Automotive Steering Gearbox Market Size 2024-2028

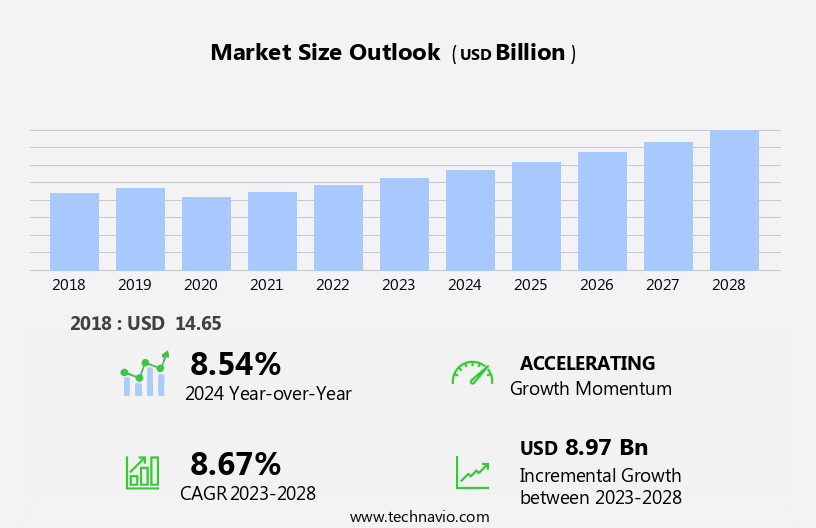

The automotive steering gearbox market size is forecast to increase by USD 8.97 billion at a CAGR of 8.67% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing demand for high torque and superior performance in trucks. Another trend influencing the market is the development of magnetic torque overlay technology, which enhances steering precision and reduces fuel consumption. However, the market is also facing challenges from the increasing cost of raw materials, particularly steel and aluminum, which are essential components in steering gearboxes. These factors are shaping the growth trajectory of the market. The report provides a comprehensive analysis of these trends and challenges, offering valuable insights to stakeholders and market participants.

What will be the Size of the Automotive Steering Gearbox Market During the Forecast Period?

- The market is experiencing significant growth, driven by the increasing demand for enhanced safety, stability, and customized driving experiences. Engineering advancements in steering systems aim to provide a more intuitive feel and improved precision, enabling better control and performance. High-tech solutions, such as electric and hybrid vehicle applications, are gaining traction due to their contribution to sustainable transportation and fuel efficiency. The integration of safety features, including driving automation and weight reduction, is a key trend shaping the market. Regulations, such as emissions and transmission technology, are also influencing the development of steering gearboxes. Innovation in materials and lifecycle analysis is essential for optimizing efficiency and reliability.

- The future of the market is marked by electrification, with electric car technology and charging infrastructure playing crucial roles. The autonomous market's growth is further fueling the demand for advanced steering systems that can provide smooth, efficient, and reliable performance. Overall, the market is a dynamic and evolving landscape, driven by engineering principles, consumer preferences, and regulatory requirements.

How is this Automotive Steering Gearbox Industry segmented and which is the largest segment?

The automotive steering gearbox industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Electric power steering

- Hydraulic power steering

- Electro-hydraulic power steering

- Application

- Passenger cars

- Commercial cars

- Geography

- APAC

- China

- Japan

- Europe

- Germany

- France

- North America

- US

- South America

- Middle East and Africa

- APAC

By Type Insights

- The electric power steering segment is estimated to witness significant growth during the forecast period.

Electric power steering systems are gaining popularity In the automotive industry due to their lightweight and fuel-efficient design. These systems offer variable power assistance, providing additional help at low speeds and reducing it at high speeds. The power required by the steering system is determined by the torque applied to the wheel. As the electric motor In the steering gearbox rotates, it reduces the force needed from the driver, enhancing smooth driving and reducing vibration. Different types of electric power steering systems exist, varying by the position of the power assist motor. Innovative technologies, such as steer-by-wire, hybrid loaders, and autonomous driving systems, are increasingly integrated into these systems.

Manufacturers focus on developing fuel-efficient automatic transmissions, including continuously variable transmissions, dual-clutch transmissions, and 10-speed automatic transmissions, to meet fuel economy regulations. Lightweight materials, such as aluminum and magnesium, are used In the construction of gearboxes to improve durability and reduce weight. Electronic controls and artificial intelligence are also employed to enhance shifting performance and improve overall driving experience.

Get a glance at the Automotive Steering Gearbox Industry report of share of various segments Request Free Sample

The Electric power steering segment was valued at USD 8.92 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 64% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific region, comprising countries like China, India, Thailand, Indonesia, and South Korea, is experiencing significant economic growth, leading to increased per-capita income and consumer purchasing power. This economic expansion has resulted in a surge in automobile sales, both for passenger cars and commercial vehicles. Additionally, APAC serves as a major offshore location for automotive manufacturing due to favorable government incentives, low costs, and abundant raw materials. For instance, Nexter Automotive Group Ltd. Established a manufacturing plant for automotive steering systems in China in 2016. The region's industrial development has also led to the adoption of advanced technologies in automotive steering gearboxes, such as hydraulic power, electric power, and electro-hydraulic power systems.

These innovations contribute to smooth driving experiences, vibration restraint, and improved fuel efficiency. Furthermore, emerging economies in APAC are focusing on sustainability, with a growing emphasis on lightweight materials and durability in automotive manufacturing. Technological advancements, including artificial intelligence, continuously variable transmissions, and dual-clutch transmissions, are also driving demand for fuel-efficient automatic transmissions and shifting performance. Electronic controls and automated manual transmissions are becoming increasingly popular, while premiums for high-end vehicles continue to rise. Overall, the market in APAC is poised for growth due to these factors and the region's strategic importance In the global automotive industry.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Automotive Steering Gearbox Industry?

Growing demand for high torque and performance in trucks is the key driver of the market.

- The market is witnessing significant growth due to the increasing demand for power assist systems in both automobiles and construction machinery. With a focus on smooth driving experiences, vibration restraint, and weight reduction, innovative technologies such as steer by wire, electric power, and electro-hydraulic power are gaining popularity. Fuel efficiency regulations have led gearbox manufacturers to develop fuel-efficient automatic transmissions, including continuously variable transmissions, dual-clutch transmissions, and 10-speed automatic transmissions. Moreover, the integration of artificial intelligence and electronic controls in steering systems is enabling advanced autonomous driving systems. The commercial vehicle sector, including heavy-duty trucks, is adopting these advancements to meet the demands of higher torque and improved responsiveness.

- For instance, TRW Automotive's TAS series power steering gears cater to the specific requirements of medium and heavy-duty commercial vehicles. These gears, designed for on-highway applications, offer enhanced steering control and meet the higher torque demands of these vehicles. The market for steering gearboxes is also influenced by the shift towards sustainability and fuel economy regulations. As disposable income increases in emerging economies, the demand for premium automobiles and fuel-efficient vehicles is rising. The use of lightweight materials and multi-speed automatic transmissions further enhances the efficiency and durability of these systems. Overall, the market is expected to experience technological advancements and growth In the coming years.

What are the market trends shaping the Automotive Steering Gearbox Industry?

Development of magnetic torque overlay is the upcoming market trend.

- The market is witnessing significant growth due to the increasing demand for power assist systems in automobiles. Advanced driver-assistance systems (ADAS) are driving this trend, as they require electric power steering for efficient functioning. However, incorporating electric power steering in heavy-duty trucks poses a challenge due to the need for greater power. This has led to the continued use of hydraulic power steering systems in heavy-duty vehicles. Innovative technologies, such as magnetic torque overlay (MTO), are resolving this issue. MTO is a hydraulic power steering gearbox equipped with an integrated electromagnetic actuator, pressure-sensing hardware, an electronic module, and additional software.

- This system enhances the functionality of ADAS in heavy-duty trucks, enabling smooth driving and vibration restraint. Moreover, the shift towards fuel-efficient and lightweight vehicles is fueling the demand for automotive steering gearboxes. The adoption of electric power, electro-hydraulic power, and steer-by-wire systems is also on the rise. Technological advancements, such as continuously variable transmissions, dual-clutch transmissions, and 10-speed automatic transmissions, are contributing to the growth of the market. Additionally, the increasing use of artificial intelligence and electronic controls in automotive transmissions is expected to further boost the market's growth. The market is also witnessing significant growth in emerging economies due to the increasing disposable income of consumers and the growing demand for premium automobiles.

- In conclusion, the market is experiencing significant growth due to the increasing demand for power assist systems, the shift towards fuel-efficient and lightweight vehicles, and the adoption of innovative technologies. The market is expected to continue growing In the coming years, driven by these trends and the increasing demand for automotive safety systems.

What challenges does the Automotive Steering Gearbox Industry face during its growth?

Increasing cost of raw materials is a key challenge affecting the industry growth.

- The market is experiencing significant growth due to the increasing demand for power assist systems in automobiles. These systems improve driving experience by reducing the effort required to steer the wheel, making vehicles more fuel-efficient and easier to maneuver. Innovative technologies such as steer by wire, electric power, and electro-hydraulic power are gaining popularity in both passenger cars and commercial vehicles. Manufacturers are focusing on weight reduction and vibration restraint to enhance fuel economy and shifting performance. Hydraulic power and electronic controls are being used to develop automated manual transmissions and continuously variable transmissions, which offer improved efficiency and smooth driving.

- Additionally, the integration of artificial intelligence and autonomous driving systems is driving the market forward. However, the rising cost of raw materials, such as aluminum, is posing a challenge to gearbox manufacturers. The increasing prices of aluminum, a widely used material in automotive components due to its lightweight properties, are putting pressure on the industry. Sanctions on major aluminum suppliers have further increased the cost of this material, impacting the affordability of automobiles and potentially affecting disposable income in emerging economies. Despite these challenges, the market is expected to continue growing due to fuel economy regulations and the ongoing technological advancements In the automotive industry.

Exclusive Customer Landscape

The automotive steering gearbox market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the automotive steering gearbox market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, automotive steering gearbox market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Akashi Kikai Kogyo Co. Ltd. - The market caters to light vehicles and standard cars with engine displacement of 1500cc or lower. This component is a crucial part of a vehicle's steering system, enabling drivers to maneuver their cars effectively. Steering gearboxes convert rotational motion from the steering wheel to the front wheels, enhancing vehicle handling and control. These systems are designed for optimal performance and durability, ensuring a smooth driving experience. Manufacturers prioritize advanced technologies, such as electric power steering (EPS), to improve fuel efficiency and reduce emissions, making them a popular choice in modern vehicles. Additionally, the market is driven by increasing demand for safety features, including electronic stability control and power assisted steering, which rely on robust and efficient steering gearboxes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akashi Kikai Kogyo Co. Ltd.

- ATS Automation Tooling Systems Inc.

- Cardone Industries Inc.

- China Automotive Systems Inc.

- DENSO Corp.

- Ford Motor Co.

- HL Mando Co. Ltd.

- Hyundai Motor Co.

- JTEKT Corp.

- Knorr Bremse AG

- Melrose Industries Plc

- Mitsubishi Heavy Industries Ltd.

- Nexteer Automotive Group Ltd.

- Robert Bosch GmbH

- thyssenkrupp AG

- ZF Steering Gear (India) Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a vital component of modern automobiles, providing power assistance to drivers for smooth and vibration-free driving experiences. This market caters to various drivetrain types, including manual, automated manual, and automatic transmissions. The primary function of a steering gearbox is to convert rotational motion from the vehicle's wheels into linear motion required for steering. Power assistance systems integrated into steering gearboxes have evolved significantly over the years. Hydraulic power and electro-hydraulic power systems have been replaced by electric power and innovative technologies such as steer-by-wire and electric transmissions. These advancements aim to enhance fuel efficiency and reduce vehicle weight, aligning with fuel economy regulations and the growing emphasis on sustainability.

Manufacturers continue to invest in research and development to create innovative steering gearboxes that cater to the needs of passenger cars and commercial vehicles. Technological advancements include the implementation of artificial intelligence and electronic controls to optimize shifting performance and improve overall driving experience. The automotive industry's shift towards autonomous driving systems has led to increased demand for advanced steering gearboxes. These systems require high precision and responsiveness to ensure safe and efficient vehicle operation. The integration of lightweight materials and durability enhancements further contribute to the market's growth. Emerging economies represent significant opportunities for steering gearbox manufacturers due to increasing disposable income and growing automotive industries.

Premiums placed on fuel efficiency and advanced technologies further boost market demand. The steering gearbox market is characterized by continuous technological advancements and evolving consumer preferences. Fuel economy regulations and the need for sustainability are driving the adoption of electric and hybrid powertrains, which in turn influence the design and construction of steering gearboxes. Innovative steering gearboxes cater to various drivetrain types, including dual-clutch transmissions, continuously variable transmissions, and 10-speed automatic transmissions. The market's competitive landscape is shaped by manufacturers' ability to deliver efficient, durable, and cost-effective solutions that cater to the unique requirements of various vehicle segments.

The steering gearbox market's future growth is influenced by factors such as shifting consumer preferences, regulatory requirements, and technological advancements. Manufacturers must remain agile and responsive to these trends to maintain a competitive edge and meet the evolving needs of the automotive industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

174 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.67% |

|

Market growth 2024-2028 |

USD 8.97 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.54 |

|

Key countries |

US, China, Japan, Germany, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Automotive Steering Gearbox Market Research and Growth Report?

- CAGR of the Automotive Steering Gearbox industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the automotive steering gearbox market growth of industry companies

We can help! Our analysts can customize this automotive steering gearbox market research report to meet your requirements.