Blockchain Technology in BFSI Market Size 2024-2028:

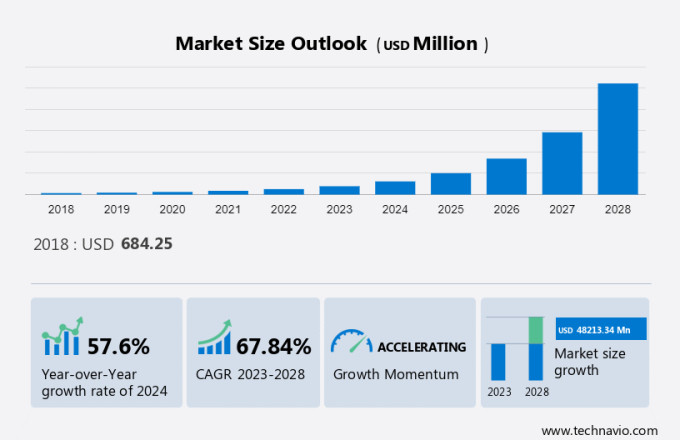

The blockchain technology in BFSI market size is forecast to increase by USD 48.21 billion, at a CAGR of 67.84% between 2023 and 2028. The growth of the market is propelled by various factors, notably the surge in Fintech spending as financial institutions invest in innovative solutions to enhance efficiency and security. Easier access to technology enables broader adoption of blockchain across diverse industries, including banking and finance. Additionally, the disintermediation of banking services drives demand for decentralized solutions like blockchain, offering greater control and transparency to users. As blockchain technology becomes more accessible and integrated into financial systems, its potential to streamline processes and reduce costs attracts increasing interest from both traditional institutions and emerging players in the Fintech space. This convergence of factors fuels the growth trajectory of the blockchain technology market, reshaping the landscape of financial services worldwide.

What will be the Size of the Market During the Forecast Period?

To learn more about this report, View Report Sample

Market Segmentation

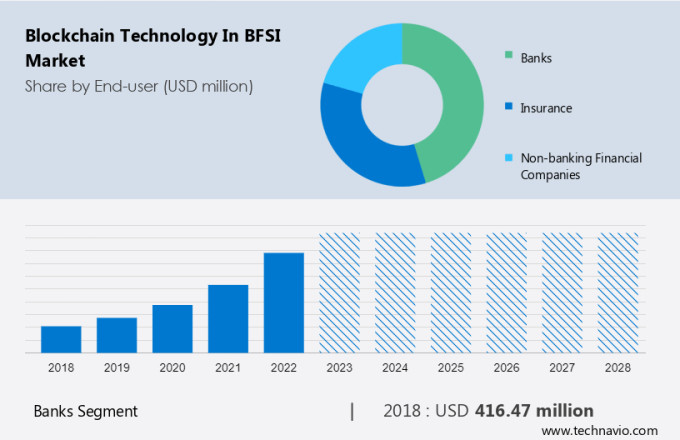

The market report extensively covers market segmentation by end-user (banks, insurance, and non-banking financial companies), type (public blockchain, private blockchain, and consortium blockchain), and geography (North America, Europe, APAC, South America, and Middle East and Africa). It also includes an in-depth analysis of drivers, trends, and challenges. Furthermore, the report includes historic market data from 2017 to 2021.

Market Dynamics and Customer Landscape

The market in the BFSI sector is driven by the need for enhanced security and efficiency in client identification systems and data management. Decentralized data storage and cryptographically secured digital ledgers offer protection against cyber-criminals, mitigating counterparty risks. The adoption of blockchain software and smart contracts streamlines processes like compliance management and record-keeping while reducing reliance on traditional APIs. However, challenges persist, including concerns over data privacy on torrent sites and the complexity of implementing blockchain solutions amidst regulatory scrutiny. Overcoming these challenges will be crucial for realizing the full potential of blockchain in BFSI.

Key Market Driver

Disintermediation of banking services is the key factor driving market growth. The rise of mobile trends has changed the way information is searched online. The growing popularity of FinTech solutions will lead to the disintermediation of traditional banking services. The process of credit provided by the traditional banking system is being disrupted by peer-to-peer lending. The equity investment search has moved online, where a large number of venture capitalists are investing in the market. Payments are also moving from standard bank accounts to virtual currencies (bitcoin), corporate credit cards, and Amazon coins.

Moreover, the transactions that take place in a Bitcoin currency are conducted through peer-to-peer technology. No central authority regulates the Bitcoin network. The payment of fees happens automatically, thus bringing new advances in the processing of transactions. Companies such as Microsoft invest in virtual and digital currency, including bitcoin, whereas other firms like Apple and Google concentrate on wallets for online transactions. Thus, the disintermediation of banking services will accelerate the growth of the market in focus during the forecast period.

Significant Market Trends

The advent of artificial intelligence (AI) is the primary trend shaping market growth. AI-powered blockchain technology is the most advanced IT development in the blockchain and cryptocurrency market. AI provides several functions to manage decentralized currency systems. AI algorithms can predict the value of bitcoins, which can help bitcoin trader manage bitcoin transactions. FinTech companies are also analyzing the implementation of AI in financial transactions. A growing number of financial businesses are trying to investigate the different implications of machine learning and AI for their businesses.

Furthermore, robotics is also playing the role of consultants and is automating the processes of FinTech solutions by avoiding disruptions. These robots help in reducing financial transactions, thereby bringing in greater transparency, so the companies can know the real profitability that they achieve on a day-to-day basis. This will also help the customers have easy access to comparative information and allow investors to be better informed before making decisions about their financial plans, which will boost the growth of the market during the forecast period.

Major Market Challenge

Network privacy and security concerns is a challenge that affects market growth. Payment service providers collect personal data and customer information using cookies so that they can personalize advertising messages and thereby target key audiences. Using cookies, service providers can gather data on customer profiling, behavior, and data mining. The indiscriminate use of this data can infringe on a customer's privacy.

In addition, consumers are reluctant to reveal their bank account details for online transactions because of security concerns. The possibility of unauthorized access to such data discourages users from adopting different FinTech platforms, which will hinder the growth of the market in focus during the forecast period.

Customer Landscape

The market research report includes the adoption lifecycle of the market research and growth, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth and forecasting strategies.

Customer Landscape

Market Segmentation By End-user

The market is characterized by its innovative solutions, offering decentralized data management and cryptographically secured transactions. With the rise of cyber-criminals targeting traditional client identification systems, blockchain software provides enhanced security through cryptographically secured digital ledgers. APIs facilitate seamless integration with existing systems, while smart contracts segment automates processes through self-executing contracts, reducing counterparty risks. Blockchain technology's decentralized nature ensures record-keeping integrity and compliance management, mitigating risks associated with centralized data storage. Cloud computing further enhances scalability and accessibility, enabling efficient data storage and retrieval. Each transaction is stored in blocks, forming a chronological data chain of immutable digital information. As organizations embrace blockchain technology for its resilience against cyber threats and its potential to revolutionize various industries, the market continues to witness rapid growth and adoption.

The market share growth by the banks segment will be significant during the forecast period. Blockchain facilitates faster and more cost-effective cross-border payments and remittances. By eliminating the middleman and using cryptocurrencies or stable coin, banks can reduce transaction fees and settlement times. Blockchain simplifies and streamlines trade finance processes by providing a transparent and immutable ledger for trade transactions.

Get a glance at the market contribution of various segments View Free PDF Sample

The banks segment showed a gradual increase in the market share of USD 416.47 million in 2018. Moreover, banks can provide customers with secure and portable digital identities stored on a blockchain. This enables individuals to control their personal information and access financial services easily. Banks can use blockchain to enhance supply chain finance by providing real-time visibility into the movement of goods, reducing fraud and errors, and facilitating quicker financing decisions. Thus, these factors will promote the growth of the banks segment, which will boost the growth of the global blockchain technology in BFSI sector market during the forecast period

Market Segmentation By Type

A public blockchain is a completely decentralized blockchain that will allow anyone on earth to carry out transactions. The introduction of public blockchain in the BFSI sector has centralized the workflow process in financial institutions. For instance, in May 2021, the Provenance Blockchain Foundation announced the launch of a new public, open-source, permissionless, decentralized, and proof-of-stake blockchain, which supports the needs of the financial services industry. Such developments will fuel the growth of the public blockchain segment, which, in turn, will drive the growth of the market during the forecast period.

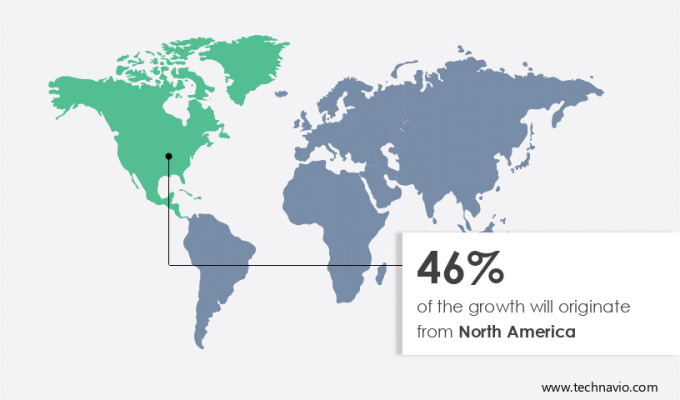

Regional Overview

For more insights on the market share of various regions Download PDF Sample now!

North America is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. North America is a prime region for the adoption of decentralization technologies, having one of the world's largest and most influential finance markets. In this region, financial institutions and insurance companies seek ways of increasing effectiveness and lowering costs on an ongoing basis.

Moreover, BFSI institutions in North America are actively exploring a wide range of blockchain use cases, including cross-border payments, trade finance, supply chain finance, identity verification, and regulatory compliance. Demonstrated use cases attract more participants and investments. Thus, these factors will drive the growth of the market in focus in the region during the forecast period.

Who are the Major Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- Accenture Plc: The company offers blockchain technology which provides multiple organizations and individuals to confidently share and access data in real-time.

- Amazon.com Inc.: The company offers blockchain technology via AWS, which provides a multi-party, fully managed blockchain network that aids in the elimination of middlemen and a centralised ledger database that keeps an immutable and cryptographically verifiable record of transactions.

- Bitfury Group Ltd.: The company offers blockchain technology namely Bitfury Exonum which is designed to help governments and companies to bring efficiency and security into their operation.

The research report also includes detailed analyses of the competitive landscape of the market and information about 20 market companies, including:

- Cegeka

- ConsenSys Software Inc.

- Dragonchain

- Factom

- GuardTime OU

- Huawei Technologies Co. Ltd.

- Infosys Ltd.

- Intel Corp.

- International Business Machines Corp.

- Nippon Telegraph and Telephone Corp.

- Oracle Corp.

- SAP SE

- SpinSys

- Stratis Group Ltd.

- Tata Consultancy Services Ltd.

- Wipro Ltd.

- WonderFi Technologies Inc

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Segment Overview

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Million" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments

- End-user Outlook

- Banks

- Insurance

- Non-banking financial companies

- Type Outlook

- Public blockchain

- Private blockchain

- Consortium blockchain

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

Market Analyst Overview

The market is experiencing rapid growth, driven by the demand for enhanced security and efficiency in financial transactions. Blockchain offers a secure client identification system through cryptographic security and digital ledger, facilitating identity management and fraud detection. With its immutable transactions and cryptographic security, blockchain technology ensures reliable record keeping and fraud reduction, attracting venture capital investment and regulatory engagement. In the fintech ecosystem, blockchain enables seamless payments and settlement, catering to both large enterprises and small and medium enterprises. Moreover, the adoption of blockchain in the BFSI sector contributes to a global network blockchain, fostering collaboration and innovation. As energy consumption concerns are addressed, blockchain continues to revolutionize the BFSI sector with its digital solutions and smart contract, driving efficiency and transparency in financial processes.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

182 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 67.84% |

|

Market Growth 2024-2028 |

USD 48,213.34 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

57.6 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 46% |

|

Key countries |

US, Canada, China, UK, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Accenture Plc, Amazon.com Inc., Bitfury Group Ltd., Cegeka, ConsenSys Software Inc., Dragonchain, Factom, GuardTime OU, Huawei Technologies Co. Ltd., Infosys Ltd., Intel Corp., International Business Machines Corp., Nippon Telegraph and Telephone Corp., Oracle Corp., SAP SE, SpinSys, Stratis Group Ltd., Tata Consultancy Services Ltd., Wipro Ltd., and WonderFi Technologies Inc |

|

Market dynamics |

Parent market growth analysis, Market Forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the market forecast period. |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the market between 2024 and 2028

- Precise estimation of the market size and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- A thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.