Cable Tester Market Size 2024-2028

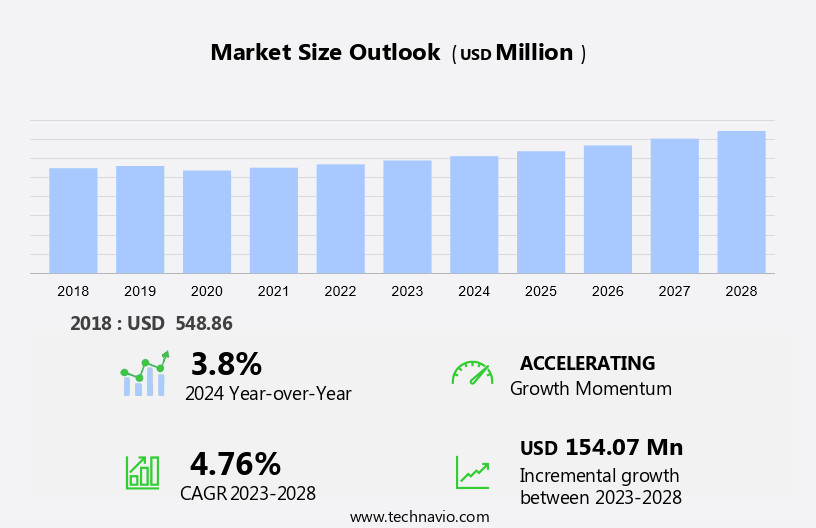

The cable tester market size is forecast to increase by USD 154.07 million at a CAGR of 4.76% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends and factors. The increase in internet penetration and increasing data traffic are driving the demand for reliable and efficient cable testing solutions. Additionally, the expansion of data centers to support cloud computing, gaming, and e-commerce industries is catalyzing the market's growth. However, the high cost of fiber optic cable remains a challenge for market growth. Furthermore, the proliferation of smart homes and smart home appliances, as well as the increasing focus on data security, digital transformation, and renewable energy, are also creating opportunities for cable testers in various industries such as construction, aviation, railroad, and telecommunications.

What will be the Size of the Cable Tester Market During the Forecast Period?

- The electronics market for network cable testers continues to experience steady growth, driven by the increasing demand for reliable cabling infrastructure in various industries, including communication and utility providers. Network cable testers play a crucial role in ensuring the proper deployment and maintenance of cabling systems, which support the transmission of data and electricity.

- These tools enable cabling professionals to test and diagnose issues related to attenuation, wire map, DC loop resistance, return loss, power factor, and other parameters for various cabling communications technologies, such as Ethernet standards and fiber optic, coaxial, and Ethernet cables. Network cable tests are essential for ensuring the performance and reliability of network transmission technologies, particularly in high-stakes applications like electricity generation and renewable energy production. Hand-held tools have gained popularity due to their portability and ease of use, making them indispensable for cabling professionals working in diverse environments.

How is this Cable Tester Industry segmented and which is the largest segment?

The cable tester industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Home appliance

- Navigation and defense

- Communication

- Type

- Fiber optic cable

- Coaxial cable

- Ethernet cable

- Geography

- North America

- Canada

- US

- APAC

- China

- Japan

- Europe

- Germany

- South America

- Middle East and Africa

- North America

By Application Insights

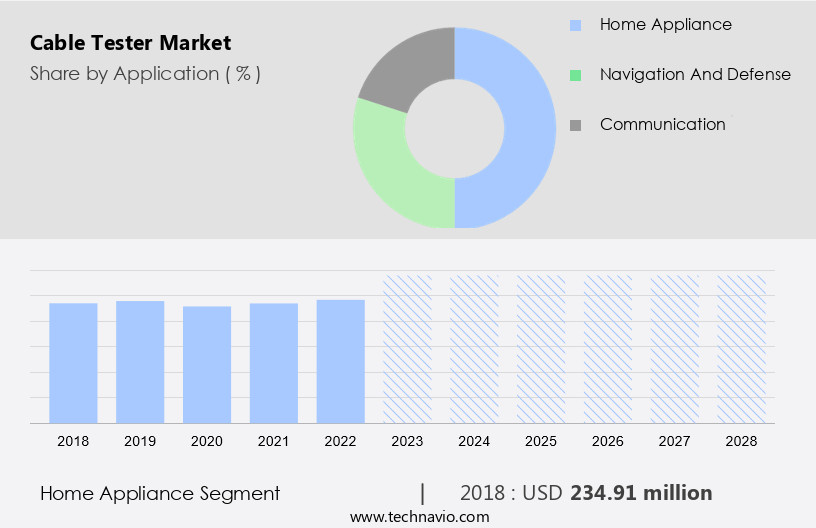

- The home appliance segment is estimated to witness significant growth during the forecast period.

The market is primarily driven by the home appliance segment due to the increasing demand for energy-efficient and digitally advanced appliances. The emphasis on connectivity and smart features, such as Wi-Fi, voice control, and app control, is fueling market growth. As incomes rise and consumer preferences evolve, cable testers with multifunctional capabilities are becoming increasingly important. Competition In the market is intense, leading manufacturers to enhance their offerings to retain consumers and replace traditional appliances. Network cable testers are essential tools for cabling professionals in various industries, including electronics, communication, connectivity, military, railways, power services, and aviation. These testers are used for network transmission technologies, such as Ethernet standards, cabling communications, and cabling infrastructure, to ensure proper system deployment and identify issues related to attenuation, return loss, and power factor.

Get a glance at the Cable Tester Industry report of share of various segments Request Free Sample

The home appliance segment was valued at USD 234.91 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market holds the largest share In the market due to the increasing demand for intra and inter-data center communications in industries within this region. The expanding IT and telecommunications sectors In the US and Canada, driven by the need for high-speed Internet connectivity, significantly contribute to the growth of the market. The adoption of cable testers is particularly high in home appliances, navigation and defense, and communication industries. Additionally, the availability of vast oil and gas reserves and technological advancements in offshore exploration and drilling activities have increased In the region. Network cable testers are essential tools for cabling professionals to ensure proper deployment and maintenance of network transmission technologies, including Ethernet standards and cabling communications.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Cable Tester Industry?

Rise in Internet penetration and data traffic is the key driver of the market.

- The market is experiencing significant growth due to the increasing adoption of electronics and network cable testers in various industries. Network transmission technologies, such as Ethernet standards, are increasingly being utilized in cabling communications for data centers, military industry, railways, power services, aviation, and communication industries. Network cable tests are essential for ensuring proper system deployment and identifying issues related to attenuation, wire map, DC loop resistance, return loss, and power factor. Hand-held tools are popular choices for cabling professionals due to their portability and ease of use. These tools are used to test various types of cables, including Fiber Optic Cable, Coaxial Cable, and Ethernet Cable, in diverse applications such as connectivity testing equipment, DTF measurements, mobile backhaul, and network infrastructure.

- The increasing demand for renewable energy production and the need to prevent power crises, blackouts, and energy utility industry issues necessitate high testing requirements. The market growth is further driven by the need for connectivity in home appliances and gaming devices, as well as the growing importance of low voltage, medium voltage, and high voltage electricity generation in various industries. The need for reliable and efficient cable testing solutions is crucial for maintaining the integrity of cabling infrastructure and ensuring seamless data communication.

What are the market trends shaping the Cable Tester Industry?

Proliferation of data centers is the upcoming market trend.

- The electronics industry's expansion, driven by the increasing demand for network cable testers, is significant In the context of data communication infrastructure development. Network cable testers are essential tools for cabling professionals, enabling them to assess various parameters such as attenuation, wire map, DC loop resistance, return loss, and power factor. These tests are crucial for ensuring the optimal performance of network transmission technologies, including Ethernet standards, in cabling communications. Several industries, including the communication industry, military industry, railways industry, utility providers, and power services industry, rely heavily on network cable tests. For instance, In the military industry, these tests are essential for navigation and defense applications.

- In the power services industry, they ensure the reliability of electricity generation and distribution networks. In the communication industry, they are used for connectivity testing equipment, DTF measurements, mobile backhaul, and network infrastructure testing. Moreover, the growing importance of fiber optic cable, coaxial cable, and Ethernet cable in various applications, from home appliances to data centers, necessitates the use of advanced network cable testers. Improper system deployment, bad products, and power crises can lead to blackouts and energy utility industry issues. Therefore, high testing standards are crucial to prevent such occurrences and maintain the integrity of cabling infrastructure. Additionally, the renewable energy production sector also benefits from these tests, as they ensure the reliability of the low voltage, medium voltage, and high voltage networks used in electricity generation.

What challenges does the Cable Tester Industry face during its growth?

High cost of fiber optic cable is a key challenge affecting the industry growth.

- The market experiences significant growth due to the increasing adoption of network cable testers for various applications in electronics industries. These testers ensure the proper functioning of cabling infrastructure, including Fiber Optic Cable, Coaxial Cable, and Ethernet Cable. They perform crucial tests such as attenuation, wire map, DC loop resistance, return loss, and power factor, ensuring optimal network transmission technologies and adherence to Ethernet standards. Cabling professionals In the communication industry, military, railways, power services, aviation, and utility providers rely on these hand-held tools for connectivity testing equipment. Fiber optic cable, in particular, offers real-time data monitoring and sensing capabilities, making it essential for navigation and defense, energy utility, and data center applications.

- Despite the benefits, the high cost of fiber optic cables and the challenges of fixing defects in harsh environments remain concerns. The high cost is influenced by the type of cable used, applications, and operating conditions. However, the potential for improved cabling communications, increased connectivity, and the prevention of issues such as power crises, blackouts, and improper system deployment justify the investment. Network cable tests are crucial for maintaining the integrity of cabling infrastructure in various industries. In the energy utility industry, cable testers ensure the reliability of low voltage, medium voltage, and high voltage networks for electricity generation.

Exclusive Customer Landscape

The cable tester market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the cable tester market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, cable tester market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Additel Corp.

- AEM Holdings Ltd.

- Anritsu Corp.

- BAE Systems Plc

- Butler and Land Technologies LLC.

- DEKRA SE

- Dell Technologies Inc.

- Fluke Corp.

- Hoyt Electrical Instrument Works Inc.

- HV Hipot Electric Co., Ltd.

- JW Fishers Mfg. Inc.

- Keysight Technologies Inc.

- Komax Holding AG

- Megger Ltd.

- Microtest Corp.

- NAC Corp. Ltd.

- Proton Products International Ltd.

- Shenzhen NOYAFA Electronic Co. Ltd.

- Softing AG

- Teledyne Technologies Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of tools utilized by cabling professionals to ensure the integrity and functionality of various cabling communications systems. These systems are integral to numerous industries, including network transmission technologies, defense, aviation, power services, and communication. Network cable testers play a crucial role in identifying and addressing issues related to attenuation, wire map, dc loop resistance, return loss, and power factor within cabling infrastructure. These tools are essential for field tasks involving data communication, such as Ethernet standards, and are increasingly relevant In the context of expanding connectivity demands in sectors like gaming devices and home appliances.

Moreover, the market caters to various cable types, including fiber optic, coaxial, and Ethernet cables. Fiber optic cable testing is critical for high-speed communication networks, while coaxial cable testing is essential for cable television and broadband services. Ethernet cable testing is indispensable for ensuring proper deployment and maintaining network infrastructure in data centers and other communication systems. Cabling infrastructure is a significant investment for industries such as the military, railways, power services, and utilities. Proper cabling infrastructure deployment is essential for the reliable transmission of data and power In these sectors. Improper system deployment or use of substandard products can lead to power crises, blackouts, and other issues.

In the context of the market, there is a growing demand for hand-held tools that offer high testing capabilities. These tools enable cabling professionals to perform various tests on the go, ensuring that cabling infrastructure remains optimized and functional. The communication industry, in particular, relies on cable testers for mobile backhaul and network infrastructure testing. The market also caters to the needs of the energy utility industry, with low voltage, medium voltage, and high voltage testing solutions. These tests are essential for ensuring the reliability and efficiency of electricity generation and distribution systems.

Furthermore, these tools enable cabling professionals to identify and address issues related to cabling infrastructure, ensuring that data and power are transmitted efficiently and effectively. The market continues to evolve, with a growing emphasis on hand-held tools and high testing capabilities to meet the expanding demands of industries such as communication, power services, and utilities.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

155 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.76% |

|

Market growth 2024-2028 |

USD 154.07 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.8 |

|

Key countries |

US, Canada, China, Japan, and Germany |

|

Competitive landscape |

Leading Companies, market growth and forecasting , Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Cable Tester Market Research and Growth Report?

- CAGR of the Cable Tester industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the cable tester market growth of industry companies

We can help! Our analysts can customize this cable tester market research report to meet your requirements.