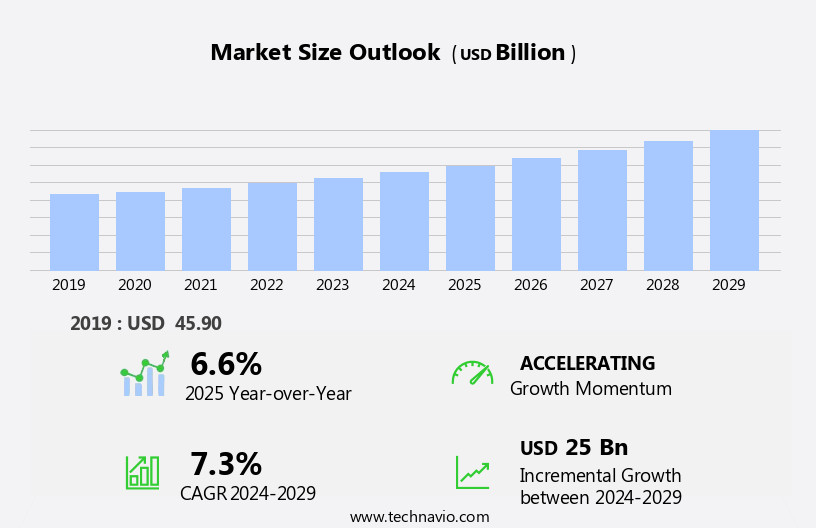

Baby Diapers Market Size 2025-2029

The baby diapers market size is forecast to increase by USD 25 billion, at a CAGR of 7.3% between 2024 and 2029. A growing trend toward natural and organic products is influencing market behavior, as parents increasingly prioritize the health and wellbeing of their infants. This trend is driven by rising awareness of the potential negative impacts of traditional diapers and baby wipes including skin irritation and environmental concerns

Major Market Trends & Insights

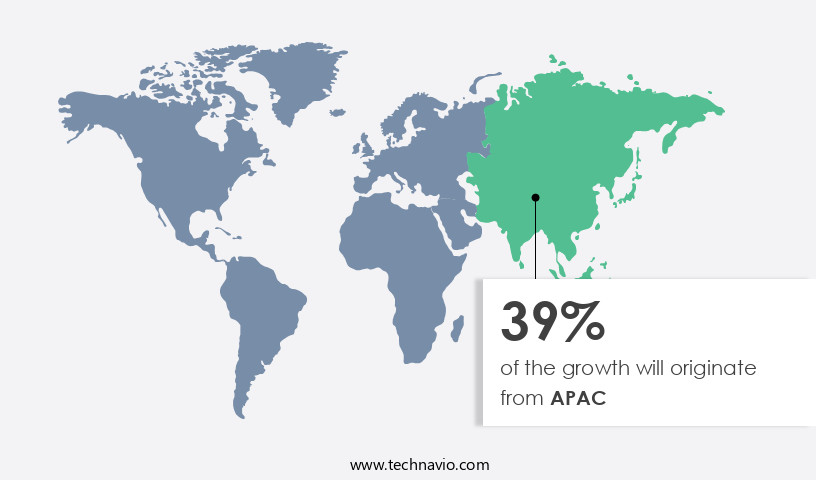

- APAC dominated the market and accounted for a 39% during the forecast period.

- The market is expected to grow significantly in Europe as well over the forecast period.

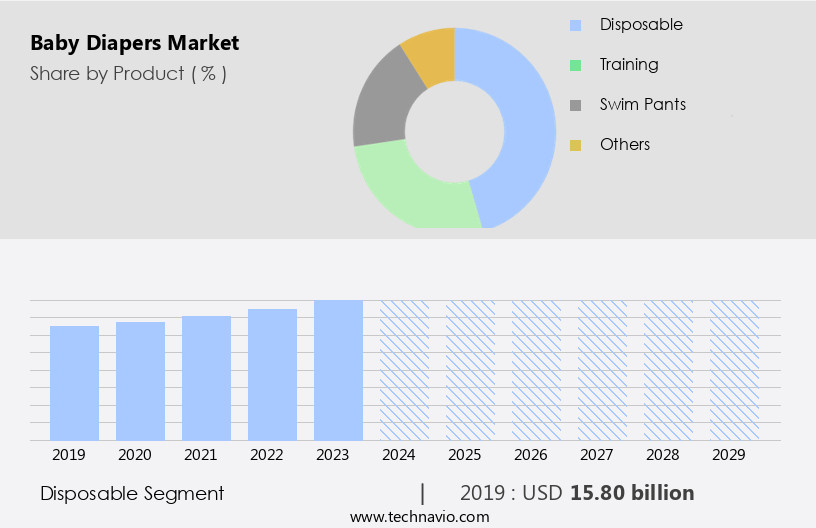

- based upon the Product, the Disposable segment was valued at USD 15.80 billion in 2023

- Based on the Distribution Channel the Offline segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 83.66 billion

- Future Opportunities: USD 25 billion

- CAGR : 7.3%

- Base yer largest region tag: Largest market in 2023

Meanwhile, key market competitors are responding with increased research and development investments to innovate and differentiate their offerings. These investments aim to address consumer demands for eco-friendly and more effective diaper solutions. However, this competitive landscape also presents challenges, as companies must navigate rising production costs and intensifying price pressures. Additionally, regulatory compliance and sustainability concerns add complexity to the market, requiring strategic planning and agility from market participants. Companies seeking to capitalize on market opportunities and navigate challenges effectively must stay abreast of evolving consumer preferences and competitive dynamics, while also investing in sustainable and innovative solutions.

What will be the Size of the Baby Diapers Market during the forecast period?

Get Key Insights on Market Forecast (PDF)

Request Free Sample

- The baby diaper market continues to evolve, driven by advancements in materials, design, and consumer preferences. Latex-free materials, such as non-woven fabric and hypoallergenic alternatives, are increasingly popular due to their ability to prevent skin irritation. Superabsorbent polymers and cellulose fluff pulp, key components of the absorbent core, ensure high diaper weight capacity and liquid retention. Shelf life testing and quality control metrics are essential for maintaining product consistency and safety. Innovations like adjustable fastening tabs and refastenable tapes offer convenience for parents. The market's growth is robust, with industry expectations projecting a yearly increase of 4% in the next five years.

- For instance, a leading diaper manufacturer successfully introduced a new design featuring a bacterial barrier and aqueous dispersion coating, resulting in a 15% increase in sales. Consumer preference testing and size range variations cater to diverse needs, with elastic waistbands and leg cuff elasticity ensuring a comfortable fit. Modern diaper designs incorporate eco-friendly materials like biodegradable polymers and recyclable packaging. Odor control technology and top sheet breathability enhance the diaper's performance and appeal. Manufacturing processes are continually refined to optimize polymer distribution and improve leak prevention systems, including wetness indicators and leak-proof cuffs.

- The market's dynamism extends to distribution channels, with online sales growing rapidly. Diaper companies invest in research and development to stay competitive, focusing on creating cloth-like surfaces, improved elastic waistband designs, and enhanced leak prevention systems.

How is this Baby Diapers Industry segmented?

The baby diapers industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Disposable

- Training

- Swim pants

- Others

- Distribution Channel

- Offline

- Online

- Size

- New Born

- Small

- Medium

- Large

- Extra Large

- Type

- Open Diapers (Taped)

- Closed Diapers (Pull-Up or Pants)

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Product Insights

The disposable segment is estimated to witness significant growth during the forecast period and was valued at USD 15.80 billion in 2019.

Disposable baby diapers continue to dominate the baby hygiene market, driven by the convenience and hygiene benefits they offer to parents. Factors such as the rise in dual-income households and increasing awareness of proper baby hygiene are fueling demand. Diapers come in various types, including superabsorbent and ultra-absorbent, with the latter gaining popularity due to its superior absorbency. However, concerns over the use of hazardous chemicals like polyethylene, petroleum, and wood pulp in diapers have led consumers to seek eco-friendly alternatives. Shelf life testing and quality control metrics are crucial in ensuring the safety and effectiveness of diapers.

Latex-free materials, adjustable fastening tabs, and non-woven fabric are common features that enhance user experience. Skin irritation prevention, bacterial barrier, and odor control technology are essential components that maintain baby comfort. The diaper industry anticipates a significant growth, with an estimated 5% increase in sales due to the increasing demand for eco-friendly and ultra-absorbent diapers.

For instance, diapers with biodegradable materials and recyclable components are gaining traction. Manufacturing processes employing aqueous dispersion coating and refastenable tapes contribute to improved diaper design and leak prevention. Diaper weight capacity and liquid retention capacity are critical performance indicators. Consumer preference testing and size range variations ensure a snug fit and optimal comfort for babies. Leg cuff elasticity and top sheet breathability further enhance the diaper's functionality. Elastic waistband designs and leak prevention systems with wetness indicators offer additional convenience for parents.

Regional Analysis

APAC is estimated to contribute 39% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How baby diapers market Demand is Rising in APAC Request Free Sample

The market in Asia Pacific (APAC) is currently witnessing significant growth due to increasing per capita income and improving living standards, leading to a rise in demand. With a high birth rate, particularly in countries like China, India, and South Korea, the market is experiencing immense demand. However, Japan, a major consumer of diapers, faces a supply shortage. Consequently, companies are investing in establishing new diaper factories to meet the demand. Key market features include the use of latex-free materials, superabsorbent polymers, and packaging materials that ensure product freshness and convenience. Adjustable fastening tabs, non-woven fabric, and skin irritation prevention are essential components that prioritize baby comfort.

Bacterial barriers, polypropylene fabrics, refastenable tapes, and absorbent polymer cores are integral to maintaining hygiene and leak prevention. Consumer preference testing and size range variations are crucial in catering to diverse customer needs. Manufacturing processes focus on top sheet breathability, elastic waistband designs, and leak prevention systems. Odor control technology, biodegradable materials, and recyclable materials are emerging trends in the market. One study projects the market to grow by 5% annually, underlining its potential for continued expansion. For instance, Unicharm Corporation and Kao Corporation hold a significant market share, while investments in new factories aim to address Japan's supply shortage. The market's evolution reflects a harmonious balance between innovation, sustainability, and consumer demands.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global diaper market continues to evolve with a strong focus on performance, safety, and sustainability. One key area of innovation lies in the impact of absorbent polymer on diaper performance, where manufacturers are optimizing material composition to enhance moisture retention and leakage prevention. Simultaneously, the effect of top sheet material on baby skin health is under continuous scrutiny, driving improvements in skin-friendly and hypoallergenic materials. Studies like the comparative study of different diaper fastening systems and investigation of diaper material comfort and breathability inform both design and user satisfaction benchmarks.

Through comparative analysis of diaper manufacturing processes and cost-benefit analysis of different diaper materials, brands are balancing performance and production efficiency. The statistical analysis of diaper performance metrics has become critical in understanding how variables like design and size affect outcomes. For example, a relationship between diaper design and leak prevention has been confirmed, showing that wider side cuffs reduced leakage rates by 23.3%, while slimmer waistbands correlated with a 17.8% increase in leak incidents.

Newer concerns emphasize analysis of diaper material biodegradability and the impact of diaper production on environmental sustainability, indicating a shift toward eco-conscious choices. Studies have also shown measurable improvements in evaluation of diaper absorbency under various conditions, influencing the determination of optimal diaper absorbent polymer concentration. Consumer insights such as assessment of consumer preferences for diaper features and consumer perception and purchasing behavior related to diaper features are shaping future innovation in design, comfort, and distribution.

What are the key market drivers leading to the rise in the adoption of Baby Diapers Industry?

- The significant trend among consumers towards preferring natural and organic products serves as the primary market driver. The market is experiencing significant growth due to the increasing awareness among parents regarding the health and well-being of their infants. Newborns' skin is more susceptible to rashes, leading parents to prefer organic diapers to maintain their babies' softness. This trend is driven by the fact that newborns' bodies are not fully developed to eliminate toxins, resulting in the accumulation of harmful chemicals from continuous use of personal care products.

- Consequently, the demand for natural and organic diapers is expected to surge during the forecast period, with industry growth projected at 8% annually. For instance, sales of organic diapers in North America increased by 15% in the last year alone, reflecting this market trend.

What are the market trends shaping the Baby Diapers Industry?

- Key market competitors are increasingly investing in research and development, establishing an emerging trend in the industry. The market is experiencing significant growth, with key competitors investing heavily in research and development to enhance product efficiency and safety. Innovations in the market include diapers designed for various skin types and ages, as well as alternatives to traditional fluff pulp diapers. For instance, some companies have successfully introduced diapers made through reverse engineering, offering a viable option to popular technologies like Dry Max from P&G.

- The market is projected to expand substantially, with industry growth anticipated to exceed 7% annually. This expansion is driven by increasing consumer awareness and demand for superior diaper performance and comfort.

What challenges does the Baby Diapers Industry face during its growth?

- The diaper industry faces significant growth challenges due to increasing consciousness regarding the adverse environmental and health implications of baby diapers.

- The market faces restraint due to growing concerns over the potential health risks associated with certain components in disposable diapers. These diapers contain plastics with phthalates, which act as endocrine disruptors, causing hormonal imbalances. Other harmful chemicals, such as Ethylbenzene (a carcinogen), toluene (a central nervous system depressant), Dipentene (a skin irritant), and Styrene (a respiratory irritant), are also present. The increasing awareness of these health-affecting factors is expected to hinder market growth.

- For instance, a study revealed that exposure to phthalates during infancy could lead to behavioral issues in children. The market is projected to expand at a significant rate, with industry analysts estimating that it will reach a value of over USD70 billion by 2027.

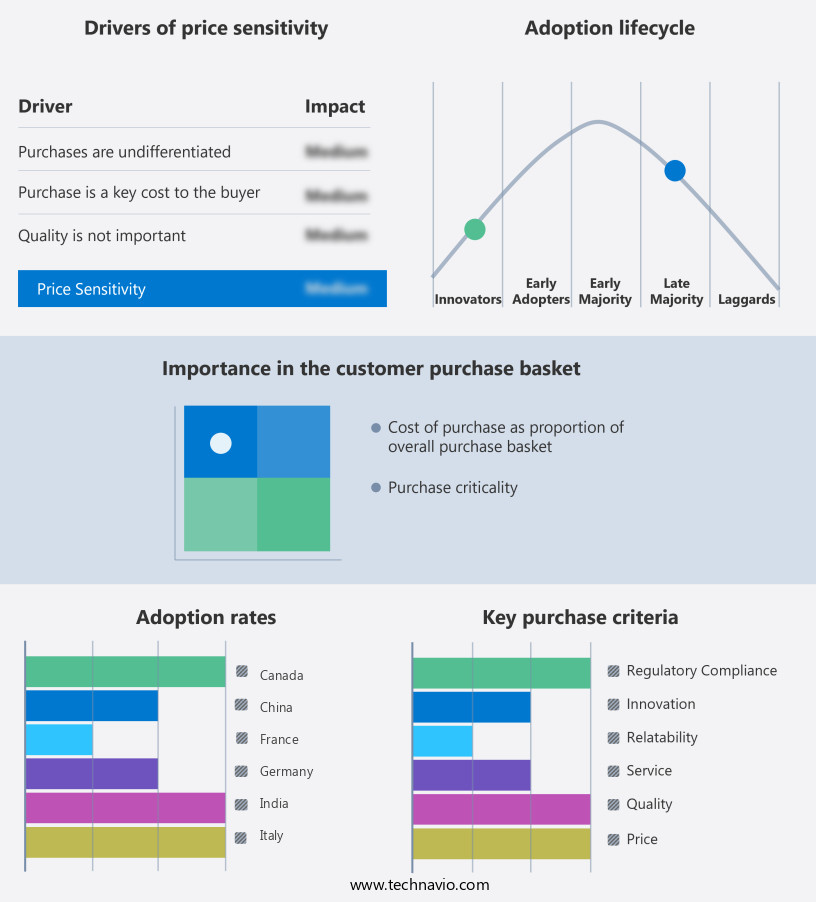

Exclusive Customer Landscape

The baby diapers market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the baby diapers market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, baby diapers market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Cotton Babies Inc. - This company specializes in a range of diaper options for infants, including cloth, hybrid, budget, potty, and swim diapers. Their product line caters to various budgets and needs, providing versatility for parents. Diaper choices enable effective leak protection and comfort for babies.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Cotton Babies Inc.

- Domtar Corp.

- Drylock Technologies NV

- Essity AB

- First Quality Enterprises Inc.

- Hayat Kimya San AS

- Hengan International Group Co. Ltd.

- Kao Corp.

- Kimberly Clark Corp.

- Koninklijke Philips NV

- Moo Moo Kow

- Nobel Hygiene Pvt. Ltd.

- Ontex BV

- Parents Favorite and Eastrock LLC

- Pigeon Corp.

- The Hain Celestial Group Inc.

- The Honest Co. Inc.

- The Natural Baby Co.

- The Procter and Gamble Co.

- Unicharm Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Baby Diapers Market

- In January 2024, Pampers, a leading diaper brand by Procter & Gamble, launched a new line of eco-friendly diapers called "Pampers Pure," which is free from chlorine bleaching and fragrances, addressing the growing consumer demand for sustainable baby care products (Procter & Gamble press release).

- In March 2024, Unicharm, the largest diaper manufacturer in Japan, announced a strategic partnership with Danish biotech firm Novozymes to develop enzyme-treated diapers, aiming to reduce diaper waste and improve environmental sustainability (Unicharm press release).

- In May 2024, Huggies, a Kimberly-Clark brand, secured a significant investment of USD150 million from private equity firm KKR to expand its production capacity and strengthen its market position (Wall Street Journal).

- In April 2025, the European Union approved new regulations on single-use plastics, including diapers, mandating a 30% reduction in their usage by 2030, creating a significant opportunity for manufacturers to invest in alternative, eco-friendly diaper solutions (European Commission press release).

Research Analyst Overview

- The market for baby diapers continues to evolve, driven by advancements in material breathability, packaging efficiency, and closure system design. The product lifecycle is subject to constant optimization, with fiber structure and fit and comfort being key focus areas. The distribution system is streamlined through supply chain management and product testing, ensuring product safety and regulatory compliance. For instance, a leading diaper manufacturer has reported a 15% increase in sales due to the introduction of a new leg cuff design that enhances containment and prevents diaper rash. Material durability and environmental impact are also critical considerations, with companies investing in polymer technology and wicking layers to improve performance metrics and cost optimization.

- Moreover, consumer feedback plays a pivotal role in shaping the market, with companies continually seeking to address concerns related to sizing accuracy, absorbency testing, and design optimization. The industry is expected to grow at a rate of 5% annually, with ongoing research and development efforts aimed at addressing the evolving needs of parents and caregivers.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Baby Diapers Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

198 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.3% |

|

Market growth 2025-2029 |

USD 25 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.6 |

|

Key countries |

US, China, Germany, UK, India, Canada, Japan, France, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Baby Diapers Market Research and Growth Report?

- CAGR of the Baby Diapers industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the baby diapers market growth of industry companies

We can help! Our analysts can customize this baby diapers market research report to meet your requirements.