Boring Tools Market Size 2024-2028

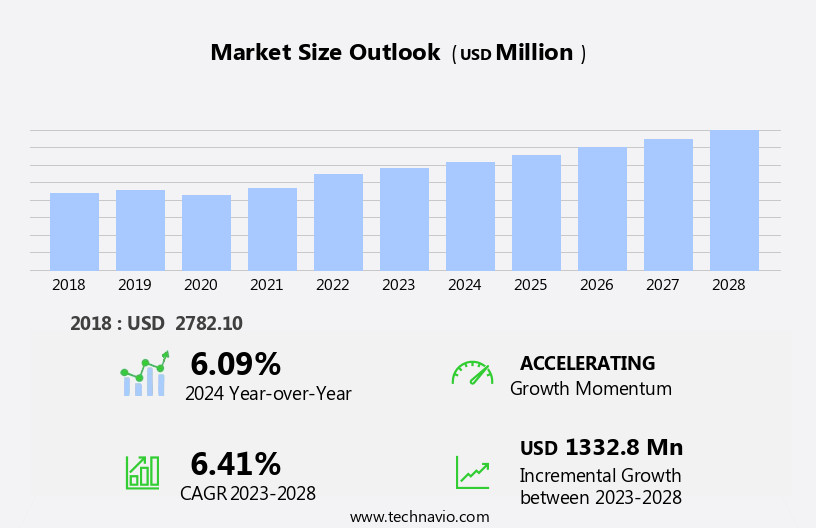

The boring tools market size is forecast to increase by USD 1.33 billion at a CAGR of 6.41% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing adoption of Computer Numerical Control (CNC) technology in boring tools production. This trend is fueled by the rising demand for precision and efficiency in manufacturing processes. Additionally, the popularity of advanced machining techniques such as Electrical Discharge Machining (EDM) and Electrochemical Machining (ECM) is propelling market expansion. EDM and ECM enable the production of complex geometries and high-precision holes, making them indispensable in industries like aerospace and automotive. However, market growth is not without challenges. Increasing competition, stringent regulatory requirements, and the need for continuous innovation to keep up with technological advancements pose significant hurdles.

- Companies seeking to capitalize on market opportunities must focus on developing cost-effective and high-performance boring tools, while also investing in research and development to stay ahead of the competition. Strategic partnerships and collaborations can also provide valuable opportunities for market expansion and technological innovation. In summary, the market is poised for growth, driven by technological advancements and evolving industry trends. Companies must navigate challenges such as competition and regulatory requirements while focusing on innovation and cost-effectiveness to capitalize on market opportunities.

What will be the Size of the Boring Tools Market during the forecast period?

- The market in the US is experiencing significant growth, driven by increasing demand in various industries, including automotive and metalworking. The automotive sector's production line expansion and the shift towards light cars are indirectly fueling the market's growth. The integration of smart tools, coordinated measuring machines, and 3D printing technology in the manufacturing process enhances efficiency and precision, further boosting market expansion. Moreover, the boring process is essential in drilling and carpentry applications, making the market's size substantial. Industrial uses, such as mass reducing operations and transportation infrastructure development, also contribute to the market's activity. The market's growth is influenced by raw material availability and price trends.

- Additionally, the adoption of fine boring tools and metal drilling equipment is increasing due to their ability to improve productivity and reduce downtime. The seaward region is also experiencing growth due to the region's significant industrial activity. Overall, the market is poised for continued expansion, driven by the need for increased efficiency and precision in various industries.

How is this Boring Tools Industry segmented?

The boring tools industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Fine boring tools

- Rough boring tools

- End-user

- Transportation

- General machinery

- Precision engineering

- Others

- Geography

- APAC

- China

- Japan

- Europe

- Germany

- UK

- North America

- US

- South America

- Middle East and Africa

- APAC

By Type Insights

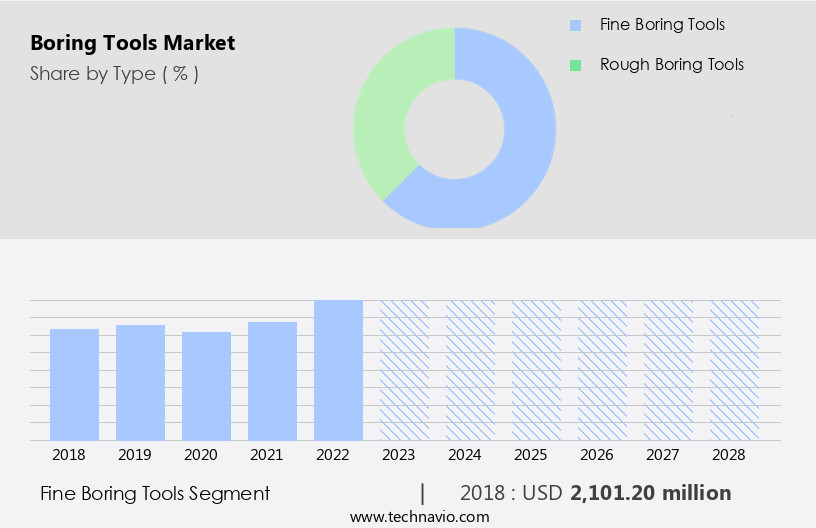

The fine boring tools segment is estimated to witness significant growth during the forecast period.

The market experienced significant growth in 2023, with the fine boring tools segment accounting for a 76.40% share. This dominance is attributed to the increasing demand for high-quality finishing in various industries. Fine boring tools offer the advantage of smaller precision adjustments, making them indispensable for creating holes with tight tolerances. These tools are particularly valuable for short-run projects where a large amount of stock remains in the hole. The production process of boring machinery involves the use of drilling equipment, grinding tools, and machine tools, among others. The market dynamics are influenced by factors such as the need for mass reducing operations, customization, and automation.

In the manufacturing sector, carpentry, metalworking, and automotive industries are significant users of boring tools. The precision engineering industry relies heavily on these tools for their production lines. The input materials pricing and indirect impact of automation and 3D printing technology on the market are essential factors to understand. Volatility in Rig Counts and demand for cars, especially light cars, impact the market. Additionally, industrial uses of boring tools extend to raw materials processing and other sectors. Boring tools are essential for industries that require dimensional accuracy, such as aerospace and automotive. Advanced technologies like CNC technology, Coordinated Measuring Machines, and CNC-based tools are increasingly used for their efficiency and precision.

Furthermore, lightweight equipment, smart tools, robotics, and electrochemical milling are emerging trends in the market. Despite the market's growth, it is essential to note that underdeveloped economies may face challenges in adopting advanced boring tools due to their high cost. Additionally, electrostatic discharge is a critical concern in the manufacturing process, and how to mitigate it is crucial. Overall, the market continues to evolve, driven by technological advancements and changing industry demands.

Get a glance at the market report of share of various segments Request Free Sample

The Fine boring tools segment was valued at USD 2.1 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

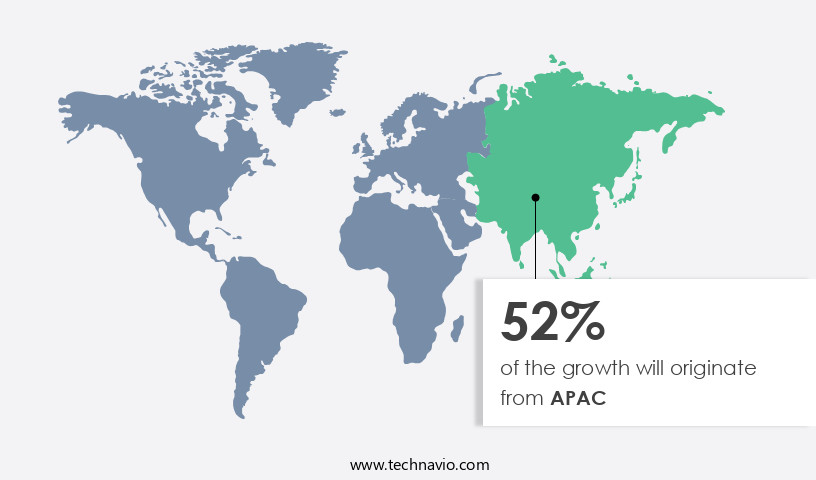

APAC is estimated to contribute 52% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is experiencing significant growth due to the increasing demand from the automotive, heavy trucks, and manufacturing industries. Key consumers of cutting tools, which include boring tools, are primarily located in countries such as China, India, Japan, South Korea, and Taiwan. Developing economies like India, Indonesia, and Taiwan are expected to contribute significantly to the market's growth. Asia is currently leading the worldwide market, with China being a major contributor, despite experiencing economic downturns due to overcapacity in state-owned manufacturing enterprises and a slump in the real estate sector. The production process in machine tools and drilling equipment relies heavily on boring tools for dimensional accuracy and mass reducing operations.

Customization and automation through CNC technology, robotics, and Coordinated Measuring Machines are also driving market growth. Additionally, the use of lightweight equipment, grinding tools, and electrochemical milling in precision engineering and production lines is increasing efficiency. The market dynamics are influenced by input materials pricing, volatility in demand for cars, and the adoption of 3D printing technology. the technical knowledge required for the use of boring tools, such as electrostatic discharge prevention, is essential for their effective implementation in industrial uses.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Boring Tools Industry?

- Emergence of CNC-based boring tools is the key driver of the market.

- Boring tools play a vital role in the production process, ensuring precision and dimensional accuracy in developing complex products. CNC (Computer Numerical Control) technology is integral to the functioning of these tools, enabling the automation of machine motions and the control of workpiece depth and rotation speed. By utilizing CNC boring tools, industries can produce superior-quality products with enhanced accuracy. These tools are essential in various industries, including automotive, aerospace, and construction, where high-precision components are required.

- The integration of CNC technology in boring tools has revolutionized manufacturing processes, allowing for increased productivity and efficiency. Additionally, the technology's flexibility enables the production of intricate shapes and designs, making it a valuable asset in today's manufacturing landscape.

What are the market trends shaping the Boring Tools Industry?

- Additive manufacturing is the upcoming market trend.

- The manufacturing sector is experiencing a significant shift with the emergence of 3D printing, also known as additive manufacturing. This innovative technology constructs three-dimensional objects using digital files, layer by layer. Compared to traditional manufacturing methods, which are subtractive in nature, 3D printing offers several advantages. The additive process optimizes material usage, reducing wastage to a minimum. In contrast, traditional techniques involve removing excess material, resulting in approximately 60-70% being discarded.

- The scrap material is later melted and reused, adding to the overall cost. By enabling the production of complex geometries, 3D printing streamlines the manufacturing process and enhances efficiency.

What challenges does the Boring Tools Industry face during its growth?

- Rise in popularity of electrical discharge and electrochemical machining is a key challenge affecting the industry growth.

- The global metal cutting tools market is experiencing challenges from advanced technologies such as electrochemical machining (ECM) and electrical discharge machining (EDM). Traditional metal cutting processes utilize boring tools made of hard and abrasive metals for cutting softer metals. In contrast, ECM and EDM employ electric current to remove unwanted metal from the workpiece. Conventional boring techniques employ various types of tools, whereas EDM utilizes the thermoelectric process for metal removal. The limitations of traditional boring methods, such as the inability to effectively work on hard and brittle materials using boring machining, can be addressed through the adoption of these new technologies.

- EDM offers advantages like higher precision, faster production rates, and the ability to work on complex geometries. Despite these benefits, traditional boring tools continue to hold a significant market share due to their affordability and widespread usage in various industries.

Exclusive Customer Landscape

The boring tools market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the boring tools market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, boring tools market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Allied Machine and Engineering Corp. - Wohlhaupter special boring tools are essential components in precision machining processes. These tools, known for their durability and accuracy, enhance productivity and efficiency in various industries. By utilizing advanced engineering techniques, Wohlhaupter ensures the production of high-quality tools that cater to diverse applications. With a focus on innovation, the company continues to expand its offerings, providing solutions for complex machining challenges.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Allied Machine and Engineering Corp.

- Asahi Diamond Industrial Co. Ltd.

- Berkshire Hathaway Inc.

- BIG DAISHOWA SEIKI CO. LTD.

- Cogsdill Tool Products Inc.

- Dorian Tool International Inc.

- Floyd Automatic Tooling Ltd.

- Fullerton Tool Co.

- Glanze Engineering Co. Pvt. Ltd.

- Harvey Performance Co. LLC

- Internal Tool Inc.

- Jimmore International Corp.

- Kennametal Inc.

- MAPAL Fabrik fur Prazisionswerkzeuge Dr. Kress KG

- Mitsubishi Materials Corp.

- NACHI FUJIKOSHI Corp.

- OSG Corp.

- Plansee SE

- R and R Bassett Engineering Ltd.

- Sandvik AB

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of machinery and equipment essential to the production process in various industries. These tools are integral to the boring process, which involves creating precise holes or cavities in raw materials to prepare them for further manufacturing steps. The market for boring tools is driven by the demand for increased efficiency, precision, and customization in manufacturing processes. Tool geometry plays a crucial role in the performance and effectiveness of boring tools. The design and shape of the cutting edges determine the tool's ability to reduce mass during operation and maintain dimensional accuracy. Drilling equipment and grinding tools are two primary categories of boring tools, each with unique applications and advantages.

The production process of finished products in industries such as automotive, aerospace, and construction relies heavily on boring tools. In the seaward region, for instance, drilling for oil and gas requires specialized boring equipment to create precise holes in the seabed. Machine tools and CNC technology have revolutionized the manufacturing process by enabling mass production and high precision. Transportation and logistics are critical factors in the market. The movement of raw materials, finished products, and equipment between various stages of production requires efficient and reliable transportation solutions. The indirect impact of boring tools on industries such as automotive and construction is significant, as the production of lightweight cars and infrastructure relies on the precision and efficiency of these tools.

The mass reducing operation of boring tools is a critical factor in the manufacturing process. Lightweight equipment and smart tools have gained popularity in recent years due to their ability to reduce production time and increase efficiency. Robotics and automation have also played a significant role in the market, enabling 24/7 production and reducing the need for manual labor. The market for boring tools is influenced by several factors, including technical knowledge, volatility in raw material pricing, and the adoption of advanced technologies such as CNC-based tools, 3D printing technology, and electrochemical milling. Underdeveloped economies present opportunities for growth in the market, as they seek to modernize their manufacturing sectors and improve production efficiency.

The demand for boring tools is closely linked to the demand for cars and other industrial uses. The automotive sector is a significant consumer of boring tools, as the production of light cars requires precision and efficiency. However, the volatility of the market can impact the demand for boring tools, as changes in consumer preferences and economic conditions can influence the production process. In summary, the market is a vital component of various industries, enabling the production of finished products through the boring process. The market is driven by factors such as tool geometry, efficiency, and customization, and is influenced by factors such as raw material pricing, technological advancements, and industrial demands.

The market for boring tools is diverse and dynamic, presenting opportunities for growth and innovation.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

175 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.41% |

|

Market growth 2024-2028 |

USD 1332.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.09 |

|

Key countries |

China, US, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Boring Tools Market Research and Growth Report?

- CAGR of the Boring Tools industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the boring tools market growth of industry companies

We can help! Our analysts can customize this boring tools market research report to meet your requirements.