacing traditional internal combustion engines (ICE) with more efficient, automated solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 22.08% |

|

Market growth 2024-2028 |

USD 693.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

17.79 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

North America at 31% |

|

Key countries |

US, Germany, China, Canada, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Benewake Beijing Co. Ltd, Cepton Inc., Continental AG, DENSO Corp., HELLA GmbH and Co. KGaA, Ibeo Automotive Systems GmbH, Infineon Technologies AG, Innoviz Technologies Ltd., LeddarTech Inc., Leishen Intelligent Systems Co. Ltd., Lumibird Canada, Luminar Technologies Inc., Ouster Inc., Quanergy Systems Inc., TE Connectivity Ltd., TetraVue Inc., Valeo SA, Velodyne Lidar Inc., and ZF Friedrichshafen AG |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch