Bra Market Size 2025-2029

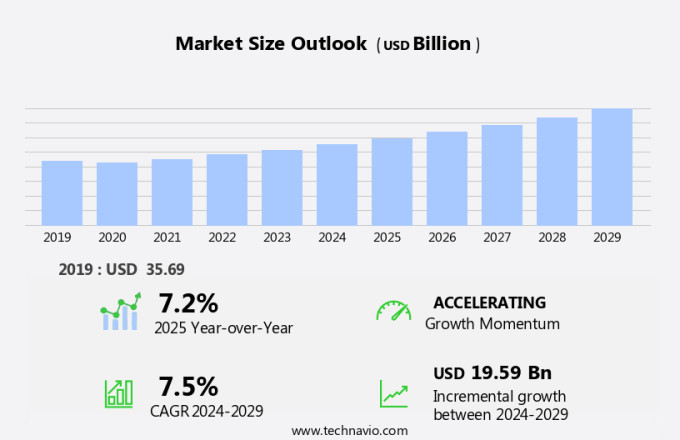

The bra market size is forecast to increase by USD 19.59 billion at a CAGR of 7.5% between 2024 and 2029.

- The market caters to the intimate clothing needs of women, transforming this essential undergarment into a fashion accessory that reflects personal style. With an increasing number of women prioritizing comfort and customization, competitors are focusing on providing consumer-oriented bras based on specific breast sizes and shapes, with many offering options made from soft, breathable cotton. Moreover, the influence of celebrities and fashion influencers on consumer preferences is driving market growth, with e-commerce platforms playing a pivotal role in making these products easily accessible. The rise in demand for eco-friendly and sustainable production methods is another significant trend. However, the market faces challenges such as the increasing prevalence of counterfeit bras in the market, which undermines brand reputation and consumer trust. To stay competitive, companies must prioritize customer service and product quality while adopting innovative marketing strategies, especially through online channels. This market analysis report delves into these trends and challenges, providing insights into the future growth prospects of the market.

What will the size of the market be during the forecast period?

- The women's intimate clothing market is witnessing significant growth, driven by various factors. One of the notable trends is the increasing popularity of stick-on bras, which offer flexibility and convenience for women. These bras, also known as adhesive or self-adhesive bras, provide a solution for women seeking support without the traditional hooks and straps. Another trend in the market is the influence of celebrities and social media influencers on consumer preferences. Their endorsements of form-fitting bras and backless tops have led to an increase in demand for these styles. Furthermore, the bras offer a sleek, seamless appearance, making them ideal for various occasions, from work to play. Working women are another key demographic in the market. They require bras that offer comfort and support throughout the day. Padded bras and convertible bras are popular choices due to their ability to provide shape and lift, while also offering adjustability for a customized fit.

- Sports bras and nursing bras are essential categories within the market. Sports bras offer support and comfort during physical activities, while nursing bras cater to the unique needs of breastfeeding mothers. Both types of bras have evolved to incorporate advanced technologies, such as moisture-wicking fabrics and seamless structures, ensuring optimal comfort and functionality. The market for intimate clothing is also witnessing a shift towards eco-friendly fabrics and sustainable materials. Organic cotton, recycled fibers, and bamboo fabric are gaining popularity due to their environmental benefits and soft, breathable textures. Specialist retailers and online stores are increasingly offering a wide range of intimate clothing made from these fabric choices. In conclusion, the women's intimate clothing market is experiencing growth due to various trends, including the rise of stick-on bras, the influence of celebrities and influencers, the demand from working women, and the shift towards eco-friendly fabrics and sustainable materials. These trends are shaping the market and providing consumers with a diverse range of options to meet their unique needs and preferences.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- T-shirt bra

- Sports bra

- Nursing bra

- Stick-on bra

- Others

- Distribution Channel

- Offline

- Online

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- South America

- Middle East and Africa

- North America

By Type Insights

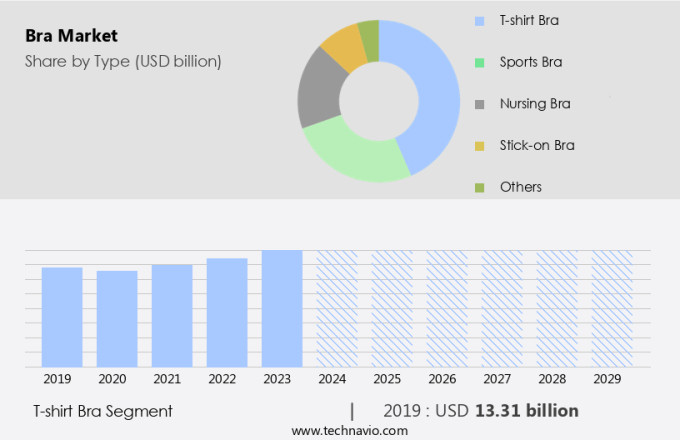

- The T-shirt bra segment is estimated to witness significant growth during the forecast period.

T-shirt bras, also known as seamless or molded bras, are popular choices for women due to their sleek design and ability to provide proper support and lift. These bras feature smooth cups and a seamless construction, making them perfect for wearing under tight-fitting clothing such as t-shirts. One of the key attributes of t-shirt bras is their padding, which provides a subtle shape and adequate coverage without revealing any lines. Moreover, these bras are made using sustainable materials, such as organic cotton, recycled fibers, bamboo fabric, and advanced fabric technology. These breathable textiles ensure comfort and durability, while seamless structures prevent any visible seams.

Additionally, moisture-wicking fabrics keep the wearer cool and dry, making these bras an excellent option for everyday wear. Several sustainable brands offer high-quality t-shirt bras that prioritize eco-friendly production methods and ethical labor practices. By investing in these bras, consumers can support sustainable fashion while enjoying the benefits of a well-fitting and comfortable undergarment. Whether you're looking for a basic t-shirt bra or a more intricate design, there are various styles and patterns available to suit different body types.

Get a glance at the market report of share of various segments Request Free Sample

The T-shirt bra segment was valued at USD 13.31 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

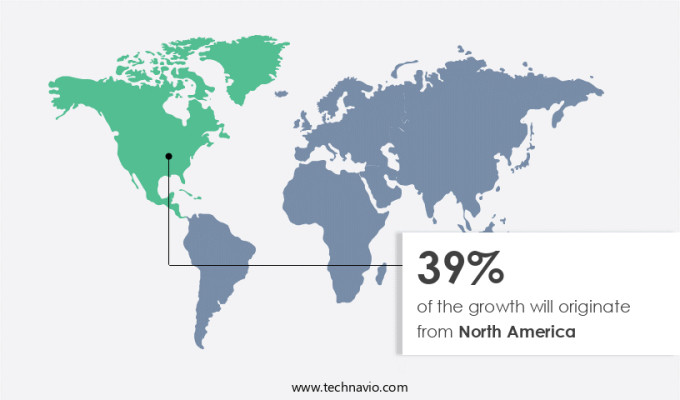

- North America is estimated to contribute 39% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American market is experiencing growth due to increasing fashion consciousness, the region's recovery from the pandemic, and the rise of online sales. The United States is the largest market in the region, with significant demand also present in Canada and Mexico. Market expansion is driven by the presence of a large working population, particularly in the US and Canada. However, competition from private labels poses a challenge, impacting profit margins and market survival. Despite these obstacles, the region's growing number of affluent individuals and working women continue to fuel market growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Bra Market?

Competitors focus on providing consumer-oriented bras based on specific needs is the key driver of the market.

- The intimate apparel market, specifically bras, continues to evolve as a significant sector within the US fashion industry. Stylish designs remain a priority for key competitors, who regularly introduce new collections to cater to diverse consumer preferences. Comfort and support are essential considerations, with offerings ranging from form-fitting bras to convertible, strapless, and backless options. Celebrities and influencers often endorse various bra styles, contributing to their popularity. Innovative fabric technologies, such as moisture-wicking, breathable textiles, and seamless structures, enhance comfort and functionality. Eco-friendly fabrics, like organic cotton, recycled fibers, and bamboo fabric, are increasingly popular, reflecting a growing focus on sustainability.

- The market accommodates various needs, from padded and nursing bras to sports and compression support bras. Online retail stores have revolutionized shopping for intimate apparel, allowing consumers to explore a wide range of options from the comfort of their homes. The athleisure trend and active lifestyles have led to an increase in demand for functional, high-performance bras. Specialist retailers and online stores cater to specific needs, offering a diverse selection of fabrics, colors, and styles. The working population relies on bras as a necessary foundation for their wardrobe, with satin, polyester, and cotton fabric choices catering to various preferences.

What are the market trends shaping the Bra Market?

Increasing focus on customer service by vendors is the upcoming trend in the market.

- In the dynamic world of intimate apparel, the market continues to evolve, catering to the diverse needs and preferences of modern women. Stylish designs, a key focus for leading brands, are increasingly incorporating celebrity endorsements and influencer collaborations to elevate their offerings. Comfortable dressing is at the forefront of consumer demands, with form-fitting bras, convertible bras, and stick-on bras gaining popularity. Online retail stores have revolutionized shopping experiences, offering a wide range of options from padded bras and sports bras to nursing bras and backless bras. Eco-conscious consumers seek sustainable materials such as organic cotton, recycled fibers, and bamboo fabric, driving innovation in fabric technology and breathable textiles.

- Seamless structures and moisture-wicking fabrics further enhance comfort, while specialist retailers and online stores cater to specific niches, including the athleisure trend and compression support. Retail outlets for intimate apparel prioritize a pleasant shopping atmosphere, with bright colors, spacious trial rooms, and helpful staff. Online shopping offers convenience and accessibility, with innovative start-ups providing customized fitting, subscription services, and a wide range of styles and designs. The market continues to grow, with consumers prioritizing personal style, comfort, and sustainability in their intimate clothing choices.

What challenges does Bra Market face during the growth?

Rise in demand for and sales of counterfeit bra is a key challenge affecting market growth.

- The market is witnessing a wave in popularity, driven by stylish designs, celebrity endorsements, and the growing trend of comfortable dressing. This market caters to various needs, including form-fitting bras for fashion-conscious women, padded bras for enhancing cleavage, sports bras for active lifestyles, nursing bras for new mothers, convertible bras for versatility, and strapless and backless bras for special occasions. Online retail stores have made shopping for innerwear more convenient, with a wide range of options available for consumers. Eco-friendly fabrics, such as organic cotton, recycled fibers, bamboo fabric, and fabric technology, are gaining popularity due to their sustainability and breathability.

- Seamless structures and moisture-wicking fabrics are also in demand for their comfort and support. The working population is a significant consumer base for bras, with satin and polyester being popular choices for office wear. The athleisure trend has led to an increase in demand for compression support and cotton fabric sports bras. Specialist retailers and online stores offer a variety of delicate brassieres, catering to different breast sizes and personal styles. Despite the availability of authentic bras from specialist retailers and online stores, the market is plagued by the issue of counterfeit products. These unauthorized replicas, often made using substandard materials and production processes, are gaining popularity due to their affordability and accessibility.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Anita Dr. Helbig GmbH

- Calida Holding AG

- Chantelle Lingerie Inc.

- Fashion Nova LLC

- Global Intimates LLC

- Hanesbrands Inc.

- Hennes and Mauritz AB

- Hunkemoller B.V.

- Jockey International Inc.

- Marks and Spencer Group plc

- MAS Holdings Pvt. Ltd.

- Nike Inc.

- Nordstrom Inc.

- PVH Corp.

- Triumph Intertrade AG

- UNIQLO India Pvt. Ltd.

- Victorias Secret and Co.

- Wacoal Holdings Corp.

- Wolf Lingerie SAS

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Women's innerwear, specifically bras, have evolved into more than just undergarments. They have become fashion accessories that enhance personal style and comfort. Stylish designs, from padded to form-fitting, cater to various preferences and needs. Celebrities and influencers' endorsements add allure to these garments, making them desirable. Comfortable dressing is a priority for working women, leading to the popularity of convertible, strapless, and backless bras. Bras have expanded to accommodate active lifestyles, with sports and nursing bras offering compression support and moisture-wicking fabrics. Bras come in various materials like cotton, chiffon, silk, and eco-friendly fabrics such as organic cotton, recycled fibers, bamboo fabric, and those with fabric technology for breathability and seamless structures. Online retail stores and shopping have made it convenient for women to purchase these intimate clothing items.

Additionally, the athleisure trend and active lifestyles have influenced the market, with specialist retailers offering a wide range of bras for different activities. Sustainable brands focus on using sustainable materials and fabric choices. Bras are no longer just undergarments; they are an essential part of women's wardrobes, reflecting their personal style and comfort. The bra market is evolving rapidly, driven by celebrity endorsements and innovative designs. From the classic brassiere to the versatile convertible bra, options abound. Consumers are increasingly drawn to styles like the strapless bra and backless bra, catering to diverse fashion needs. The demand for multi-way bras and adhesive bras is rising, particularly in hypermarkets and supermarkets, alongside specialty stores that focus on fit and comfort. Cotton fabric remains a favorite for its breathability, while multi-brand specialty stores offer various styles to suit different breast sizes. Fashion trends from Vogue designs highlight the importance of cleavage and style, ensuring every woman finds her perfect fit in a delicate brassiere.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.5% |

|

Market growth 2025-2029 |

USD 19.59 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.2 |

|

Key countries |

US, Germany, China, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch