Bioinsecticides Market Size 2024-2028

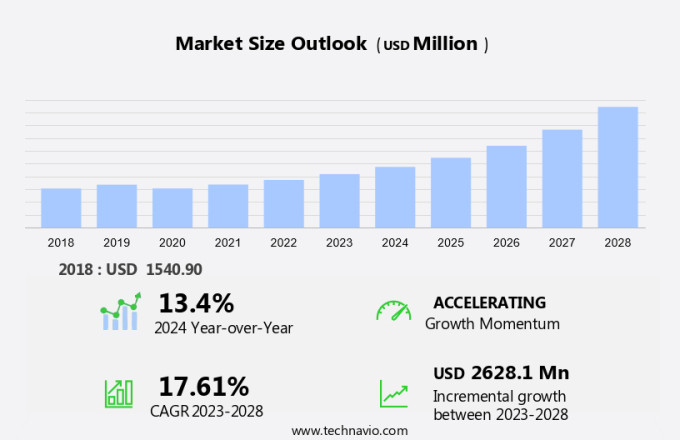

The bioinsecticides market size is forecast to increase by USD 2.63 billion, at a CAGR of 17.61% between 2023 and 2028. The market is growing rapidly as demand for eco-friendly pest control in agriculture rises. Climate changes have made pest management vital for modern farming. Bioinsecticides, derived from microorganisms, offer targeted insect control while protecting the environment, making them an effective solution for diverse agricultural settings.

Governmental subsidies and grants for organic farming and the production of organic food further fuel the market's growth. The use of bioinsecticides in place of toxic pesticides not only adheres to agricultural norms but also ensures food quality and food safety by minimizing pesticide residues. The availability of synthetic pesticides and herbicides, however, poses a challenge to the market's growth. Nevertheless, the targeted approach of insecticides and their ability to adapt to various agricultural conditions make them a preferred choice for farmers. Axalion insecticide, for instance, is a successful bioinsecticide that has gained popularity due to its effectiveness in controlling pests while maintaining environmental sustainability.

Market Analysis

Bioinsecticides are a type of pest management solution that utilizes living organisms, such as fungi, bacteria, viruses, and microbes, to control invasive pests in high-value crops. This holistic strategy offers an alternative to conventional chemical insecticides, which often contain harmful chemicals that can negatively impact human health and the ecosystem. The use of bioinsecticides minimizes the risk of residues on crops and reduces harm to non-target creatures. Virus-based bioinsecticides, such as those derived from baculovirus, have gained popularity due to their specificity and low toxicity to non-target organisms. Fungi and bacteria, such as Beauveria bassiana and Bacillus thuringiensis, are also commonly used bioinsecticides.

Farmers have increasingly adopted this approach as part of a comprehensive pest management strategy, incorporating it alongside chemical solutions and other pest management techniques. Some popular bioinsecticides include neem oil, pyrethrum, and chrysanthemum cinerariaefolium, which are effective against pests like aphids and whiteflies. The shift towards bioinsecticides is driven by growing concerns over the impact of synthetic pesticides on human well-being and the environment. This trend is particularly prevalent in organic farming and among consumers with dietary habits that prioritize sustainability and minimizing exposure to harmful chemicals.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Crop based

- Non crop based

- Geography

- North America

- Canada

- US

- APAC

- China

- India

- South America

- Brazil

- Europe

- Middle East and Africa

- North America

By Application Insights

The crop based segment is estimated to witness significant growth during the forecast period. Bioinsecticides, derived from natural resources such as beneficial bacteria and minerals, offer effective pest control solutions for crops without posing harm to the soil or the environment. These environmentally friendly alternatives to synthetic pesticides are increasingly gaining popularity among farmers, landowners, and producers, particularly in the context of growing consumer demand for sustainable agriculture and food security. Bioinsecticides are particularly useful in controlling pests, weeds, snails, mites, ticks, slugs, and other insects that can negatively impact crop growth. The use of bioinsecticides is subject to various laws and regulatory pressure to ensure their efficacy, shelf life, and safety for consumers.

Maximum residue levels are set to prevent health dangers from chemical residues in foods. The compositions of bioinsecticides are carefully formulated to maintain their efficacy against target pests while minimizing the impact on pollinators and other beneficial insects. Biotechnology plays a crucial role in the production of bioinsecticides, enabling the mass production of beneficial microorganisms and the development of more effective and sustainable pest management strategies. The long-term ecological health and safety of crops are prioritized through the use of bioinsecticides, contributing to the overall goal of sustainable agriculture. Farmers and producers benefit from the use of bioinsecticides by reducing their reliance on synthetic pesticides, improving crop quality, and enhancing their reputation as sustainable agricultural practices gain more recognition.

Consumers, in turn, can enjoy the health benefits of consuming foods produced using organic techniques and free from chemical residues. Bioinsecticides are a vital component of the transition towards a more sustainable and healthier food system.

Get a glance at the market share of various segments Request Free Sample

The crop based segment was valued at USD 1.12 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

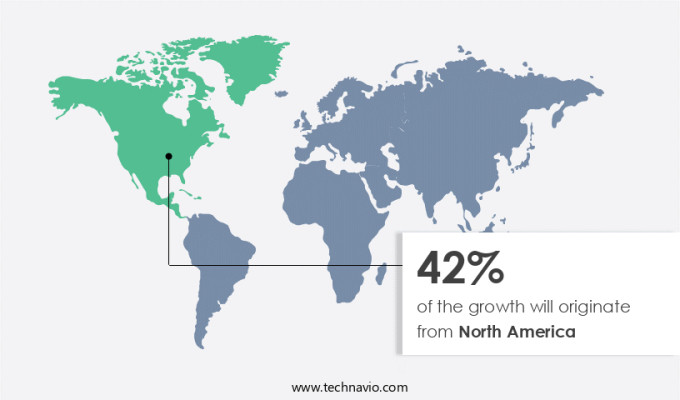

North America is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in North America is anticipated to expand substantially due to the escalating demand for organic farm produce and the increasing regulatory pressure on the utilization of chemical fertilizers in the region. The prohibition of cosmetic pesticides, notably in Canada, is poised to propel market expansion. Primarily used in cereals and grains, this market is witnessing a noteworthy rise in North America due to the expanding organic products sector. Within North America, the United States holds the largest market share for bioinsecticides, with Canada and Mexico following suit. Innovations in seed treatment methods, particularly for crops like corn, maize, wheat, and soybean, are significantly contributing to the market growth in the US.

The efficacy of bioinsecticides in pest management aligns with the goals of sustainable agriculture, long-term ecological health, and food security. Ensuring quality, safety, and adherence to maximum residue levels are crucial for both farmers and landowners. The use of bioinsecticides offers a viable alternative to chemical residues, mitigating potential health dangers. The biotechnological advancements in the compositions of bioinsecticides further enhance their shelf life and overall performance.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Growing demand for organic farming and organic food is the key driver of the market. This expansion can be attributed to the rising demand for sustainable pest management techniques that prioritize human health, native species, and ecosystem preservation. Bioinsecticides, derived from fungi, bacteria, and plants, offer a holistic approach to pest control by specifically targeting pest populations without harming non-target creatures or disrupting ecological equilibrium. As concerns regarding the negative impacts of conventional chemical insecticides on human health and the environment continue to mount, bioinsecticides have emerged as an effective and eco-friendly alternative. These biological solutions have proven particularly valuable in agricultural settings, where they help mitigate the resistance development in pest populations and minimize the use of invasive pesticides.

The market for bioinsecticides is expected to grow significantly in the coming years, with a focus on research and development to enhance their targeting capability and broaden their application spectrum.

Market Trends

Increasing governmental support for the use of bio-based products in agriculture is the upcoming trend in the market. Bioinsecticides, derived from living organisms such as fungi, bacteria, and plants, have gained significant attention in agriculture as an alternative to conventional chemical insecticides. The use of bioinsecticides offers several advantages over chemical solutions, including reduced impact on human health, minimized harm to non-target creatures, and a more holistic approach to pest management. These benefits are crucial in maintaining the ecosystem and ensuring the long-term well-being of both agriculture and the environment. Governments worldwide are promoting the adoption of bioinsecticides through various initiatives. These include farm-level extension and promotion programs, financial assistance to investors in setting up production units, subsidies on sales, and direct production in public sector spaces, cooperative organizations, universities, and research institutions.

Moreover, this support is essential in addressing the growing concerns over the resistance of pest populations to chemical pesticides and the negative impact of invasive pests on native species and biodiversity. Bioinsecticides provide a targeted solution to pest infestations while maintaining ecological equilibrium in agricultural settings. The market for bioinsecticides is expected to grow significantly as more farmers recognize the benefits of these eco-friendly pest management techniques. The use of bioinsecticides is not only a responsible choice for human well-being but also a vital step towards sustainable agriculture.

Market Challenge

The availability of synthetic pesticides and herbicides is a key challenge affecting the market growth. Bioinsecticides represent a significant shift from conventional chemical insecticides in pest management techniques for agriculture and other sectors. These alternatives, derived from fungi, bacteria, plants, and other living organisms, offer advantages over chemical solutions in terms of human health, ecosystem preservation, and the well-being of non-target creatures. Bioinsecticides are increasingly popular as they minimize the risk of resistance development in pest populations and reduce the impact on invasive pests and native species, contributing to the maintenance of biodiversity and ecological equilibrium in agricultural settings. companies are investing heavily in the development of new bioinsecticides to expand their product portfolios, catering to the growing demand for sustainable pest control methods.

For instance, in early 2020, FMC Corporation introduced Authority Edge, a new bioherbicide for use in soybeans, sunflowers, and dry-shelled peas, which has already received EPA registration. This holistic strategy, targeting both pests and the environment, is essential for ensuring long-term agricultural productivity and maintaining the delicate balance of ecosystems.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

BASF SE - The company offers bioinsecticides product brands under the brand name AgCelence.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AgBiTech Pty Ltd.

- Andermatt Group AG

- Bayer AG

- Biobest Group NV

- BioSafe Systems LLC

- BioWorks Inc.

- DuPont de Nemours Inc.

- Futureco Bioscience SA

- IPL Biologicals Ltd.

- Kan biosys

- Kilpest India Ltd.

- Koppert

- Mitsui and Co. Ltd.

- Novozymes AS

- Nufarm Ltd.

- Pro Farm Group Inc.

- Syngenta Crop Protection AG

- Valent BioSciences LLC

- Vestaron Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Bioinsecticides are eco-friendly pest control methods that utilize living things such as fungi, bacteria, and viruses to target and control insect pests in agricultural settings. These alternatives to conventional chemical insecticides offer several advantages, including minimal harm to human health, reduced impact on non-target creatures, and protection of the ecosystem. Bioinsecticides are effective against various pest populations, including invasive species, and can help maintain ecological equilibrium and biodiversity. Bioinsecticides are gaining popularity due to increasing regulatory pressure and consumer demand for residue-free or low-residue crops. The market is driven by the need for sustainable agriculture, food security, and long-term ecological health.

Additionally, the market includes various bioinsecticide compositions, such as virus-based bioinsecticides like baculovirus and bacterial strains like Bacillus thuringiensis (BT), Beauveria bassiana, Metarhizium anisopliae, and Bacillus sphaericus. These microbial solutions offer versatility in controlling insects and environmental protection, making them suitable for various agricultural terrain and crops, including high-value fruits and vegetables, cereals, grains, oilseeds, pulses, and leguminous seeds. Factors influencing the market include weather conditions, unpredictable climatic changes, and the need for precision and efficiency in pest management. Farmers, landowners, and producers are adopting bioinsecticides to ensure food quality and safety while minimizing the use of harmful chemicals. The market is expected to grow due to export demand, the adoption of foliar spray applications, and the development of new bioinsecticides and precision agricultural methods.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

134 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 17.61% |

|

Market Growth 2024-2028 |

USD 2.63 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

13.4 |

|

Regional analysis |

North America, APAC, South America, Europe, and Middle East and Africa |

|

Performing market contribution |

North America at 42% |

|

Key countries |

US, China, Brazil, Canada, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AgBiTech Pty Ltd., Andermatt Group AG, BASF SE, Bayer AG, Biobest Group NV, BioSafe Systems LLC, BioWorks Inc., DuPont de Nemours Inc., Futureco Bioscience SA, IPL Biologicals Ltd., Kan biosys, Kilpest India Ltd., Koppert, Mitsui and Co. Ltd., Novozymes AS, Nufarm Ltd., Pro Farm Group Inc., Syngenta Crop Protection AG, Valent BioSciences LLC, and Vestaron Corp. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, South America, Europe, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch