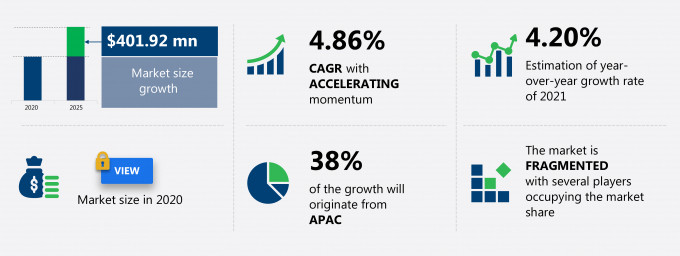

The bentonite market share is expected to increase by USD 401.92 million from 2020 to 2025, and the market’s growth momentum will accelerate at a CAGR of 4.86%.

This bentonite market research report provides valuable insights on the post COVID-19 impact on the market, which will help companies evaluate their business approaches. Furthermore, this report extensively covers bentonite market segmentations by product (sodium bentonite, calcium bentonite, and others), application (foundry sands, iron ore pelletizing, pet litter, drilling mud, and others), and geography (APAC, North America, Europe, South America, and MEA). The bentonite market report also offers information on several market vendors, including CIMBAR Performance Minerals, Clariant International Ltd., EP Minerals LLC, Halliburton Co., Imerys, KUNIMINE INDUSTRIES Co. Ltd., LKAB Minerals AB, Minerals Technologies Inc., Mitsubishi Corp., and Wyo-Ben Inc. among others.

What will the Bentonite Market Size be During the Forecast Period?

Download the Free Report Sample to Unlock the Bentonite Market Size for the Forecast Period and Other Important Statistics

Bentonite Market: Key Drivers, Trends, and Challenges

Based on our research output, there has been a negative impact on the market growth during and post COVID-19 era. The horizontal drilling: an innovation in oil and gas extraction is notably driving the bentonite market growth, although factors such as competition from organic binders may impede market growth. Our research analysts have studied the historical data and deduced the key market drivers and the COVID-19 pandemic impact on the bentonite industry. The holistic analysis of the drivers will help in deducing end goals and refining marketing strategies to gain a competitive edge.

Key Bentonite Market Driver

The horizontal drilling: an innovation in oil and gas extraction is a major factor driving the global bentonite market share growth. Technological advances in drilling technologies have revolutionized the oil and gas industry and have enabled access to the most remote locations, unconventional formations, deepwater regions, and even the arctic. Such developments have played a key role in driving the consumption of bentonite for drilling. In North America, horizontal drilling rigs constitute the largest share of the overall rig count. According to the EIA, the number of horizontal drilling rigs increased by about 14% during 2008-2018 in the US. Horizontal drilling allows the operator to drill long, lateral wells at sections of wellbores to access the entire reservoir. The growing adoption of lateral drilling techniques is estimated to boost the demand for bentonite, as it facilitates the drilling of new reservoirs. In the US, rapid technological advancement is allowing the adoption of new drilling and fracking techniques and has ensured that the extraction of hydrocarbons is more economical, which has increased the production of oil & gas, which further accelerates the demand for bentonite in the market. Due to such reasons, the demand for the market will grow in the forecast period.

Key Bentonite Market Trend

The organically modified bentonites and their increased use in geosynthetic clay liner system is another factor supporting the global bentonite market share growth. Organically modified bentonite clay is used to improve the performance of clay for organic pollutants. Geosynthetic clay liners and geomembranes are widely used to control the migration of leachates from waste disposal facilities. Geomembranes possess many limitations and require well-constructed clay backup. Geosynthetic clay liners perform better and are easy to construct and reduce the volume of the lining system for disposal facilities. Geosynthetic clays have bentonite glued to geomembrane that helps in reducing permeability, improving their mechanical properties, and improving the retention capacity for various pollutants present in the leachates. However, bentonite has a high retention capacity only with respect to inorganic ions. Thus, the clay needs to be organically modified to improve bentonite's retention capacity for organic contaminants. The contents of organically modified bentonite and bentonite are chosen based on their geotechnical and sorption capacities. Therefore, the market will grow significantly during the forecast period.

Key Bentonite Market Challenge

The competition from organic binders will be a major challenge for the global bentonite market share growth during the forecast period. Iron ore pelletizing from low-grade ores is a very important development in the beneficiation of iron ore. The quality of mined iron ore is decreasing globally. This has led to an increase in levels of silica in the concentrate. Bentonite is the most widely used inorganic binder in this industry. Bentonite improves the physical quality of pellets at all stages of agglomeration; however, it leads to high levels of silica. Bentonite assays have more than 50% SiO2. Thus, in order to reduce or prevent the silica content while mining a lower grade ore, organic binders are preferred. Organic binders reduce silica (acidic gangue), resulting in an increase in steel quality and productivity and reduced fuel consumption in the furnace. Organic binders have low silica content, which increases the iron content in the final pellet. Lowering of silica content in direct reduction grade pellets leads to a reduction in the cost incurred by melting these pellets in an electric arc furnace. Essentially, organic binders are substituting bentonite, especially in iron ore pelletizing from low-grade ores, thereby hampering the market growth.

This bentonite market analysis report also provides detailed information on other upcoming trends and challenges that will have a far-reaching effect on the market growth. The actionable insights on the trends and challenges will help companies evaluate and develop growth strategies for 2021-2025.

Parent Market Analysis

Technavio categorizes the global bentonite market as part of the global diversified metals and mining market. Our research report has extensively covered external factors influencing the parent market growth potential in the coming years, which will determine the levels of growth of the bentonite market during the forecast period.

Who are the Major Bentonite Market Vendors?

The report analyzes the market’s competitive landscape and offers information on several market vendors, including:

- CIMBAR Performance Minerals

- Clariant International Ltd.

- EP Minerals LLC

- Halliburton Co.

- Imerys

- KUNIMINE INDUSTRIES Co. Ltd.

- LKAB Minerals AB

- Minerals Technologies Inc.

- Mitsubishi Corp.

- Wyo-Ben Inc.

This statistical study of the bentonite market encompasses successful business strategies deployed by the key vendors. The bentonite market is fragmented and the vendors are deploying growth strategies such as advanced product offerings and strengthening their positions in local markets to gain a competitive advantage to compete in the market.

Product Insights and News

- CIMBAR Performance Minerals- The company offers bentonite products such as Sodium bentonite and Calcium bentonite.

To make the most of the opportunities and recover from post COVID-19 impact, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

The bentonite market forecast report offers in-depth insights into key vendor profiles. The profiles include information on the production, sustainability, and prospects of the leading companies.

Bentonite Market Value Chain Analysis

Our report provides extensive information on the value chain analysis for the bentonite market, which vendors can leverage to gain a competitive advantage during the forecast period. The end-to-end understanding of the value chain is essential in profit margin optimization and evaluation of business strategies. The data available in our value chain analysis segment can help vendors drive costs and enhance customer services during the forecast period.

The value chain of global diversified metals and mining market includes the following core components:

- Inputs

- Inbound logistics

- Operations

- Outbound logistics

- Marketing and sales

- Service

- Support activities

- Innovation

The report has further elucidated on other innovative approaches being followed by manufacturers to ensure a sustainable market presence.

Which are the Key Regions for Bentonite Market?

For more insights on the market share of various regions Request for a FREE sample now!

38% of the market’s growth will originate from APAC during the forecast period. China and India are the key markets for bentonite market in APAC. Market growth in this region will be faster than the growth of the market in all other regions.

The rising demand for foundry sand will facilitate the bentonite market growth in APAC over the forecast period. This market research report entails detailed information on the competitive intelligence, marketing gaps, and regional opportunities in store for vendors, which will assist in creating efficient business plans.

What are the Revenue-generating Product Segments in the Bentonite Market?

To gain further insights on the market contribution of various segments Request for a FREE sample

The bentonite market share growth by the sodium bentonite segment will be significant during the forecast period. Sodium bentonite has high swelling properties which makes it ideal for use as a sealant in industries. Sodium bentonite is also used as binders, liner material, and as a suspension agent in concrete, wall boards, cement tiles, and water-proofing building materials. The growing use of sodium bentonite as an effective sealant is driving the growth of the segment. This report provides an accurate prediction of the revenue share of all the segments to the growth of the bentonite market size.

This report provides an accurate prediction of the contribution of all the segments to the growth of the bentonite market size and actionable market insights on post COVID-19 impact on each segment.

|

Bentonite Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

120 |

|

Base year |

2020 |

|

Forecast period |

2021-2025 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.86% |

|

Market growth 2021-2025 |

$ 401.92 million |

|

Market structure |

Fragmented |

|

YoY growth (%) |

4.20 |

|

Regional analysis |

APAC, North America, Europe, South America, and MEA |

|

Performing market contribution |

APAC at 38% |

|

Key consumer countries |

US, China, India, Germany, and Brazil |

|

Competitive landscape |

Leading companies, Competitive strategies, Consumer engagement scope |

|

Key companies profiled |

CIMBAR Performance Minerals, Clariant International Ltd., EP Minerals LLC, Halliburton Co., Imerys, KUNIMINE INDUSTRIES Co. Ltd., LKAB Minerals AB, Minerals Technologies Inc., Mitsubishi Corp., and Wyo-Ben Inc. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Bentonite Market Report?

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will drive bentonite market growth during the next five years

- Precise estimation of the bentonite market size and its contribution to the parent market

- Accurate predictions on upcoming trends and changes in consumer behavior

- The growth of the bentonite industry across APAC, North America, Europe, South America, and MEA

- A thorough analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of bentonite market vendors

We can help! Our analysts can customize this report to meet your requirements. Get in touch