Big Data Security Market Size 2025-2029

The big data security market size is forecast to increase by USD 23.9 billion, at a CAGR of 15.7% between 2024 and 2029. Stringent regulations regarding data protection will drive the big data security market.

Major Market Trends & Insights

- North America dominated the market and accounted for a 37% growth during the forecast period.

- By Deployment - On-premises segment was valued at USD 10.91 billion in 2023

- By End-user - Large enterprises segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 188.34 billion

- Market Future Opportunities: USD USD 23.9 billion

- CAGR : 15.7%

- North America: Largest market in 2023

Market Summary

- The market is a dynamic and ever-evolving landscape, with stringent regulations driving the demand for advanced data protection solutions. As businesses increasingly rely on big data to gain insights and drive growth, the focus on securing this valuable information has become a top priority. The core technologies and applications underpinning big data security include encryption, access control, and threat detection, among others. These solutions are essential as the volume and complexity of data continue to grow, posing significant challenges for organizations. The service types and product categories within the market include managed security services, software, and hardware. Major companies, such as IBM, Microsoft, and Cisco, dominate the market with their comprehensive offerings.

- However, the market is not without challenges, including the high investments required for implementing big data security solutions and the need for continuous updates to keep up with evolving threats. Looking ahead, the forecast timeline indicates steady growth for the market, with adoption rates expected to increase significantly. According to recent estimates, The market is projected to reach a market share of over 50% by 2025. As the market continues to unfold, related markets such as the Cloud Security and Cybersecurity markets will also experience similar trends.

What will be the Size of the Big Data Security Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Big Data Security Market Segmented and what are the key trends of market segmentation?

The big data security industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Deployment

- On-premises

- Cloud-based

- End-user

- Large enterprises

- SMEs

- Solution

- Software

- Services

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

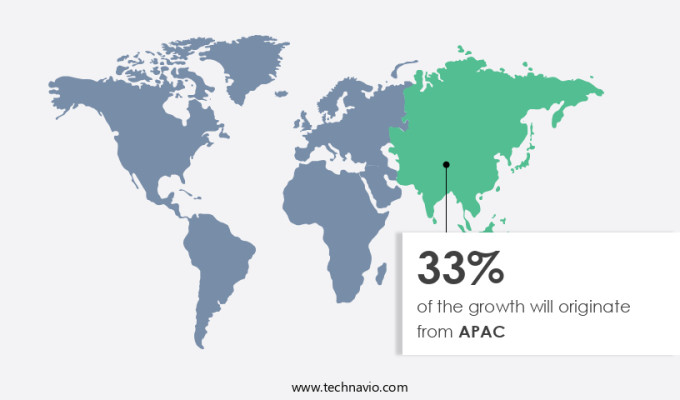

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Deployment Insights

The on-premises segment is estimated to witness significant growth during the forecast period.

The market trends encompass various advanced technologies and strategies that businesses employ to safeguard their valuable data. Threat intelligence platforms analyze potential risks and vulnerabilities, enabling proactive threat detection and response. Data encryption methods secure data at rest and in transit, ensuring confidentiality. Security automation tools streamline processes, reducing manual efforts and minimizing human error. Data masking techniques and tokenization processes protect sensitive information by obfuscating or replacing it with non-sensitive data. Vulnerability management tools identify and prioritize risks, enabling remediation. Federated learning security ensures data privacy in collaborative machine learning environments. Real-time threat detection and data breaches prevention employ anomaly detection algorithms and artificial intelligence security to identify and respond to threats.

Access control mechanisms and security incident response systems manage and mitigate unauthorized access and data breaches. Security orchestration automation, machine learning security, and big data anonymization techniques enhance security capabilities. Risk assessment methodologies and differential privacy techniques maintain data privacy while enabling data usage. Homomorphic encryption schemes and blockchain security implementations provide advanced data security. Behavioral analytics security monitors user behavior and identifies anomalous activities. Compliance regulations and data privacy regulations mandate adherence to specific security standards. Zero trust architecture and network security monitoring ensure continuous security evaluation and response. Intrusion detection systems and data governance frameworks further strengthen security posture.

According to recent studies, the market has experienced a significant 25.6% increase in adoption. Furthermore, industry experts anticipate a 31.8% expansion in the market's size over the next few years. These figures underscore the growing importance of big data security in today's digital landscape.

The On-premises segment was valued at USD 10.91 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Big Data Security Market Demand is Rising in North America Request Free Sample

The North American the market, primarily driven by the US and Canada, is experiencing notable growth. In 2024, the US accounted for the largest revenue share in the region. This trend is expected to continue due to a high number of big data breaches, with the US reporting over 100,000 in 2024. Historically, there have been numerous significant data breaches, such as the 2025 CMS incident affecting approximately 100,000 to 103,000 Medicare beneficiaries.

These incidents underscore the pressing need for robust security measures in handling big data.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth as businesses increasingly rely on large volumes of data to fuel their operations. With the adoption of advanced technologies like artificial intelligence (AI) and machine learning (ML) for data analysis, the need to secure this valuable asset has become paramount. To mitigate risks, companies are implementing data encryption algorithms and advanced threat detection systems to safeguard their data. In fact, The market is projected to reach USD118.6 billion by 2027, growing at a CAGR of 23.3% during the forecast period. This growth can be attributed to the increasing number of data security incidents, which have led organizations to invest in data loss prevention system implementation and data breaches mitigation strategies.

Cloud data security best practices are also gaining importance as more businesses move their data to the cloud. Real-time data security monitoring and privacy preserving data analytics are essential components of cloud security. Moreover, network security monitoring solutions and data governance framework compliance are critical to maintaining security in a cloud environment. Big data anonymization techniques, such as differential privacy implementation and homomorphic encryption applications, are becoming increasingly popular for preserving privacy while still allowing data to be analyzed. Secure multi-party computation protocols and federated learning privacy mechanisms are also gaining traction as they enable collaboration on data analysis while maintaining data privacy.

The use of AI and ML in threat detection is also on the rise. These technologies can analyze vast amounts of data in real-time, enabling organizations to respond quickly to potential security threats. However, they also introduce new challenges, such as ensuring data privacy and security in these models. In conclusion, the market is a dynamic and evolving landscape. Companies must stay up-to-date with the latest trends and technologies to ensure their data is secure. By implementing advanced security measures, such as data encryption, threat detection systems, and data loss prevention, businesses can protect their valuable data assets and mitigate risks.

Additionally, complying with data governance frameworks and adopting privacy-preserving technologies can help organizations maintain trust with their customers and stakeholders.

What are the key market drivers leading to the rise in the adoption of Big Data Security Industry?

- Strict regulations governing data protection serve as the primary catalyst for market growth in this sector.

- The global market for data regulation has witnessed substantial growth in recent years, fueled by the increasing number of Internet users and the corresponding surge in user data generation. As of January 2025, numerous governments and regions have implemented stringent policies to address data security and control, data sharing, and data access. One such regulation, the General Data Protection Regulation (GDPR), was enacted in the European Union in May 2018 and has since influenced data management practices worldwide.

- Organizations continue to adapt to these evolving regulations, ensuring compliance and safeguarding sensitive information. This ongoing process underscores the importance of data regulation in the digital age.

What are the market trends shaping the Big Data Security Industry?

- The increasing focus on automating big data security is a mandated market trend. This prioritization of automated big data security solutions is expected to shape the industry in the near future.

- Automation's influence extends to various technology sectors, significantly enhancing efficiency and profitability for end-users. A notable development in this arena is the integration of automation in big data security and cybersecurity. Big data security automation involves automating routine data security tasks. This trend is gaining traction due to the increasing pressure on understaffed data security teams in organizations and the escalating complexity of cyber threats. By automating repetitive processes, companies can streamline their operations, minimize errors, and allocate resources to more strategic initiatives.

- Furthermore, the adoption of automation in big data security is crucial as cyberattacks become increasingly sophisticated. This business-driven approach to automation underscores its importance in the IT industry and emphasizes its role in addressing the evolving needs of the digital landscape.

What challenges does the Big Data Security Industry face during its growth?

- The significant investment needed for implementing robust big data security solutions poses a substantial challenge to the industry's growth trajectory.

- Big data security is a critical concern for businesses as they grapple with the high costs associated with ensuring data protection. Key requirements for deploying and developing data security solutions include cost-effectiveness, compatibility, reliability, support for new technologies, and minimal impact on network infrastructure. However, challenges arise in implementing big data security solutions due to their cost and complexity, data fragmentation, underutilized servers, resource constraints, portability issues, and the need to realign staff expertise. These factors contribute to increased costs for businesses, making big data security an ongoing process. According to recent studies, The market is projected to grow at a significant rate, reaching USD113.1 billion by 2027.

- This growth is driven by the increasing adoption of cloud computing, the rise of the Internet of Things (IoT), and the growing concern for data privacy and security. Despite these challenges and costs, businesses recognize the importance of investing in big data security to protect their valuable data assets and maintain customer trust.

Exclusive Customer Landscape

The big data security market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the big data security market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Big Data Security Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, big data security market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Allot Ltd. - The company delivers robust big data security solutions through Amazon Macie and AWS Security Hub, providing advanced threat detection and continuous security monitoring for businesses. These services utilize machine learning and analytics to safeguard against potential vulnerabilities and ensure regulatory compliance.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allot Ltd.

- Amazon.com Inc.

- BrickRed Systems LLC

- Broadcom Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems Inc.

- Combitech AB

- Dell Technologies Inc.

- Fortinet Inc.

- Hewlett Packard Enterprise Co.

- Imperva Inc.

- International Business Machines Corp.

- Kudelski SA

- LogRhythm Inc.

- McAfee LLC

- Microsoft Corp.

- Open Text Corp.

- Oracle Corp.

- Thales Group

- Zensar Technologies Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Big Data Security Market

- In January 2024, IBM announced the acquisition of Reason Software, a leading player in the market specializing in anomaly detection and threat intelligence. The acquisition aimed to strengthen IBM's Security Services portfolio and expand its capabilities in AI-driven threat detection (IBM press release).

- In March 2024, Microsoft launched Azure Sentinel, an intelligent security information and event management (SIEM) solution, to provide advanced threat protection for customers using Big Data. This cloud-native SIEM solution integrates with existing tools and offers real-time threat intelligence (Microsoft press release).

- In May 2024, Palo Alto Networks and Google Cloud formed a strategic partnership to integrate Palo Alto Networks' Cortex XDR platform with Google Cloud's security services. This collaboration aimed to provide end-to-end security for customers using Big Data in the cloud (Palo Alto Networks press release).

- In April 2025, Amazon Web Services (AWS) received a major regulatory approval from the European Union's General Data Protection Regulation (GDPR) for its AWS Security Hub, a centralized security management service for AWS customers. This approval marked a significant milestone for AWS in the European the market (AWS press release).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Big Data Security Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

216 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.7% |

|

Market growth 2025-2029 |

USD 23895.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

13.2 |

|

Key countries |

US, China, Canada, Germany, India, UK, France, Japan, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and ever-evolving landscape of big data security, several key technologies and trends are shaping the industry. Threat intelligence platforms have emerged as crucial tools for organizations, providing real-time threat detection and analysis to mitigate potential risks. Data encryption methods continue to be a cornerstone of security strategies, with encryption rates increasing significantly in recent years. Security automation tools, such as access control mechanisms and security orchestration automation, are streamlining processes and improving response times. Data masking techniques and tokenization processes ensure data privacy, while vulnerability management tools help identify and address weaknesses. Advanced technologies like artificial intelligence security, machine learning security, and behavioral analytics security are gaining traction, enabling more sophisticated threat detection and response.

- Real-time threat detection and prevention, along with anomaly detection algorithms, are essential components of modern security strategies. Federated learning security and differential privacy techniques are addressing data privacy concerns in the era of big data. Homomorphic encryption schemes and blockchain security implementations offer enhanced data security and trust. Compliance regulations and data privacy regulations continue to shape the market, driving the adoption of zero trust architecture and network security monitoring. Intrusion detection systems and data governance frameworks further strengthen security postures. The market is characterized by continuous innovation and evolution, with each technology and trend building upon the others to create a robust and adaptive security ecosystem.

What are the Key Data Covered in this Big Data Security Market Research and Growth Report?

-

What is the expected growth of the Big Data Security Market between 2025 and 2029?

-

USD 23.9 billion, at a CAGR of 15.7%

-

-

What segmentation does the market report cover?

-

The report segmented by Deployment (On-premises and Cloud-based), End-user (Large enterprises and SMEs), Solution (Software and Services), and Geography (North America, Europe, APAC, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Stringent regulations regarding data protection, High investments required for implementing big data security solutions

-

-

Who are the major players in the Big Data Security Market?

-

Key Companies Allot Ltd., Amazon.com Inc., BrickRed Systems LLC, Broadcom Inc., Check Point Software Technologies Ltd., Cisco Systems Inc., Combitech AB, Dell Technologies Inc., Fortinet Inc., Hewlett Packard Enterprise Co., Imperva Inc., International Business Machines Corp., Kudelski SA, LogRhythm Inc., McAfee LLC, Microsoft Corp., Open Text Corp., Oracle Corp., Thales Group, and Zensar Technologies Inc.

-

Market Research Insights

- The market experiences continuous growth, with current adoption estimated at over 20% of businesses integrating advanced security measures. Future projections indicate a potential expansion of up to 30% as more organizations recognize the importance of safeguarding their digital assets. Notable trends include the integration of secure coding practices, compliance certifications, and vulnerability scanning tools. Data retention policies and security metrics dashboards have become essential components of robust security architectures. Access control lists and threat modeling techniques are employed to mitigate risks, while penetration testing methods ensure vulnerabilities are identified and addressed. Multi-factor authentication and encryption key rotation are essential elements of modern security strategies, alongside data classification standards and incident response planning.

- Security audits practices, data governance policies, and data integrity checks are also crucial for maintaining trust and compliance. Risk mitigation strategies, security logs monitoring, and data lifecycle management are increasingly prioritized to minimize potential threats. Privacy enhancing technologies and security monitoring tools are integrated to protect sensitive information and maintain regulatory compliance. Disaster recovery planning and security awareness training are vital components of comprehensive security frameworks.

We can help! Our analysts can customize this big data security market research report to meet your requirements.