Automotive Secondary Wiring Harness Market Size 2024-2028

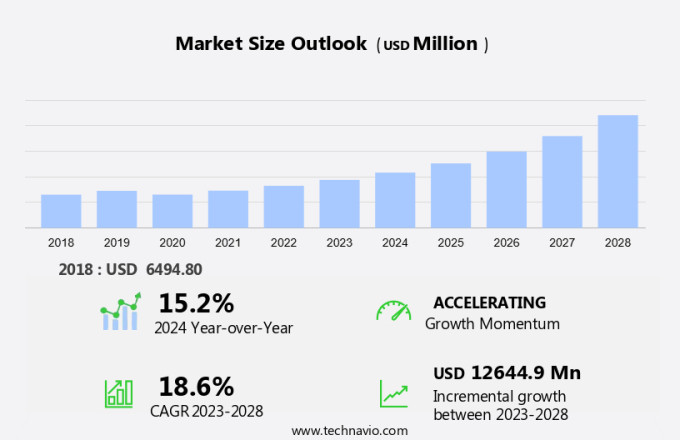

The automotive secondary wiring harness market size is forecast to increase by USD 12.64 billion at a CAGR of 18.6% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. Mechanical and electrical design advancements are driving the demand for more complex electrical systems in vehicles. Environmental conditions, such as temperature, humidity, sunlight, and dirt, necessitate the use of strong wiring harnesses that can withstand these conditions. Moreover, the increasing popularity of electric vehicles (EVs) and advances in autonomous driving technology are creating new opportunities for market growth. Strict regulatory norms and standards for automotive wiring are also pushing manufacturers to invest in advanced wiring harnesses to ensure safety and reliability. In terms of trends, the market is witnessing a shift towards lightweight and flexible wiring harnesses that can reduce vehicle weight and improve fuel efficiency. Additionally, the integration of advanced sensors and connectivity technologies is enabling the development of smart wiring harnesses that can monitor and diagnose electrical system issues in real time. The market is poised for growth due to the increasing demand for advanced electrical systems, the rise of EVs and autonomous vehicles, and stringent regulatory norms. Manufacturers are responding by investing in lightweight, flexible, and smart wiring harness solutions to meet these demands.

- The market plays a vital role in the mechanical and electrical design of road vehicles, including trucks and buses. These harnesses are essential components of the electrical systems, connecting various mechanical and electrical components within the vehicle. The electrical design of wiring harnesses is critical to ensure the reliable and safe operation of the vehicle's electrical systems. The harnesses must withstand various environmental conditions, such as temperature, humidity, sunlight, dirt, and vibration. Reliability and safety-critical design are paramount in the automotive industry. Wiring harnesses must meet stringent safety standards to prevent electrical hazards, such as electrical fires. The use of flame-retardant sleeves and insulating materials is common practice in the manufacturing of wiring harnesses. Autonomous driving and advanced infotainment platforms are increasingly becoming standard features in modern vehicles. These systems require intricate electrical wiring networks, making the design and manufacturing of wiring harnesses more complex. The design process of wiring harnesses involves the use of software tools, 2D and 3D layouts, and manufacturing plants. The harnesses are assembled using wiring assembly techniques to ensure proper connection of electrical components.

- Moreover, electrical power is transmitted through the wiring harness, and its efficiency and reliability are essential for optimal vehicle performance. The use of high-quality insulating materials and proper cable harness design can help reduce electrical resistance and ensure the longevity of the harness. Environmental conditions, such as extreme temperatures and humidity, can affect the performance and lifespan of wiring harnesses. Proper design considerations, such as the use of protective sleeves and insulating materials, can help mitigate the effects of these conditions. In conclusion, the market is a crucial segment in the design and manufacturing of road vehicles, including trucks and buses. The harnesses play a vital role in the electrical systems, ensuring the reliable and safe operation of various components. Proper design considerations, manufacturing techniques, and the use of high-quality materials are essential to meet the stringent safety standards and the increasing complexity of modern vehicles.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Application

- Sensors

- HVAC

- Geography

- APAC

- China

- Japan

- South Korea

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

By Application Insights

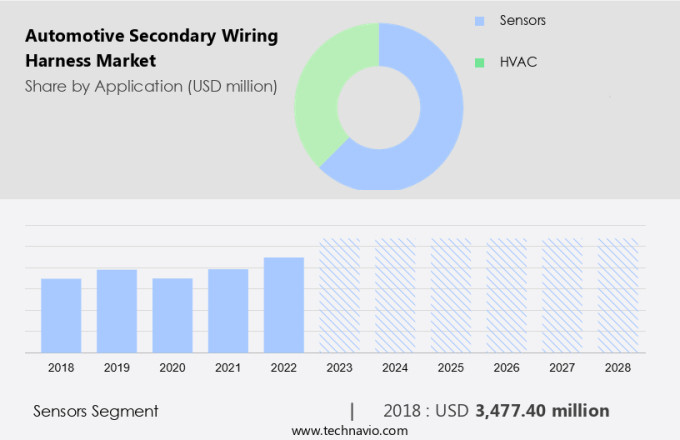

- The sensors segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to the increasing use of sensors in road vehicles, including trucks and buses. These sensors are essential for real-time monitoring and analysis of automotive systems, leading to the increased adoption of secondary wiring harnesses. Factors such as advancements in sensor technology and the integration of artificial intelligence (AI) in automotive electrical systems are key drivers for market expansion. The global automotive industry is undergoing rapid transformations, with a focus on creating safer, cleaner, and more connected vehicles. Innovative solutions are being implemented to meet the evolving needs of consumers and regulatory requirements. Environmental conditions, such as temperature, humidity, sunlight, and dirt, pose challenges to the electrical design and mechanical integrity of secondary wiring harnesses. However, these challenges are being addressed through the development of advanced materials and manufacturing techniques. The market is expected to continue its growth trajectory, driven by the increasing demand for advanced automotive technologies.

Get a glance at the market share of various segments Download the PDF Sample

The sensors segment was valued at USD 3.48 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 58% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Download PDF Sample now!

The market is a significant segment of the global automotive industry. Wiring assemblies play a crucial role in the electrical power distribution within vehicles, requiring insulating materials for protection. Manufacturing plants utilize software tools for designing 2D and 3D layouts to streamline the production process. Electrical system engineers are responsible for managing electrical loads and ensuring the proper functioning of electrical equipment. The connection points in these wiring harnesses are meticulously engineered to ensure reliable performance. APAC is the global leader in automotive production and sales, with China and Japan being the major contributors. China's dominance in the region is driven by the substantial demand for automobiles, particularly in the luxury vehicle segment. Japan follows closely behind, with a strong manufacturing sector and stringent safety regulations. Emerging markets such as India and Southeast Asian countries are also expected to contribute significantly to regional market growth due to the increasing implementation of regulatory norms on vehicle safety and vehicular emissions. The market is a vital component of the global automotive industry, with APAC leading the way in production and sales. The demand for wiring harnesses is driven by the growing demand for automobiles, particularly in the luxury vehicle segment, and the increasing implementation of regulatory norms on vehicle safety and emissions. Manufacturing plants utilize advanced software tools and design techniques to ensure the production of high-quality wiring harnesses, making this a dynamic and growing market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Automotive Secondary Wiring Harness Market?

The increasing demand for EVs is notably driving market growth.

- The market is experiencing notable growth due to the increasing sales of electric vehicles (EVs) in the global market. EVs, which operate on all-electric powertrains and related systems and components, account for approximately two-thirds of all electric vehicles sold annually. China leads in the sales of battery electric vehicles, followed closely by Europe, particularly in countries like Norway, Iceland, and Sweden.

- Further, factors contributing to the growth of the market include advancements in electric vehicle technology, enhancements to charging infrastructure and improving socio-economic conditions. Electrical schematics play a crucial role in the design of electrical cables and signal transmission for various electrical applications and electronic devices in EVs. The performance of these electrical circuits is essential in extreme conditions, ensuring the reliability of the vehicles under various driving scenarios. Thus, such factors are driving the growth of the market during the forecast period.

What are the market trends shaping the Automotive Secondary Wiring Harness Market?

The advances in autonomous vehicles is the key trend in the market.

- The market has experienced significant growth due to the increasing adoption of advanced technologies in the automotive industry, particularly in the development of hybrid cars. These vehicles require high currents to manage electrical loads and withstand high heat conditions, making customized harnesses from companies like Miracle Electronics essential. The electromagnetic noise generated in these vehicles necessitates the use of specialized harnesses to ensure proper functionality. The rise of autonomous vehicles is another key factor driving the demand for advanced secondary wiring harnesses. With the increasing number of prototypes and testing developments in this sector, original equipment manufacturers (OEMs), tier-1 suppliers, and shared mobility service providers are investing heavily in these technologies.

- Moreover, the intricate electrical systems and connectivity requirements of autonomous vehicles necessitate the use of sophisticated harnesses that can meet individual specifications and production process demands. In summary, the growing trend towards advanced automotive technologies, particularly in the areas of hybrid cars and autonomous vehicles, is fueling the demand for high-performance secondary wiring harnesses in the US market. Companies specializing in this area, such as Miracle Electronics, are well-positioned to meet the unique requirements of this sector. Key players in the automotive industry are investing in research and development to create customized harnesses that can effectively manage high currents, electrical loads, and electromagnetic noise while ensuring proper functionality and production efficiency. Thus, such trends will shape the growth of the market during the forecast period.

What challenges does Automotive Secondary Wiring Harness Market face during its growth?

The stringent regulatory norms and standards are the major challenge that affects the growth of the market.

- The automotive industry is subject to stringent regulatory requirements regarding vehicle safety and emissions. These regulations dictate the use of secondary wiring harnesses in various automobiles, including cars, utility vehicles, and commercial vehicles. Three-wheelers are also subject to these regulations. Manufacturers of body wiring harnesses, engine wiring harnesses, and chassis wiring must adhere to these regulations to ensure compliance. The safety concerns associated with high electrical loads flowing through wiring harnesses necessitate stringent quality standards. Regulatory bodies and industrial organizations have set these standards to ensure the durability and reliability of these harnesses.

- However, the use of non-flexible bundles and durable materials is essential to meet these standards. Automotive secondary wiring harnesses play a crucial role in enabling data and electrical signals to transfer within vehicles. The harnesses' quality and performance are essential for fuel efficiency and overall vehicle performance. The challenges for manufacturers lie in meeting the regulatory requirements while maintaining cost-effectiveness and efficiency. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aeromotive Services Inc.

- Aptiv Plc

- Assembly Solutions Ltd.

- Continental AG

- Coroplast Fritz Muller GmbH and Co. KG

- Epec LLC

- Fujikura Co. Ltd.

- Furukawa Electric Co. Ltd.

- Harness Techniques (I) Pvt. Ltd.

- Leoni AG

- Minda Corp. Ltd.

- Miracle Electronics Devices Pvt. Ltd.

- Samvardhana Motherson International Ltd.

- Nexans autoelectric GmbH

- Robert Bosch GmbH

- Sparsh Electronics India Pvt. Ltd.

- Sumitomo Electric Industries Ltd.

- Tianhai Auto Electronics Group Co. Ltd.

- Yazaki Corp.

- YURA Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The automotive secondary wiring harness market caters to the electrical needs of various road vehicles, including trucks, buses, and cars. Mechanical design and electrical design play crucial roles in the creation of these harnesses. Electrical systems in vehicles are exposed to harsh environmental conditions such as temperature, humidity, sunlight, dirt, vibration, and extreme conditions. To ensure reliability and safety-critical design, wiring harnesses and cable assemblies are engineered with flame-retardant sleeves, insulating materials, and electrical schematics. Autonomous driving, infotainment platforms, and electronic devices necessitate advanced wiring harnesses for signal transmission and electrical power distribution.

Electrical hazards, such as electrical fires, are mitigated through the use of electrical cables, connection methods, and electrical equipment. Wiring harnesses come in various design variants, including body wiring harnesses, engine wiring harnesses, and chassis wiring. The manufacturing process involves the use of software tools for 2D and 3D layouts, electrical load calculations, and electrical circuit design. Electrical system engineers are responsible for managing electrical loads, designing electrical circuits, and ensuring the performance of electrical devices. The market also offers customized harnesses to meet individual specifications and production process requirements.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

140 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 18.6% |

|

Market growth 2024-2028 |

USD 12.64 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

15.2 |

|

Key countries |

China, US, Japan, Germany, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch