Basketball Apparel Market Size 2025-2029

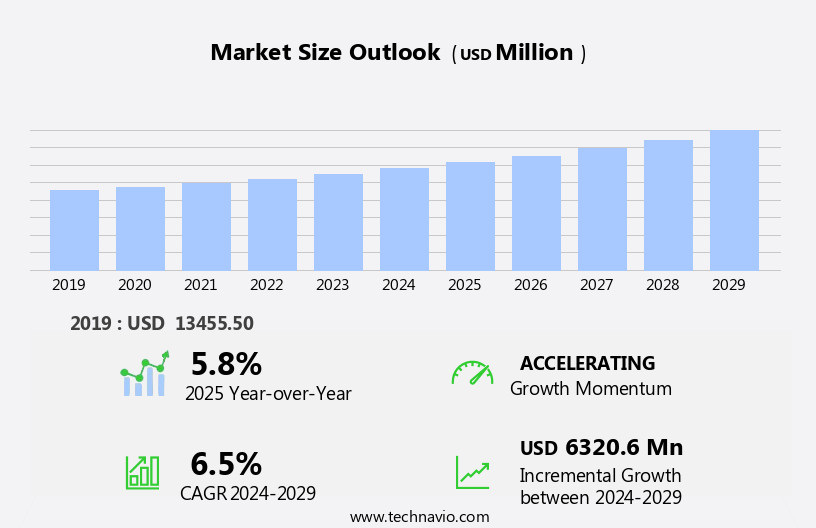

The basketball apparel market size is forecast to increase by USD 6.32 billion, at a CAGR of 6.5% between 2024 and 2029.

- The market is experiencing significant growth, driven by innovations in designs and portfolio expansion. Brands are investing in advanced technologies to create performance-enhancing and stylish basketball apparel, catering to the evolving needs of athletes and fans alike. A notable trend is the introduction of connected basketball apparel, which integrates technology to monitor performance metrics and enhance the overall user experience. The market is witnessing significant growth due to the increasing popularity of sports and the innovation in sports equipment. However, market growth is not without challenges. Inconsistent raw material prices pose a significant obstacle, making it difficult for manufacturers to maintain profitability and sustainability.

- As a result, companies must effectively manage their supply chains and explore alternative sourcing strategies to mitigate price volatility and maintain competitiveness. By staying informed of market trends and addressing these challenges, basketball apparel companies can capitalize on the growing demand for innovative, high-performance apparel and position themselves for long-term success.

What will be the Size of the Basketball Apparel Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology, consumer preferences, and industry trends. Fit and sizing innovations have revolutionized the market, with entities focusing on compression garments and performance enhancement. Performance metrics, such as moisture-wicking technology and breathable materials, have become essential for athletes seeking to optimize their training regimens. Sublimation printing and custom apparel have gained popularity in the basketball community, allowing teams and individuals to showcase their unique styles and brand loyalty. Brand licensing and collaborations have also emerged as significant market drivers, with athletes and influencers endorsing various apparel brands.

Trend forecasting plays a crucial role in the basketball apparel industry, with fashion trends and lifestyle apparel influencing consumer preferences. Brands are increasingly focusing on sustainability, ethical sourcing, and supply chain management to meet the evolving demands of consumers. Basketball training and injury prevention have become key applications for basketball apparel, with brands investing in research and development to create products that enhance performance and protect athletes from injuries. E-commerce platforms and digital marketing campaigns have transformed retail distribution, allowing consumers to access a wide range of basketball apparel from anywhere in the world. Brand equity and fan engagement have become essential components of marketing strategies, with brands leveraging social media and influencer marketing to build customer loyalty and awareness.

Customer service, returns and exchanges, and data analytics are also critical areas of focus, ensuring that customers receive high-quality products and services. The market is a dynamic and ever-changing landscape, with entities continually adapting to meet the evolving needs of consumers and athletes. From performance enhancement to fashion trends, basketball apparel is more than just clothing â it's a reflection of personal style, athletic prowess, and team spirit.

How is this Basketball Apparel Industry segmented?

The basketball apparel industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Male

- Female

- Distribution Channel

- Offline

- Online

- Material

- Polyester

- Blended fabrics

- Cotton

- Nylon

- Product Type

- Jerseys

- Shorts

- Warm-up suits

- Socks

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Spain

- UK

- APAC

- Australia

- China

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

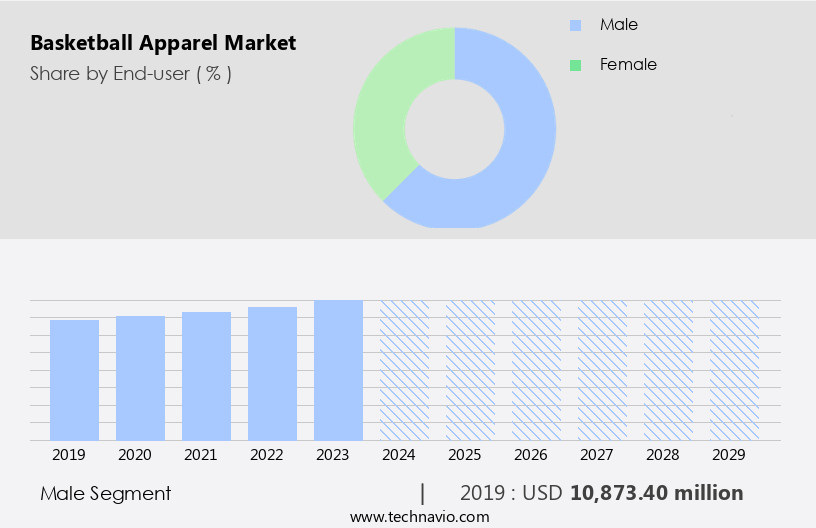

The male segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth, driven by various factors. Social media marketing plays a crucial role in promoting brands and engaging fans. Streetwear culture continues to influence basketball apparel trends, with moisture-wicking technology becoming increasingly popular for performance-focused clothing. Retail distribution channels expand, offering consumers convenient access to casual wear and team uniforms. Sustainable manufacturing practices and ethical sourcing are prioritized, enhancing brand equity. Marketing campaigns leverage influencer marketing and data analytics to reach consumers effectively. Team uniforms incorporate heat transfer technology for customization and durability testing. Injury prevention is a key consideration, with compression garments and performance enhancement apparel gaining traction.

E-commerce platforms facilitate easy purchasing, while size charts ensure accurate fit and sizing. International basketball tournaments, such as the Summer Olympic Games and FIBA championships, fuel demand for basketball apparel. Product development focuses on fashion trends, lifestyle apparel, and performance fabrics. Competitor analysis and design innovation are essential for maintaining brand awareness and staying competitive. Brand loyalty is fostered through quality control, customer service, and trend forecasting. Youth basketball and brand licensing contribute to the market's growth. Athletic wear, breathable materials, and performance metrics are essential features for basketball apparel. Custom apparel, digital printing, and sublimation printing cater to individual preferences.

Inventory management and wholesale channels ensure customer acquisition and retention. Compression garments, performance enhancement, and basketball training apparel cater to specific consumer needs.

The Male segment was valued at USD 10.87 billion in 2019 and showed a gradual increase during the forecast period.

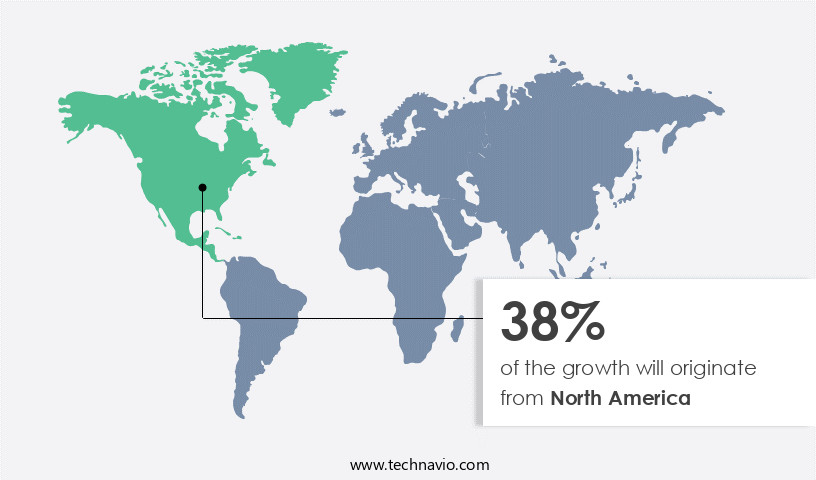

Regional Analysis

North America is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, particularly in North America, where the sport's popularity continues to soar. The health benefits associated with basketball, combined with the minimal need for protective gear compared to other sports, is driving consumer interest. Social media marketing and streetwear culture have also played a pivotal role in increasing brand awareness and fan engagement. Moisture-wicking technology and performance fabrics are essential features in basketball apparel, ensuring comfort and durability during intense training and games. Retail distribution channels, including e-commerce platforms, have streamlined access to these innovative products. Team uniforms, custom apparel, and screen printing are popular options for fans and players alike.

Injury prevention and compression garments are also key considerations, with brands investing in research and development to enhance performance and provide injury protection. Sustainable manufacturing practices and ethical sourcing are increasingly important to consumers, with many brands focusing on recycled materials and reducing their carbon footprint. Customer service, pricing strategy, and inventory management are essential elements of a successful business model. Data analytics and trend forecasting help brands stay competitive and adapt to changing consumer preferences. Competitor analysis, brand equity, and consumer insights are crucial components of marketing campaigns. Heat transfer and sublimation printing are popular techniques for creating eye-catching designs.

Performance metrics and breathable materials are essential for athletes seeking to improve their game. Basketball training and compression garments are essential for injury prevention and performance enhancement. Brand loyalty and quality control are essential for long-term success in the market. Fashion trends and lifestyle apparel continue to influence basketball apparel design, with digital printing and material analysis playing a significant role in creating innovative, high-performance fabrics. Youth basketball and brand licensing are growing segments, with athletic wear and performance fabrics remaining popular choices for players at all levels.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Basketball Apparel Industry?

- The primary catalyst for market growth in basketball apparel is the continuous innovation in design and the expansion of product portfolios.

- The market is experiencing significant growth due to design innovations and expanding product portfolios. Leading brands, such as Adidas, Nike, and Under Armour, are utilizing advanced materials for creating high-performance basketball apparel. These companies prioritize durability and comfort, with features like sweat-wicking fabrics and lightweight designs. Nike, for instance, offers basketball shorts with double-knit fabric for enhanced breathability. Inventory management and digital printing technology are essential aspects of the basketball apparel industry. Companies conduct rigorous durability testing and material analysis to ensure product quality. Fashion trends and lifestyle apparel preferences influence market dynamics, with performance fabrics gaining popularity.

- Customer acquisition and retention are crucial for companies, and they leverage wholesale channels to expand their reach. Innovative basketball apparel designs include Nike's Kobe Bryant City Edition Authentic (Los Angeles Lakers), LeBron James Statement Edition Authentic (Los Angeles Lakers), Russell Westbrook City Edition Authentic (Oklahoma City Thunder), and Brooklyn Nets City Edition Biggie Swingman. Companies focus on cost optimization and pricing strategies to maintain profitability and remain competitive.

What are the market trends shaping the Basketball Apparel Industry?

- The introduction of connected basketball apparel represents a significant market trend in the sports industry. Smart technology is increasingly being integrated into athletic wear, enabling real-time performance tracking and data analysis for athletes.

- The market is experiencing significant growth due to the integration of technology into athletic wear. Companies are introducing smart features, such as Nike's NikeConnect, which allows customers to access team and player statistics, exclusive content, and more, by connecting their jerseys to their smartphones. This innovation is a response to the global trend of performance enhancement and basketball training. Comfort and fit are crucial factors in basketball apparel, and compression garments made from breathable materials ensure optimal performance and mobility. Quality control and brand loyalty are essential in this market, with consumers seeking reliable and trustworthy brands. Trend forecasting plays a vital role in the basketball apparel industry, with youth basketball and brand licensing driving demand for athletic wear.

- Sublimation printing is a popular technique used to create vibrant and long-lasting designs on basketball jerseys and other apparel. Performance metrics, such as moisture-wicking and UV protection, are essential features that athletes look for in basketball apparel. Overall, the market is dynamic and innovative, with a focus on enhancing the athletic experience for players and fans alike.

What challenges does the Basketball Apparel Industry face during its growth?

- The inconsistency in raw material prices poses a significant challenge to the industry's growth trajectory.

- In the current market environment, basketball apparel manufacturers face challenges in maintaining consistent profit margins. The volatility of raw material prices and intensifying competition among companies have led to price wars. This trend compels global players to lower their product prices, reducing their profitability. Moreover, foreign currency fluctuations directly impact the cost of raw materials, such as cotton and natural fabrics, further straining profitability. The time lag between cost fluctuations and price adjustments exacerbates the issue. To stay competitive, basketball apparel manufacturers employ various marketing strategies, including social media marketing and fan engagement, to boost brand equity. They also focus on casual wear, moisture-wicking technology, and retail distribution to cater to the growing demand for comfortable and functional apparel.

- Additionally, sustainable manufacturing and pricing strategies are becoming essential as consumers increasingly prioritize eco-friendly and affordable options. Marketing campaigns and wear testing are other essential elements in the market, ensuring product quality and customer satisfaction. E-commerce platforms have also gained popularity, enabling seamless sales and distribution, particularly during the pandemic. Overall, the market remains dynamic, requiring companies to stay agile and responsive to market trends and consumer preferences.

Exclusive Customer Landscape

The basketball apparel market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the basketball apparel market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, basketball apparel market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

47 Brand LLC - The company specializes in basketball apparel, providing a diverse range of options including Franklin, Scrum, Lacer, and Shortstop Hood.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 47 Brand LLC

- Adidas AG

- ANTA Sports Products Ltd.

- ASICS Corp.

- Authentic Brands Group LLC

- Ballislife LLC

- BasicNet S.p.A

- Decathlon SA

- FILA Holdings Corp.

- Iconix International

- Mcdavid

- Mitchell and Ness Nostalgia Co.

- New Balance Athletics Inc.

- Nike Inc.

- POINT 3 Basketball

- PUMA SE

- Russell Brands LLC

- Under Armour Inc.

- Wilson Sporting Goods

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Basketball Apparel Market

- In January 2024, Nike Inc. Launched its new basketball apparel line, "Nike Basketball Swish," featuring advanced moisture-wicking technology and improved breathability (Nike Press Release).

- In March 2024, Adidas and the National Basketball Association (NBA) announced a multi-year partnership extension, granting Adidas exclusive rights to outfit the NBA's referees starting from the 2024-2025 season (Adidas Press Release).

- In April 2024, Under Armour secured a strategic partnership with the National Basketball Players Association (NBPA) to become the official outfitter of the NBPA's Elite Youth Basketball League (EYBL) (Under Armour Press Release).

- In May 2025, Puma announced the acquisition of Jay-Z's athletic apparel brand, Rocawear, for USD 327 million, expanding its presence in the market (Reuters). These developments underscore the ongoing competition and innovation within the market, with key players launching new product lines, securing strategic partnerships, and making significant acquisitions.

Research Analyst Overview

- In the dynamic market, sizing standards and sales forecasting play crucial roles in catering to customers' needs and anticipating market demands. Mesh fabrics, a popular choice for athletic wear, are subject to customer reviews and sales trends. Promotional pricing and licensing agreements are effective strategies to boost sales, while content marketing and brand partnerships enhance customer satisfaction. Discounting strategies, search engine optimization, and email marketing are essential tools for reaching potential buyers. Manufacturing facilities ensure garment construction adheres to retail markup and team branding specifications. Sponsorship opportunities and printing techniques add value to merchandise, while shipping and handling, color matching, and lead times impact customer perception.

- Product ratings, fit testing, and thread count influence marketing ROI, and social media engagement and fabric weight shape consumer preferences. Embroidery threads and player names contribute to the overall appeal of basketball apparel, while production processes and sizing specifications ensure quality and consistency. Online reviews and affiliate marketing further expand reach and influence.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Basketball Apparel Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

240 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.5% |

|

Market growth 2025-2029 |

USD 6320.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.8 |

|

Key countries |

US, Canada, France, China, Spain, Brazil, UK, Germany, Australia, and Argentina |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Basketball Apparel Market Research and Growth Report?

- CAGR of the Basketball Apparel industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the basketball apparel market growth of industry companies

We can help! Our analysts can customize this basketball apparel market research report to meet your requirements.