Body Armor Market Size 2025-2029

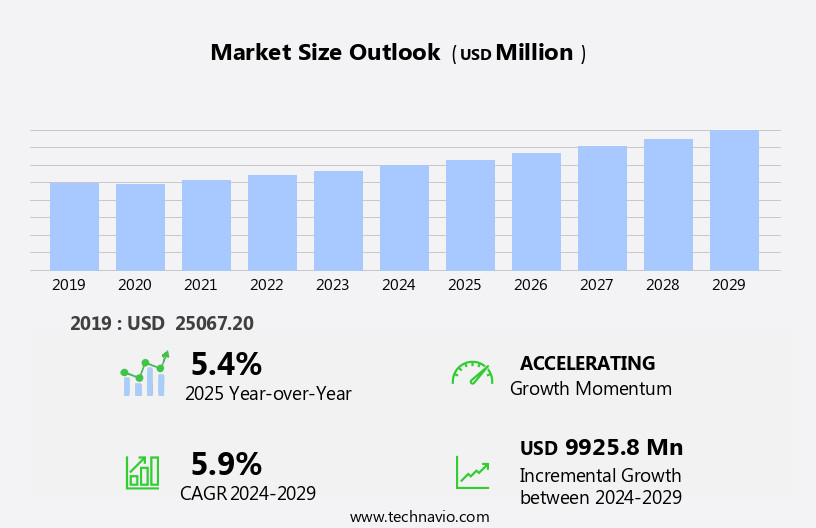

The body armor market size is forecast to increase by USD 9.93 billion, at a CAGR of 5.9% between 2024 and 2029.

- The market is experiencing significant growth due to the escalating security threats worldwide. The increasing demand for personal protection solutions, particularly in high-risk industries and regions, is driving market expansion. A key trend shaping the market is the development of ergonomically designed body armor to enhance comfort and mobility for users. However, one of the significant challenges facing the industry is the difficulty in optimizing the weight of body armor to ensure adequate protection without compromising the wearer's mobility and comfort.

- As threats continue to evolve, manufacturers must innovate to provide effective, lightweight, and ergonomic body armor solutions to meet the evolving needs of customers. Companies that successfully address these challenges will capitalize on the market's potential for growth and maintain a competitive edge.

What will be the Size of the Body Armor Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the constant unfolding of market dynamics and the expanding applications across various sectors. Active shooter protection remains a primary focus, with continuous advancements in materials and design. Comfort features, such as moisture-wicking fabric and ergonomic shoulder pads, are increasingly integrated into law enforcement and tactical vests. Ballistic testing and protection zones are essential components of body armor, with NIJ standards setting the benchmark for threat protection. Impact resistance and penetration resistance are crucial factors, with ceramic plates and steel plates offering varying levels of protection. Ballistic panels and polymer composites are also utilized to enhance protection against different threat levels.

Cut-resistant fabrics and stab-resistant vests cater to the industrial safety sector, ensuring workers are protected against potential hazards. Distribution channels continue to expand, with supply chain optimization and security solutions becoming increasingly important. Riot control and counter-terrorism applications also require specialized body armor, with NIJ standards and ballistic testing ensuring adequate protection. The ongoing development of protective clothing, including underwear armor and concealed carry vests, underscores the market's continuous evolution. Threat assessment and personal protective equipment are integral to the body armor industry, with abrasion resistance and flame resistance also critical considerations. The integration of ballistic panels, body armor inserts, and soft armor ensures comprehensive protection for various applications.

How is this Body Armor Industry segmented?

The body armor industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- BPJ

- BPH

- Product

- Overt

- Covert

- Product Type

- Tactical armor

- Concealable armor

- Stab armor

- Geography

- North America

- US

- Europe

- Germany

- Russia

- UK

- Middle East and Africa

- Turkey

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

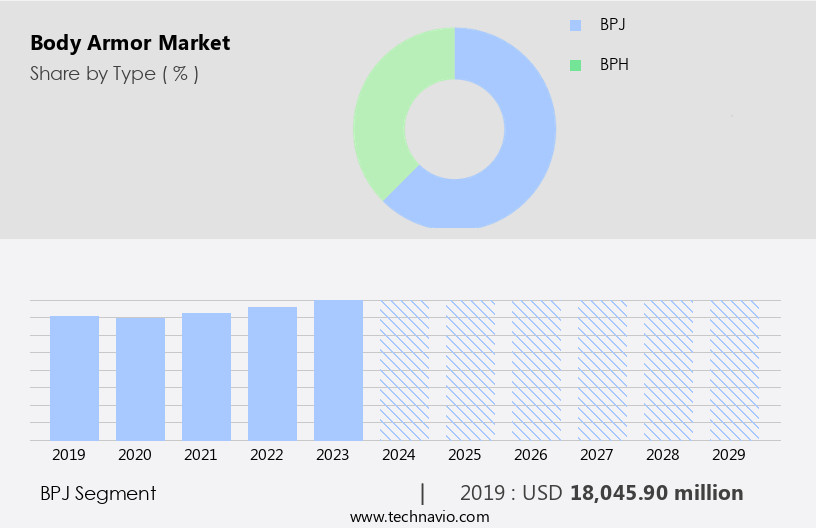

The bpj segment is estimated to witness significant growth during the forecast period.

Body armor, also referred to as ballistic jackets (BPJ), is a critical component of protective clothing that absorbs impacts and prevents fragmentation from projectiles and explosions. These armors come in various forms, including soft armor, commonly used by law enforcement and industrial workers, and hard armor, utilized by military personnel and those in high-risk environments. Soft armor, typically made of materials like Kevlar, offers impact resistance, high strength, and low weight, making it suitable for handgun bullets. Hard armor, on the other hand, consists of ceramic plates, steel plates, or polymer composites, providing enhanced protection against high-caliber bullets and explosives.

Threat levels play a significant role in the selection of appropriate body armor, with NIJ standards setting the benchmark for ballistic resistance. Government contracts and counter-terrorism initiatives have driven the demand for advanced body armor solutions. The supply chain for body armor involves various components, including ballistic panels, trauma plates, shoulder pads, and stab-resistant vests, all of which undergo rigorous ballistic testing to ensure protection. The market for body armor is diverse, catering to different industries and applications. Industrial safety requires protective clothing, including flame-resistant and cut-resistant fabrics, while construction safety focuses on high-impact resistance. Military vests and tactical gear incorporate comfort features, such as moisture-wicking materials, for extended wear.

Body armor inserts, including underwear armor and concealed carry vests, offer discreet protection for personal safety. Riot control and riot gear often include ballistic panels and hard armor to protect against projectiles and blunt trauma. In the realm of protective equipment, body armor plays a crucial role in ensuring safety and security, with ongoing research and development focusing on improving materials, comfort, and protection zones. The distribution channels for body armor span various sectors, from law enforcement and military to industrial and civilian markets.

The BPJ segment was valued at USD 18.05 billion in 2019 and showed a gradual increase during the forecast period.

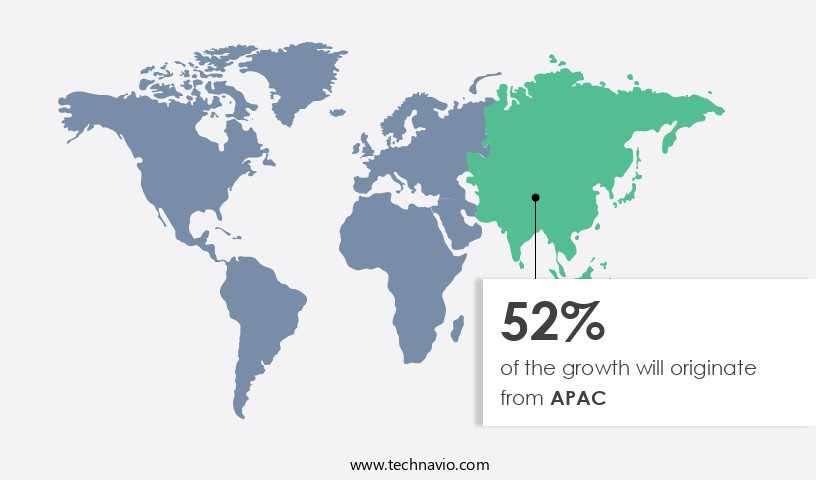

Regional Analysis

APAC is estimated to contribute 52% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth due to escalating threats and the increasing demand for personal protective equipment (PPE) in various industries and applications. The market encompasses a range of products, including plate carriers, vest carriers, underwear armor, soft armor, and hard armor, among others. Threat levels and protection requirements vary across sectors, with industrial safety, construction, and law enforcement having distinct needs. Government contracts and counter-terrorism initiatives have been major drivers for the market. Ceramic plates, steel plates, and aramid fibers are key components of body armor, offering penetration resistance, impact resistance, and stab resistance. Flame resistance and moisture wicking are essential features for certain applications.

Ballistic testing and NIJ standards ensure the effectiveness of body armor. Manufacturers focus on producing comfortable and lightweight designs, integrating shoulder pads and other comfort features. The supply chain is critical for timely delivery and quality control. Distribution channels include military, law enforcement, and commercial sectors. Cut-resistant fabrics and polymer composites are essential materials for producing body armor inserts. Security solutions, such as riot control and active shooter protection, are gaining prominence. The market caters to diverse needs, including motorcycle armor and concealed carry vests. Threat assessment and personal protective equipment are integral to the market's growth. Abrasion resistance and protection zones are essential considerations for various applications.

The market is dynamic, with ongoing research and development efforts to improve ballistic panels and armor materials.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Body Armor Industry?

- The escalating security threats serve as the primary catalyst for market growth.

- The market has gained significant importance in recent years due to the increasing threats to national security from various sources, including conflicts, terrorism, and industrial hazards. According to the National Institute of Justice (NIJ), over 95% of injuries sustained by military personnel in combat situations are caused by ballistic, stab, and blast threats. In response, defense agencies have been investing in advanced body armor technologies to protect troops from these threats. Flame resistance and trauma protection are key features of body armor. Trauma plates made of steel or ceramic materials provide protection against blasts and ballistic threats, while stab-resistant vests made of aramid fibers or other advanced materials offer protection against edged weapons.

- Shoulder pads and moisture-wicking technologies are also essential features to ensure comfort and mobility for the wearer. NIJ standards set the benchmark for body armor certification, ensuring that the armor provides adequate protection against various threats. The use of advanced materials such as aramid fibers, ceramics, and polymers in body armor production has led to significant improvements in protection levels while maintaining lightweight and flexibility. The market is driven by the increasing demand for advanced protective clothing from various industries, including military, law enforcement, and industrial sectors. The market is expected to grow due to the ongoing research and development in body armor technology and the increasing awareness of the importance of personal protective equipment in various hazardous environments.

What are the market trends shaping the Body Armor Industry?

- Body armor with ergonomic designs is currently gaining popularity in the market. This trend reflects a growing emphasis on comfort and functionality in protective equipment.

- The market is witnessing significant growth due to the increasing demand for advanced protection solutions, particularly in the context of active shooter situations. Comfort is a crucial factor in the design of body armor, with ergonomic features reducing stress, increasing mobility, and preventing injuries. Technological advancements have led to the development of lightweight body armor, enhancing both protection and agility. Impact resistance and ballistic testing are essential elements of body armor, ensuring optimal protection against various threats. Protection zones and distribution channels are also critical considerations, ensuring that body armor reaches those who need it most efficiently.

- Cut-resistant fabrics and ballistic panels are key components, providing essential protection against different types of threats. The focus on ergonomics and technological advancements is driving innovation in the body armor industry, making it an essential investment for law enforcement and tactical teams.

What challenges does the Body Armor Industry face during its growth?

- The optimization of body armor weight represents a significant challenge that impedes growth in the industry. This issue, which requires the development of lighter and more effective materials, is a key concern for manufacturers and stakeholders alike.

- The market dynamics revolve around the integration of advanced technologies and lightweight materials to address the challenge of excessive weight. High-performance body armor includes specialized equipment, enhancing combat readiness. However, added devices such as radios, ammunition, optics, communication systems, face protection, video cameras, oxygen systems, and other technologies increase the weight, affecting mobility, flexibility, and efficiency. This issue necessitates ongoing research and development to optimize manufacturing processes and reduce weight. Lightweight polymer composites are a potential solution for enhancing abrasion resistance while minimizing weight.

- Body armor inserts and motorcycle armor also benefit from these advancements. Riot control applications require high levels of protection, and body armor must offer sufficient threat assessment capabilities. Personal protective equipment continues to evolve, ensuring the safety and security of personnel in various industries.

Exclusive Customer Landscape

The body armor market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the body armor market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, body armor market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The company specializes in producing advanced body armor solutions, including 3M's lightweight options, catering to various industries and applications with a focus on protection and innovation.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Ace Link Industrial Inc.

- Armored Republic Holdings LLC

- BAE Systems Plc

- Canadian Armour Ltd.

- Craig International Ballistics Pty. Ltd.

- DFNDR Armor

- DuPont de Nemours Inc.

- Hellweg International Pty Ltd.

- Hoplite Armor LLC

- Indian Armour Systems Pvt. Ltd.

- MARS Armor

- Med Eng Holdings ULC

- Point Blank Enterprises Inc.

- PT Armor Inc.

- Spartan Armor Systems

- Survival Armor Inc.

- U.S. ARMOR Corp.

- ULBRICHTS GMBH

- United Shield International LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Body Armor Market

- In January 2024, Safariland LLC, a leading provider of body armor solutions, announced the launch of its X2 SPEED PLATE CARRIER, offering enhanced protection and mobility to law enforcement personnel (Safariland Press Release, 2024).

- In March 2024, Honeywell International Inc. And Kevlar manufacturer, DuPont, signed a multi-year agreement to expand their collaboration on advanced body armor technologies, aiming to improve ballistic protection and comfort for military and law enforcement personnel (DuPont Press Release, 2024).

- In May 2024, Ceradyne, Inc., a body armor manufacturer, completed the acquisition of ArmorSource, a leading supplier of ballistic armor and related products, strengthening Ceradyne's position in the market and expanding its customer base (Ceradyne Press Release, 2024).

- In April 2025, the U.S. Department of Defense awarded a contract to Second Chance Body Armor, a body armor manufacturer, for the production of over 100,000 ballistic vests, reflecting the ongoing demand for body armor solutions within the military sector (DoD Contract Announcement, 2025).

Research Analyst Overview

- The market is driven by the continuous development of next-generation materials and fiber technology, leading to enhanced protection levels and improved comfort for body armor systems. Impact absorption is a critical factor, and testing methods are rigorously employed to ensure safety solutions providers meet performance standards. Custom plate carriers and concealed armor are popular choices, with manufacturing technologies advancing to include composite design and high-performance fabrics. Trauma inserts and energy dissipation are essential protective technologies, ensuring enhanced mobility and safety for security personnel equipment. Discreet armor is also gaining traction, with lightweight armor and modular armor designs offering improved protection while maintaining discretion.

- Advanced composites and material science are at the forefront of innovation, ensuring safety standards compliance and life cycle management. End-of-life disposal is a growing concern, with a focus on sustainable solutions and armor certifications ensuring quality control. Protective garments and protective solutions continue to evolve, integrating advanced protective layers and safety solutions to meet the diverse needs of emergency response gear and security personnel.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Body Armor Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

212 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.9% |

|

Market growth 2025-2029 |

USD 9925.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.4 |

|

Key countries |

India, China, Russia, US, Germany, UK, Japan, South Korea, Australia, and Turkey |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Body Armor Market Research and Growth Report?

- CAGR of the Body Armor industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the body armor market growth of industry companies

We can help! Our analysts can customize this body armor market research report to meet your requirements.