Bone Grafts And Substitutes Market Size 2024-2028

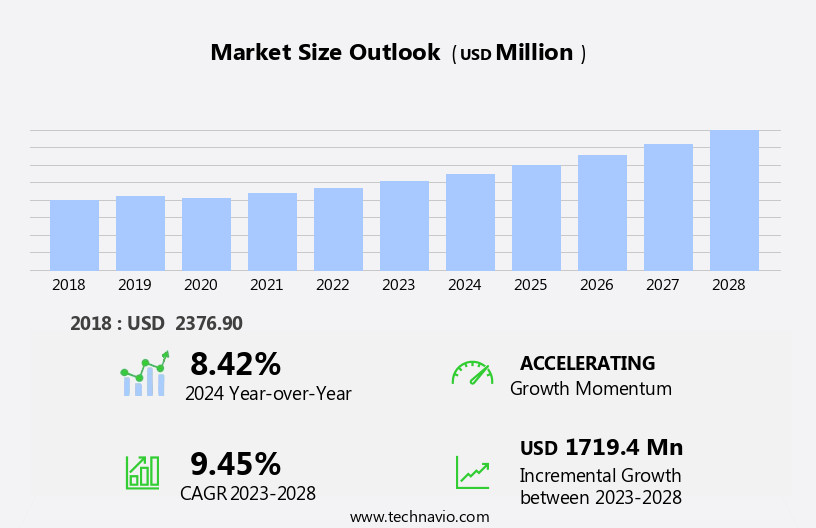

The bone grafts and substitutes market size is forecast to increase by USD 1.72 billion, at a CAGR of 9.45% between 2023 and 2028.

- The market is witnessing significant growth, driven by the increasing prevalence of orthopedic conditions and the subsequent rise in surgical procedures. The market is further fueled by the adoption of minimally invasive surgical techniques, which reduce recovery time and post-operative complications, making bone grafts and substitutes increasingly popular. However, high costs associated with implants and procedures pose a substantial challenge for market growth. Despite this, opportunities exist for companies to innovate and offer cost-effective solutions, catering to the growing demand for efficient and affordable bone grafting technologies.

- In summary, the market is experiencing robust growth due to the rising number of orthopedic conditions and surgical procedures, with the adoption of minimally invasive techniques providing additional momentum. However, high costs remain a significant challenge, offering opportunities for companies to differentiate themselves by offering cost-effective solutions.

What will be the Size of the Bone Grafts And Substitutes Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and research. Three-dimensional (3D) printing is revolutionizing the industry, enabling the creation of customized bone grafts with precise dimensions and mechanical strength. Synthetic bone grafts, such as tricalcium phosphate and calcium phosphate cements, offer advantages over harvested bone grafts, including eliminating the need for a second surgical site and reducing donor site morbidity. Bone remodeling, a critical aspect of bone grafting, is being enhanced through the use of bioactive glass and stem cells. These materials promote tissue engineering and bone regeneration, leading to improved patient outcomes. Minimally invasive surgery is another trend gaining traction, allowing for faster recovery times and reduced infection rates.

Long-term stability is a key consideration in bone grafting procedures, with scaffolding materials and bone substitutes playing crucial roles. Antimicrobial coatings and drug delivery systems are also being integrated into bone grafts to prevent infection and promote healing. Regulatory approvals for new bone grafting techniques and materials are ongoing, with clinical trials and pre-clinical testing providing valuable insights into patient outcomes and safety. Reconstructive surgery, oncology surgery, trauma surgery, and orthopedic applications are among the sectors benefiting from these advancements. Surgical techniques continue to evolve, with image-guided surgery and tissue engineering offering promising solutions for complex cases. The future of bone grafting lies in the continued exploration of innovative materials and technologies, ensuring the best possible outcomes for patients.

How is this Bone Grafts And Substitutes Industry segmented?

The bone grafts and substitutes industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Xenografts

- Allografts

- Synthetic bone grafts

- DBM

- Application

- Spinal fusion

- Trauma

- Craniomaxillofacial

- Joint reconstruction

- Dental bone grafting

- End-User

- Hospitals

- Orthopedic Clinics

- Ambulatory Surgical Centers

- Dental Clinics

- Material

- Autologous Bone

- Ceramic-Based

- Polymer-Based

- Growth Factor-Based

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

By Product Insights

The xenografts segment is estimated to witness significant growth during the forecast period.

Xenografts, derived from transplants between closely related species, function as biological dressings for wound healing. They offer protection against bacterial and physical trauma, alleviate pain, and enhance moisture and heat retention. In the market, xenografts hold the largest share due to the rising prevalence of knee and hip injuries, technological advancements such as 3D-printed implants, and new product introductions from key players. In dentistry, xenografts are predominantly porcine and bovine, sourced from pig and cow tissues. Thoroughly cleaned, sterilized, and prepared for implantation, these grafts contribute significantly to the field of regenerative medicine. Advancements in tissue engineering, bioactive glass, stem cells, and antimicrobial coatings further bolster the market's growth.

Clinical trials, craniofacial and dental applications, minimally invasive surgery, long-term stability, and infection rates are crucial factors influencing market dynamics. Synthetic bone grafts, calcium phosphate cements, and bone substitutes also play essential roles in bone regeneration. Regulatory approvals, patient outcomes, and pre-clinical testing are integral components of the market's evolution.

The Xenografts segment was valued at USD 1.31 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing steady growth, driven by the increasing prevalence of orthopedic conditions, advancements in technology, and regulatory approvals. Tricalcium phosphate, a popular bone substitute, is gaining traction due to its biocompatibility and osteoconductive properties, enhancing bone regeneration. Tissue engineering and 3D printing technologies are revolutionizing bone grafting procedures, offering minimally invasive options and customized implants. Clinical trials are underway for novel bone grafting solutions, such as stem cell-based therapies and bioactive glass, which promise improved mechanical strength and long-term stability. Infection rates remain a concern, leading to the development of antimicrobial coatings and drug delivery systems.

Synthetic bone grafts, calcium phosphate cements, and scaffolding materials are increasingly being used in reconstructive, oncology, and trauma surgeries. Pre-clinical testing and patient outcomes are crucial factors influencing market trends. Regulatory approvals and surgical techniques continue to evolve, ensuring the safety and efficacy of bone grafts and substitutes. Bioresorbable materials are also gaining attention for their ability to promote bone remodeling and minimize implant failure.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global bone grafts and substitutes market size and forecast projects growth, driven by bone grafts market trends 2024-2028. B2B bone graft solutions leverage advanced biomaterial technologies for efficacy. Bone grafts market growth opportunities 2025 include grafts for orthopedic surgery and synthetic bone substitutes, meeting demand. Bone graft supply chain software optimizes operations, while bone grafts market competitive analysis highlights key manufacturers. Sustainable biomaterial practices align with eco-friendly medical trends. Bone grafts regulations 2024-2028 shapes bone graft demand in North America 2025. Bioactive graft solutions and premium bone graft insights boost adoption. Grafts for dental surgery and customized graft designs target niches. Bone grafts market challenges and solutions address biocompatibility, with direct procurement strategies for grafts and bone graft pricing optimization enhancing profitability. Data-driven bone graft analytics and regenerative medicine trends drive innovation.

What are the key market drivers leading to the rise in the adoption of Bone Grafts And Substitutes Industry?

- The orthopedic market is primarily driven by the increasing prevalence of orthopedic conditions necessitating surgical interventions. Bone grafts and substitutes have gained significant attention in the medical field due to their role in promoting bone regeneration and tissue engineering. These materials are essential for the treatment of various orthopedic conditions, including fractures and degenerative joint diseases. Tricalcium phosphate, bioactive glass, and stem cells are some of the commonly used bone graft substitutes. Wound healing is accelerated through these materials, reducing the recovery time and healthcare costs. Advancements in technology have led to the development of antimicrobial coatings and tissue engineering techniques to prevent infection and enhance bone growth. Clinical trials are ongoing to evaluate the safety and efficacy of these innovative solutions.

- Craniofacial and dental applications are the primary markets for bone grafts and substitutes. The increasing prevalence of bone disorders and the growing number of surgeries, particularly in ambulatory surgical centers, are expected to fuel the demand for these products. In summary, bone grafts and substitutes play a crucial role in the treatment of bone injuries and diseases. With advancements in technology and ongoing research, these materials offer promising solutions for improving bone regeneration and reducing healthcare costs. Clinical trials and innovations in tissue engineering and antimicrobial coatings are expected to further expand the applications and market potential of bone grafts and substitutes.

What are the market trends shaping the Bone Grafts And Substitutes Industry?

- The increasing preference for minimally invasive surgeries represents a significant market trend. This surgical approach, characterized by smaller incisions and reduced trauma to the body, is gaining widespread adoption among healthcare professionals and patients alike.

- Minimally invasive bone grafting procedures are gaining popularity in orthopedics due to their numerous advantages over traditional open surgeries. These advantages include less pain and discomfort, lower infection and bleeding rates, shorter hospital stays, smaller scars, and quicker recovery times. This novel technique, which requires a smaller incision, is used in various orthopedic procedures such as arthroscopy, knee and hip replacement, and spine fusion. It is particularly preferred for treating sports-related injuries. Synthetic bone grafts and scaffolding materials, including those produced through 3D printing, are increasingly being used in bone grafting procedures. These alternatives to bone harvesting offer long-term stability and reduced risk of complications.

- Infection rates are a significant concern in bone grafting, and the use of synthetic materials can help mitigate this risk. The orthopedic industry is continually innovating to improve bone grafting techniques and materials, ensuring better outcomes for patients. Minimally invasive surgery and synthetic bone grafts are expected to continue driving growth in this field.

What challenges does the Bone Grafts And Substitutes Industry face during its growth?

- The escalating costs related to implant procedures are a significant challenge impeding the growth of the industry, requiring continuous efforts to mitigate these expenses and ensure affordability for patients.

- The market faces a significant challenge due to the high cost of bone grafting procedures. Orthopedic implants are essential for treating various conditions related to joints, spine, and maxillofacial injuries. The cost of these bone grafts and substitutes varies based on applications and features. For instance, the average cost of dental grafting procedures ranges from USD2,500 to USD3,500. Mechanical strength, a crucial factor in bone grafts and substitutes, influences their cost. Bone substitutes, such as calcium phosphate cements, offer an alternative to traditional bone grafts. However, regulatory approvals and the development of advanced bone substitutes with improved drug delivery systems and bone regeneration capabilities continue to drive market growth.

- Implant failure is a concern in bone grafting procedures, leading to increased demand for superior bone grafts and substitutes. Reconstructive surgery using bone grafts and substitutes is an immersive and harmonious process that requires a robust value chain. The cost of bone grafting increases by 130%-150% across the value chain. Despite the challenges, the market for bone grafts and substitutes remains a vital area of research and development, with a focus on creating cost-effective and efficient solutions.

Exclusive Customer Landscape

The bone grafts and substitutes market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the bone grafts and substitutes market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, bone grafts and substitutes market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AlloSource - This company specializes in bone graft and substitute innovations, featuring demineralized bone matrix in a reverse-phase medium. Their offerings aim to address bone regeneration needs, enhancing surgical efficacy and patient outcomes.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AlloSource

- Arthrex Inc.

- Baxter International Inc.

- Bioventus LLC

- Ed. Geistlich Sohne AG

- Institut Straumann AG

- Integra Lifesciences Corp.

- Johnson and Johnson Services Inc.

- Medtronic Plc

- MTF Biologics

- NovaBone Products LLC

- Nuvasive Inc.

- Orthofix Medical Inc.

- OST Laboratories

- RTI Surgical Inc.

- Smith and Nephew plc

- Stryker Corp.

- TBF TISSUE ENGINEERING

- Xtant Medical Holdings Inc.

- Zimmer Biomet Holdings Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Bone Grafts And Substitutes Market

- In January 2024, Stryker Corporation, a leading medical technology company, announced the FDA approval of its new bone graft substitute, Reef⢠DBM Putty Plus with Antibiotic. This innovative product, which incorporates antibiotic technology, aims to reduce the risk of infection during bone grafting procedures (Stryker Corporation, 2024).

- In March 2024, Medtronic plc and Orthofix Medical Inc. Entered into a strategic partnership to expand their offerings in the bone graft substitutes market. The collaboration combines Medtronic's spinal and orthopedic expertise with Orthofix's bone graft substitutes and biologics portfolio, aiming to provide comprehensive solutions for healthcare providers (Medtronic plc, 2024).

- In May 2024, Smith & Nephew, a global medical technology business, completed the acquisition of Osiris Therapeutics, a leading regenerative medicine company. The acquisition adds Osiris' extensive portfolio of bone graft substitutes and cell therapies to Smith & Nephew's product offerings, enhancing their presence in the regenerative medicine market (Smith & Nephew, 2024).

- In April 2025, the European Commission granted marketing authorization for Integra LifeSciences Holdings Corporation's Bone Substitute, BMP-2 Infuse Eluting Implant. This approval marks a significant milestone for Integra, expanding its product offerings in Europe and further strengthening its position in the global bone graft substitutes market (Integra LifeSciences Holdings Corporation, 2025).

Research Analyst Overview

- The market encompasses various types of grafts, including autologous bone marrow and allogeneic and xenogeneic grafts. In vivo and in vitro studies are crucial in evaluating the inflammation response, mechanical properties, and degradation kinetics of these grafts. Storage conditions, such as temperature and humidity, significantly impact the shelf life and tensile strength of bone grafts. Cytotoxicity testing and histological analysis are essential for assessing the safety and bioactivity of bone grafts. Surface coatings and modifications, like platelet-rich plasma (PRP), improve graft integration and enhance mechanical properties, such as compressive strength and fatigue resistance. Quality control and sterilization methods play a vital role in ensuring the safety and efficacy of bone grafts.

- Market access and reimbursement policies also influence the adoption of bone grafts, particularly in the context of cancellous and cortical bone applications. In vitro studies on xenogeneic bone grafts reveal promising results in terms of mechanical properties and bioactivity assays. Surface coatings and cell seeding techniques further enhance their potential. However, concerns regarding cytotoxicity and degradation kinetics persist, necessitating rigorous testing and quality control measures. Allogeneic bone grafts offer advantages in terms of availability and eliminating the need for a second surgical site. However, challenges related to immunogenic response and shelf life remain. Innovations in surface modification, such as bioactive peptides, aim to address these challenges and expand the application scope of allogeneic bone grafts.

- The market continues to evolve, driven by advancements in material science, biotechnology, and regulatory frameworks. Understanding the interplay between these factors is crucial for stakeholders seeking to capitalize on the market's growth potential.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Bone Grafts And Substitutes Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

183 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.45% |

|

Market growth 2024-2028 |

USD 1719.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.42 |

|

Key countries |

US, Germany, UK, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Bone Grafts And Substitutes Market Research and Growth Report?

- CAGR of the Bone Grafts And Substitutes industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the bone grafts and substitutes market growth of industry companies

We can help! Our analysts can customize this bone grafts and substitutes market research report to meet your requirements.