Automotive Radar Sensors Market Size 2025-2029

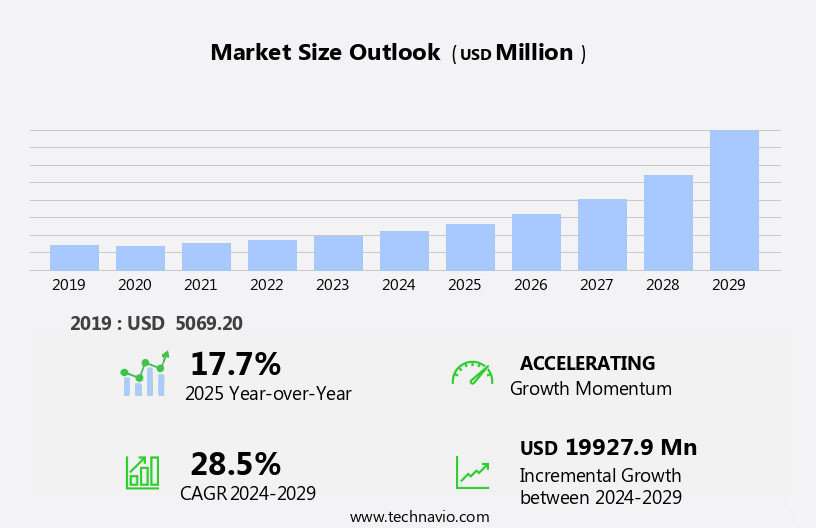

The automotive radar sensors market size is forecast to increase by USD 19.93 billion, at a CAGR of 28.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by the availability of high-frequency radar sensors and the increased accuracy in perceiving the environment through sensor fusion techniques. These advancements enable enhanced safety features, such as adaptive cruise control, blind spot detection, and lane departure warning systems. However, the market faces challenges related to cybersecurity risks. With the increasing integration of radar sensors into vehicle systems, there is a growing concern for potential vulnerabilities that could lead to data breaches or even manipulation of sensor data.

- Companies must prioritize cybersecurity measures to mitigate these risks and maintain consumer trust. This dynamic market requires strategic planning and a focus on innovation to capitalize on opportunities and navigate challenges effectively.

What will be the Size of the Automotive Radar Sensors Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in object detection technology and its applications across various sectors. Antenna-in-package (AIP) designs offer improved false alarm rates, enabling more accurate driver monitoring and safety features such as automatic emergency braking. Solid-state radar, with its cost efficiency and manufacturing process innovations, is gaining traction in the market. Image processing and signal processing technologies enhance clutter rejection and velocity resolution, leading to better blind spot detection and adaptive cruise control systems. Long-range radar enables vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication, paving the way for autonomous driving. The ongoing development of millimeter-wave radar, CMOS technology, and ultra-wideband (UWB) radar is further expanding the capabilities of radar sensors, allowing for more precise target classification and object tracking.

Regulatory compliance and safety standards continue to shape the market, with power consumption and manufacturing cost efficiency remaining key considerations. Advancements in artificial intelligence (AI), machine learning, and sensor fusion are also playing a significant role in the market's evolution, enabling more sophisticated pedestrian detection and lane departure warning systems. The supply chain continues to adapt to these technological advancements, ensuring a steady flow of innovative radar sensors to meet the growing demand.

How is this Automotive Radar Sensors Industry segmented?

The automotive radar sensors industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Medium-range

- Long-range

- Short-range

- Application

- FCW

- AEBS

- ACC

- Others

- Component

- Radar sensors

- Radar modules

- ECUs

- End-user

- Passenger cars

- Commercial vehicles

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Type Insights

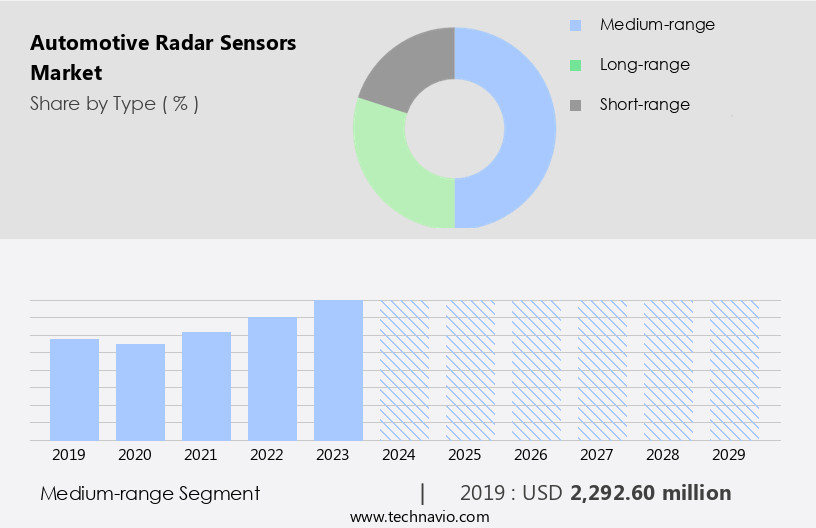

The medium-range segment is estimated to witness significant growth during the forecast period.

The mid-range the market is experiencing significant growth due to their ability to offer reliable object detection and support features for advanced driver assistance systems (ADAS), including adaptive cruise control (ACC), blind spot recognition, and collision avoidance. These sensors strike a balance between performance and cost efficiency, making them an attractive option for vehicle manufacturers. The increasing global focus on vehicle safety regulations is driving demand for mid-range radar sensors. Their ability to improve driver monitoring systems and support automatic emergency braking systems is crucial in enhancing road safety. The manufacturing process for mid-range radar sensors is continually evolving, with advancements in technologies like solid-state radar, frequency-modulated continuous-wave (FMCW), and multiple-input multiple-output (MIMO) contributing to improved clutter rejection, velocity resolution, and range resolution.

Major market players, such as Bosch, Continental AG, and Denso Corp., are investing heavily in research and development to innovate mid-range radar sensors, integrating artificial intelligence (AI) and machine learning algorithms for target classification and deep learning-based pedestrian detection. These advancements are expected to further enhance the capabilities of mid-range radar sensors, making them indispensable in the automotive industry. Mid-range radar sensors are also essential components in vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication systems, enabling real-time data exchange and improving overall road safety. The increasing adoption of these technologies is expected to fuel the growth of the mid-range radar sensors market in the coming years.

As safety standards become more stringent, mid-range radar sensors are becoming an essential component in the automotive industry. Their ability to support driver assistance systems while maintaining cost efficiency makes them a preferred choice for mass-market vehicles. The mid-range radar sensors market is poised for growth, with advancements in technology, regulatory compliance, and increasing demand for safer, more efficient vehicles.

The Medium-range segment was valued at USD 2.29 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 57% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European the market is experiencing significant growth, primarily driven by the increasing adoption of Advanced Driver-Assistance Systems (ADAS) and autonomous vehicles. Consumers prioritize collision avoidance technology, leading to heightened demand. Stricter safety standards, such as the European Union's mandatory automated emergency braking systems in new cars, further propel market expansion. Key players, including Continental AG, Robert Bosch GmbH, and Valeo, dominate the market, focusing on radar-based solutions. As the push towards Level 3 and above autonomous driving continues, there is a growing need for advanced radar sensors with capabilities like object detection, false alarm rate reduction, image processing, short- and long-range radar, clutter rejection, velocity resolution, blind spot detection, and pedestrian detection.

Manufacturing processes are evolving, with a focus on cost efficiency, machine learning, and sensor fusion. Technological advancements include solid-state radar, frequency-modulated continuous-wave (FMCW), multiple-input multiple-output (MIMO), ultra-wideband (UWB) radar, and millimeter-wave radar. Regulatory compliance and power consumption are also crucial considerations. Additionally, vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication, target classification, and deep learning are emerging trends.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and innovative industry, driven by advancements in technology and the increasing demand for enhanced safety features in vehicles. This market encompasses cutting-edge solutions that leverage radar technology to detect objects in real-time, enabling collision avoidance, adaptive cruise control, and other driver assistance systems. Radar sensors offer several advantages, including all-weather functionality, long-range detection, and accuracy. Key players in this market focus on developing advanced features, such as multi-mode radar systems and 77GHz frequency bands, to cater to evolving consumer needs. The integration of radar sensors with other autonomous driving technologies, such as LiDAR and cameras, is also a significant trend in the market. Additionally, the growing popularity of electric and autonomous vehicles is expected to fuel market growth, as radar sensors play a crucial role in their safety systems. Overall, the market represents a promising and exciting space for technological innovation and growth.

What are the key market drivers leading to the rise in the adoption of Automotive Radar Sensors Industry?

- The market's growth is primarily driven by the availability and utilization of high-frequency radar sensors due to their advanced capabilities in detection and accuracy.

- The market is driven by the increasing demand for enhanced safety standards in vehicles. Ultra-wideband (UWB) radar and millimeter-wave radar are the two primary types of radar sensors used in the automotive industry. Regulatory compliance with safety regulations is a significant factor driving the adoption of these sensors. Millimeter-wave radar, which operates at frequencies between 24 and 110 GHz, provides high-resolution angle resolution and target classification capabilities. On the other hand, UWB radar, which operates below 10 GHz, offers advantages such as precise positioning and vehicle-to-infrastructure (V2I) communication. Cmos technology and silicon-germanium (SiGe) technology are the two main technologies used in the production of radar sensors.

- These technologies enable the miniaturization of radar sensors, making them more cost-effective and efficient. Artificial intelligence (AI) is also being integrated into radar sensors to improve target recognition and classification. This integration enhances the overall performance of radar sensors and enables advanced driver assistance systems (ADAS) and autonomous driving features. In summary, the market is witnessing significant growth due to the increasing demand for safety features, the adoption of advanced technologies, and regulatory compliance. Millimeter-wave radar and UWB radar, along with cmos technology and SiGe technology, are the key enablers of this growth.

What are the market trends shaping the Automotive Radar Sensors Industry?

- Sensor fusion technique is gaining popularity in the market due to its ability to enhance environmental perception by increasing accuracy. This approach combines data from multiple sensors to provide more comprehensive and reliable information.

- The market is experiencing significant growth due to the increasing adoption of advanced driver-assistance systems (ADAS) in modern vehicles. With the proliferation of electronic systems, cars are equipped with various sensors, including radar, ultrasound, LIDAR, and cameras. Strict regulations and OEMs' efforts to differentiate themselves are driving the demand for radar sensors in safety applications such as parking assist, lane departure warning, pedestrian detection, and object tracking. However, the limitations of these sensors operating independently create a need for more effective and realistic vehicle operations. Sensor fusion, a technique that combines data from multiple sensors, is gaining popularity to address these limitations.

- Machine learning algorithms and high-resolution radar are essential components of sensor fusion, enabling improved signal processing and object detection. Power consumption is a critical factor in the development of automotive radar sensors, and advancements in technology are focusing on reducing power consumption while maintaining performance. In summary, the market is witnessing growth due to the increasing adoption of ADAS, stringent regulations, and OEM differentiation efforts. The limitations of independent sensor operations necessitate the use of sensor fusion to enhance the effectiveness and realism of safety functions in vehicles. Machine learning algorithms, high-resolution radar, and power consumption are essential considerations in the development of automotive radar sensors.

What challenges does the Automotive Radar Sensors Industry face during its growth?

- Cybersecurity risks pose significant concerns that can hinder the growth of the industry. It is essential for organizations to prioritize and invest in robust cybersecurity measures to mitigate potential threats and protect their digital assets. Failure to do so may result in reputational damage, financial losses, and legal consequences. The integration of advanced technologies, such as artificial intelligence and machine learning, can strengthen cybersecurity defenses and help businesses stay ahead of evolving threats. It is crucial for industry professionals to stay informed about the latest cybersecurity trends and best practices to ensure the protection of sensitive data and systems.

- Radar sensors, a critical component of advanced driver-assistance systems (ADAS) and autonomous vehicles, are increasingly vulnerable to cyber threats. Malicious actors can intercept radar sensor signals transmitted between vehicles or infrastructure to gain sensitive information or disrupt operations. Eavesdropping attacks can compromise privacy, expose confidential data such as location information and driving patterns, and potentially endanger road safety. Moreover, denial-of-service (DoS) attacks against radar sensors or their communication networks can impair performance, degrade system reliability, and disrupt safety-critical functions. By overwhelming radar sensors with excessive traffic or communication channels, DoS attacks can significantly impact the vehicle's ability to detect obstacles and maintain safe distances.

- Radar sensor systems are also susceptible to malware and ransomware attacks, where malicious software is injected into the electronic control units (ECUs) or networked components. These attacks can result in system crashes, data loss, and unauthorized access to sensitive information. As the adoption of radar sensors continues to grow, it is crucial to implement robust cybersecurity measures to protect against these threats and maintain the integrity and reliability of these systems.

Exclusive Customer Landscape

The automotive radar sensors market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive radar sensors market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive radar sensors market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Acconeer AB - This company specializes in advanced automotive radar sensors, including the 4D UHD Sensor for front and rear applications and the UMRR 11 TRURGD Premium Line of traffic sensors. These sensors are utilized in a wide array of industries globally, encompassing automotive, industrial, consumer products, and IoT solutions. By leveraging cutting-edge radar technology, these sensors deliver accurate and reliable data, enhancing safety, efficiency, and performance in various applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acconeer AB

- Aptiv Plc

- Autoliv Inc.

- Continental AG

- DENSO Corp.

- HELLA GmbH and Co. KGaA

- Huawei Technologies Co. Ltd.

- Infineon Technologies AG

- MediaTek Inc.

- NXP Semiconductors NV

- Renesas Electronics Corp.

- Robert Bosch GmbH

- Rohde and Schwarz GmbH and Co. KG

- S.m.s Smart Microwave Sensors GmbH

- Schaeffler AG

- Texas Instruments Inc.

- Tsien UK Ltd

- Valeo SA

- Vayyar Imaging Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Automotive Radar Sensors Market

- In January 2024, Continental AG, a leading automotive technology company, announced the launch of its new long-range radar sensor, the S500, designed for Level 3 and above autonomous driving systems. This new radar sensor offers a detection range of up to 300 meters, making it one of the longest-ranging radar sensors in the market (Continental AG press release).

- In March 2024, Bosch and NVIDIA, two technology giants, formed a strategic partnership to integrate Bosch's automotive radar technology with NVIDIA's Drive AGX Orin platform. This collaboration aims to provide automakers with a comprehensive, high-performance sensor system for advanced driver-assistance systems (ADAS) and autonomous driving applications (Bosch press release).

- In May 2024, Infineon Technologies AG, a leading provider of semiconductor solutions, completed the acquisition of ISSC Technologies, a Taiwan-based radar sensor specialist. This acquisition strengthens Infineon's position in the automotive radar sensor market and adds ISSC's advanced radar technology to Infineon's portfolio (Infineon Technologies AG press release).

- In April 2025, the European Union passed the new European Union Regulation No. 2025/2021, mandating the installation of advanced driver-assistance systems, including radar sensors, in all new passenger cars from 2027 onwards. This regulation is expected to significantly boost the demand for automotive radar sensors in Europe (European Parliament press release).

Research Analyst Overview

- The market is experiencing significant advancements, driven by the integration of advanced technologies such as RF front ends, edge computing, and cloud computing into product design. Antenna arrays and system integration are crucial elements in radar sensor development, requiring precise timing and real-time processing to mitigate EMI and ensure optimal performance. Sensor calibration and data analytics are essential for improving system accuracy and reliability. Data security and data acquisition are paramount in the automotive industry, with algorithm development and lifecycle management playing a vital role in ensuring seamless integration of radar sensors with other vehicle systems. Environmental testing and EMC compliance are necessary to ensure radar sensors operate effectively in various conditions and minimize electromagnetic interference.

- Power amplifiers, microcontroller units, phase shifters, and low-noise amplifiers are integral components in radar sensor design, requiring careful consideration for optimal performance and power efficiency. Over-the-air updates enable remote software upgrades, enhancing system functionality and improving overall system reliability.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Automotive Radar Sensors Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

243 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 28.5% |

|

Market growth 2025-2029 |

USD 19927.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

17.7 |

|

Key countries |

US, China, Japan, India, Canada, UK, Germany, France, The Netherlands, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Radar Sensors Market Research and Growth Report?

- CAGR of the Automotive Radar Sensors industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive radar sensors market growth of industry companies

We can help! Our analysts can customize this automotive radar sensors market research report to meet your requirements.