Banking As A Service Market Size 2024-2028

The banking as a service market size is forecast to increase by USD 39.44 billion at a CAGR of 20.65% between 2023 and 2028.

- The Banking as a Service (BaaS) market is experiencing significant growth, driven by increasing adoption by end-users seeking more convenient and efficient financial services. This trend is further fueled by the growing number of partnerships, collaborations, and agreements between financial institutions and fintech companies. However, the implementation and data security challenges associated with BaaS remain a concern. Financial institutions must ensure strong security measures to protect sensitive customer information and maintain trust. As the market continues to evolve, staying abreast of these trends and challenges is crucial for success. The BaaS market is poised for continued expansion, offering opportunities for innovation and growth In the financial sector.

What will be the Size of the Banking As A Service Market During the Forecast Period?

- The Banking as a Service (BaaS) market is experiencing significant growth due to the digitalization of financial services. Traditional retail banking institutions are increasingly partnering with fintech businesses to offer APIs and BaaS platforms, enabling open banking and enhancing customer experiences. Incumbent banks are embracing BaaS technology to remain competitive In the market. BaaS solutions are driving the digital transformation of various industries, including e-commerce, health, travel, retail, telecom, and others. Newer fintech organizations and non-banking financial institutions are leveraging these platforms to offer banking services without the need for a license. The BaaS market is segmented into platform component and services segments.

- Additionally, cloud-based and API-based BaaS solutions are gaining popularity due to their flexibility and scalability. Large enterprises and small to medium-sized businesses are adopting BaaS to streamline their financial operations and improve customer experiences. Artificial intelligence and digital banking are key trends In the BaaS market, providing advanced financial services and personalized customer experiences. BaaS technology is revolutionizing the way businesses manage their finances and interact with their customers.

How is this Banking As A Service Industry segmented and which is the largest segment?

The banking as a service industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Banks

- NBFC

- Government

- Component

- Platform

- Services

- Geography

- North America

- Canada

- US

- Europe

- Germany

- France

- APAC

- China

- South America

- Middle East and Africa

- North America

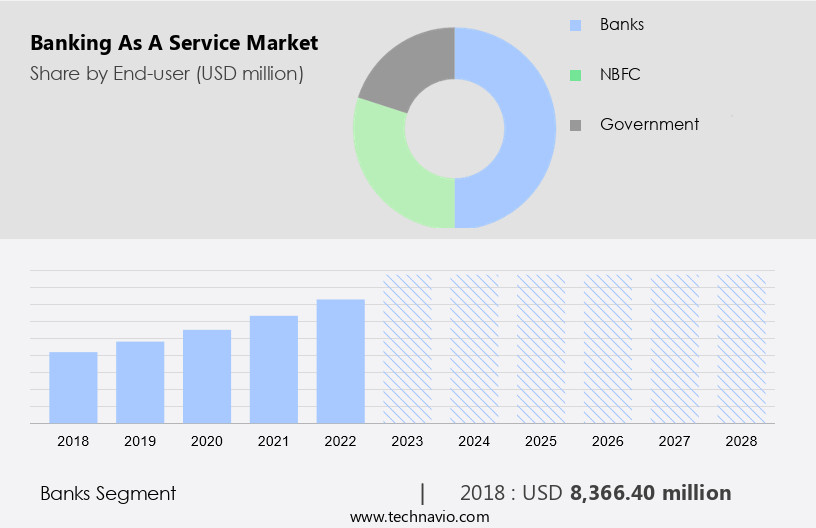

By End-user Insights

The banks segment is estimated to witness significant growth during the forecast period. The market is experiencing substantial growth, with the banks segment leading the way in 2023. Advanced financial technology adoption in banks is driving this segment's expansion. Banking as a service enables banks to utilize APIs, facilitating data sharing with external financial institutions. Open banking's rise is further fueling the market's growth, offering new revenue opportunities for banks. This solution benefits banks in several ways, including cost savings. By leveraging banking as a service, banks can minimize expenses and generate revenue through partnerships with fintech businesses, e-commerce platforms, and other non-banking financial institutions.

Additionally, cloud-based and API-based banking as a service solutions provide enhanced digital banking capabilities, including liquidity management, risk management, and API-driven connectivity for licensed institutions. This technology empowers product innovation, enabling domestic and international fund transaction services for large enterprises, small and medium businesses, and retail customers. The market encompasses various components, including platform and services segments, catering to diverse industries like retail banking, retail, travel, telecom, health, and e-commerce.

Get a glance at the Banking As A Service Industry report of share of various segments Request Free Sample

The banks segment was valued at USD 8.37 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

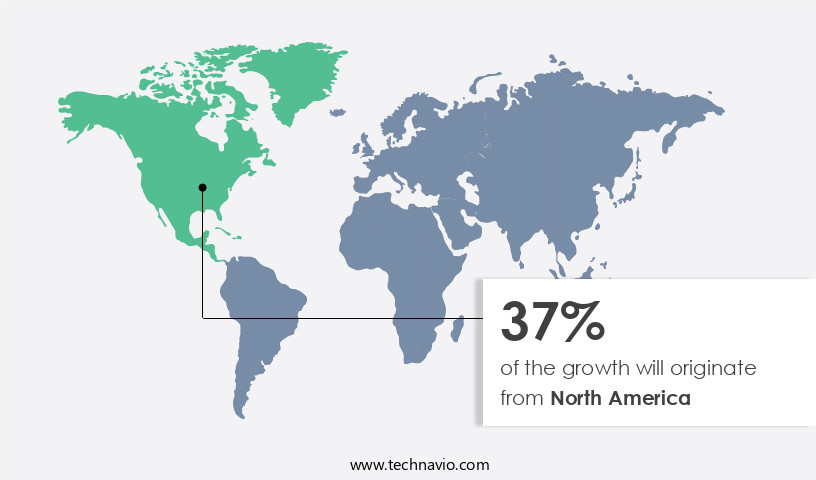

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market is projected to expand due to the region's technological advancement and early adoption of innovations. Leading financial institutions are investing in digital solutions, such as APIs and online banking platforms, to enhance customer experience. Fintech businesses and non-banking financial companies (NBFCs) are also leveraging banking-as-a-service (BaaS) platforms and open banking frameworks to offer financial services to various industries, including e-commerce, health, travel, retail, telecom, and retail. BaaS technology, such as cloud-based and API-based solutions, enables large enterprises and small to medium-sized enterprises (SMEs) to access banking services without the need for a license. This market growth is further fueled by the increasing demand for digital banking services, advanced liquidity and risk management capabilities, and API-driven connectivity among licensed institutions. Product innovation and the integration of artificial intelligence are also key drivers in the market.

Market Dynamics

Our banking as a service market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the Banking As A Service Industry?

- Increasing adoption by end-users is the key driver of the market. Banking as a Service (BaaS) is revolutionizing the financial industry by enabling digitalization and API-based integration for fintech businesses and retail banking institutions. BaaS platforms provide access to banking capabilities, such as account management, payment processing, and lending services, allowing businesses to innovate and offer superior financial solutions. This trend is particularly prominent in non-banking financial institutions (NBFCs), e-commerce, health, travel, retail, telecom, and other industries. BaaS technology, including cloud-based and API-driven connectivity, is facilitating open banking frameworks and API platforms, empowering smaller businesses and large enterprises alike. Leading BaaS providers, such as Finastra, Treezor, Currency Cloud, and FIS, offer advanced services like small business lending, liquidity management, and risk management capabilities.

- Additionally, the adoption of BaaS technology is driving product innovation and competition In the financial services sector. Traditional banking institutions, or incumbents, are also embracing BaaS to stay competitive and meet the evolving needs of their customers. Open banking frameworks and API platforms enable seamless integration of third-party services, further expanding the range of offerings for customers. BaaS providers offer various solutions, including cloud-based and API-based services, catering to the needs of diverse segments, including domestic fund transaction services, licensed institutions, and NBFCs. As the financial services landscape continues to evolve, the demand for BaaS solutions is expected to grow significantly, offering numerous opportunities for businesses to enhance their offerings and better serve their customers.

What are the market trends shaping the Banking As A Service Industry?

- Growing partnerships, collaborations, and agreements are the upcoming market trend. The digitalization of banking services continues to gain momentum, with APIs playing a pivotal role in facilitating online banking for fintech businesses and newer nonbanking financial organizations. BaaS platforms are increasingly being adopted by large enterprises and small to medium-sized businesses in sectors such as e-commerce, health, travel, retail, telecom, and more. The market for BaaS technology is expected to grow significantly due to the increasing demand for digital banking services and open banking frameworks. Some of the recent developments in this space include the acquisition of Afterpay by Block Inc. In January 2022, which aims to expand access to financial products and services for a larger customer base.

- Similarly, collaborations and partnerships between licensed banks, fintech providers, and enterprise software platforms are on the rise. These collaborations enable the provision of services such as domestic fund transaction services, liquidity management, risk management capabilities, and API-driven connectivity to licensed institutions. Moreover, cloud-based and API-based BaaS solutions are becoming increasingly popular, offering benefits such as product innovation, flexibility, and scalability. The services segment and platform component segment are expected to dominate the market during the forecast period. Overall, the market is poised for significant growth due to the increasing demand for digital banking services and the strategic collaborations and partnerships among key players.

What challenges does the Banking As A Service Industry face during its growth?

- Implementation and data security challenges is a key challenge affecting the industry growth. In the rapidly digitalizing financial landscape, Banking as a Service (BaaS) has emerged as a game-changer for fintech businesses seeking to offer banking functionalities without the need to become licensed banks. BaaS platforms enable these companies to access APIs from licensed banks and non-banking financial institutions (NBFCs), facilitating online banking services, small business lending, and other financial solutions. Digital banking is at the forefront of this trend, with open banking frameworks and API platforms enabling seamless connectivity between financial institutions and third-party providers. The BaaS market caters to various industries, including e-commerce, health, travel, retail, telecom, and more, offering services segmented into platform components and BaaS technology.

- Large enterprises and small to medium-sized businesses (SMEs) are increasingly adopting cloud-based BaaS and API-based BaaS for their financial needs. BaaS providers offer advanced capabilities such as Artificial Intelligence, liquidity management, risk management, and APIdriven connectivity. However, the implementation of BaaS comes with challenges. Security and data privacy concerns are paramount, as the handling of sensitive customer information necessitates strong protection. Financial enterprises are cautious about potential data misuse and are demanding transparency and accountability from BaaS providers. Despite these challenges, the market is expected to grow significantly, with FIS, Treezor, Currency Cloud, and other BaaS providers leading the way. The future of banking lies in the integration of technology and financial services, enabling innovation and convenience for customers.

Exclusive Customer Landscape

The banking as a service market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the banking as a service market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, banking as a service market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 11:FS

- Alkami Technology Inc.

- Banco Bilbao Vizcaya Argentaria SA

- Block Inc.

- Bnkbl Ltd.

- ClearBank Ltd.

- CREALOGIX Holding AG

- Currency Cloud Group Ltd.

- Finastra

- Fiserv Inc.

- Green Dot Corp.

- MatchMove Pay Pte Ltd.

- Movencorp Inc.

- PayPal Holdings Inc.

- Q2 Holdings Inc.

- Societe Generale SA

- Solarisbank AG

- StoneCastle Digital Solutions LLC

- Temenos AG

- Urban FT Group Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market has experienced significant growth in recent years, driven by the increasing demand for digitalization and open banking solutions. BaaS platforms enable non-banking financial organizations and retail businesses to offer banking services to their customers without the need to obtain a banking license. These platforms provide access to APIs, enabling seamless integration with various e-commerce, health, travel, retail, telecom, and other industries. BaaS technology has revolutionized the financial landscape by enabling smaller and medium enterprises (SMEs) to access banking services more easily. Traditional incumbents have responded by investing in BaaS solutions to remain competitive. The market is segmented into platform component and services segments. Cloud-based BaaS and API-based BaaS are the two primary types of solutions, with the former offering more flexibility and scalability. BaaS technology has also enabled product innovation, with licensed institutions offering a range of services such as small business lending, fund transaction services, and FX solutions.

Furthermore, the adoption of BaaS technology has been driven by the need for real-time, API-driven connectivity and advanced risk management capabilities. Large enterprises have been early adopters of BaaS solutions due to their size and complexity. However, SMEs and non-bank organizations are also increasingly turning to BaaS providers for their banking needs. According to a recent survey, over 50% of SMEs In the US are considering using BaaS providers for their banking requirements. The BaaS market is expected to continue growing, driven by the increasing demand for digital banking solutions and the need for greater efficiency and flexibility in banking services. The market is expected to be driven by the increasing adoption of open banking frameworks and API platforms, which will enable greater interoperability and collaboration between banks and non-banking organizations. BaaS providers are also investing in artificial intelligence and machine learning capabilities to offer more personalized and efficient services to their customers.

Thus, this will enable them to offer more targeted and relevant services, improving the customer experience and driving growth In the market. Despite the growth potential, the BaaS market also faces challenges, including regulatory compliance, security concerns, and the need for standardization. BaaS providers must navigate these challenges to remain competitive and offer innovative and secure solutions to their customers. In summary, the BaaS market is poised for significant growth, driven by the increasing demand for digital banking solutions and the need for greater efficiency and flexibility in banking services. BaaS technology is enabling smaller and medium enterprises to access banking services more easily, while also driving innovation and competition In the market. However, challenges such as regulatory compliance, security concerns, and the need for standardization must be addressed to ensure the long-term success of the market.

|

Banking As A Service Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

153 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20.65% |

|

Market growth 2024-2028 |

USD 39.44 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

15.57 |

|

Key countries |

US, China, Canada, France, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Banking As A Service Market Research and Growth Report?

- CAGR of the Banking As A Service industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the banking as a service market growth of industry companies

We can help! Our analysts can customize this banking as a service market research report to meet your requirements.